https://t.co/nerydN5oDo highest stablecoin and HYPE yields on DeFi or I cut my dick off and eat it on stream

23 subscribers

How to get URL link on X (Twitter) App

https://twitter.com/ScottPh77711570/status/2003291111104872756First thing you wanna do is remove the effects of all the things you know are fucking with price

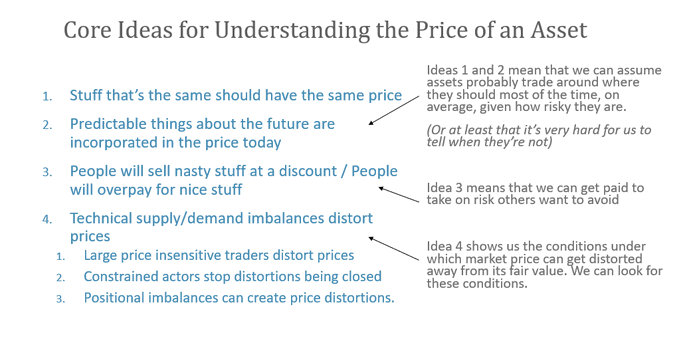

https://twitter.com/bennpeifert/status/1992739484539175419IMO you want to do things in this order

https://twitter.com/Defikoko/status/1980574867150995661If someone is planning on a coordinated market manipulation plan to pump some shitcoin to 100x it's fair value

https://twitter.com/Freenotthinker/status/1976978553188340029You might be tempted to draw some KEY LEVELS on your chart

https://twitter.com/Freenotthinker/status/1976978553188340029Firstly, the best risk management is the one you actually do

https://twitter.com/noalphadecay/status/1962569033766650131The usual way retailers approach something like this is to run a backtest and take the best approach

https://twitter.com/kirbyongeo/status/1867958297577549846

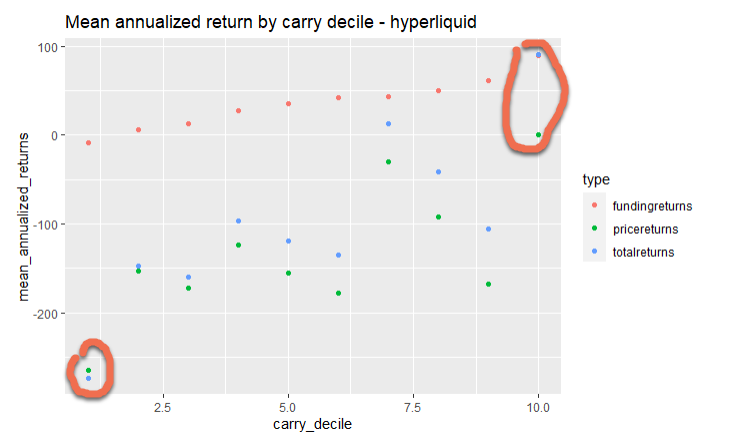

Yeah I got an airdrop from that, and stat arb carry worked gud like it does everywhere new

Yeah I got an airdrop from that, and stat arb carry worked gud like it does everywhere new

https://twitter.com/ScottPh77711570/status/1945290188130746593There are only two elements to trading

Let me tell you a couple of three things...

Let me tell you a couple of three things...

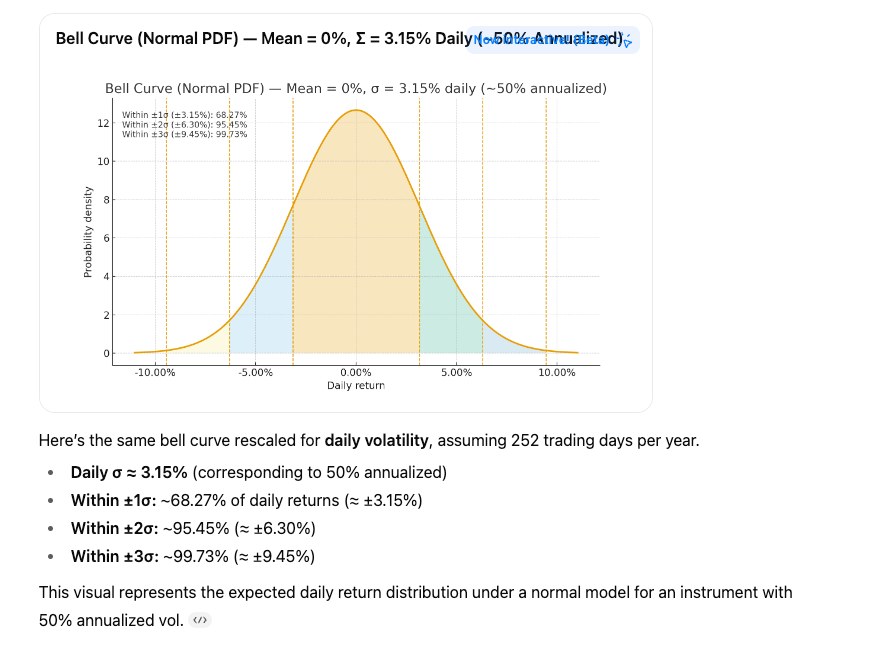

Which would you prefer (higher vol = higher drawdowns, more luck required)

Which would you prefer (higher vol = higher drawdowns, more luck required)

https://twitter.com/zhusu/status/1899722717504634941For some background see this excellent thread from @0xkinnif

https://x.com/0xkinnif/status/1899720420359868428