Gold is telling the future:

The S&P 500 is in one of its strongest bull runs in decades, up +1,650 POINTS in under 5 months.

Meanwhile, Gold's YTD return just hit +37%, nearly 4 TIMES more than the S&P 500 YTD.

Why is gold crushing stocks in a bull market?

(a thread)

The S&P 500 is in one of its strongest bull runs in decades, up +1,650 POINTS in under 5 months.

Meanwhile, Gold's YTD return just hit +37%, nearly 4 TIMES more than the S&P 500 YTD.

Why is gold crushing stocks in a bull market?

(a thread)

And, in case you are new here, this trend is not.

Take a look at Gold vs the S&P 500 since 2023.

Gold prices are now up ~100% compared to a ~67% gain in the S&P 500.

Despite the AI Revolution, the biggest breakthrough in technology since the internet, stocks are LAGGING gold.

Take a look at Gold vs the S&P 500 since 2023.

Gold prices are now up ~100% compared to a ~67% gain in the S&P 500.

Despite the AI Revolution, the biggest breakthrough in technology since the internet, stocks are LAGGING gold.

Here's why it's even more strange:

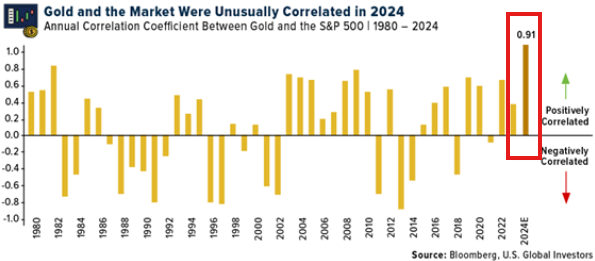

Take a look at the historical relationship between gold and the S&P 500.

Gold is a safe haven asset, historically LIKE bonds, which rises in times of uncertainty and with equity market weakness.

Then in 2020, this trend began shifting.

Take a look at the historical relationship between gold and the S&P 500.

Gold is a safe haven asset, historically LIKE bonds, which rises in times of uncertainty and with equity market weakness.

Then in 2020, this trend began shifting.

Below is a chart summarizing the S&P 500 to Gold correlation.

In 2024, gold and the S&P 500 had a record high correlation coefficient of 0.91.

The increasingly positive relationship between gold and the S&P 500 is indicative of a major macroeconomic shift.

In 2024, gold and the S&P 500 had a record high correlation coefficient of 0.91.

The increasingly positive relationship between gold and the S&P 500 is indicative of a major macroeconomic shift.

So, why is this happening?

It's a combination of market pricing in higher long-term inflation and more deficit spending.

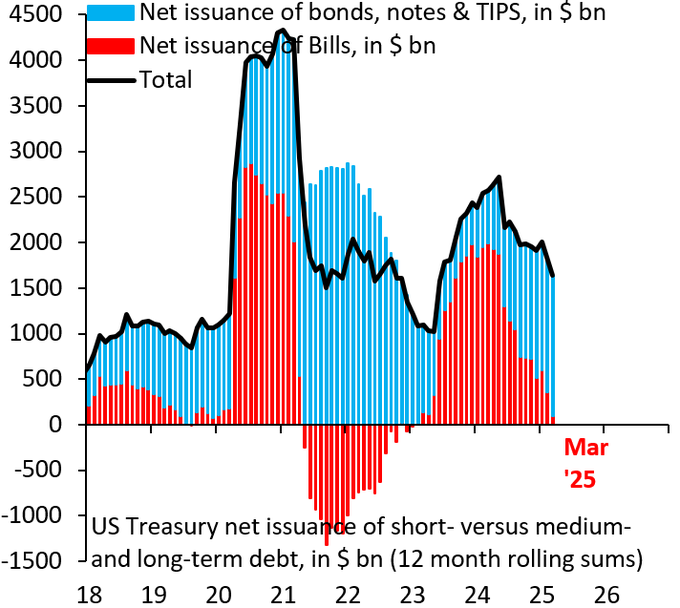

And, adding fuel to the fire, deficit spending is flooding the US Treasury market with supply.

Gold has become the GLOBAL safe haven asset.

It's a combination of market pricing in higher long-term inflation and more deficit spending.

And, adding fuel to the fire, deficit spending is flooding the US Treasury market with supply.

Gold has become the GLOBAL safe haven asset.

As the annual US deficit nears $2 trillion, the government is issuing more debt.

As the supply of US Treasuries grows, bond prices are falling, making bonds a less attractive safe haven than gold.

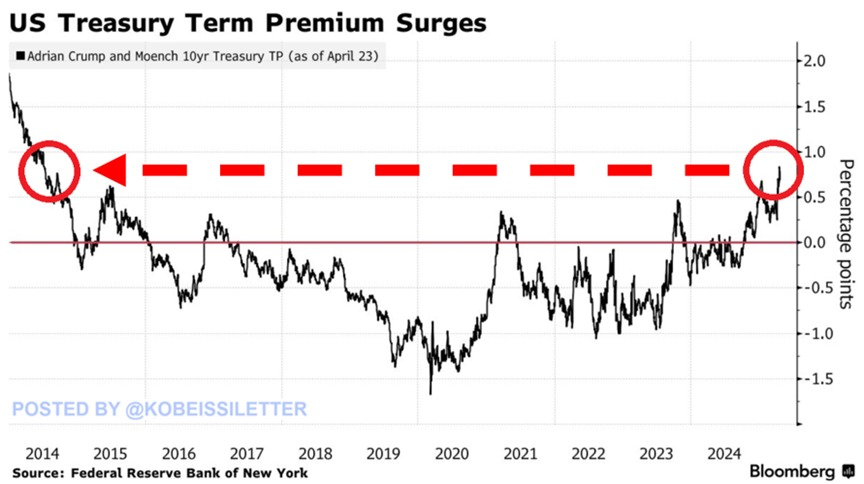

It also explains why Term Premiums are up to 2014 levels.

As the supply of US Treasuries grows, bond prices are falling, making bonds a less attractive safe haven than gold.

It also explains why Term Premiums are up to 2014 levels.

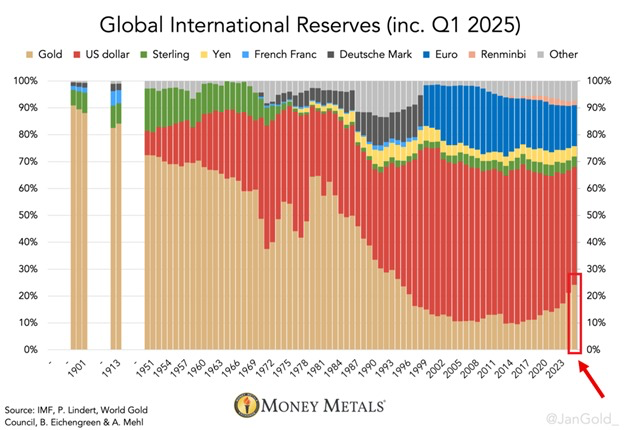

As you can see in this chart, central banks got ahead of this trend.

Central banks now hold more gold than US Treasuries for the first time since 1996.

The unprecedented gold buying spree by central banks is not a coincidence.

This chart will soon become widely referenced.

Central banks now hold more gold than US Treasuries for the first time since 1996.

The unprecedented gold buying spree by central banks is not a coincidence.

This chart will soon become widely referenced.

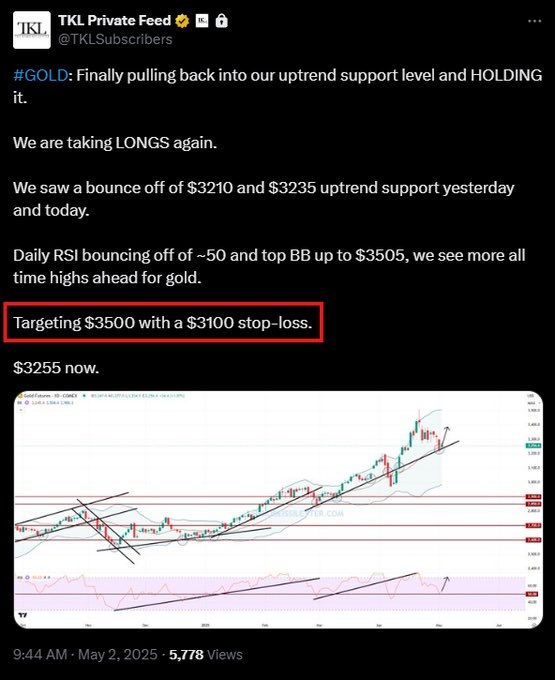

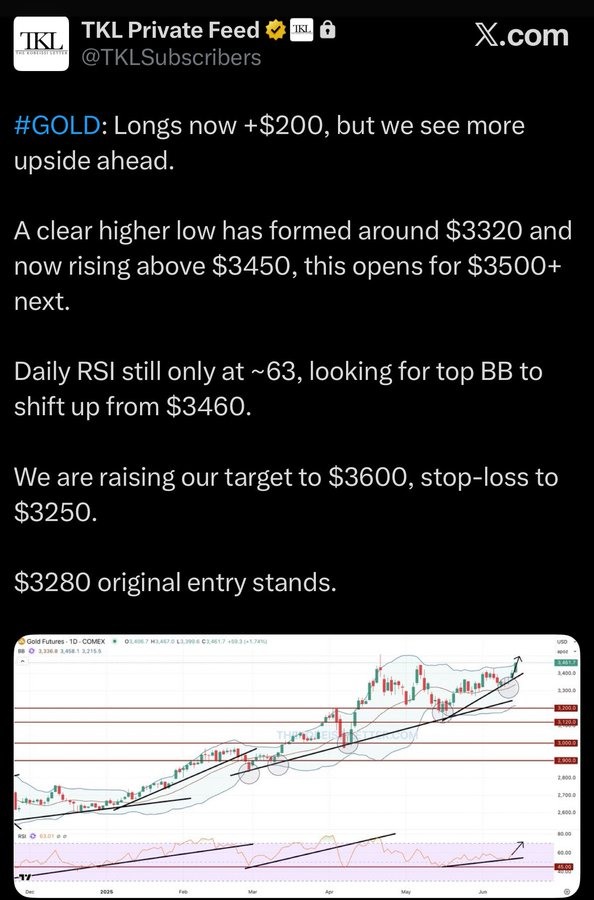

In May 2025 and June 2025, we posted the below notes for our premium members.

We raised our gold target to $3,500 and then $3,600, both of which were just crossed.

Staying ahead of macro shifts is essential.

Subscribe to access our analysis below:

thekobeissiletter.com/subscribe

We raised our gold target to $3,500 and then $3,600, both of which were just crossed.

Staying ahead of macro shifts is essential.

Subscribe to access our analysis below:

thekobeissiletter.com/subscribe

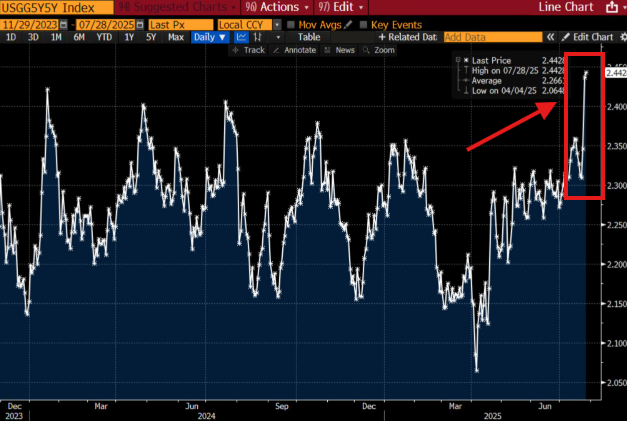

Meanwhile, here are MARKET-BASED inflation expectations over the next 5-10 years.

Long-term inflation expectations have been moving higher and gold knows this.

It seems that markets have come to terms with the fact that the Fed's 2% inflation target is distant at best.

Long-term inflation expectations have been moving higher and gold knows this.

It seems that markets have come to terms with the fact that the Fed's 2% inflation target is distant at best.

The rotation into gold accelerated in late-April and early-May as Term Premiums surged.

The US Treasury term premium jumped to ~0.75%, the highest in 11 years.

Term premium is the extra return investors demand for holding a long-term bond due to higher perceived risk.

The US Treasury term premium jumped to ~0.75%, the highest in 11 years.

Term premium is the extra return investors demand for holding a long-term bond due to higher perceived risk.

As we look ahead, we continue to expect similar drivers to remain at play.

Global central banks are cutting rates into rising inflation due to deteriorating labor market and economic conditions.

All while trying to spend their way out of it.

It's deficit spending + inflation.

Global central banks are cutting rates into rising inflation due to deteriorating labor market and economic conditions.

All while trying to spend their way out of it.

It's deficit spending + inflation.

We conclude with this chart: A sudden surge in Gold as a % of global reserves as the % of USD falls.

Reducing the US deficit would solve many of our problems.

For now, all we can do is position accordingly.

Follow us @KobeissiLetter for real time analysis as this develops.

Reducing the US deficit would solve many of our problems.

For now, all we can do is position accordingly.

Follow us @KobeissiLetter for real time analysis as this develops.

• • •

Missing some Tweet in this thread? You can try to

force a refresh