It's very unusual for someone to pay the wrong amount of stamp duty when they're receiving tax advice.

There are probably three possibilities:

(1) Ms Rayner got the law wrong

(2) She didn't take the right advice

(3) She didn't disclose all the facts to the law firm.

There are probably three possibilities:

(1) Ms Rayner got the law wrong

(2) She didn't take the right advice

(3) She didn't disclose all the facts to the law firm.

If it's the law firm's fault, then hard to blame Ms Rayner.

If it's scenario 2 or 3, then completely fair to blame her

Given Ms Rayner's position, it's reasonable to expect full transparency as to what happened

If it's scenario 2 or 3, then completely fair to blame her

Given Ms Rayner's position, it's reasonable to expect full transparency as to what happened

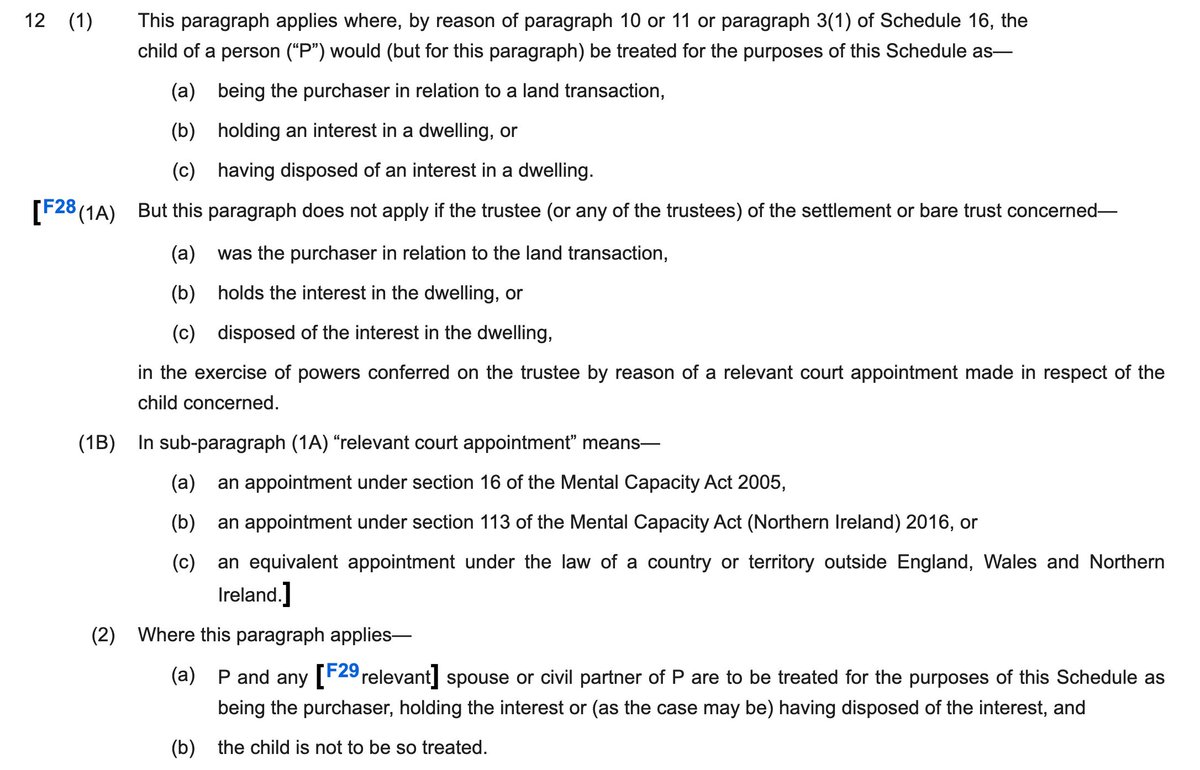

It sounds like it's para 12 Sch 4ZA Finance 2003 that applied. A trust in favour of child can deem the parents as still owning the property.

Yes, the rules are complicated, but if you can't advise on complex stamp duty then you shouldn't be advising on stamp duty.

Yes, the rules are complicated, but if you can't advise on complex stamp duty then you shouldn't be advising on stamp duty.

If Ms Rayner took proper advice and followed it, but the advice was wrong, then she'll have to pay the stamp duty, plus interest.

But if she didn't take appropriate advice, she could face "carelessness" penalties, probably around 30%.

But if she didn't take appropriate advice, she could face "carelessness" penalties, probably around 30%.

• • •

Missing some Tweet in this thread? You can try to

force a refresh