🇵🇸 GAZA RESIDENTS CRYPTO OFFER?

Postwar plans being drawn up by Trump's administration will reportedly see the US offer Palestinians digital tokens in exchange for "voluntarily" leaving their land in Gaza.

The so-called "GREAT Trust Proposal" would see land redeveloped... 🧵

Postwar plans being drawn up by Trump's administration will reportedly see the US offer Palestinians digital tokens in exchange for "voluntarily" leaving their land in Gaza.

The so-called "GREAT Trust Proposal" would see land redeveloped... 🧵

Redevelopment plans include 6 to 8 "AI-powered, smart cities," an "Elon Musk Smart Manufacturing Zone," and "Trump Riviera."

Those who agree to trade their land for tokens will be allowed to return to Gaza 10 years later, once redevelopment is done.

Those who agree to trade their land for tokens will be allowed to return to Gaza 10 years later, once redevelopment is done.

The trust estimates it would save $23K per person that would otherwise be spent on temporary housing for those choosing to stay in Gaza.

It's also willing to "permanently relocate" Gazan families & will offer them 4 years of subsidized rent and "packages" worth ~ $55K each.

It's also willing to "permanently relocate" Gazan families & will offer them 4 years of subsidized rent and "packages" worth ~ $55K each.

By year 10, the trust estimates that roughly 500K people will have left Gaza as part of this scheme.

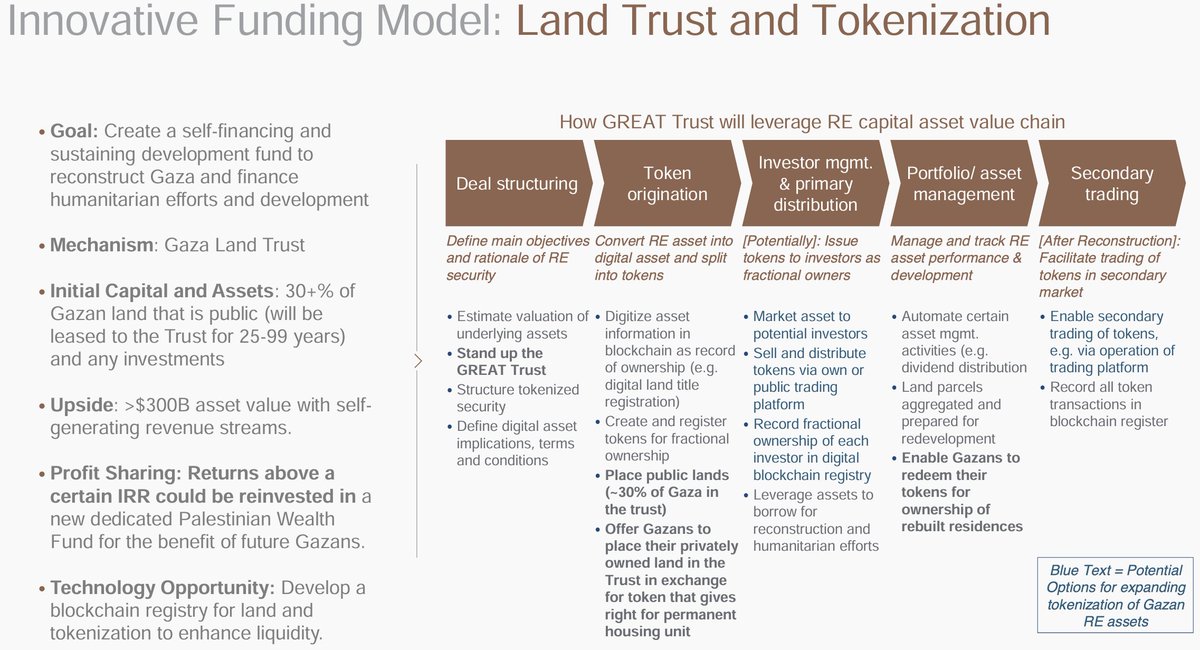

Token aspect involves 5 stages that would create a blockchain-based Gaza land registry, sell & distribute tokens to investors, and eventually see tokenized rights to Gazan land

Token aspect involves 5 stages that would create a blockchain-based Gaza land registry, sell & distribute tokens to investors, and eventually see tokenized rights to Gazan land

The @washingtonpost obtained plans of the proposed scheme and noted that the trust was developed by the Israeli-backed Gaza Humanitarian Foundation ⤵️

https://x.com/Protos/status/1962580150228279304

• • •

Missing some Tweet in this thread? You can try to

force a refresh