Does trend following work differently on the short side?

A thread, about the answer, but also how to approach questions like this

1/

A thread, about the answer, but also how to approach questions like this

1/

https://twitter.com/noalphadecay/status/1962569033766650131

The usual way retailers approach something like this is to run a backtest and take the best approach

This is shit. Don't do this, for many reasons, all of which boil down to the 3 types of overfitting (explicit, implicit, tacit)

/2

This is shit. Don't do this, for many reasons, all of which boil down to the 3 types of overfitting (explicit, implicit, tacit)

/2

So how SHOULD you approach something like this building your trading systems?

The key question: Do we have any basis for thinking that participants might be different on the long and the short side, and constrained in different ways?

/3

The key question: Do we have any basis for thinking that participants might be different on the long and the short side, and constrained in different ways?

/3

Ignore any behavioral reasons like "bull trends are greed, bear moves are fear" because they are 99% bullshit by weight and volume

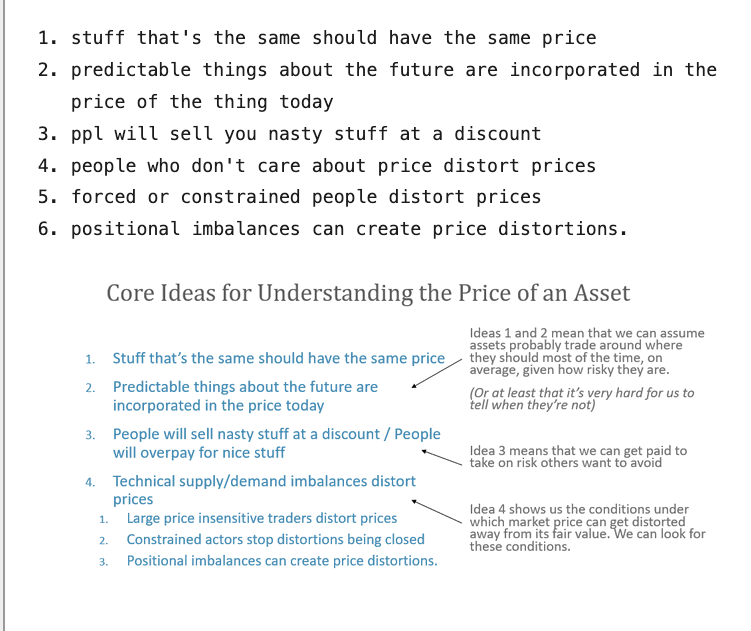

Edge in trading mostly comes from: (me cosplaying @therobotjames)

/4

Edge in trading mostly comes from: (me cosplaying @therobotjames)

/4

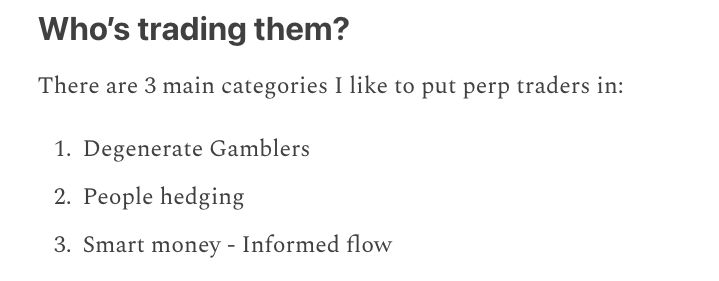

@therobotjames We will circle back on that list but lets talk about who is trading perps

My great friend @liquiditygoblin splits perp traders into 3 groups

/5

My great friend @liquiditygoblin splits perp traders into 3 groups

/5

@therobotjames @liquiditygoblin When we think about it, given that there's a big retail participation in crypto, and they are mostly long, there are plenty of reasons why we would see more hedging on the short side

Its not the most obvious thing to look for, but its worth a look I reckon

/6

Its not the most obvious thing to look for, but its worth a look I reckon

/6

@therobotjames @liquiditygoblin And when a project does crime, hedging their bags with perp short exposure, they are informed flow (they know they intend to rug it so the odds are better that they actually do rug)

/7

/7

@therobotjames @liquiditygoblin Lets circle back on James's list

"Predictable things about the future are incorporated in the price today"

People extrapolating future gains into today looks like

"If demand for Ai chips continues like it has in the very recent past... Ayyyyyyy"

/8

"Predictable things about the future are incorporated in the price today"

People extrapolating future gains into today looks like

"If demand for Ai chips continues like it has in the very recent past... Ayyyyyyy"

/8

@therobotjames @liquiditygoblin This is the sloppiest and least reliable driver of trend effects (which show up as unbalanced flows in the orderbook way before any of this nonsense) but its still a thing, at rare times, and briefly

/9

/9

@therobotjames @liquiditygoblin You might have just understood a key thing about momentum effects, that they aren't really one thing, but kind of a catch-all for shit that doesn't show up elsewhere in a factor model

Anyway, there's probably reason those type of situations are different on the short side

/10

Anyway, there's probably reason those type of situations are different on the short side

/10

@therobotjames @liquiditygoblin What about the rest of it?

Are hedgers (selling perps to balance spot long exposure) different?

Probably, yes

If I'm long ETH spot short ETH futures collecting basis (like USD.e, like @liminalmoney , like many others) I probably don't care if it goes up or down

/11

Are hedgers (selling perps to balance spot long exposure) different?

Probably, yes

If I'm long ETH spot short ETH futures collecting basis (like USD.e, like @liminalmoney , like many others) I probably don't care if it goes up or down

/11

@therobotjames @liquiditygoblin @liminalmoney So yes we have some pretty worthwhile reasons for investigating whether the short side behaves differently in crypto

Note NONE of these involve a backtest anywhere in the process except maybe at the very end if you're a pussy

Backtests are made of lies

/12

Note NONE of these involve a backtest anywhere in the process except maybe at the very end if you're a pussy

Backtests are made of lies

/12

@therobotjames @liquiditygoblin @liminalmoney Shouldn't this be widely known and arbitraged away?

Well, you'd think so, right?

But no. Crypto has huge inefficiencies, and probably will for the next 5 years

This is key to understand.

/13

Well, you'd think so, right?

But no. Crypto has huge inefficiencies, and probably will for the next 5 years

This is key to understand.

/13

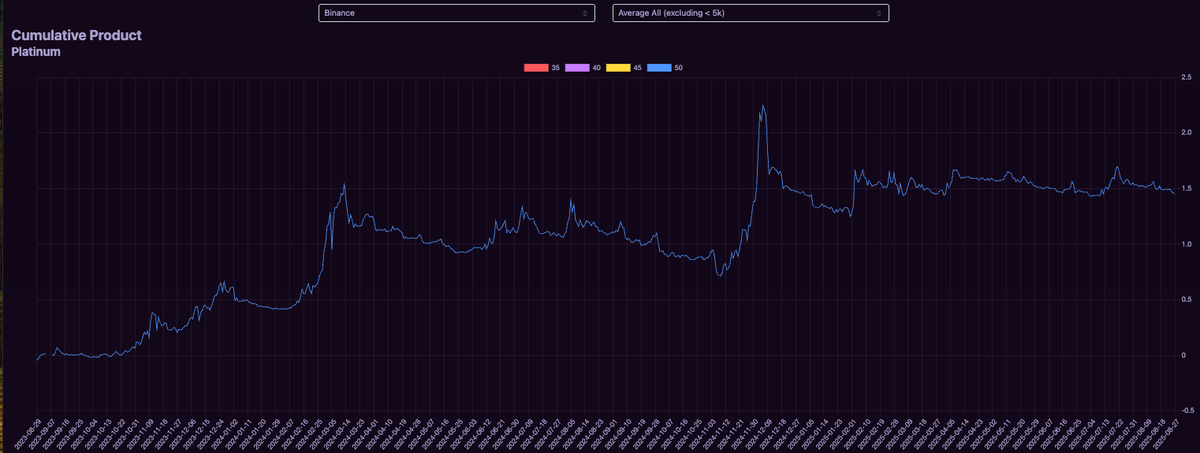

@therobotjames @liquiditygoblin @liminalmoney A standard crypto trend system (these are my returns for the last 2 years) looks like this

Which is to say, like dogshit. 150% in 2 years ain't nothing, but it hasn't been a party

Can we turn this into something better?

/14

Which is to say, like dogshit. 150% in 2 years ain't nothing, but it hasn't been a party

Can we turn this into something better?

/14

@therobotjames @liquiditygoblin @liminalmoney Well yeah actually we can.

Crypto trend starts off around 2-3x as better, apples for apples, as in TradFi

I think we can get it to Sharpe 3 (actually higher but I'll scale into that)

That would be a nice trick

It's actually what we are doing with @HyperTrendLabs

/15

Crypto trend starts off around 2-3x as better, apples for apples, as in TradFi

I think we can get it to Sharpe 3 (actually higher but I'll scale into that)

That would be a nice trick

It's actually what we are doing with @HyperTrendLabs

/15

@therobotjames @liquiditygoblin @liminalmoney @HyperTrendLabs How can you take a simple, well understood strategy like trend (which is just buying the stuff thats gone up and shorting what's gone down) into something GREAT?

/16

/16

@therobotjames @liquiditygoblin @liminalmoney @HyperTrendLabs @macrocephalopod does, and he's a wonderful man who has helped me an enormous amount

He runs a "mid frequency" system

So, in a great leap of deduction, I wanted to run a mid freq system too

Funny that innit

/17

He runs a "mid frequency" system

So, in a great leap of deduction, I wanted to run a mid freq system too

Funny that innit

/17

@therobotjames @liquiditygoblin @liminalmoney @HyperTrendLabs @macrocephalopod What IS a mid frequency crypto system?

Well, its exactly like my daily time frame trend system with a few key changes

/18

Well, its exactly like my daily time frame trend system with a few key changes

/18

@therobotjames @liquiditygoblin @liminalmoney @HyperTrendLabs @macrocephalopod My current system takes a bunch of "features" (forecasts of future price) and averages them together

If the forecast is positive, we go long

Negative we go short

Works pretty well aye

hyperliquid

/19

If the forecast is positive, we go long

Negative we go short

Works pretty well aye

hyperliquid

/19

@therobotjames @liquiditygoblin @liminalmoney @HyperTrendLabs @macrocephalopod Mid frequency is milliseconds to hours type trading.

How do we convert this to a shorter timeframe?

It's NOT just by doing the same thing on 5m charts - that doesn't work at all

What we do is take a daily chart and CONTINUOUSLY calculate our daily bar

Why?

/20

How do we convert this to a shorter timeframe?

It's NOT just by doing the same thing on 5m charts - that doesn't work at all

What we do is take a daily chart and CONTINUOUSLY calculate our daily bar

Why?

/20

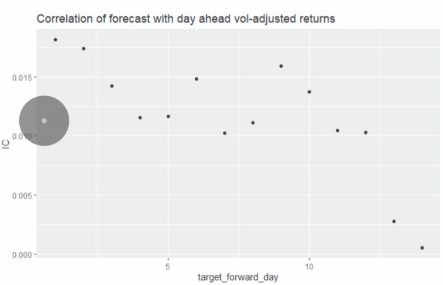

@therobotjames @liquiditygoblin @liminalmoney @HyperTrendLabs @macrocephalopod Here is a correlation of trend forecast with returns

You can see that they are MOST predictive for the first day, and gradually tail off to about 2 weeks out

So ideally, you'd get more edge by trading just the first day, except you'd be trading more (expensive)

/21

You can see that they are MOST predictive for the first day, and gradually tail off to about 2 weeks out

So ideally, you'd get more edge by trading just the first day, except you'd be trading more (expensive)

/21

@therobotjames @liquiditygoblin @liminalmoney @HyperTrendLabs @macrocephalopod So there's money if you can trade faster, but trading faster is expensive

How in the fuck do you trade more without burning money?

Good trick

/22

How in the fuck do you trade more without burning money?

Good trick

/22

@therobotjames @liquiditygoblin @liminalmoney @HyperTrendLabs @macrocephalopod I could have spent millions of dollars and a decade building 3rd rate market making infra

Instead I did what I always do, ask my smart mates

@liquiditygoblin isn't just a pretty shitposter, he has some of the best HFT MM infra in DeFi

/23

Instead I did what I always do, ask my smart mates

@liquiditygoblin isn't just a pretty shitposter, he has some of the best HFT MM infra in DeFi

/23

@therobotjames @liquiditygoblin @liminalmoney @HyperTrendLabs @macrocephalopod When I touch a trade, I bleed money

When @liquiditygoblin touches a trade, he makes money

We are not the same

/24

When @liquiditygoblin touches a trade, he makes money

We are not the same

/24

@therobotjames @liquiditygoblin @liminalmoney @HyperTrendLabs @macrocephalopod Goblin is an part owner of our firm now, and his firm is doing the MM infra for @HyperTrendLabs

So we short cut ourselves into being a mid frequency crypto fund

That gets us above Sharpe 2 and unlocks some scale

Can we make it better?

/25

So we short cut ourselves into being a mid frequency crypto fund

That gets us above Sharpe 2 and unlocks some scale

Can we make it better?

/25

@therobotjames @liquiditygoblin @liminalmoney @HyperTrendLabs @macrocephalopod Turns out there are predictable things driving trend effects in crypto

Those are

-size

-volatility

-liquidity

-how much something has trended

And those things are different long and short

/26

Those are

-size

-volatility

-liquidity

-how much something has trended

And those things are different long and short

/26

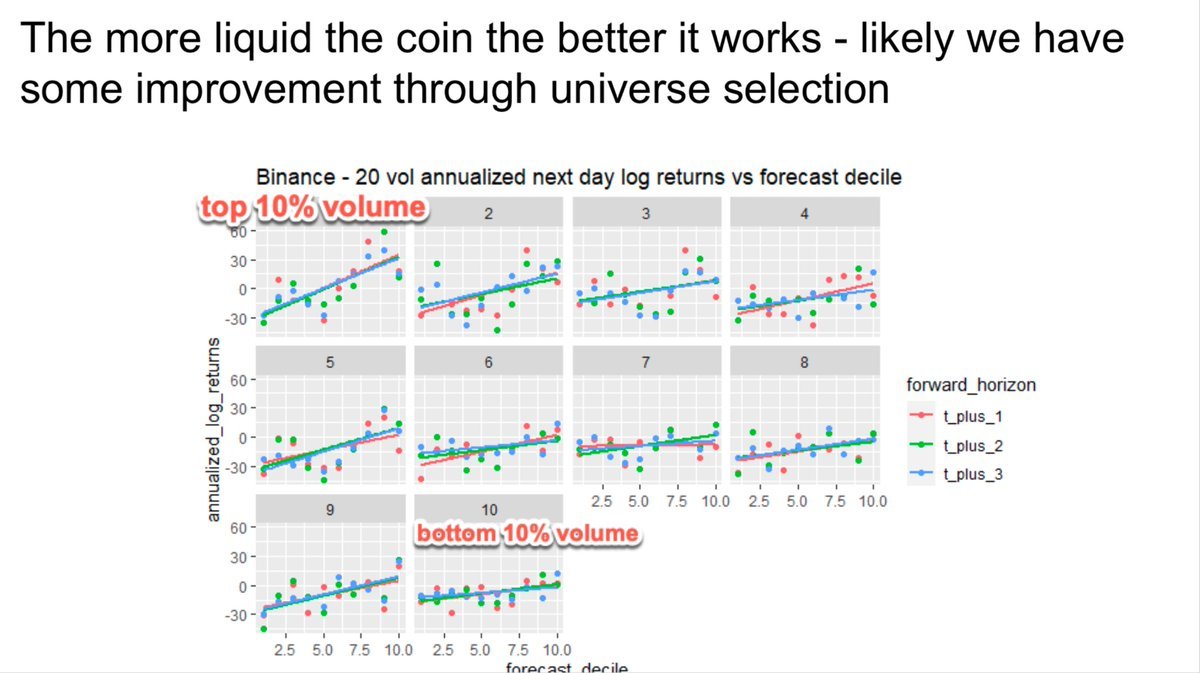

@therobotjames @liquiditygoblin @liminalmoney @HyperTrendLabs @macrocephalopod You can see that trend "works bigger on the big shit"

/27

/27

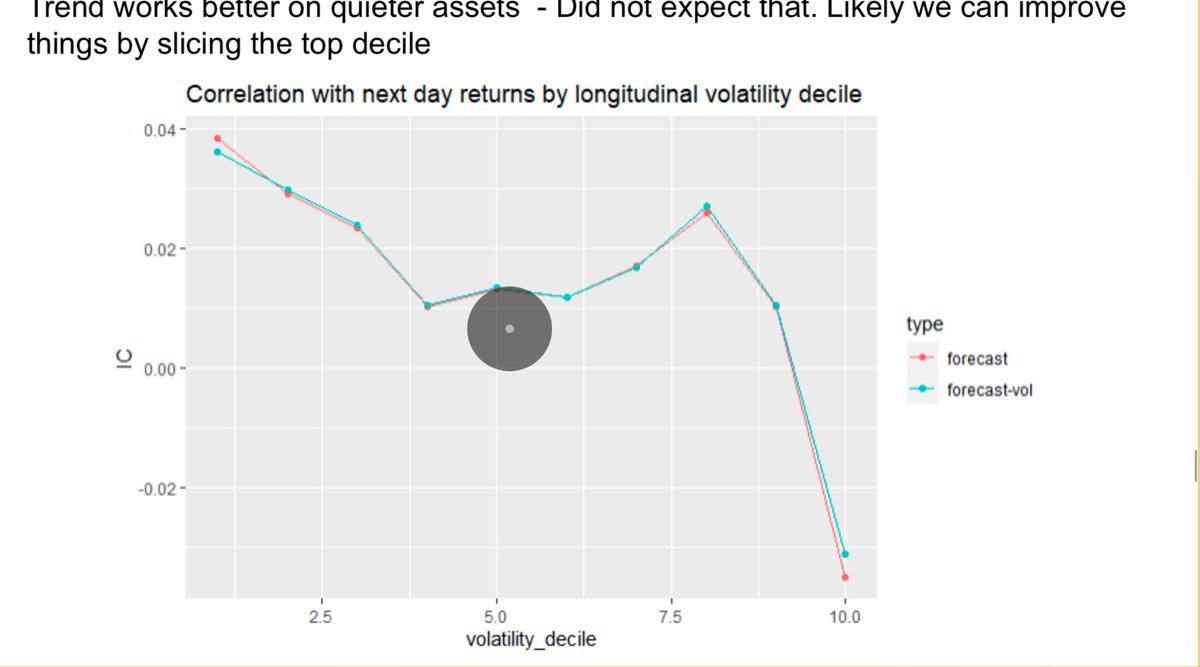

@therobotjames @liquiditygoblin @liminalmoney @HyperTrendLabs @macrocephalopod Trend also works better on low volatility coins

/28

/28

@therobotjames @liquiditygoblin @liminalmoney @HyperTrendLabs @macrocephalopod Understanding the predictable drivers of trend effects lets us build better systems

Let's go back to my current results. OK but a ballache.

When we do proper kwanting, and have the execution to match, we can get something that looks more fun

Something like this

/29

Let's go back to my current results. OK but a ballache.

When we do proper kwanting, and have the execution to match, we can get something that looks more fun

Something like this

/29

@therobotjames @liquiditygoblin @liminalmoney @HyperTrendLabs @macrocephalopod Its trend following, that doesn't actually suck to do

@HyperTrendLabs is a tokenized hedge fund on the HyperEVM

Why this? Why not just a bunch of carrywhoring or yield sluttery like other people do?

No shade on those people, im a big fan of most of them

/30

@HyperTrendLabs is a tokenized hedge fund on the HyperEVM

Why this? Why not just a bunch of carrywhoring or yield sluttery like other people do?

No shade on those people, im a big fan of most of them

/30

@therobotjames @liquiditygoblin @liminalmoney @HyperTrendLabs @macrocephalopod By approaching the market from a risk-forward perspective we can expect 5-10x the yield you can get from simple AAVE/MORPHO lending

IF we are good.

/31

IF we are good.

/31

@therobotjames @liquiditygoblin @liminalmoney @HyperTrendLabs @macrocephalopod That's the pitch. Massive yields on stables and HYPE (you can deposit hype) by taking more risk

If you'd like to read a bit more about the project this is a very draft doc (the project is built, the docs and website and other stuff not so much)

docs.google.com/document/d/1yY…

/32

If you'd like to read a bit more about the project this is a very draft doc (the project is built, the docs and website and other stuff not so much)

docs.google.com/document/d/1yY…

/32

@therobotjames @liquiditygoblin @liminalmoney @HyperTrendLabs @macrocephalopod This will be the highest stablecoin and HYPE yields in DeFi, or I cut my dick off an eat it live on stream

You think I'm joking, but I'm serious

Bacon and eggs. The chicken is merely involved

I'm COMMITTED

/33hypertrend.xyz

You think I'm joking, but I'm serious

Bacon and eggs. The chicken is merely involved

I'm COMMITTED

/33hypertrend.xyz

@therobotjames @liquiditygoblin @liminalmoney @HyperTrendLabs @macrocephalopod Aside from being a fancy gambling engine, we can do stuff that you can't do in current HL vaults.

Cross exchange arb, on chain, pendle vaults, investing spare capital for yield

If you've got a project that you think is a good fit for us to invest some spare capital in...

/34

Cross exchange arb, on chain, pendle vaults, investing spare capital for yield

If you've got a project that you think is a good fit for us to invest some spare capital in...

/34

@therobotjames @liquiditygoblin @liminalmoney @HyperTrendLabs @macrocephalopod Or you're part of the Hyperliquid eco and want support, help, or to just vibe

Get in touch

Thanks for your support

/fin

Get in touch

Thanks for your support

/fin

• • •

Missing some Tweet in this thread? You can try to

force a refresh