American investors are living through the most psychologically brutal economic period since 2008.

But it's not a recession causing the damage...

It's the slow-motion wealth destruction that nobody talks about.

Here's what's actually happening to your money:🧵

But it's not a recession causing the damage...

It's the slow-motion wealth destruction that nobody talks about.

Here's what's actually happening to your money:🧵

The economic data tells a story of systematic middle-class erosion disguised as "resilient growth."

Q2 GDP hit 3.0% annualized growth, but that number hides a darker reality.

July job creation collapsed to just 73,000 new positions.

Unemployment ticked up to 4.2%.

Q2 GDP hit 3.0% annualized growth, but that number hides a darker reality.

July job creation collapsed to just 73,000 new positions.

Unemployment ticked up to 4.2%.

Most Americans don't realize they're paying a hidden tax that dwarfs their income gains.

Tariffs have quietly raised the average effective rate from 2.4% to over 18% this year.

That's a systematic transfer of wealth from your paycheck to government coffers.

Let's take a look:

Tariffs have quietly raised the average effective rate from 2.4% to over 18% this year.

That's a systematic transfer of wealth from your paycheck to government coffers.

Let's take a look:

Here's the math that financial advisors won't show you:

The average American household is paying an extra $2,400 annually in tariff costs.

Your grocery bill, furniture, clothing, and household goods all cost more.

But your salary didn't increase by $2,400...

The average American household is paying an extra $2,400 annually in tariff costs.

Your grocery bill, furniture, clothing, and household goods all cost more.

But your salary didn't increase by $2,400...

The Yale Budget Lab calculated the real impact:

- Clothing short-term price increase 37%, long-term 17%.

- Household furnishings up 17%.

These aren't temporary spikes.

These are permanent adjustments to your cost of living.

And there's more:

- Clothing short-term price increase 37%, long-term 17%.

- Household furnishings up 17%.

These aren't temporary spikes.

These are permanent adjustments to your cost of living.

And there's more:

Consumer price inflation sits at 2.6% in July, but that number is meaningless.

Core PCE inflation runs at 3.1%, well above the Fed's 2% target.

The Federal Reserve collected $26.6 billion in tariffs just in June.

Someone has to pay that bill...

Core PCE inflation runs at 3.1%, well above the Fed's 2% target.

The Federal Reserve collected $26.6 billion in tariffs just in June.

Someone has to pay that bill...

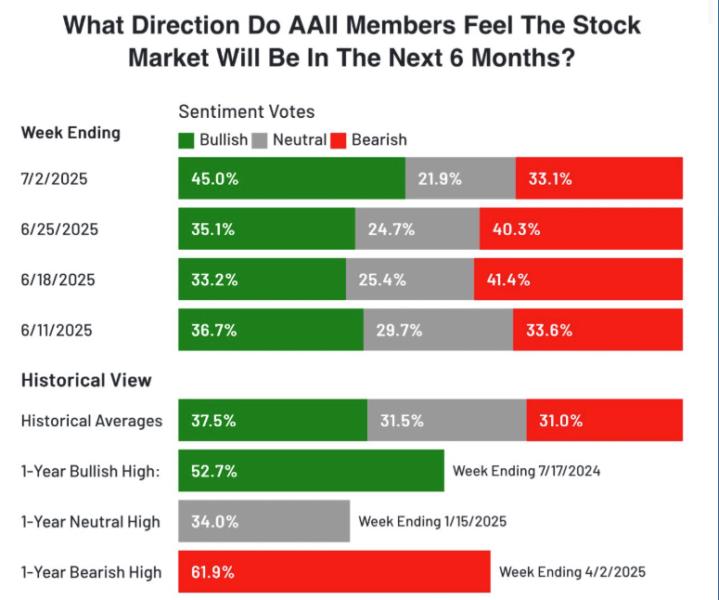

Individual investors are feeling the psychological weight.

AAII sentiment survey shows 44.8% bearish readings as of August 20th.

That's 13.8 percentage points above the historical average.

Fear levels haven't been this extreme since early 2025...

AAII sentiment survey shows 44.8% bearish readings as of August 20th.

That's 13.8 percentage points above the historical average.

Fear levels haven't been this extreme since early 2025...

The disconnect between official "growth" and lived reality is causing mass investor paralysis.

The U.S. Consumer Confidence Index dropped to 58.2 in August, down from 61.7.

People know something is wrong.

But here's what the fear is missing:

The U.S. Consumer Confidence Index dropped to 58.2 in August, down from 61.7.

People know something is wrong.

But here's what the fear is missing:

Extreme bearish sentiment historically signals market bottoms, not tops.

When AAII bearish readings exceeded 61.9% in April 2025, historical patterns show the S&P 500 typically gains about 16% over the following year.

Panic creates opportunities.

When AAII bearish readings exceeded 61.9% in April 2025, historical patterns show the S&P 500 typically gains about 16% over the following year.

Panic creates opportunities.

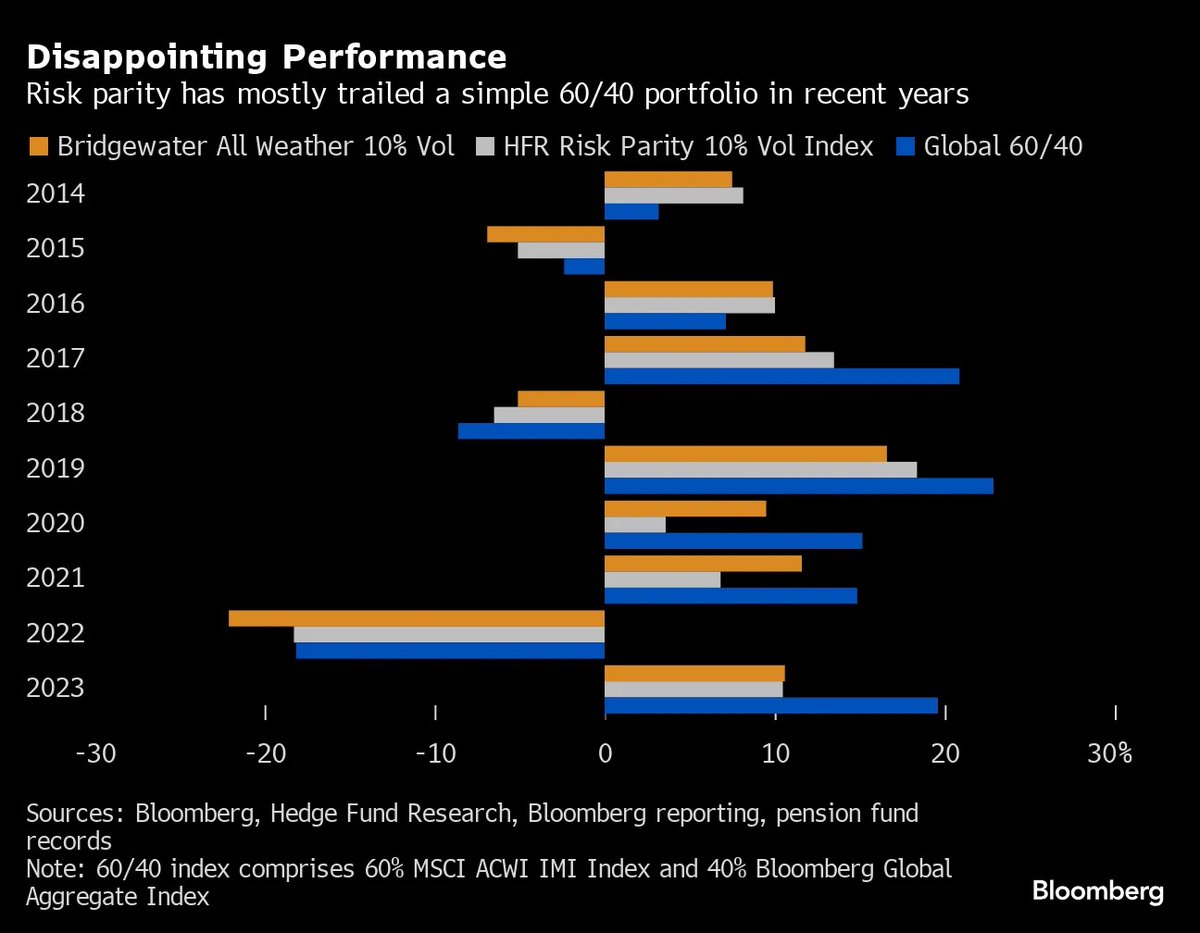

The Fed faces an impossible choice between fighting inflation and supporting a slowing economy.

Rate cuts would fuel more inflation.

Rate holds would deepen the economic slowdown.

Either way, traditional investment strategies built on predictable Fed policy are obsolete:

Rate cuts would fuel more inflation.

Rate holds would deepen the economic slowdown.

Either way, traditional investment strategies built on predictable Fed policy are obsolete:

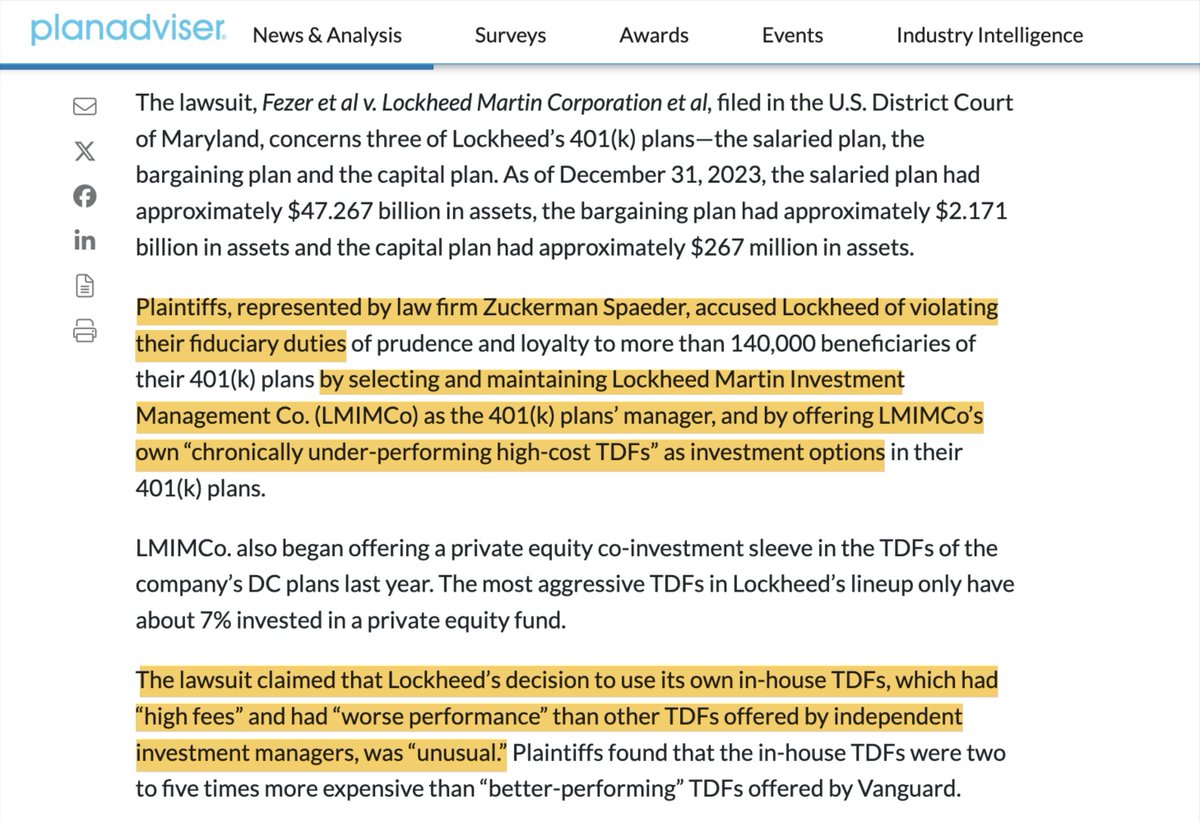

High-fee advisors can't navigate systematic policy-driven cost increases.

Independence matters more than ever.

Smart investors recognize that this isn't a normal business cycle:

Independence matters more than ever.

Smart investors recognize that this isn't a normal business cycle:

This is a structural shift in how the American economy operates.

High tariff costs, persistent inflation, and slow growth create a new baseline.

The old rulebook doesn't work anymore:

High tariff costs, persistent inflation, and slow growth create a new baseline.

The old rulebook doesn't work anymore:

Families see their standard of living erode despite working harder.

Investors watch portfolios gain in nominal terms while losing in real terms.

The gap between financial markets and financial reality widens daily.

This creates an opportunity:

Investors watch portfolios gain in nominal terms while losing in real terms.

The gap between financial markets and financial reality widens daily.

This creates an opportunity:

When fear dominates and traditional strategies fail, independent investors who understand the new economic reality can build wealth.

Not by following the crowd.

But by recognizing that the crowd is usually wrong at turning points:

Not by following the crowd.

But by recognizing that the crowd is usually wrong at turning points:

Tired of high-fee advisors who underdeliver?

Our FREE weekly newsletter teaches:

- How to spot hidden portfolio fees

- Macro trends Wall Street hides

- Independent investing strategies

Subscribe here for FREE: dalyam.beehiiv.com

Our FREE weekly newsletter teaches:

- How to spot hidden portfolio fees

- Macro trends Wall Street hides

- Independent investing strategies

Subscribe here for FREE: dalyam.beehiiv.com

If you found this helpful consider:

- RTing the tweet below

- Following me @DalyAManagement

Thanks for reading.

- RTing the tweet below

- Following me @DalyAManagement

Thanks for reading.

https://twitter.com/1897772264696799232/status/1962878279628779905

• • •

Missing some Tweet in this thread? You can try to

force a refresh