I made 65% in 12 days, playing the latest DeFi black magic (400M% APY IF compounded)

It's called Funding Rate Trading on Boros @boros_fi

The future of France is here

Let me show you how to play

@pendle_fi #Boros

It's called Funding Rate Trading on Boros @boros_fi

The future of France is here

Let me show you how to play

@pendle_fi #Boros

The facts:

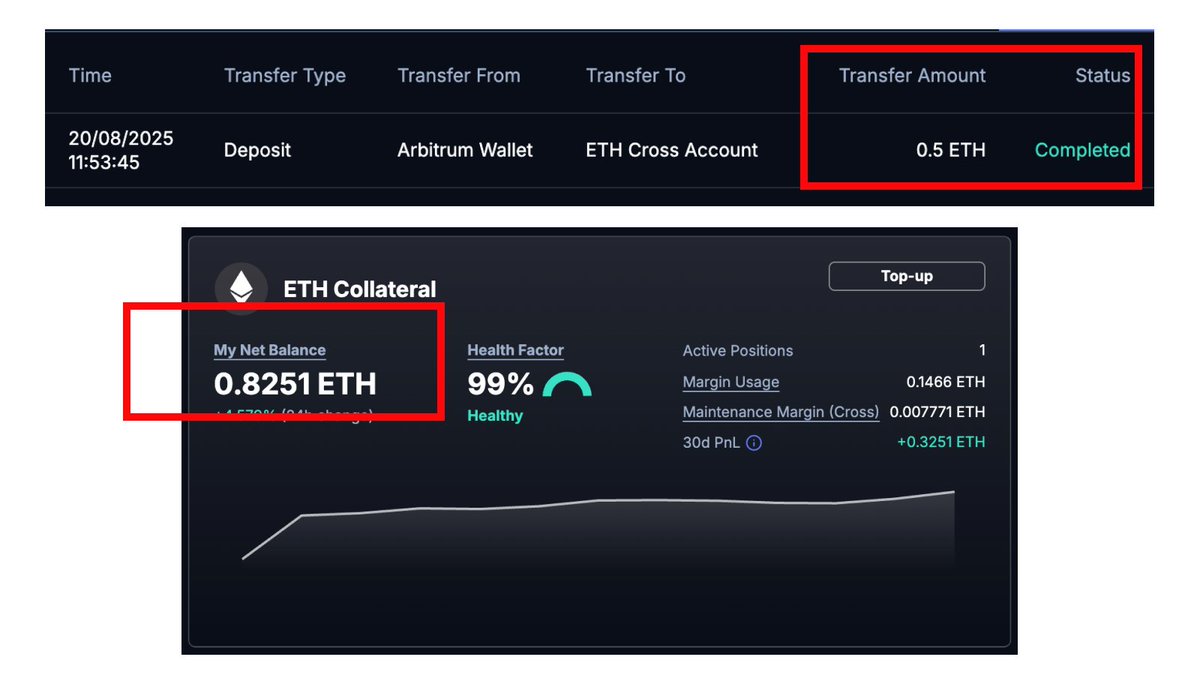

- Deposited 0.5 ETH on 20th Aug

- Balance today: 0.825 ETH (+65% in 12 days)

Track my wallet here: 0xB2684Cd15b0CF17050531C51d581A9dDc365f1ef

Crazy? Yes.

Real? Also yes.

What’s the catch? It's a high-risk, high-reward game, and the market is still inefficient now

- Deposited 0.5 ETH on 20th Aug

- Balance today: 0.825 ETH (+65% in 12 days)

Track my wallet here: 0xB2684Cd15b0CF17050531C51d581A9dDc365f1ef

Crazy? Yes.

Real? Also yes.

What’s the catch? It's a high-risk, high-reward game, and the market is still inefficient now

So what exactly is Funding Rate Trading? 🤔

You’re not trading ETH. Not even perps.

You’re trading the funding rate itself

See it live here 👉

(Open it RIGHT NOW while reading - will be easier to follow)boros.pendle.finance/markets/3

You’re not trading ETH. Not even perps.

You’re trading the funding rate itself

See it live here 👉

(Open it RIGHT NOW while reading - will be easier to follow)boros.pendle.finance/markets/3

First, let's start with the APE SUMMARY 🐒 of what I did:

• Binance Funding Rate goes up → I LONGED RATE

• Binance Funding Rate goes down → I SHORTED RATE

That’s it.

Stupidly simple.

But it worked.

• Binance Funding Rate goes up → I LONGED RATE

• Binance Funding Rate goes down → I SHORTED RATE

That’s it.

Stupidly simple.

But it worked.

The MOST DUMBED DOWN EXPLANATION of the strategy: you just need to know 3 things:

1. Blue line = Binance real-time FR (Underlying APR). Go check it out on Boros RIGHT NOW. If you haven’t, you are DISAPPOINTING ME, THE DEFI GODS AND SATOSHI NAKAMOTO.

2. Candles = Market price of average FR till maturity (Implied APR). It’s what you are longing and shorting in Boros.

3. What I did:

- Whenever I saw Underlying dipping below Implied APR, and it looks like a sustained trend → I Shorted

- Whenever I saw Underlying rising above Implied APR, and it looks like a sustained trend → I Longed.

1. Blue line = Binance real-time FR (Underlying APR). Go check it out on Boros RIGHT NOW. If you haven’t, you are DISAPPOINTING ME, THE DEFI GODS AND SATOSHI NAKAMOTO.

2. Candles = Market price of average FR till maturity (Implied APR). It’s what you are longing and shorting in Boros.

3. What I did:

- Whenever I saw Underlying dipping below Implied APR, and it looks like a sustained trend → I Shorted

- Whenever I saw Underlying rising above Implied APR, and it looks like a sustained trend → I Longed.

If you prefer learning by aping like me, just click Long Rates/Short Rates with a small size first, to get a feel for how things work.

Yes, you might get rekt.

But it’s the fastest way to learn 🧪

For those who want the full breakdown, read on.

There will be an alpha hidden somewhere along the way also ;)

Yes, you might get rekt.

But it’s the fastest way to learn 🧪

For those who want the full breakdown, read on.

There will be an alpha hidden somewhere along the way also ;)

Still here? Good. You’re among the top 5% of DeFi traders who care to understand. The Real Content will begin now.

Here’s what I’ll cover:

- 4 Basic Concepts of Funding Rate trading

- The strategy I followed: Optimistic Funding Rate Farming

Here’s what I’ll cover:

- 4 Basic Concepts of Funding Rate trading

- The strategy I followed: Optimistic Funding Rate Farming

To trade funding rates properly, you need to know 4 key concepts 👇

1️⃣ Yield Unit (YU)

- Think of it as exposure to the funding rate on 1 ETH short position until maturity

- Example: Long 100 ETH-YU = exposure to funding rate of a 100 ETH short position until maturity.

2️⃣ Implied APR / Fixed APR

- When you Long/Short YU, you do it at the current price = the Implied APR

- That entry price becomes your Fixed APR (the rate you’ve locked in for your position).

3️⃣ Settlements & Realised PnL

- At every funding settlement (≈8h): you realise the difference between the actual Perp’s Funding Rate and your Fixed APR

- Example: Binance FR was 10%, and you longed at 6% → You realise a 4% APR for the 8 hours

4️⃣ Trading Profits (Unrealised PnL)

- If Implied APR moves after you enter:

Longed at 6%, Implied jumps to 7% → profit

Shorted at 6%, Implied drops to 5% → profit

- You can realise this by closing your position, which is really just similar to selling a token after its price increased

👉 Learn these 4 concepts, and you’ll understand exactly what’s happening.

1️⃣ Yield Unit (YU)

- Think of it as exposure to the funding rate on 1 ETH short position until maturity

- Example: Long 100 ETH-YU = exposure to funding rate of a 100 ETH short position until maturity.

2️⃣ Implied APR / Fixed APR

- When you Long/Short YU, you do it at the current price = the Implied APR

- That entry price becomes your Fixed APR (the rate you’ve locked in for your position).

3️⃣ Settlements & Realised PnL

- At every funding settlement (≈8h): you realise the difference between the actual Perp’s Funding Rate and your Fixed APR

- Example: Binance FR was 10%, and you longed at 6% → You realise a 4% APR for the 8 hours

4️⃣ Trading Profits (Unrealised PnL)

- If Implied APR moves after you enter:

Longed at 6%, Implied jumps to 7% → profit

Shorted at 6%, Implied drops to 5% → profit

- You can realise this by closing your position, which is really just similar to selling a token after its price increased

👉 Learn these 4 concepts, and you’ll understand exactly what’s happening.

Now, on to the strategy itself: Optimistic Funding Rate Farming⚡️

I will explain things in 4 parts:

- What “Funding Rate Farming” means

- The timing

- What “Optimistic” means

- How you could get rekt

I will explain things in 4 parts:

- What “Funding Rate Farming” means

- The timing

- What “Optimistic” means

- How you could get rekt

First, let’s explain what “Funding Rate Farming” means:

- FR is “generally higher” than Implied APR → Long Rate

- FR is “generally lower” than Implied APR → Short Rate

The goal is to farm the difference between FR and Implied APR, always aiming for a positive return at settlements.

- FR is “generally higher” than Implied APR → Long Rate

- FR is “generally lower” than Implied APR → Short Rate

The goal is to farm the difference between FR and Implied APR, always aiming for a positive return at settlements.

Second, let’s talk about timing, which is the key to the strategy

Let’s roughly say that there are “bullish periods” where real-time Funding Rate > Implied APR and “bearish periods” where real-time Funding Rate < Implied APR, on average.

These periods tend to last for days, mostly due to the switching of the general sentiments of the market.

Your edge = spotting the switch early.

What I did: In a bearish period (holding a short), I set an alert for when real-time FR exceeds Implied APR by a margin. If triggered, I check charts + market to judge if it’s a true bullish shift—then flip or adjust my position accordingly. (Info on how to set alerts to come later on)

Let’s roughly say that there are “bullish periods” where real-time Funding Rate > Implied APR and “bearish periods” where real-time Funding Rate < Implied APR, on average.

These periods tend to last for days, mostly due to the switching of the general sentiments of the market.

Your edge = spotting the switch early.

What I did: In a bearish period (holding a short), I set an alert for when real-time FR exceeds Implied APR by a margin. If triggered, I check charts + market to judge if it’s a true bullish shift—then flip or adjust my position accordingly. (Info on how to set alerts to come later on)

Thirdly, here’s the “Optimistic” bit:

You don’t just earn settlement PnL.

If you flip early and correctly, Implied APR also moves in your favor. Why?

- If it's a correct shift (from a bearish to a bullish period for example), other users will want to flip after you to farm settlement PnL also

- Fundamentally, shifting into a bullish period naturally increases the expected average bullishness until maturity, hence Implied APR should indeed go up if the market is efficient

So you get:

✅ Settlement gains

✅ Extra PnL from APR shift (i.e. buy low, sell high)

That’s how my profits compounded.

You don’t just earn settlement PnL.

If you flip early and correctly, Implied APR also moves in your favor. Why?

- If it's a correct shift (from a bearish to a bullish period for example), other users will want to flip after you to farm settlement PnL also

- Fundamentally, shifting into a bullish period naturally increases the expected average bullishness until maturity, hence Implied APR should indeed go up if the market is efficient

So you get:

✅ Settlement gains

✅ Extra PnL from APR shift (i.e. buy low, sell high)

That’s how my profits compounded.

Finally, the disclaimers on how this strategy can rekt you:

❌ If you flip too late, Implied APR already moved bigly → You might buy high, sell low

❌ If you misjudge a switch (e.g. FR > Implied APR briefly, you flipped to Long but it’s still a bearish period), you might lose on both settlements and APR moves.

After all, it's a game open to everyone, and the devil is in the details.

That’s also what makes it fun.

❌ If you flip too late, Implied APR already moved bigly → You might buy high, sell low

❌ If you misjudge a switch (e.g. FR > Implied APR briefly, you flipped to Long but it’s still a bearish period), you might lose on both settlements and APR moves.

After all, it's a game open to everyone, and the devil is in the details.

That’s also what makes it fun.

Congrats, warrior ⚔️ You now know how to play on the newest DeFi battlefield.

Yes, you can totally get rekt with wrong timings and wrong judgment, but at least you should understand why now.

Trade away and make us proud, o DeFi warrior.

It’s the frontier of DeFi, and we are very early.

P.S. I will give you the well-deserved alpha: you can set alerts on Underlying APR and Implied APR using this telegram bot: t.me/boros_info_bot

Yes, you can totally get rekt with wrong timings and wrong judgment, but at least you should understand why now.

Trade away and make us proud, o DeFi warrior.

It’s the frontier of DeFi, and we are very early.

P.S. I will give you the well-deserved alpha: you can set alerts on Underlying APR and Implied APR using this telegram bot: t.me/boros_info_bot

If you found this thread interesting, do Like/Retweet the first tweet to spread the word.

Follow me @gabavineb to learn more about Boros, funding rate trading, and other interesting strategies.

Follow me @gabavineb to learn more about Boros, funding rate trading, and other interesting strategies.

https://twitter.com/1069950948645068800/status/1963240181232009555

Tagging fellow threadoors that have covered Pendle/Boros before:

@crypto_linn

@LouisCooper_

@TheDeFinvestor

@nauhcner

@DeFi_Made_Here

@2lambro

@Cryptotrissy

@0x7d54

@JackNiewold

@GarrettZ

@CryptoShiro_

@jermywkh

@ThorHartvigsen

@0xTindorr

@korpi87

@ViNc2453

@T_Brown480

@defi_naly

@DaoChemist

@crypto_linn

@LouisCooper_

@TheDeFinvestor

@nauhcner

@DeFi_Made_Here

@2lambro

@Cryptotrissy

@0x7d54

@JackNiewold

@GarrettZ

@CryptoShiro_

@jermywkh

@ThorHartvigsen

@0xTindorr

@korpi87

@ViNc2453

@T_Brown480

@defi_naly

@DaoChemist

@defi_mochi

@Subli_Defi

@_tolks

@DeFiMinty

@CryptoDamus411

@kindahangry

@Ceazor7

@alpha__pls

@phtevenstrong

@0xSalazar

@rektdiomedes

@LeftsideEmiri

@0xvanillacream

@Doomammu

@Flowslikeosmo

@PinkPunks__

@monosarin

@0xCheeezzyyyy

@MeshClans

@0xspicexr

@keiblog_eth

@Kripto_Jo

@0xMughal

@0xanonnnn

@kenodnb

@hzl123331

@Bitcoineo

@EthereumThaila1

@KazumaxCrypto

@quant_sheep

@twindoges

@eli5_defi

@zerototom

@BTW0205

@Neoo_Nav

@NewPaguinfo

@Subli_Defi

@_tolks

@DeFiMinty

@CryptoDamus411

@kindahangry

@Ceazor7

@alpha__pls

@phtevenstrong

@0xSalazar

@rektdiomedes

@LeftsideEmiri

@0xvanillacream

@Doomammu

@Flowslikeosmo

@PinkPunks__

@monosarin

@0xCheeezzyyyy

@MeshClans

@0xspicexr

@keiblog_eth

@Kripto_Jo

@0xMughal

@0xanonnnn

@kenodnb

@hzl123331

@Bitcoineo

@EthereumThaila1

@KazumaxCrypto

@quant_sheep

@twindoges

@eli5_defi

@zerototom

@BTW0205

@Neoo_Nav

@NewPaguinfo

• • •

Missing some Tweet in this thread? You can try to

force a refresh