How to get URL link on X (Twitter) App

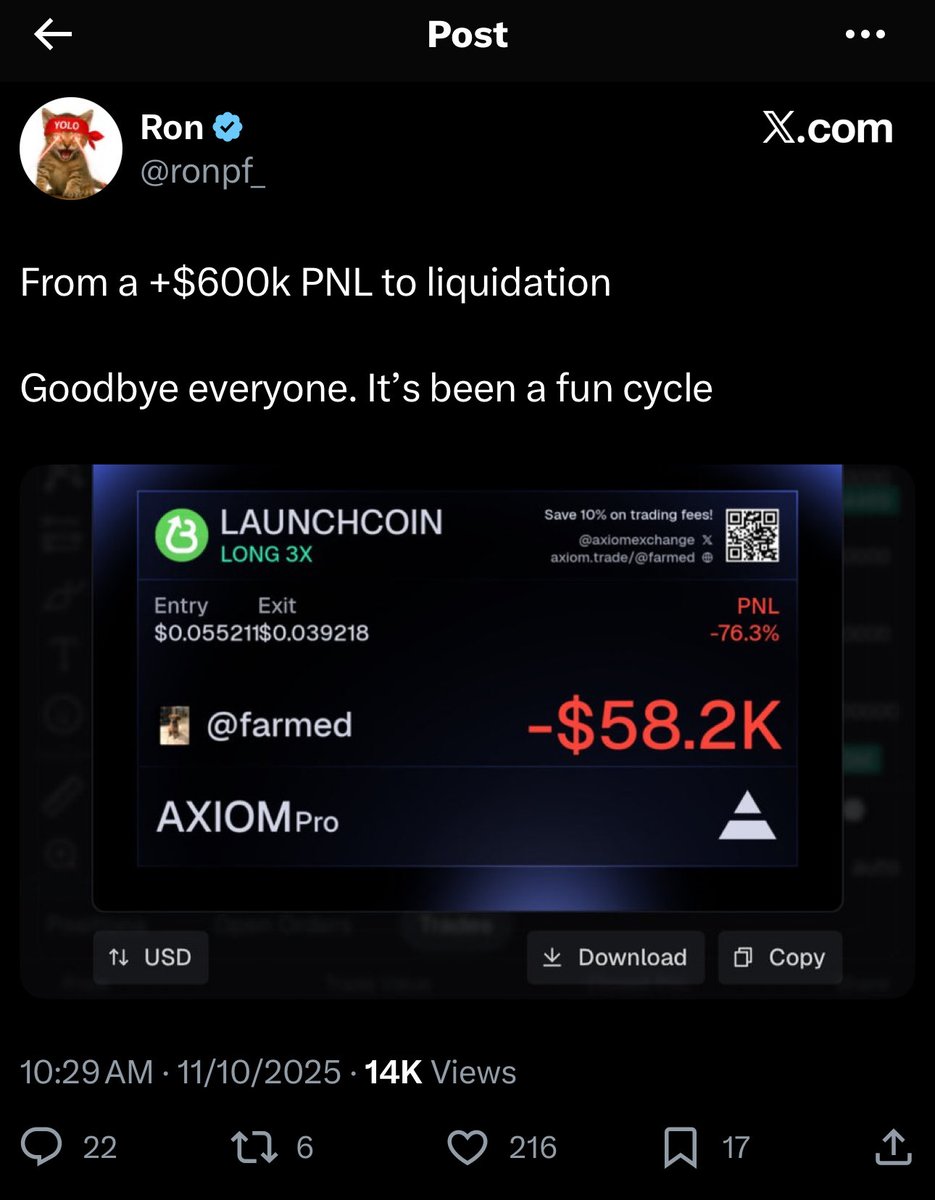

Okay guys I FUCKED UP but can’t edit the post now

Okay guys I FUCKED UP but can’t edit the post now

https://x.com/zoomyzoomm/status/2021119213788954803?s=20

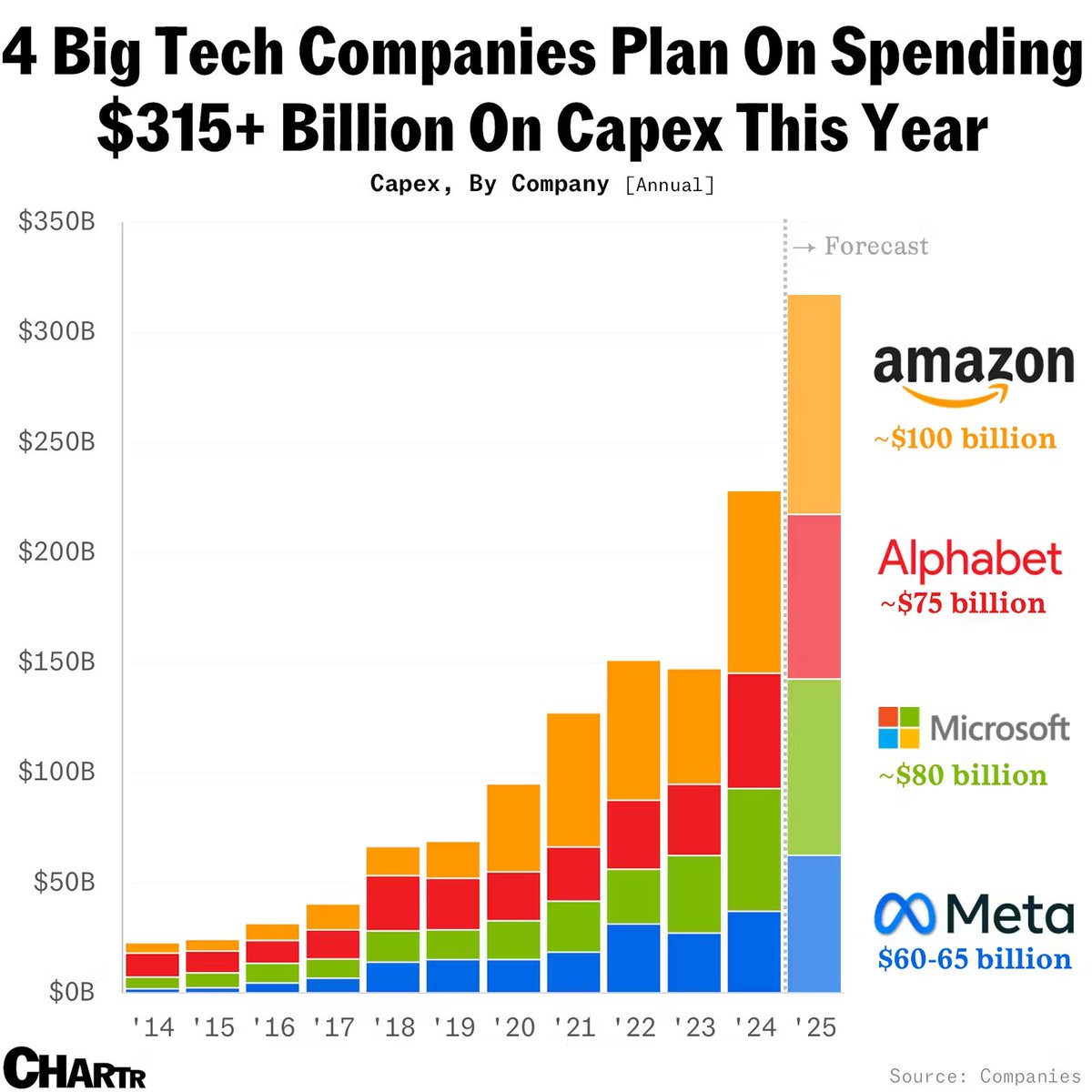

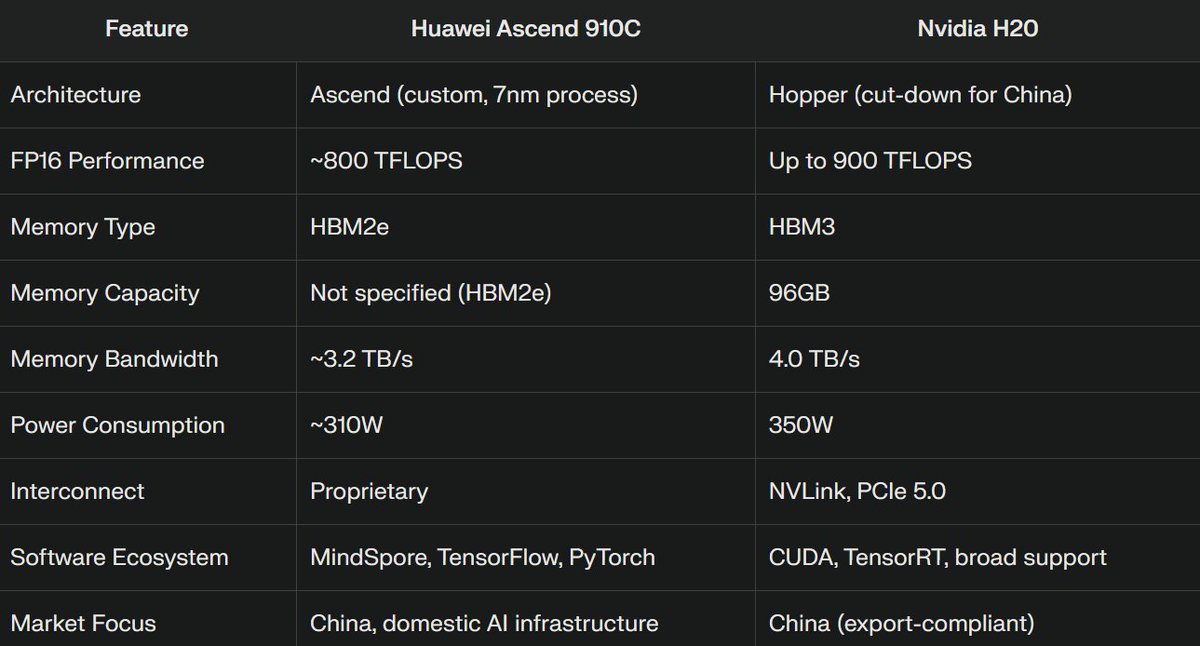

2/ In 2025, AI capex spend will hit >$300b, funneled toward data centers & GPUs to support generative AI workloads.

2/ In 2025, AI capex spend will hit >$300b, funneled toward data centers & GPUs to support generative AI workloads.

https://x.com/zoomyzoomm/status/1952487878187249707

https://twitter.com/boringbiz_/status/1948943965375320504BTW

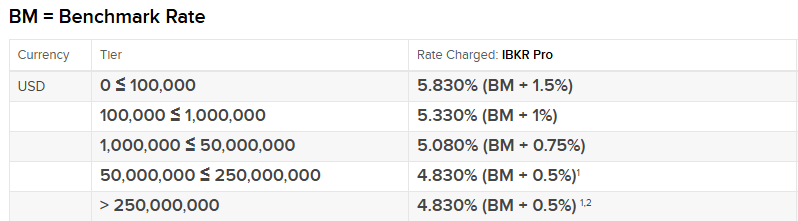

Let's say hypothetically the three biz's went to $0 overnight and they roll up the entire company tomorrow.

Let's say hypothetically the three biz's went to $0 overnight and they roll up the entire company tomorrow.