I talk about Funding Rate trading, yield trading, and DeFi alphas in general.

Hustler at @pendle_fi

How to get URL link on X (Twitter) App

The facts:

The facts:

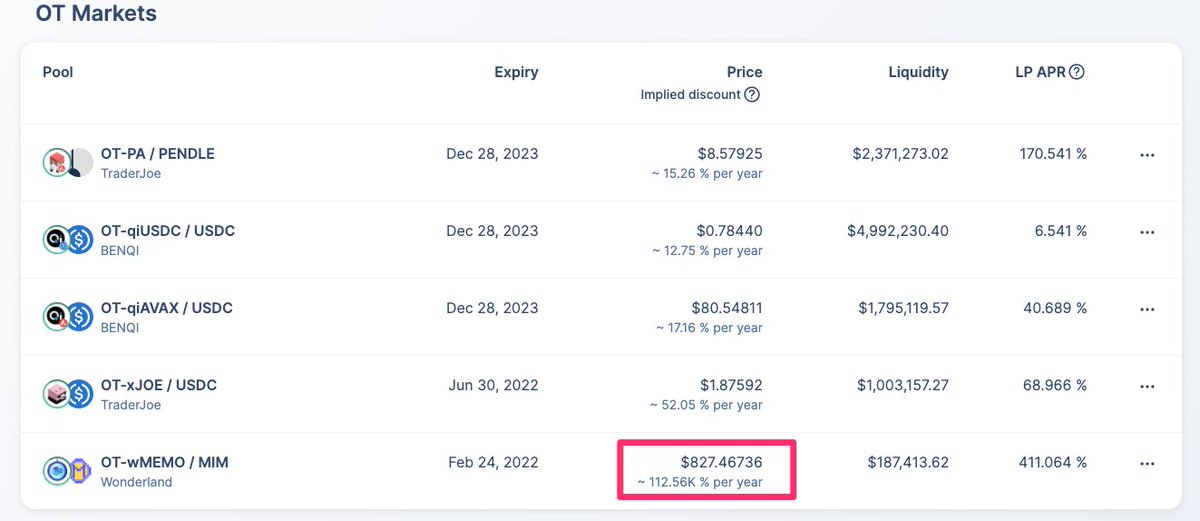

First, lets look at historical data of the pool:

First, lets look at historical data of the pool:

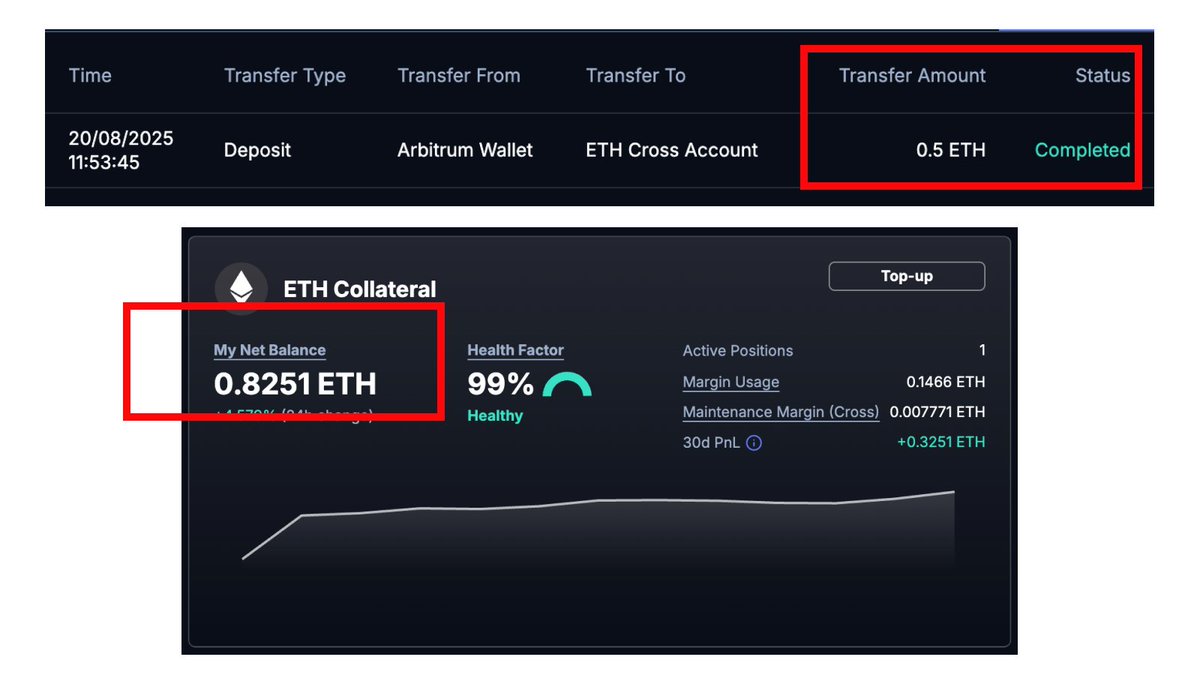

How to do it?

How to do it?

First things first, let me share a story

First things first, let me share a story

First, let’s revisit the old meta. Let's talk about 2 DeFi personas:

First, let’s revisit the old meta. Let's talk about 2 DeFi personas:https://twitter.com/gabavineb/status/1641062468305948672For GLP:

Free money - How?

Free money - How?

I will go through the following in my thread:

I will go through the following in my thread:

I know the numbers are crazy, so you could verify it by:

I know the numbers are crazy, so you could verify it by:

Is this too ridiculous and no way sustainable? Yes

Is this too ridiculous and no way sustainable? Yes

https://twitter.com/danielesesta/status/1483182059002957824