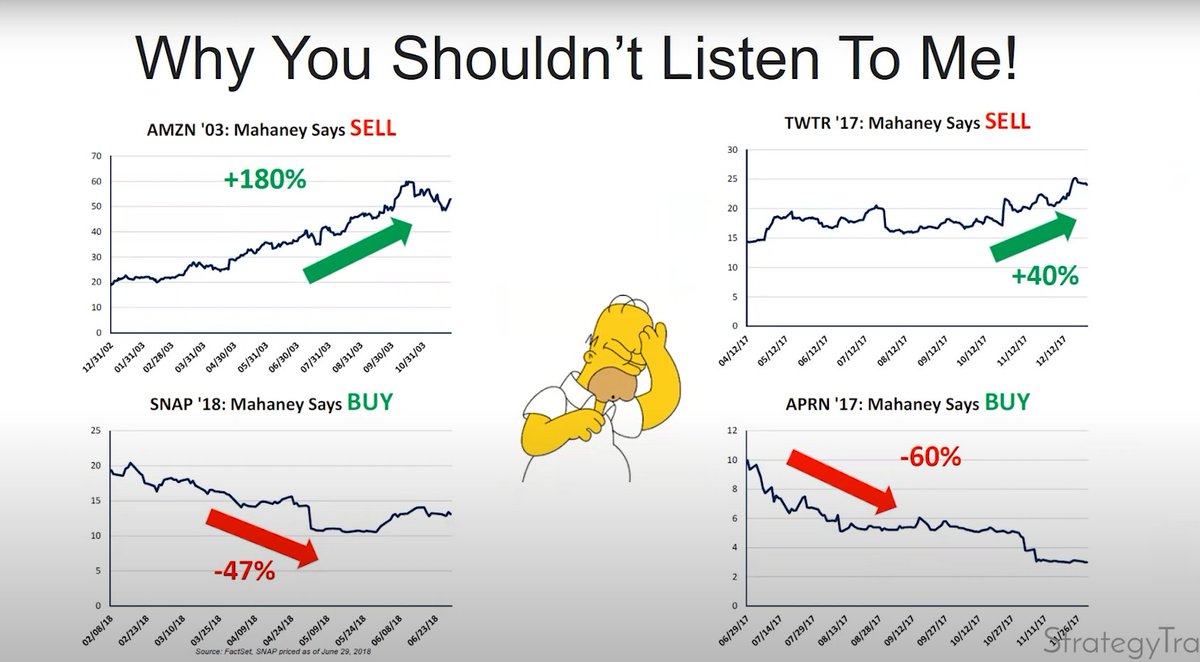

He's had some notable misses:

SELL on $AMZN

SELL on $TWTR

BUY on $SNAP

BUY on $APRN

But he's v v transparent.

SELL on $AMZN

SELL on $TWTR

BUY on $SNAP

BUY on $APRN

But he's v v transparent.

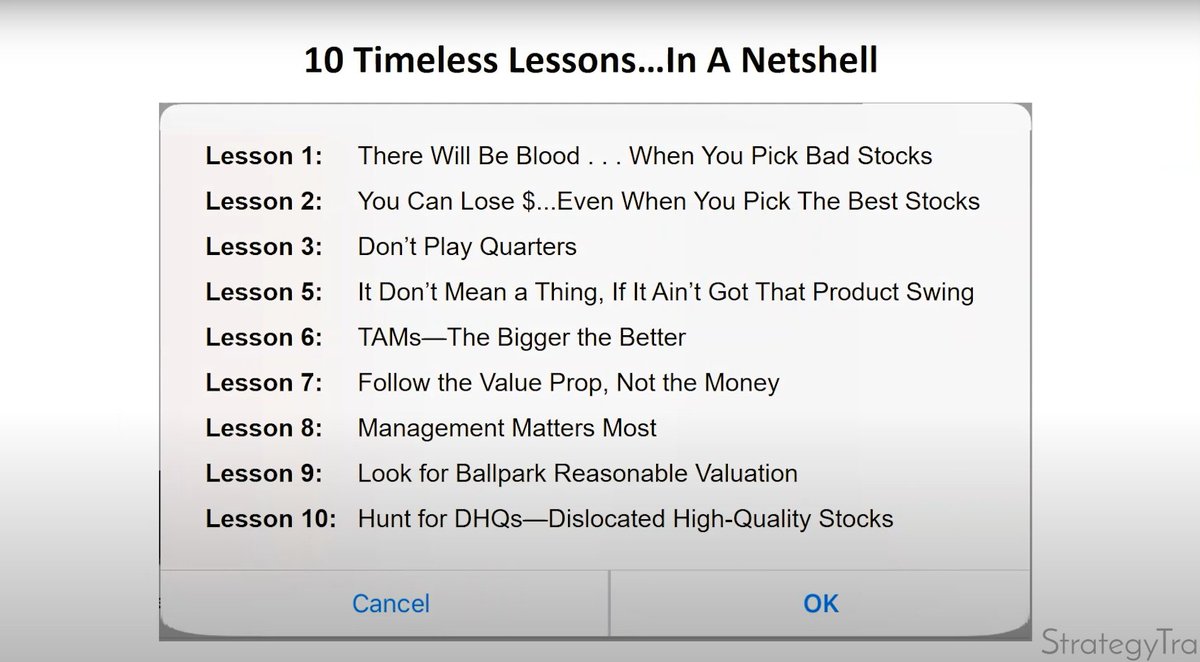

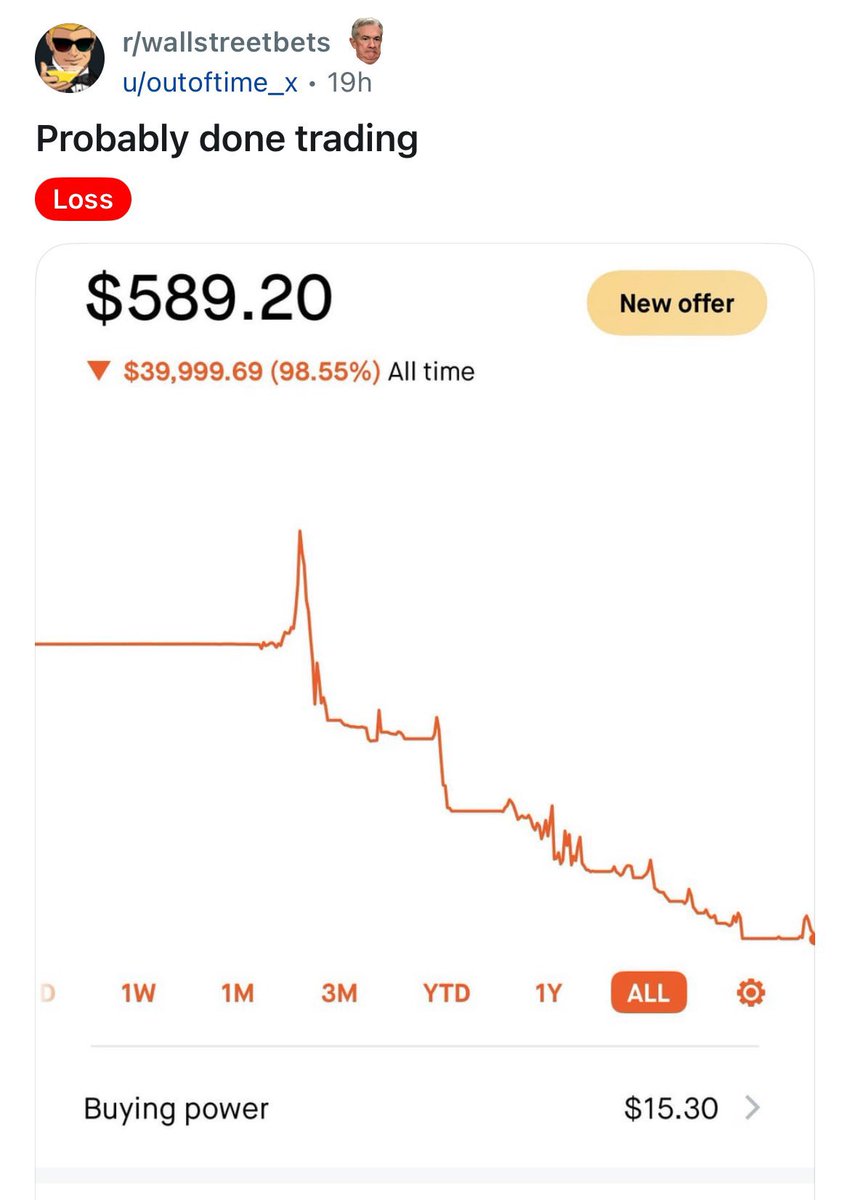

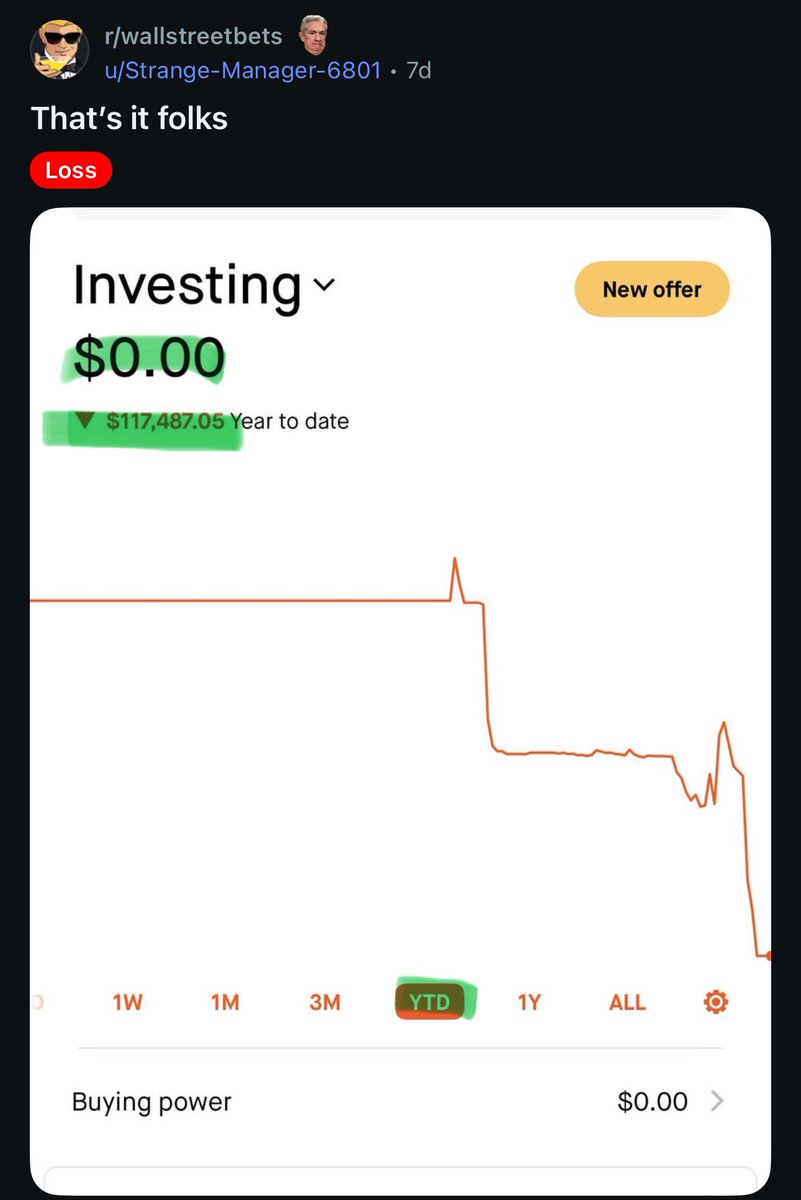

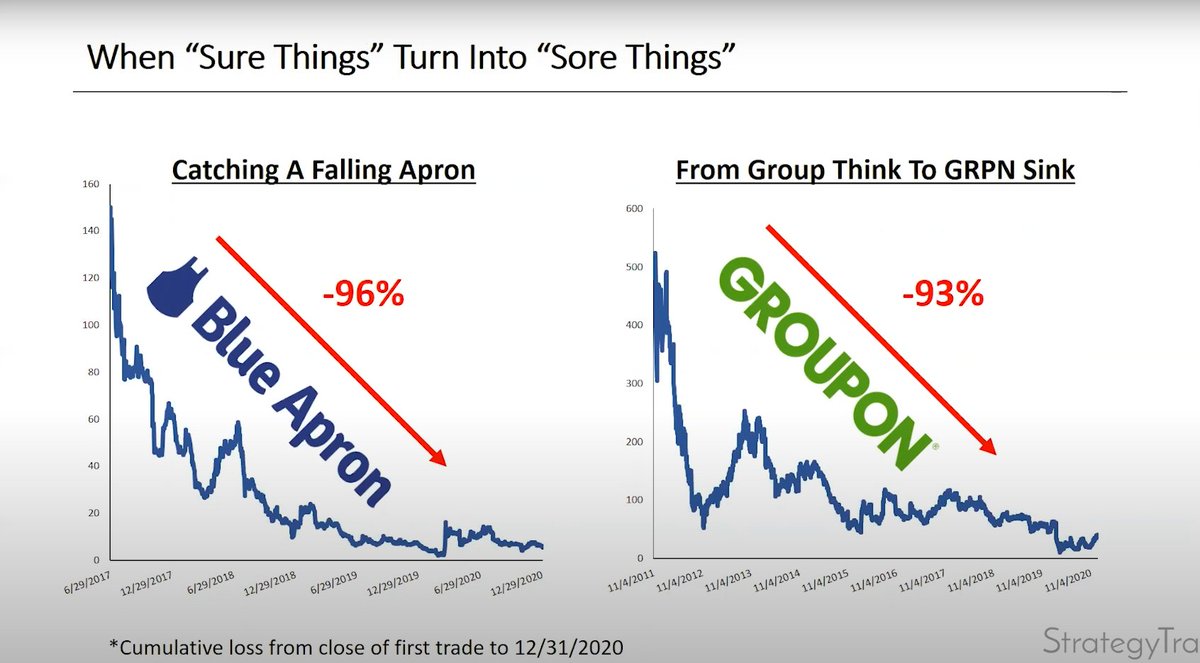

Lesson 1: Pick bad stocks and you're fucked.

You're gonna lose money.

ESPECIALLY if you trade around stocks.

(He's not a technicals guy)

You're gonna lose money.

ESPECIALLY if you trade around stocks.

(He's not a technicals guy)

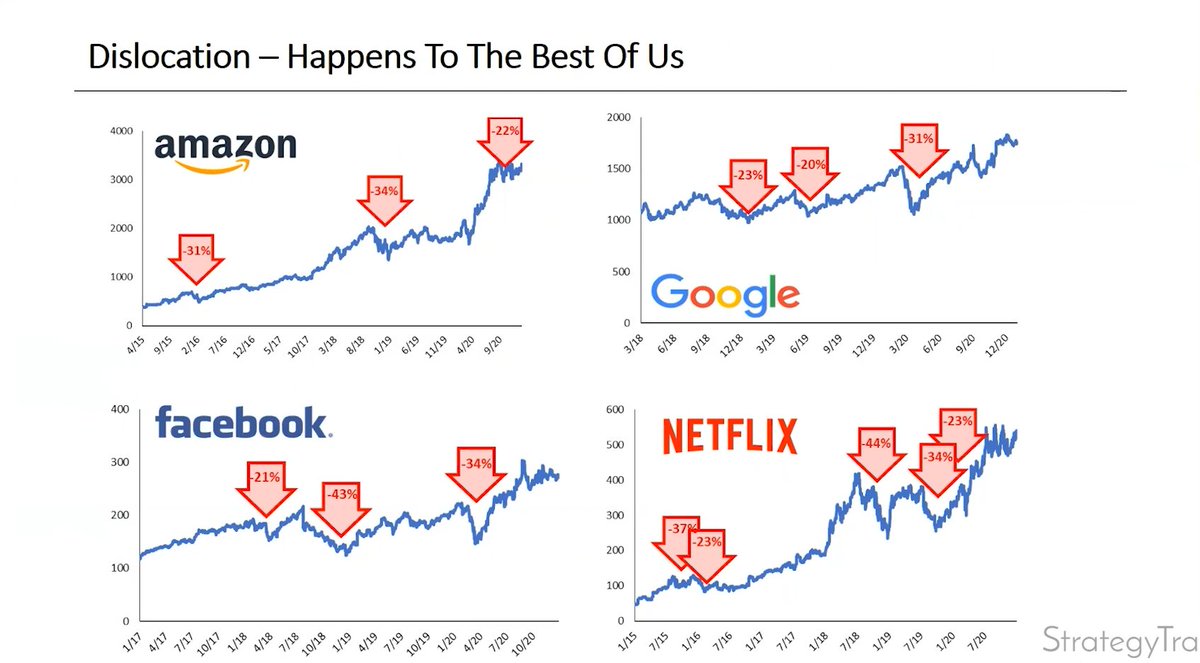

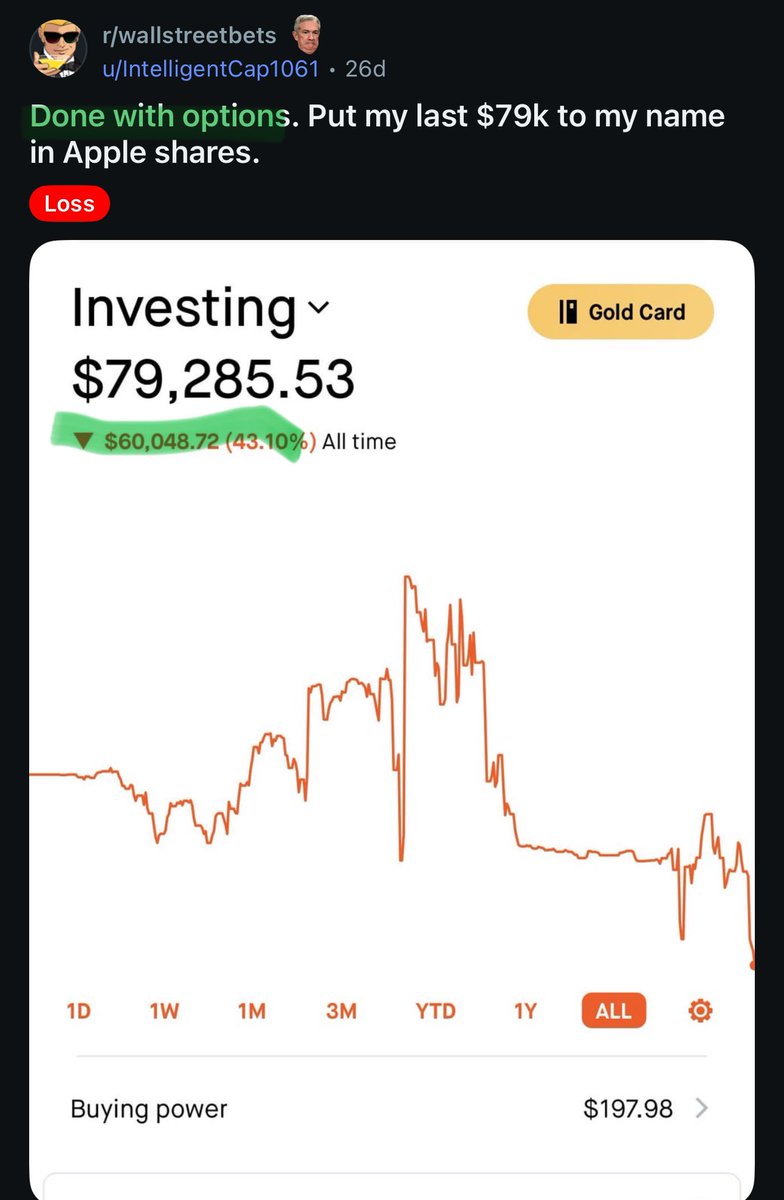

Lesson 2: Even if you pick right, expect disgusting downside volatility.

Even best in class stocks crash 20-40%

This is even worse if you're highly concentrated.

Even best in class stocks crash 20-40%

This is even worse if you're highly concentrated.

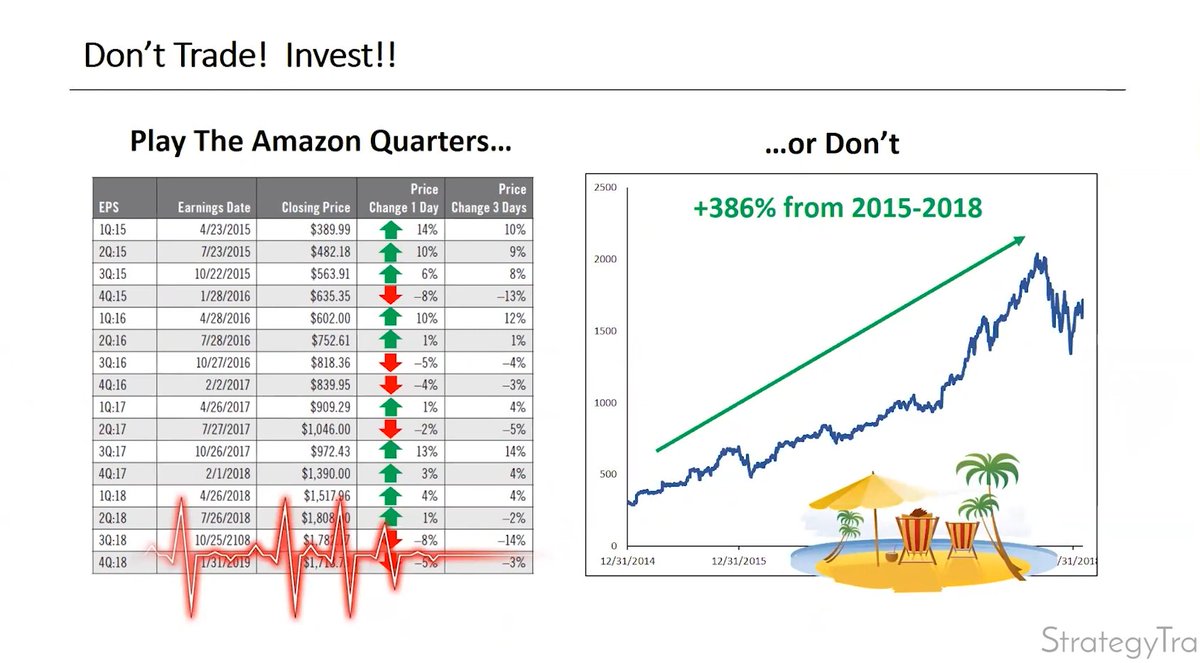

Lesson 3: Don't trade around quarters.

Buy and hold companies for their long term fundamentals.

To trade around quarters, you need to be:

1. Right on fundamentals.

2. Right on near term expectations (difficult to do).

Just stick to the long term.

Ignore short term prices.

Buy and hold companies for their long term fundamentals.

To trade around quarters, you need to be:

1. Right on fundamentals.

2. Right on near term expectations (difficult to do).

Just stick to the long term.

Ignore short term prices.

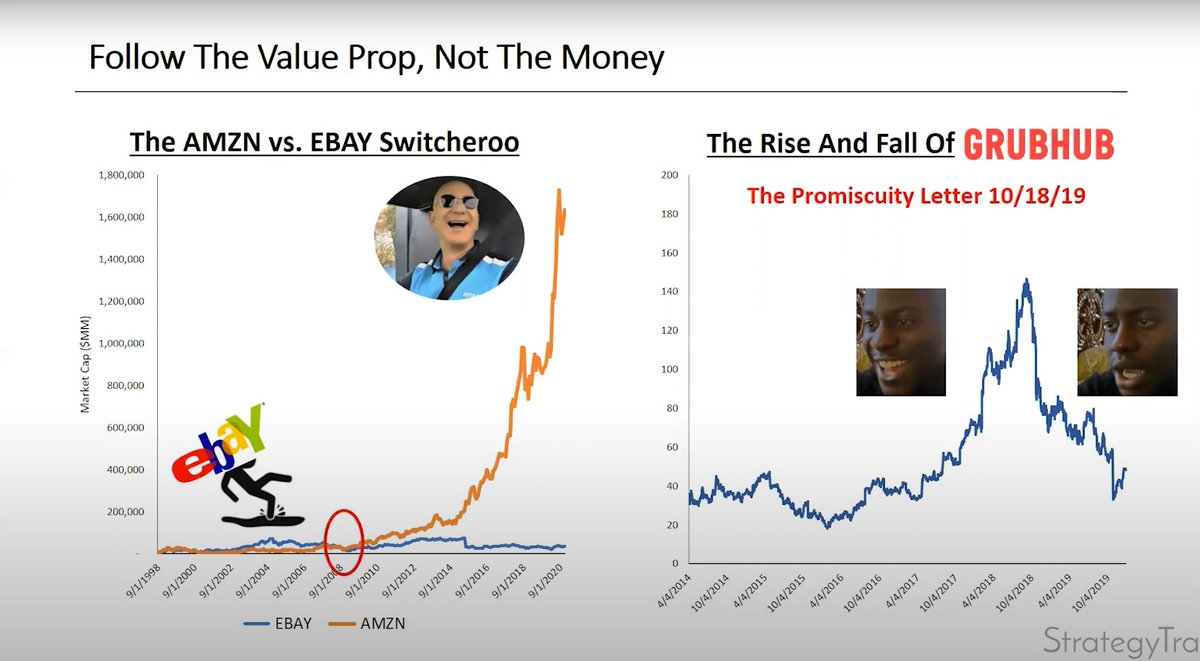

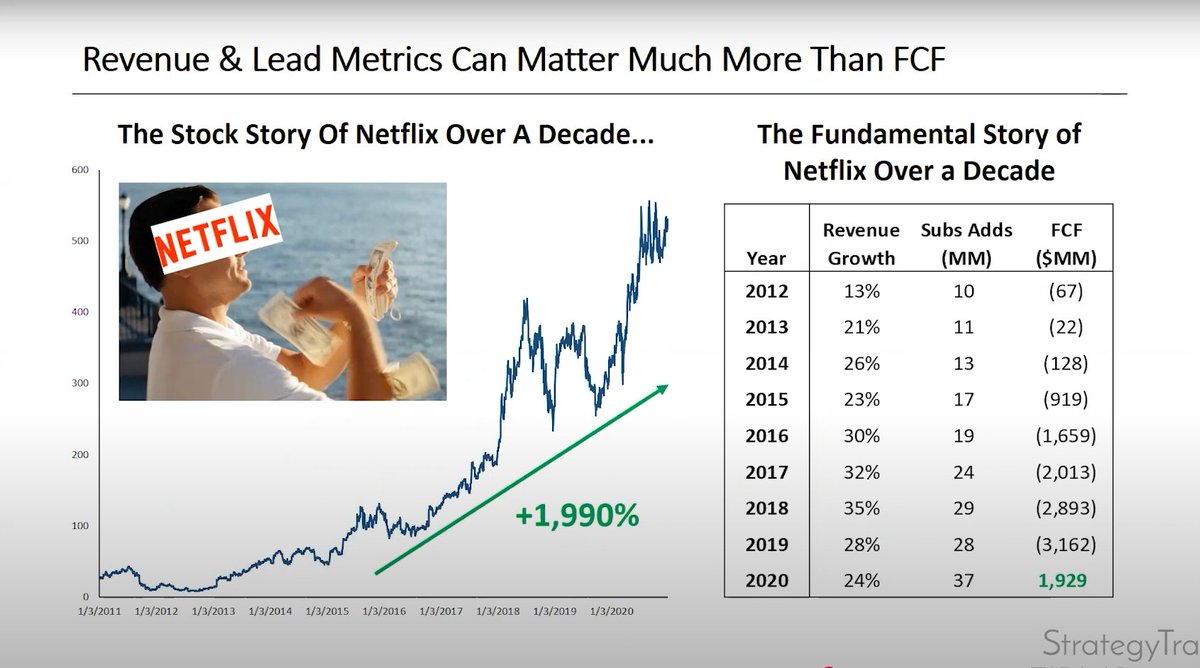

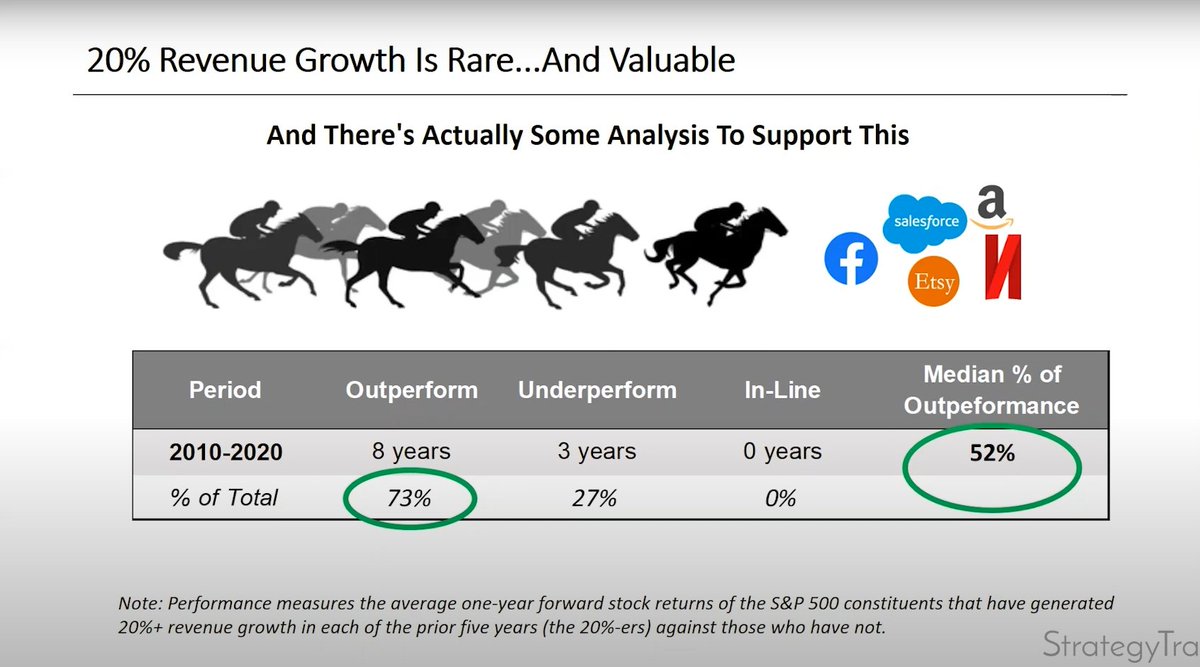

Lesson 4: Tech stocks follow revenue growth.

Revenue.

Revenue.

Revenue.

Look for 20%+ Revenue.

Stock prices SOMETIMES follow earnings.

Stock prices ALWAYS follow revenue.

Revenue.

Revenue.

Revenue.

Look for 20%+ Revenue.

Stock prices SOMETIMES follow earnings.

Stock prices ALWAYS follow revenue.

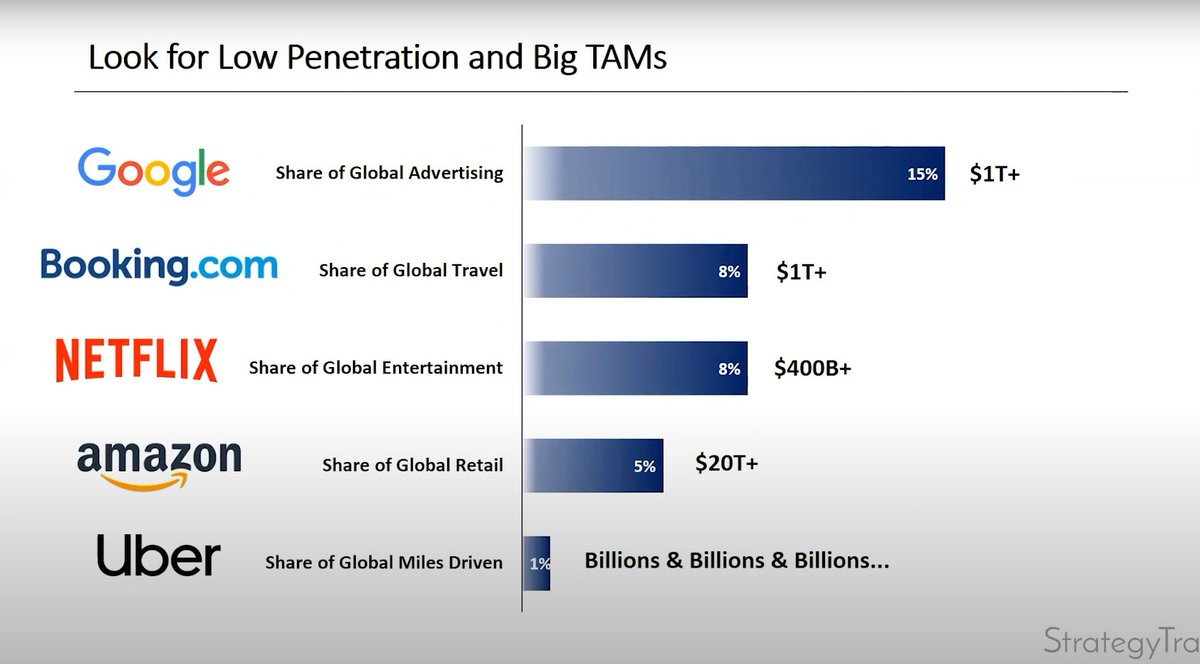

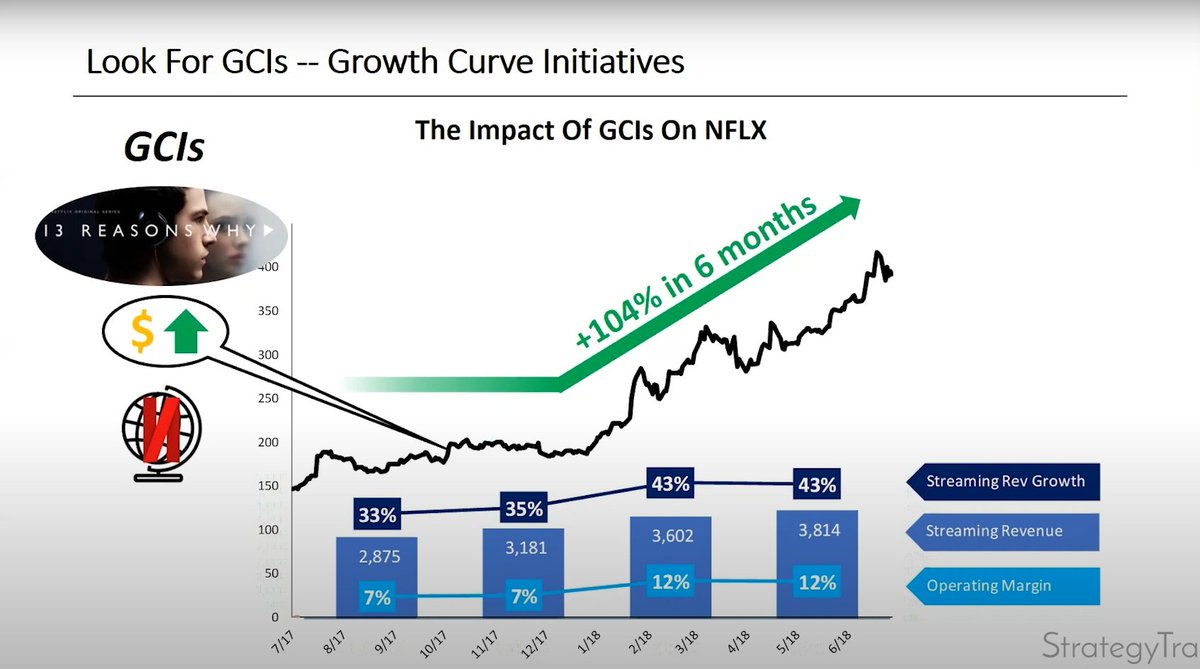

Top tip #1: focus on Growth Curve Initiatives (GCI)

E.g. new products, new markets, new pricing tiers, anything that expands the TAM.

E.g. new products, new markets, new pricing tiers, anything that expands the TAM.

Pro tip #2: Only a FEW tech companies can truly grow >20% QoQ for sustained periods of time.

Double down on these if you find them.

Double down on these if you find them.

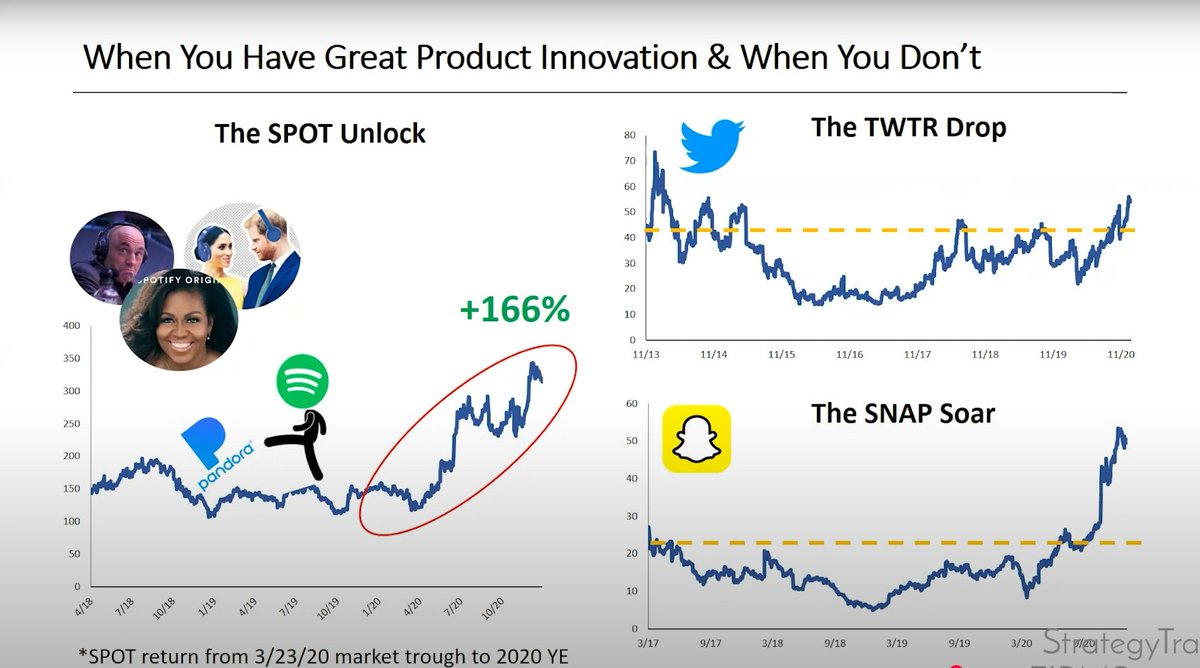

Pro tip #3: Product innovation is king.

Companies that have avenues/areas to reinvest excess FCF at high rates of return will continue to compound for a long long time.

Companies that have avenues/areas to reinvest excess FCF at high rates of return will continue to compound for a long long time.

Lesson 8: Management matters.

Founder-led companies.

Long term vision.

Deep industry knowledge.

Customer obsession.

Strong technical backgrounds.

Quality c-suite.

Founder-led companies.

Long term vision.

Deep industry knowledge.

Customer obsession.

Strong technical backgrounds.

Quality c-suite.

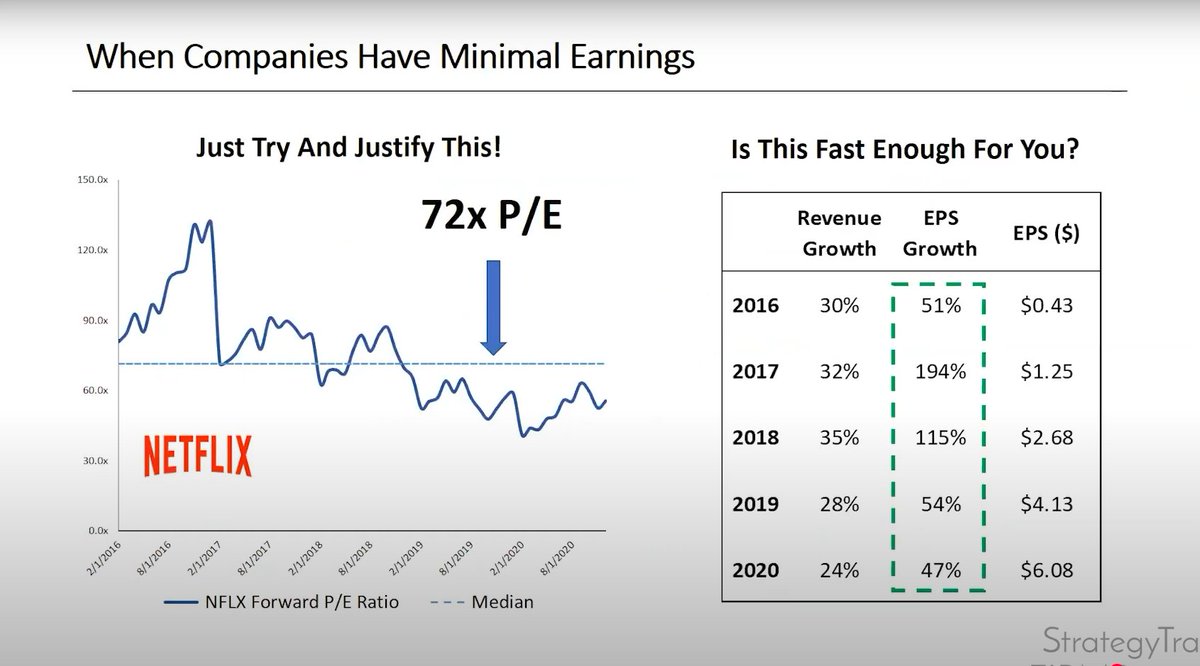

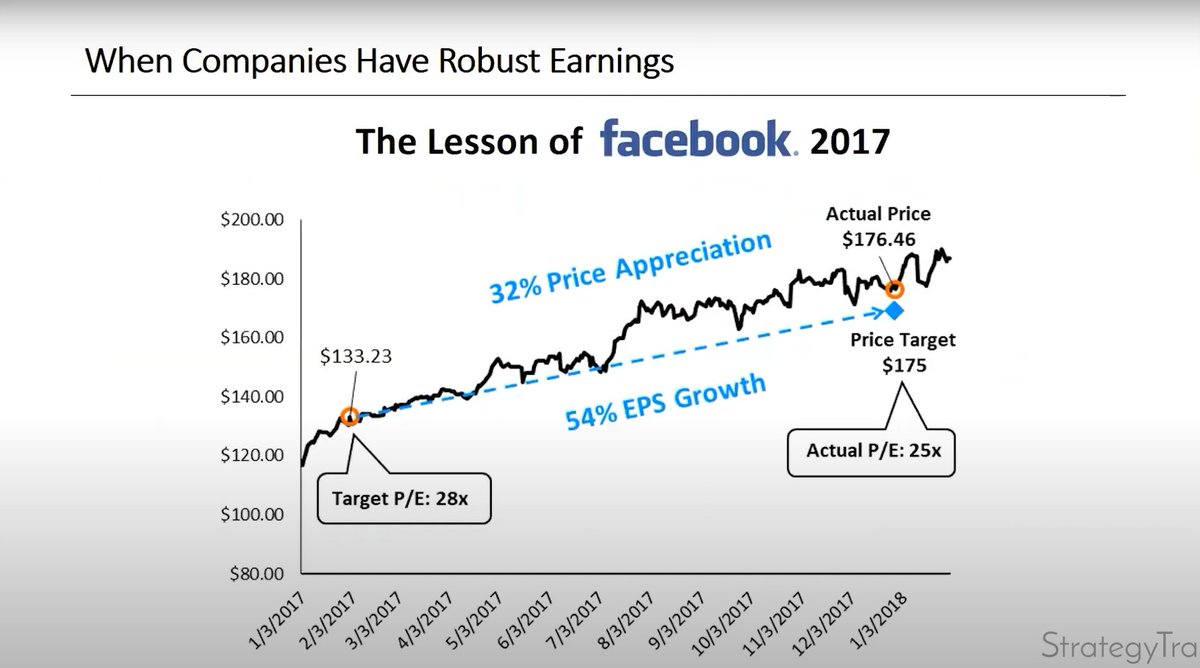

Lesson 9: Valuation isn't precise - just be in the right "ballpark."

Valuation is more art than science.

Don't fall into the precision trap.

Valuation is SECONDARY to business fundamentals.

The question you need to answer is "does this valuaiton look ballpark reasonable?"

Valuation is more art than science.

Don't fall into the precision trap.

Valuation is SECONDARY to business fundamentals.

The question you need to answer is "does this valuaiton look ballpark reasonable?"

Lesson 10: Hunt for Dislocated High Quality (DHQ)

How to minimize the 2 investing risks:

1. Fundamentals -> pick high quality tech cos

2. Valuation -> buy stocks when they're 20/30 off the highs or trading at discount to its growth rate.

This works EVEN with high risky stocks.

How to minimize the 2 investing risks:

1. Fundamentals -> pick high quality tech cos

2. Valuation -> buy stocks when they're 20/30 off the highs or trading at discount to its growth rate.

This works EVEN with high risky stocks.

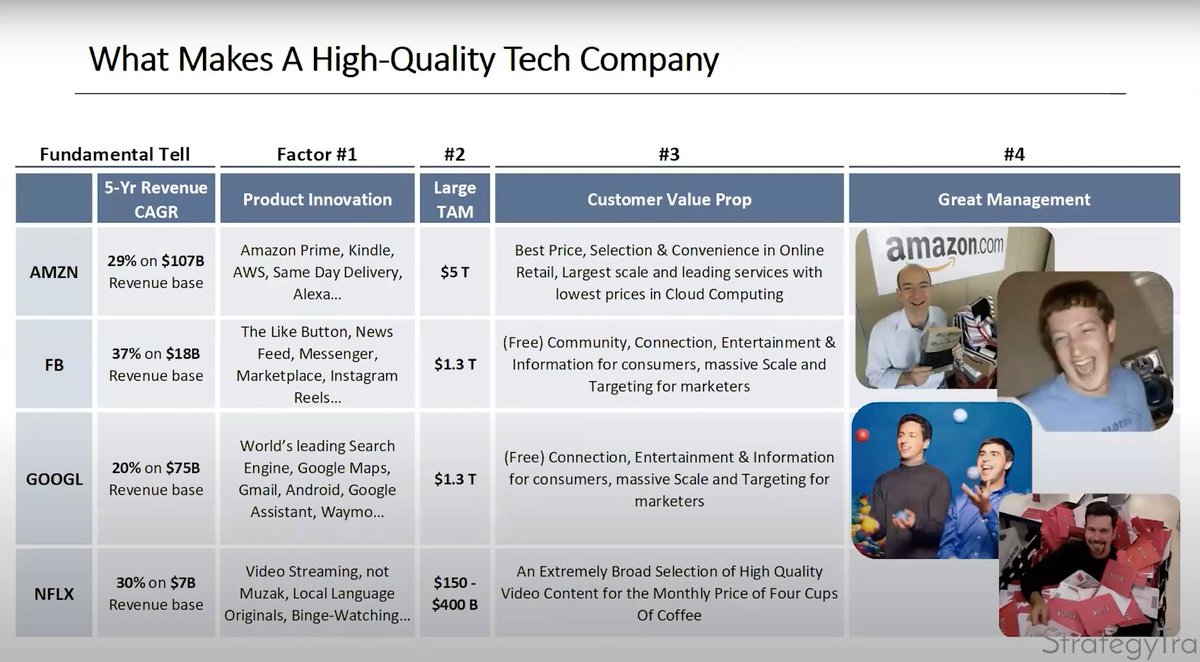

What makes a high quality company?

1. >20% revenue growth

2. Product innovation

3. Large TAMs.

4. Customer value prop

5. Great management

1. >20% revenue growth

2. Product innovation

3. Large TAMs.

4. Customer value prop

5. Great management

If you're looking for a stock screener to find 10 baggers using this criteria - I recommend Koyfin.

It's hands down the BEST investment platform I've tried and I now use this exclusively over a bloomberg terminal. Just incredible software.

koyfin.com/affiliate/koyf…

It's hands down the BEST investment platform I've tried and I now use this exclusively over a bloomberg terminal. Just incredible software.

koyfin.com/affiliate/koyf…

• • •

Missing some Tweet in this thread? You can try to

force a refresh