How to get URL link on X (Twitter) App

Redevelopment plans include 6 to 8 "AI-powered, smart cities," an "Elon Musk Smart Manufacturing Zone," and "Trump Riviera."

Redevelopment plans include 6 to 8 "AI-powered, smart cities," an "Elon Musk Smart Manufacturing Zone," and "Trump Riviera."

Today's hearing is entitled: "The Future of Digital Assets: Measuring the Regulatory Gaps in the Digital Asset Markets" and more details can be found here: financialservices.house.gov/calendar/event…

Today's hearing is entitled: "The Future of Digital Assets: Measuring the Regulatory Gaps in the Digital Asset Markets" and more details can be found here: financialservices.house.gov/calendar/event…

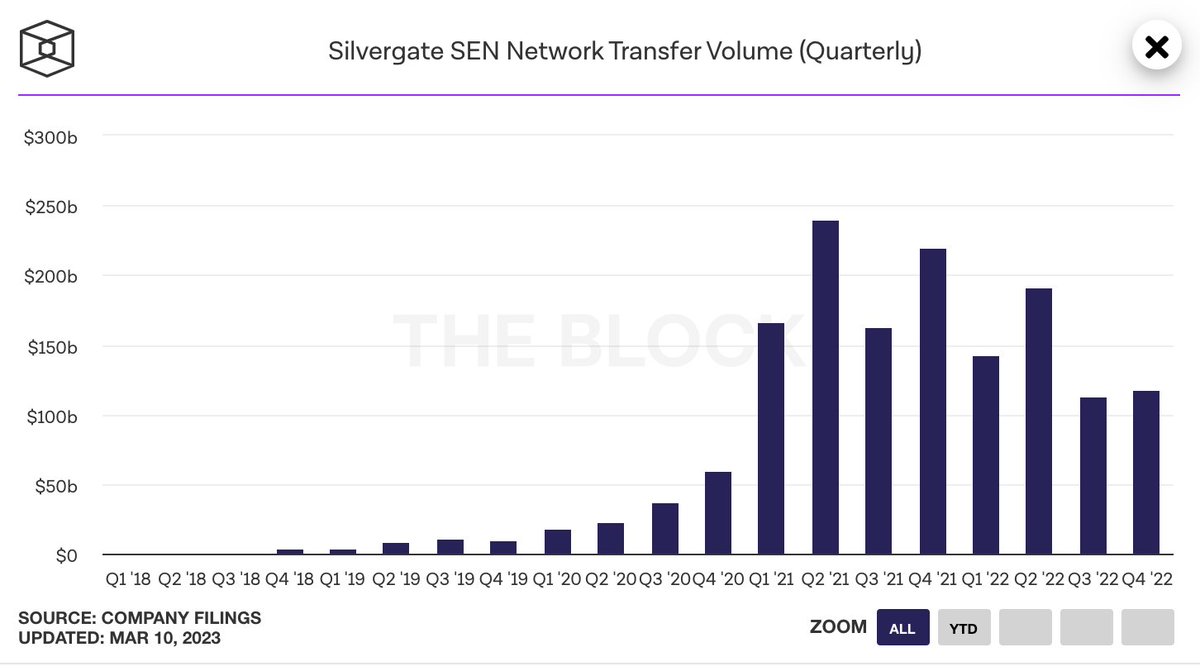

2/ In ‘20, Silvergate launched a controversial system to move funds between its accounts 24/7, called Silvergate Exchange Network.

2/ In ‘20, Silvergate launched a controversial system to move funds between its accounts 24/7, called Silvergate Exchange Network.