Elon Musk warns of "low birth rates."⚠️

But the real threat isn’t too few people, it’s the system’s limits.📈

The Limits to Growth study had the answer 50 years ago.

A thread.

🧵1/12

But the real threat isn’t too few people, it’s the system’s limits.📈

The Limits to Growth study had the answer 50 years ago.

A thread.

🧵1/12

https://twitter.com/elonmusk/status/1962680097816879208

Musk’s story: if population falls, economies collapse.

His "fix"? Have more children.

But this assumes growth = bodies. It misses the real constraint: the material system that supports those bodies.

🧵2/12

His "fix"? Have more children.

But this assumes growth = bodies. It misses the real constraint: the material system that supports those bodies.

🧵2/12

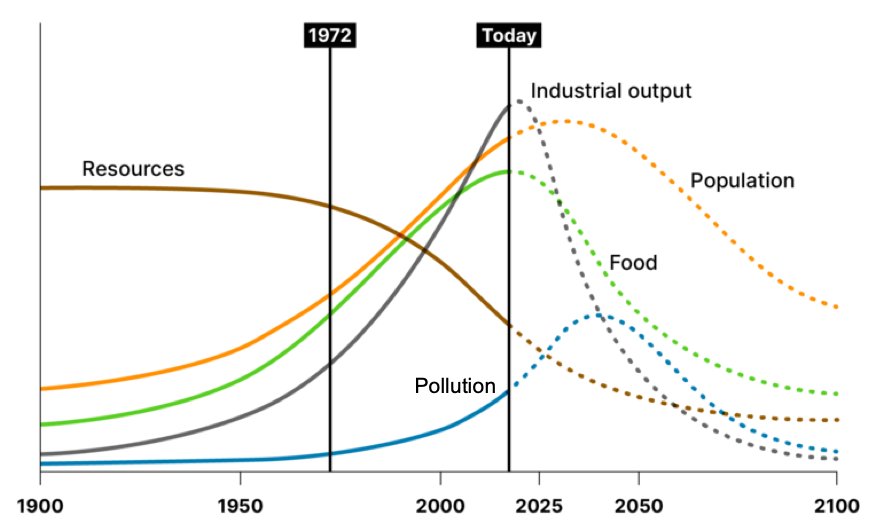

Back in 1972, Limits to Growth modeled the global economy as a system of stocks and flows:

–Population

–Resources

–Industrial output

–Food

–Pollution

The feedbacks between them told a stark story.

🧵3/12

–Population

–Resources

–Industrial output

–Food

–Pollution

The feedbacks between them told a stark story.

🧵3/12

The key finding: unchecked growth runs into planetary limits.

Resource depletion + rising pollution = falling output and falling living standards.

Population growth doesn’t save you. It makes collapse sharper.

🧵4/12

Resource depletion + rising pollution = falling output and falling living standards.

Population growth doesn’t save you. It makes collapse sharper.

🧵4/12

And the data?

Multiple independent reviews show the world has tracked close to the “standard run” of the 1972 model.

Industrial output, resource use, population, all moving along the projected path.

🧵5/12

Multiple independent reviews show the world has tracked close to the “standard run” of the 1972 model.

Industrial output, resource use, population, all moving along the projected path.

🧵5/12

So the problem isn’t "too few babies."

It’s too much extraction, too much pollution, too much dependence on exponential growth in a finite system.

🧵6/12

It’s too much extraction, too much pollution, too much dependence on exponential growth in a finite system.

🧵6/12

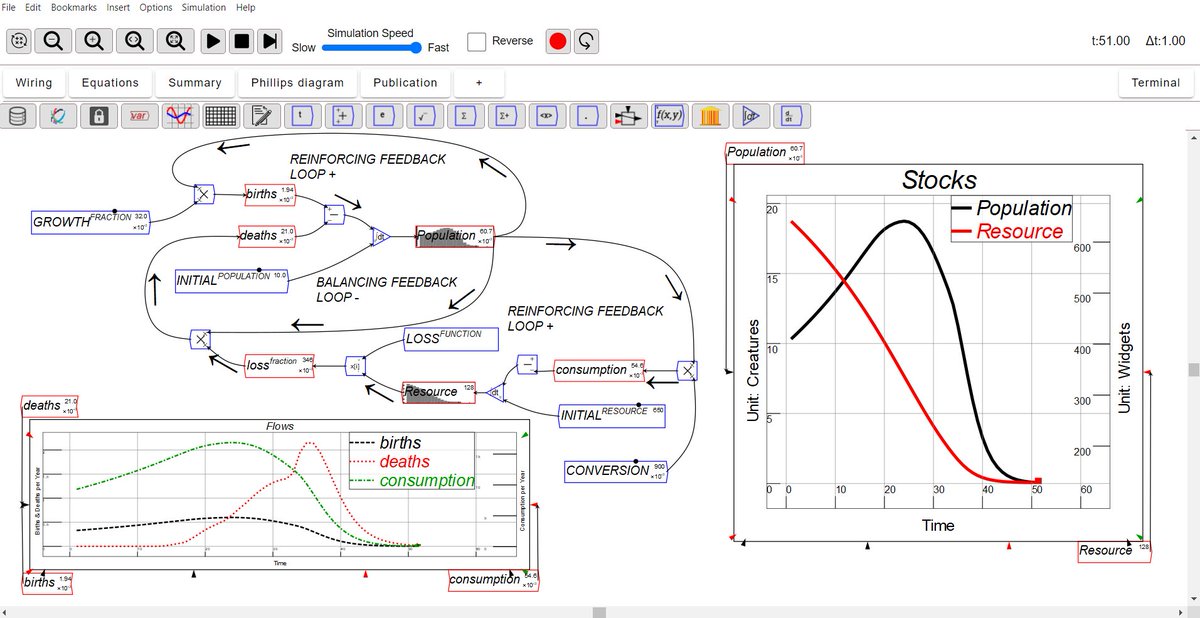

Musk imagines growth as linear: more people = more progress.

But in system dynamics, growth creates reinforcing loops that strain limits faster, unless you actively redesign the system.

🧵7/12

But in system dynamics, growth creates reinforcing loops that strain limits faster, unless you actively redesign the system.

🧵7/12

The real solution flagged in Limits to Growth:

Shift resources from raw expansion to stabilizing feedbacks, renewables, efficiency, equity.

Stability, not endless population growth, sustains prosperity.

🧵8/12

Shift resources from raw expansion to stabilizing feedbacks, renewables, efficiency, equity.

Stability, not endless population growth, sustains prosperity.

🧵8/12

This is why the obsession with birth rates is a distraction.

The danger is overshoot, not undershoot.

The challenge isn’t "too few workers", it’s building systems that work without infinite throughput.

🧵9/12

The danger is overshoot, not undershoot.

The challenge isn’t "too few workers", it’s building systems that work without infinite throughput.

🧵9/12

We’re seeing the warning lights now:

–Climate crisis

–Soil depletion

–Freshwater stress

–Pollution load

These weren’t “doomsday predictions.” They were system feedbacks unfolding.

🧵10/12

–Climate crisis

–Soil depletion

–Freshwater stress

–Pollution load

These weren’t “doomsday predictions.” They were system feedbacks unfolding.

🧵10/12

The choice isn’t "population collapse vs growth."

It’s collapse by overshoot or stability by design.

More people in an unstable system accelerates breakdown.

🧵11/12

It’s collapse by overshoot or stability by design.

More people in an unstable system accelerates breakdown.

🧵11/12

So when Musk frets about low birth rates, he’s missing the point.

The future depends less on how many people exist — and more on whether we respect the system’s limits.

📖Check out my Patreon for this and more:

🧵12/12

patreon.com/c/relearningec…

The future depends less on how many people exist — and more on whether we respect the system’s limits.

📖Check out my Patreon for this and more:

🧵12/12

patreon.com/c/relearningec…

• • •

Missing some Tweet in this thread? You can try to

force a refresh