Trump's Trade War is Not Chaos but a fake "Facade".

It is a design to achieve what Trump wanted since long.

Trump will come out the biggest winner from it.

It was never about Trade imbalance, tariffs etc.

It has been always about Trump.

SCO Meeting in Tianjin what has brought him closer to his goal.

Read this thread till the end and you will understand it.

It is a design to achieve what Trump wanted since long.

Trump will come out the biggest winner from it.

It was never about Trade imbalance, tariffs etc.

It has been always about Trump.

SCO Meeting in Tianjin what has brought him closer to his goal.

Read this thread till the end and you will understand it.

Trump’s Trade War is not random chaos. It is a carefully staged drama.

Do you remember Trump's spat with JP Morgan CEO and Bank of American in 2018-19 he accused JP Morgan and Bank Of America of denying keeping his money?

It hurt Trump's ego same way when Obama made fun of him during a white house dinner in 2013/14.

Do you really think US's biggest strength is export?

It is its monopolistic companies like Apple, Google, NVIDIA, Meta etc.

The “trade imbalance” story is a cover. Trump's personal business and wealth ambition have lot to do with all of this. Let's start with...

Do you remember Trump's spat with JP Morgan CEO and Bank of American in 2018-19 he accused JP Morgan and Bank Of America of denying keeping his money?

It hurt Trump's ego same way when Obama made fun of him during a white house dinner in 2013/14.

Do you really think US's biggest strength is export?

It is its monopolistic companies like Apple, Google, NVIDIA, Meta etc.

The “trade imbalance” story is a cover. Trump's personal business and wealth ambition have lot to do with all of this. Let's start with...

Trump talks about wanting a “strong dollar,” but his personal empire benefits from the opposite.

A weaker dollar makes real estate prices go up, makes it easier to pay off big debts, and raises the value of gold, oil, and commodities.

Foreign investors also find U.S. assets cheaper when the dollar falls. Trump’s wealth is tied to real estate and debt-heavy businesses.

That means when the dollar weakens, he personally wins. His “strong dollar” talk is for markets and media. But behind the scenes, his real incentive is a weaker dollar.

A weaker dollar makes real estate prices go up, makes it easier to pay off big debts, and raises the value of gold, oil, and commodities.

Foreign investors also find U.S. assets cheaper when the dollar falls. Trump’s wealth is tied to real estate and debt-heavy businesses.

That means when the dollar weakens, he personally wins. His “strong dollar” talk is for markets and media. But behind the scenes, his real incentive is a weaker dollar.

If you look at U.S. trade, the tariff war doesn’t make sense.

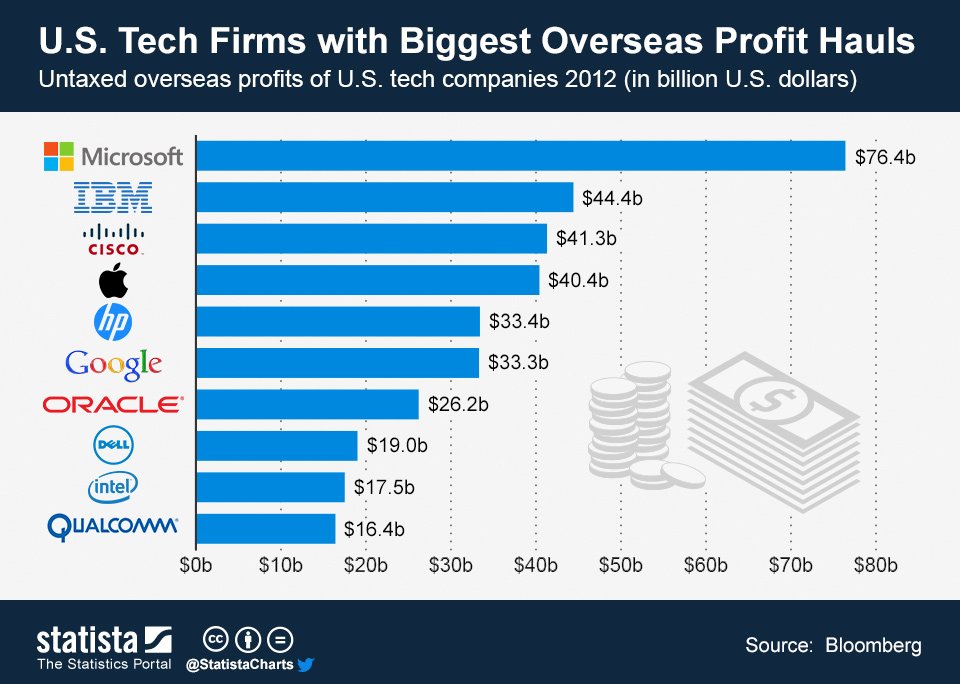

America’s real power is not cheap goods — it’s tech, services, and finance. Apple designs in the U.S., manufactures abroad, and sells everywhere. Google, Microsoft, and Meta export digital products, not soybeans or steel.

The U.S. earns trillions through IP, software, and Wall Street, not just goods trade.

So punishing India’s $77B exports or complaining about India buying Russian oil is meaningless compared to tech-driven profits. That’s why tariffs are more about politics and disruption than fixing trade gaps.

America’s real power is not cheap goods — it’s tech, services, and finance. Apple designs in the U.S., manufactures abroad, and sells everywhere. Google, Microsoft, and Meta export digital products, not soybeans or steel.

The U.S. earns trillions through IP, software, and Wall Street, not just goods trade.

So punishing India’s $77B exports or complaining about India buying Russian oil is meaningless compared to tech-driven profits. That’s why tariffs are more about politics and disruption than fixing trade gaps.

So why the tariff drama?

Because it creates fear and pushes countries to think about life beyond the dollar. Buying Greenland, joking about Canada as a 51st state, or threatening 145% tariffs are not “solutions.”

They are pressure tactics.

The louder the threats, the more countries wonder if relying only on the U.S. dollar is too risky.

That thought pushes blocs like BRICS and others to speed up work on local currency trade. In simple terms: the tariffs don’t fix trade but they push others away from the dollar.

Because it creates fear and pushes countries to think about life beyond the dollar. Buying Greenland, joking about Canada as a 51st state, or threatening 145% tariffs are not “solutions.”

They are pressure tactics.

The louder the threats, the more countries wonder if relying only on the U.S. dollar is too risky.

That thought pushes blocs like BRICS and others to speed up work on local currency trade. In simple terms: the tariffs don’t fix trade but they push others away from the dollar.

And here is the twist: Trump benefits when that happens. Smaller economies that can’t build big currency agreements will look at crypto as an option.

Crypto or tokenized trade becomes the fallback.

Trump has recently embraced crypto, even taking campaign donations in Bitcoin.

Financial analysis and various reports suggest overall profits from the Trump meme coin alone exceeded $350 million, and in some accounts reached as high as $385 million when including fees and realized sales.

At one stage, the market value of Trump’s meme coin holdings was temporarily estimated at many billions of dollars

That is not random — it shows he sees opportunity if alternatives to the dollar grow. If crypto systems take off, those who build them early — Trump’s allies, donors, or his businesses — stand to profit.

Tariff chaos becomes a way to build a new money system Trump can cash in on.

Crypto or tokenized trade becomes the fallback.

Trump has recently embraced crypto, even taking campaign donations in Bitcoin.

Financial analysis and various reports suggest overall profits from the Trump meme coin alone exceeded $350 million, and in some accounts reached as high as $385 million when including fees and realized sales.

At one stage, the market value of Trump’s meme coin holdings was temporarily estimated at many billions of dollars

That is not random — it shows he sees opportunity if alternatives to the dollar grow. If crypto systems take off, those who build them early — Trump’s allies, donors, or his businesses — stand to profit.

Tariff chaos becomes a way to build a new money system Trump can cash in on.

The tariff logic also fails because of supply chains. U.S. tech companies depend on cheaper production in Asia, India, and other economies.

If you put tariffs on those imports, costs go up for American firms themselves. That’s why these fights are not really about economics — they are about headlines, disruption, and creating political noise.

Behind the noise, the bigger shift is already happening: countries are moving slowly toward alternatives to the dollar, and Trump’s circle is preparing to benefit when that shift speeds up.

If you put tariffs on those imports, costs go up for American firms themselves. That’s why these fights are not really about economics — they are about headlines, disruption, and creating political noise.

Behind the noise, the bigger shift is already happening: countries are moving slowly toward alternatives to the dollar, and Trump’s circle is preparing to benefit when that shift speeds up.

Look at South Asia.

During Operation Sindoor, Trump quickly claimed he had mediated a ceasefire between India and Pakistan.

India publicly denied it, but inside Pakistan it looked like Trump had forced their generals to beg for peace.

Then Trump’s anti-India comments made him look friendly to Pakistan’s military elite.

Why does that matter? Because Pakistan is rich in minerals.

Building influence with the army there means gaining future access to resources.

Trump initiated this just around Pahalgam Attack taking Pakistani General Asim Munir in confidence.

China was in the lead with infra investments but Trump made a wild card entry.

During Operation Sindoor, Trump quickly claimed he had mediated a ceasefire between India and Pakistan.

India publicly denied it, but inside Pakistan it looked like Trump had forced their generals to beg for peace.

Then Trump’s anti-India comments made him look friendly to Pakistan’s military elite.

Why does that matter? Because Pakistan is rich in minerals.

Building influence with the army there means gaining future access to resources.

Trump initiated this just around Pahalgam Attack taking Pakistani General Asim Munir in confidence.

China was in the lead with infra investments but Trump made a wild card entry.

Ukraine is even bigger.

The country has massive deposits of rare earths and critical minerals — key for defense, energy, and tech.

Some estimates say they are worth trillions. Trump has often talked about pushing for a ceasefire. Of course, peace would be good for the world, but it would also give him a way to be in the room when deals over Ukraine’s resources are made.

If sanctions on Russia are lifted after a peace deal, new trade will open.

Trade will boom through local currencies, gold, crypto etc. Examples will be taken from how India or China traded with Russia during sanctions.

Again Trump's crypto and other non-dollar systems will come into play.

The country has massive deposits of rare earths and critical minerals — key for defense, energy, and tech.

Some estimates say they are worth trillions. Trump has often talked about pushing for a ceasefire. Of course, peace would be good for the world, but it would also give him a way to be in the room when deals over Ukraine’s resources are made.

If sanctions on Russia are lifted after a peace deal, new trade will open.

Trade will boom through local currencies, gold, crypto etc. Examples will be taken from how India or China traded with Russia during sanctions.

Again Trump's crypto and other non-dollar systems will come into play.

Now to SCO: At the Tianjin Summit, Xi, Putin, and Modi stood united in front of 20+ leaders, pushing the idea of alternatives to U.S.-led financial systems.

They announced a new SCO development bank, financial aid, AI cooperation, and BeiDou satellite access—tools undercutting dollar dominance.

Leaders committed to using national currencies for trade, and talked about launching regional swap funds and digital-payment systems.

All of this plays directly into Trump’s broader play: weakening the dollar while ramping up global alternatives that he and his families and allies can exploit.

They announced a new SCO development bank, financial aid, AI cooperation, and BeiDou satellite access—tools undercutting dollar dominance.

Leaders committed to using national currencies for trade, and talked about launching regional swap funds and digital-payment systems.

All of this plays directly into Trump’s broader play: weakening the dollar while ramping up global alternatives that he and his families and allies can exploit.

These SCO moves feed into a global de-dollarization trend. China is pushing a multipolar world while offering infrastructure, credit, and tech outside Western institutions.

India’s involvement signals strategic autonomy. Central banks are buying gold, reducing dollar reserves.

The dollar’s shrinking role and rise of new systems (gold, regional currencies, crypto) are not abstract—they reshape global power.

Meanwhile, Trump’s asset portfolio—real estate, debt-heavy holdings, minerals, crypto—is poised to benefit from this financial realignment.

India’s involvement signals strategic autonomy. Central banks are buying gold, reducing dollar reserves.

The dollar’s shrinking role and rise of new systems (gold, regional currencies, crypto) are not abstract—they reshape global power.

Meanwhile, Trump’s asset portfolio—real estate, debt-heavy holdings, minerals, crypto—is poised to benefit from this financial realignment.

The bottom line: Trump’s Trade War was never about fixing trade balances.

It was about fracturing dollar dominance, nudging the world toward financial alternatives, and building access—for himself—to the value systems that emerge. The SCO summit brought us a step closer.

As global power diversifies, Trump may be the unexpected king of the rubble. It was never about America’s trade deficit—it was always about Trump.

It was about fracturing dollar dominance, nudging the world toward financial alternatives, and building access—for himself—to the value systems that emerge. The SCO summit brought us a step closer.

As global power diversifies, Trump may be the unexpected king of the rubble. It was never about America’s trade deficit—it was always about Trump.

• • •

Missing some Tweet in this thread? You can try to

force a refresh