The UK's bond market is collapsing:

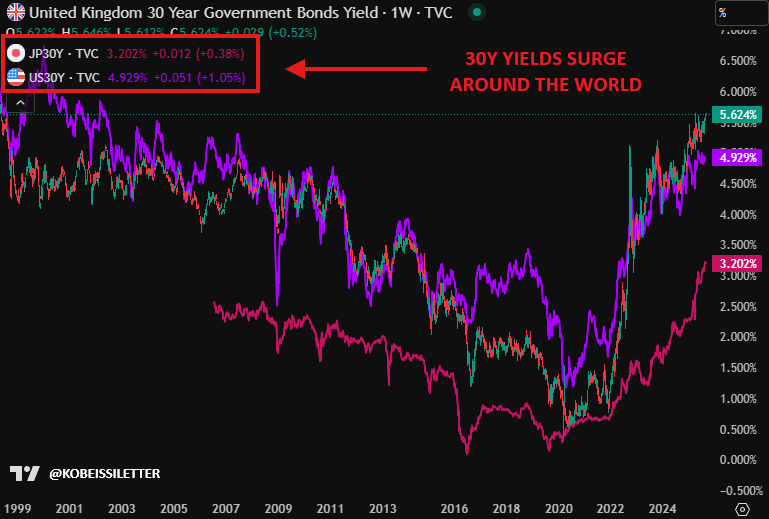

Today, the yield on a 30Y Bond in the UK rose to 5.64%, its highest level since 1998.

Yields in the UK are now 15 TIMES higher than they were at the 2020 low, just 5 years ago.

What is happening? Let us explain.

(a thread)

Today, the yield on a 30Y Bond in the UK rose to 5.64%, its highest level since 1998.

Yields in the UK are now 15 TIMES higher than they were at the 2020 low, just 5 years ago.

What is happening? Let us explain.

(a thread)

Most people don't realize just how bad the fiscal picture is for the UK.

Spending is set to cross 60% of GDP, compared to 53% during the pandemic.

Meanwhile, revenue as a % of GDP is set to drift slightly lower, below 40%.

This is the UK government's OWN forecast.

Spending is set to cross 60% of GDP, compared to 53% during the pandemic.

Meanwhile, revenue as a % of GDP is set to drift slightly lower, below 40%.

This is the UK government's OWN forecast.

As a result, the UK is facing a mountain of national debt.

By 2073, the UK's debt is on course to be 274% of GDP.

This would imply a deficit that is running at a massive 21% of GDP.

Interest on this debt ALONE would be equal to ~13% of GDP.

This is a fiscal collapse.

By 2073, the UK's debt is on course to be 274% of GDP.

This would imply a deficit that is running at a massive 21% of GDP.

Interest on this debt ALONE would be equal to ~13% of GDP.

This is a fiscal collapse.

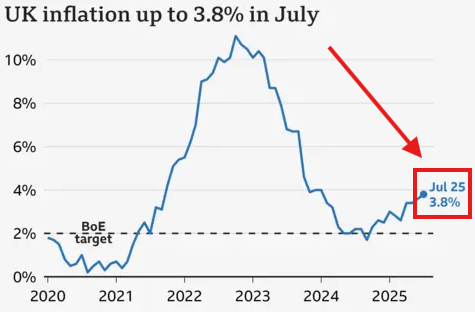

Meanwhile, inflation is back on the rise, and it's rising sharply.

CPI inflation in the UK hit 3.8% in July with expectations of 4%+ coming in August.

This puts inflation at DOUBLE the level that the Bank of England is targeting.

And, here's where it gets even worse.

CPI inflation in the UK hit 3.8% in July with expectations of 4%+ coming in August.

This puts inflation at DOUBLE the level that the Bank of England is targeting.

And, here's where it gets even worse.

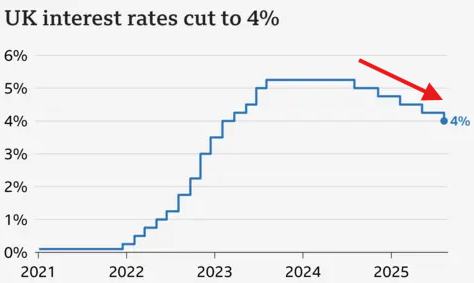

Even as deficit spending soars and inflation rebounds, the BOE is CUTTING interest rates, now down to 4%.

Why?

The BOE is calling some of its inflation drivers "transitory."

But, in reality, economic growth has become so weak in the UK that they have no other option.

Why?

The BOE is calling some of its inflation drivers "transitory."

But, in reality, economic growth has become so weak in the UK that they have no other option.

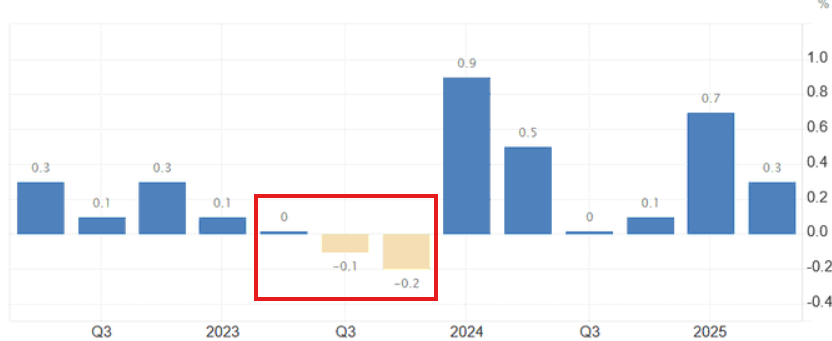

GDP growth in the UK completely flatlined in Q3 2024 and then turned negative.

Recession risks are rising, hiring is slowing, and prices are back on the rise.

It appears that the UK is nearing stagflation for the first time since 2008.

You can't borrow your way out of this.

Recession risks are rising, hiring is slowing, and prices are back on the rise.

It appears that the UK is nearing stagflation for the first time since 2008.

You can't borrow your way out of this.

This trend is spreading across the world.

Take a look at Japan, whose 30Y Bond Yield just broke above 3.20% for the first time in history.

The US is right behind the UK with 30Y Yields on track to break 5.00%.

The clock is ticking on the deficit spending disaster.

Take a look at Japan, whose 30Y Bond Yield just broke above 3.20% for the first time in history.

The US is right behind the UK with 30Y Yields on track to break 5.00%.

The clock is ticking on the deficit spending disaster.

This explains what is coming next for the US and why gold is surging.

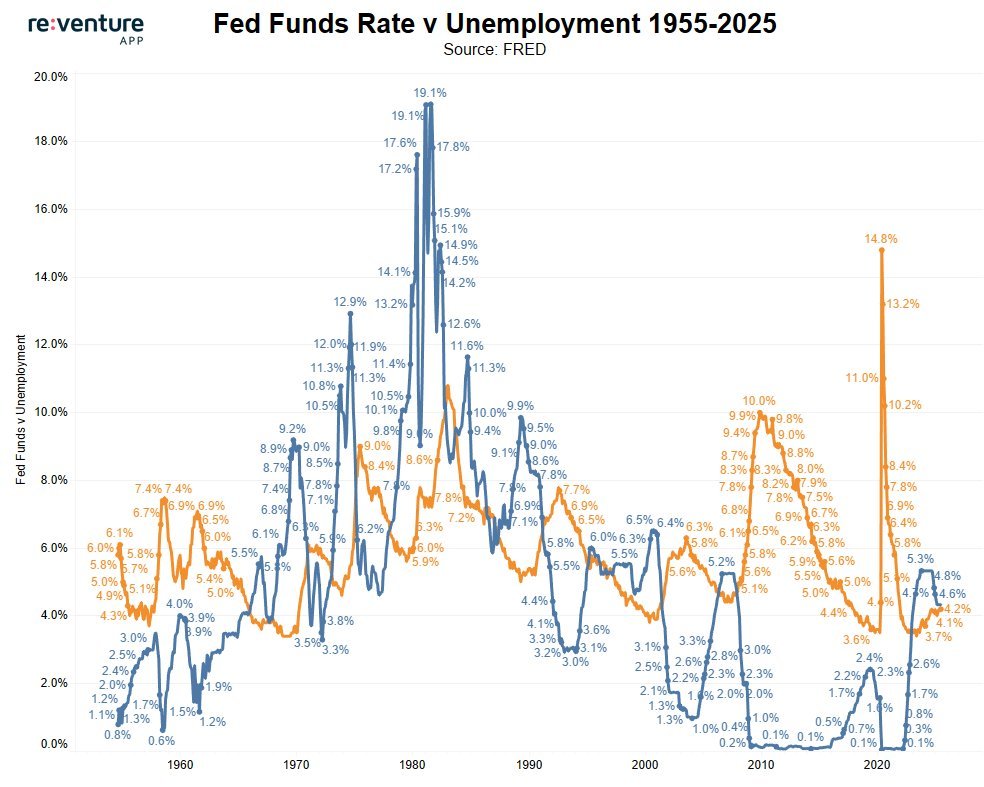

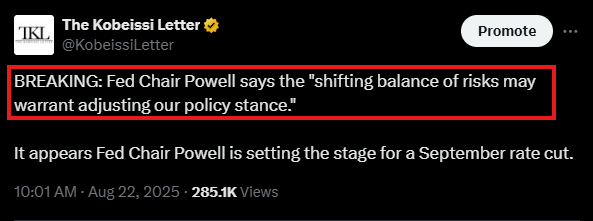

The Fed is about to cut rates in inflation that is above 3% and rising.

Gold is now up +30% YTD and has TRIPLED the S&P 500's return in a bull market.

This is not "normal" price action.

The Fed is about to cut rates in inflation that is above 3% and rising.

Gold is now up +30% YTD and has TRIPLED the S&P 500's return in a bull market.

This is not "normal" price action.

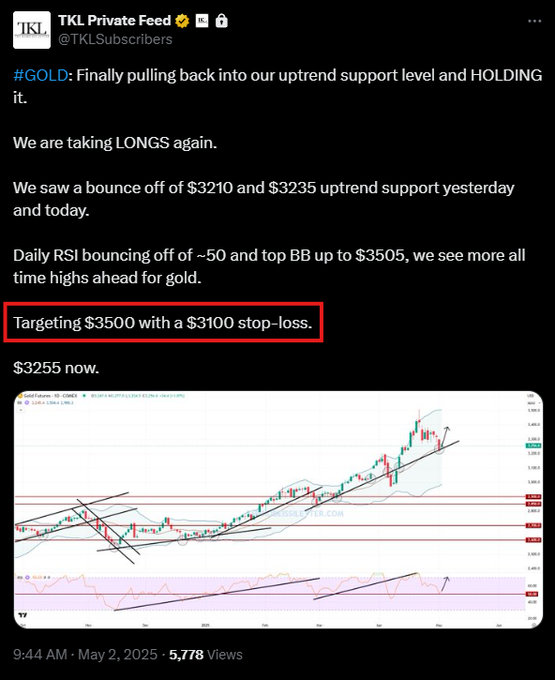

Our premium members have been positioned for this since May 2025.

We have been buying DIPS in gold, including the below alert.

On Friday, our $3500 target was crossed for a large gain.

Subscribe to access ALL of our alerts below:

thekobeissiletter.com/subscribe

We have been buying DIPS in gold, including the below alert.

On Friday, our $3500 target was crossed for a large gain.

Subscribe to access ALL of our alerts below:

thekobeissiletter.com/subscribe

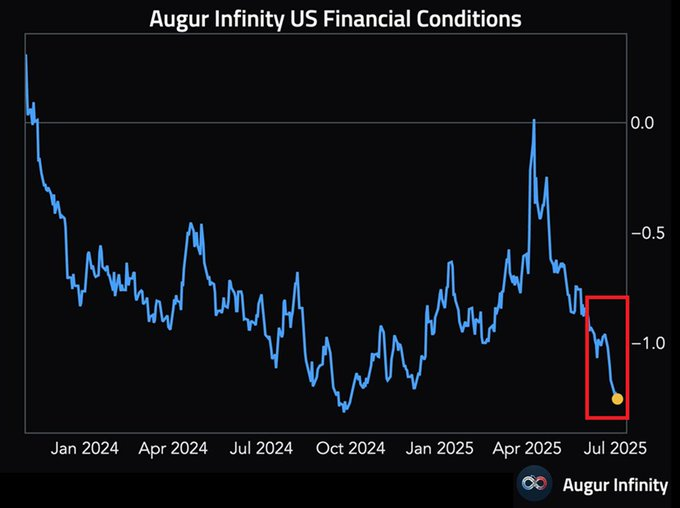

It also explains why rates are still rising even as financial conditions ease.

US financial conditions are now the easiest since September 2024.

Meanwhile, yields are elevated and refuse to drop.

Bond markets know exactly what is coming next for the US fiscal picture.

US financial conditions are now the easiest since September 2024.

Meanwhile, yields are elevated and refuse to drop.

Bond markets know exactly what is coming next for the US fiscal picture.

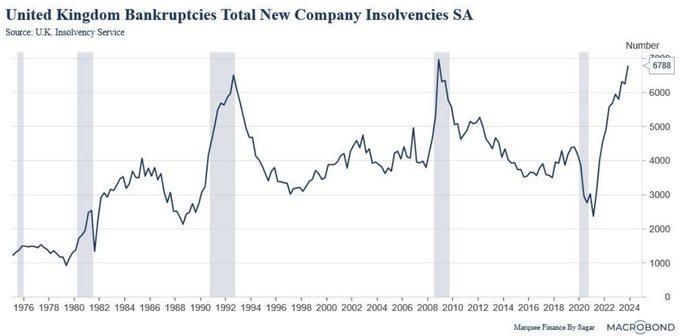

Lastly, the Bank of England had its hands tied as bankruptcies hit 2008 levels in 2024.

The UK had to pick between persistent inflation or a bankruptcy crisis.

All while deficit spending keeps getting worse.

Follow us @KobeissiLetter for real time analysis as this develops.

The UK had to pick between persistent inflation or a bankruptcy crisis.

All while deficit spending keeps getting worse.

Follow us @KobeissiLetter for real time analysis as this develops.

• • •

Missing some Tweet in this thread? You can try to

force a refresh