🧵 Housing Hyper-Speculation & the Bitcoin Savings Standard

An expanded analysis of housing market dysfunction and a Bitcoin-based alternative strategy 👇

An expanded analysis of housing market dysfunction and a Bitcoin-based alternative strategy 👇

The Diagnostic Snapshot: Understanding the Affordability Crisis

The current state of American housing reveals a profound market distortion that has priced out an entire generation. The median U.S. home resale price has reached $𝟰𝟮𝟮,𝟰𝟬𝟬, while the typical American household earns just $𝟴𝟬,𝟲𝟭𝟬 annually according to Census data and the National Association of REALTORS®.

This creates a price-to-income ratio of approximately 5.2×, meaning the average home costs more than five times what the average family makes in a year. To put this in perspective, economists and housing policy experts have long considered a ratio above 3.5× to be fundamentally unaffordable for most families.

What does this mean practically? A family earning the median income would need to dedicate an unsustainable portion of their earnings to housing costs, even with traditional financing. This ratio suggests that housing has become disconnected from the underlying economic reality of what Americans actually earn, indicating that prices are being driven by factors other than local wage growth and genuine housing demand.

This imbalance represents the foundational problem underlying all other housing market dysfunctions we'll explore in this thread.

The current state of American housing reveals a profound market distortion that has priced out an entire generation. The median U.S. home resale price has reached $𝟰𝟮𝟮,𝟰𝟬𝟬, while the typical American household earns just $𝟴𝟬,𝟲𝟭𝟬 annually according to Census data and the National Association of REALTORS®.

This creates a price-to-income ratio of approximately 5.2×, meaning the average home costs more than five times what the average family makes in a year. To put this in perspective, economists and housing policy experts have long considered a ratio above 3.5× to be fundamentally unaffordable for most families.

What does this mean practically? A family earning the median income would need to dedicate an unsustainable portion of their earnings to housing costs, even with traditional financing. This ratio suggests that housing has become disconnected from the underlying economic reality of what Americans actually earn, indicating that prices are being driven by factors other than local wage growth and genuine housing demand.

This imbalance represents the foundational problem underlying all other housing market dysfunctions we'll explore in this thread.

Cheap-Credit Mutation: How Federal Reserve Policy Distorted Housing

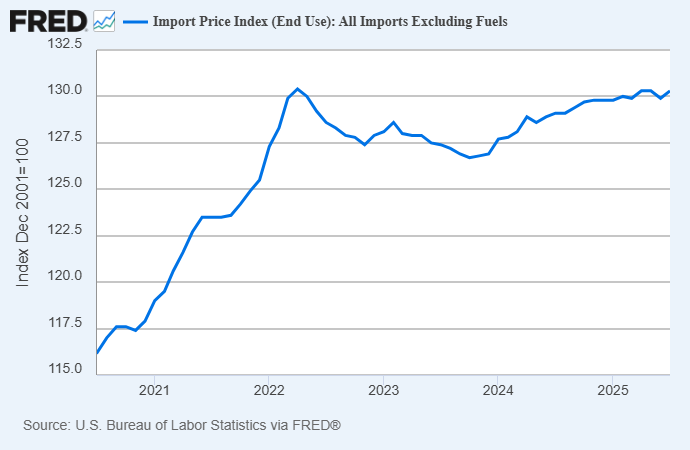

The Federal Reserve's monetary policy created a perfect storm in the housing market through dramatic interest rate manipulation. Thirty-year mortgage rates plummeted to historic lows below 3% during 2021, then whipsawed upward to 6.56% by August 28, 2025, according to Fox Business reporting.

The Low-Rate Period (2020-2022): Ultra-low interest rates essentially subsidized borrowing, allowing buyers to afford much higher purchase prices with the same monthly payment. This created a bidding war dynamic where families competed not based on their actual income and savings, but on how much debt they could service at artificially low rates.

Example: A family that could afford a $2,000 monthly payment could borrow:

- At 3% rate: ~$475,000

- At 6.56% rate: ~$315,000

This $160,000 difference in borrowing power explains much of the price inflation during the low-rate period.

The Current High-Rate Reality: Now that rates have normalized upward, existing homeowners with 3% mortgages are essentially "rate prisoners" - they cannot afford to sell and buy elsewhere without dramatically increasing their monthly payments. This artificial constraint on housing supply keeps inventory tight and prices elevated, even as affordability has collapsed for new buyers.

The result is a frozen market where mobility is artificially constrained by monetary policy rather than economic fundamentals.

The Federal Reserve's monetary policy created a perfect storm in the housing market through dramatic interest rate manipulation. Thirty-year mortgage rates plummeted to historic lows below 3% during 2021, then whipsawed upward to 6.56% by August 28, 2025, according to Fox Business reporting.

The Low-Rate Period (2020-2022): Ultra-low interest rates essentially subsidized borrowing, allowing buyers to afford much higher purchase prices with the same monthly payment. This created a bidding war dynamic where families competed not based on their actual income and savings, but on how much debt they could service at artificially low rates.

Example: A family that could afford a $2,000 monthly payment could borrow:

- At 3% rate: ~$475,000

- At 6.56% rate: ~$315,000

This $160,000 difference in borrowing power explains much of the price inflation during the low-rate period.

The Current High-Rate Reality: Now that rates have normalized upward, existing homeowners with 3% mortgages are essentially "rate prisoners" - they cannot afford to sell and buy elsewhere without dramatically increasing their monthly payments. This artificial constraint on housing supply keeps inventory tight and prices elevated, even as affordability has collapsed for new buyers.

The result is a frozen market where mobility is artificially constrained by monetary policy rather than economic fundamentals.

The Algorithmic Landlord: Wall Street's Housing Invasion

Institutional investors and investment firms purchased

18.7% of all U.S. homes sold in Q1 2024, according to Redfin data. This means nearly one in five single-family homes that changed hands went to investors rather than families who would actually live in them.

The Scale of the Problem: These investors are particularly aggressive in the lower-priced segments of the market - capturing more than 25% of the nation's most affordable inventory. This directly competes with first-time homebuyers who typically target entry-level properties.

How the Algorithm Works: Large investment firms use sophisticated software to:

1. Monitor Multiple Listing Service (MLS) data in real-time

2. Automatically generate cash offers within hours of listing

3. Bid above asking price to guarantee acquisition

4. Convert single-family homes into rental properties

Why Cash Beats Families: Cash offers have several advantages over traditional mortgage-dependent purchases:

- No financing contingencies that could delay or kill the deal

- Faster closing times (often 10-14 days vs. 30-45 days)

- No appraisal requirements that might reduce the purchase price

- Certainty for sellers in competitive markets

This creates a scenario where families saving for down payments and navigating mortgage approvals simply cannot compete with algorithmic cash deployment. The result is the systematic conversion of homeownership opportunities into rental income streams for Wall Street.

Institutional investors and investment firms purchased

18.7% of all U.S. homes sold in Q1 2024, according to Redfin data. This means nearly one in five single-family homes that changed hands went to investors rather than families who would actually live in them.

The Scale of the Problem: These investors are particularly aggressive in the lower-priced segments of the market - capturing more than 25% of the nation's most affordable inventory. This directly competes with first-time homebuyers who typically target entry-level properties.

How the Algorithm Works: Large investment firms use sophisticated software to:

1. Monitor Multiple Listing Service (MLS) data in real-time

2. Automatically generate cash offers within hours of listing

3. Bid above asking price to guarantee acquisition

4. Convert single-family homes into rental properties

Why Cash Beats Families: Cash offers have several advantages over traditional mortgage-dependent purchases:

- No financing contingencies that could delay or kill the deal

- Faster closing times (often 10-14 days vs. 30-45 days)

- No appraisal requirements that might reduce the purchase price

- Certainty for sellers in competitive markets

This creates a scenario where families saving for down payments and navigating mortgage approvals simply cannot compete with algorithmic cash deployment. The result is the systematic conversion of homeownership opportunities into rental income streams for Wall Street.

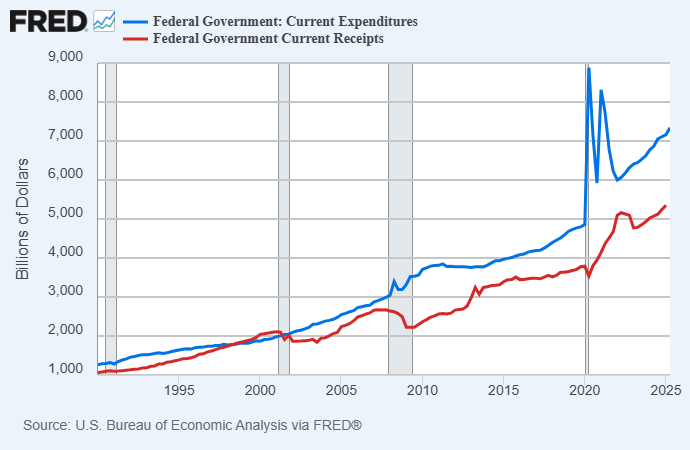

Tax-Code Fuel: How Government Policy Subsidizes Speculation

The U.S. tax code contains numerous provisions that artificially channel investment capital toward real estate, regardless of whether this creates genuine economic value or productive capacity.

Mortgage Interest Deduction: Homeowners can deduct mortgage interest payments from their taxable income, effectively subsidizing borrowing for home purchases. While intended to promote homeownership, this benefit is disproportionately captured by higher-income households who can afford larger mortgages and benefit more from tax deductions.

1031 Exchanges: These allow real estate investors to defer capital gains taxes indefinitely by rolling proceeds from one property sale into another "like-kind" property. This creates a powerful incentive to continually reinvest in real estate rather than diversifying into other asset classes or productive investments.

Depreciation Schedules: Investment properties can be depreciated over 27.5 years for tax purposes, allowing investors to claim paper losses that offset other income, even while the property may be appreciating in value.

The Distortion Effect: These policies collectively redirect billions of dollars in capital toward real estate speculation rather than productive business investment, research and development, or job-creating enterprises. As the thread author puts it, "capital chases granite countertops instead of new ideas."

The tax code essentially tilts the investment landscape to favor real estate over other potentially more productive uses of capital, contributing to both housing price inflation and reduced investment in economic growth drivers.

The U.S. tax code contains numerous provisions that artificially channel investment capital toward real estate, regardless of whether this creates genuine economic value or productive capacity.

Mortgage Interest Deduction: Homeowners can deduct mortgage interest payments from their taxable income, effectively subsidizing borrowing for home purchases. While intended to promote homeownership, this benefit is disproportionately captured by higher-income households who can afford larger mortgages and benefit more from tax deductions.

1031 Exchanges: These allow real estate investors to defer capital gains taxes indefinitely by rolling proceeds from one property sale into another "like-kind" property. This creates a powerful incentive to continually reinvest in real estate rather than diversifying into other asset classes or productive investments.

Depreciation Schedules: Investment properties can be depreciated over 27.5 years for tax purposes, allowing investors to claim paper losses that offset other income, even while the property may be appreciating in value.

The Distortion Effect: These policies collectively redirect billions of dollars in capital toward real estate speculation rather than productive business investment, research and development, or job-creating enterprises. As the thread author puts it, "capital chases granite countertops instead of new ideas."

The tax code essentially tilts the investment landscape to favor real estate over other potentially more productive uses of capital, contributing to both housing price inflation and reduced investment in economic growth drivers.

Rent-versus-Buy Distortion: When Owning Costs 38% More

Current market conditions have produced a historic

inversion: in all 50 of the largest U S metros, the average mortgage payment on a median-priced home is about 38 % higher than the average rent on a comparable property.

Bankrate’s April 2025 study shows that while the national median rent holds near $2 000–$2 500, the blended mortgage payment (principal, interest, property tax, insurance) on a $425 k home sits just under $3 450, leaving an extra ≈ $950 every month on the homeowner’s ledger.

Understanding the Math

- Median monthly rent: ~ $2 500

- Median monthly mortgage (PITI at ~6.9 % with 20 % down): ~ $3 450

- Premium to own: ≈ $950, or 38 % more out of pocket

Why People Still Buy When Math Says “Rent”

1. Priced-Out-Forever” Anxiety - Buyers worry future appreciation will lock them out permanently, so they stretch today.

2. Inflation-Hedge Narrative - A house is viewed as protection against currency debasement and rent hikes.

3. Forced-Savings Argument - Mortgage amortization feels like a piggy bank, even if the equity is illiquid and region-tied.

4. Cultural Signaling - Homeownership remains the default badge of stability and adult success.

The Feedback Loop

Fear-driven bidding fuels higher comps, which appraisers bake into next month’s “market value.” Sellers anchor to those inflated numbers, and buyers, anxious about being left behind, outbid each other again. Cheap leverage magnifies every round.

The result is price growth unmoored from local wage growth, sustained by sentiment rather than fundamentals. Supply stays tight because owners with sub-3 % loans refuse to move, investors convert listings to rentals, and new construction trails household formation. The market levitates on the psychology of scarcity, not on underlying affordability.

Bottom line: paying a 38 % premium to “own” may feel rational when you fear eternal exclusion, yet the arithmetic shows the premium often buys little more than leverage risk and illiquidity. Recognizing this distortion is the first step toward exploring alternative wealth rails - like a disciplined Bitcoin savings plan - that can build liquid capital without feeding the speculative frenzy.

Current market conditions have produced a historic

inversion: in all 50 of the largest U S metros, the average mortgage payment on a median-priced home is about 38 % higher than the average rent on a comparable property.

Bankrate’s April 2025 study shows that while the national median rent holds near $2 000–$2 500, the blended mortgage payment (principal, interest, property tax, insurance) on a $425 k home sits just under $3 450, leaving an extra ≈ $950 every month on the homeowner’s ledger.

Understanding the Math

- Median monthly rent: ~ $2 500

- Median monthly mortgage (PITI at ~6.9 % with 20 % down): ~ $3 450

- Premium to own: ≈ $950, or 38 % more out of pocket

Why People Still Buy When Math Says “Rent”

1. Priced-Out-Forever” Anxiety - Buyers worry future appreciation will lock them out permanently, so they stretch today.

2. Inflation-Hedge Narrative - A house is viewed as protection against currency debasement and rent hikes.

3. Forced-Savings Argument - Mortgage amortization feels like a piggy bank, even if the equity is illiquid and region-tied.

4. Cultural Signaling - Homeownership remains the default badge of stability and adult success.

The Feedback Loop

Fear-driven bidding fuels higher comps, which appraisers bake into next month’s “market value.” Sellers anchor to those inflated numbers, and buyers, anxious about being left behind, outbid each other again. Cheap leverage magnifies every round.

The result is price growth unmoored from local wage growth, sustained by sentiment rather than fundamentals. Supply stays tight because owners with sub-3 % loans refuse to move, investors convert listings to rentals, and new construction trails household formation. The market levitates on the psychology of scarcity, not on underlying affordability.

Bottom line: paying a 38 % premium to “own” may feel rational when you fear eternal exclusion, yet the arithmetic shows the premium often buys little more than leverage risk and illiquidity. Recognizing this distortion is the first step toward exploring alternative wealth rails - like a disciplined Bitcoin savings plan - that can build liquid capital without feeding the speculative frenzy.

Gen Z on the Sidelines

A new Clever Real Estate survey of 1 000 adults aged 18-28 shows the depth of the affordability crisis. Sixty-two percent of Gen Z fear they will never own a home, and a stunning 21 percent say World War III seems more likely than holding a deed within five years.

Among those doubters, 82 percent cite sheer unaffordability as the primary reason.

Rent already consumes 46 percent of paychecks for many respondents, and 34 percent carry more debt than savings. The traditional 20 percent down payment has become a mathematical fantasy when price-to-income ratios drift above 5×, meaning local wages no longer anchor valuations.

A new Clever Real Estate survey of 1 000 adults aged 18-28 shows the depth of the affordability crisis. Sixty-two percent of Gen Z fear they will never own a home, and a stunning 21 percent say World War III seems more likely than holding a deed within five years.

Among those doubters, 82 percent cite sheer unaffordability as the primary reason.

Rent already consumes 46 percent of paychecks for many respondents, and 34 percent carry more debt than savings. The traditional 20 percent down payment has become a mathematical fantasy when price-to-income ratios drift above 5×, meaning local wages no longer anchor valuations.

Bitcoin Enters the Chat

Consider a median starter home at $422 400.

A typical 30-year mortgage with 20 percent down costs about $1 500 in principal and interest each month (excluding taxes and insurance).

Redirecting that same **$1 500 into a disciplined Bitcoin dollar-cost average at a conservative 30 percent CAGR compounds to roughly $184 000 in liquid sats after five years.

By contrast, the forced savings of amortization on the mortgage builds only ≈ $75 000 in home equity over the same period, and that equity is illiquid and geographically locked.

Liquidity, portability, and global market depth give Bitcoin the edge as a first-step wealth-accumulation rail.

Consider a median starter home at $422 400.

A typical 30-year mortgage with 20 percent down costs about $1 500 in principal and interest each month (excluding taxes and insurance).

Redirecting that same **$1 500 into a disciplined Bitcoin dollar-cost average at a conservative 30 percent CAGR compounds to roughly $184 000 in liquid sats after five years.

By contrast, the forced savings of amortization on the mortgage builds only ≈ $75 000 in home equity over the same period, and that equity is illiquid and geographically locked.

Liquidity, portability, and global market depth give Bitcoin the edge as a first-step wealth-accumulation rail.

Phase I: Parallel Savings

Until your local price-to-income ratio retreats to the historical comfort zone of 3.5× or lower, funnel at least 30 percent of the mortgage payment you would be making into Bitcoin every month.

Automate the transfer, use multi-signature custody, and add time-locks that release coins only after five years.

This structure prevents panic selling during volatility spikes and replaces the down-payment treadmill with a liquid, censorship-resistant balance sheet.

Until your local price-to-income ratio retreats to the historical comfort zone of 3.5× or lower, funnel at least 30 percent of the mortgage payment you would be making into Bitcoin every month.

Automate the transfer, use multi-signature custody, and add time-locks that release coins only after five years.

This structure prevents panic selling during volatility spikes and replaces the down-payment treadmill with a liquid, censorship-resistant balance sheet.

Phase II: BTC-Collateral Micro-Mortgages

Once a substantial Bitcoin cushion exists, fintech lenders can issue five-year, 50 percent loan-to-value notes collateralized by cold-stored BTC.

Shorter amortization slashes lifetime interest expense and removes the 30-year debt shackle that distorts career and family decisions.

Because lenders receive instantly liquid collateral, they skip the costly and slow foreclosure process, which lowers systemic risk for both borrower and bank.

Once a substantial Bitcoin cushion exists, fintech lenders can issue five-year, 50 percent loan-to-value notes collateralized by cold-stored BTC.

Shorter amortization slashes lifetime interest expense and removes the 30-year debt shackle that distorts career and family decisions.

Because lenders receive instantly liquid collateral, they skip the costly and slow foreclosure process, which lowers systemic risk for both borrower and bank.

System-Wide Repricing

Federal Reserve data peg household real-estate holdings at $48.1 trillion.

If only 10 percent of that equity - about $4.8 trillion - rotated into Bitcoin, BTC’s float-adjusted market cap would likely double, based on historical supply-elasticity estimates.

Simultaneously, roughly one million leveraged buyers per year would exit the housing market, easing demand pressure and allowing prices to reconnect with local wages.

Hard-cap money re-anchors credit, draining speculative froth from residential property.

Federal Reserve data peg household real-estate holdings at $48.1 trillion.

If only 10 percent of that equity - about $4.8 trillion - rotated into Bitcoin, BTC’s float-adjusted market cap would likely double, based on historical supply-elasticity estimates.

Simultaneously, roughly one million leveraged buyers per year would exit the housing market, easing demand pressure and allowing prices to reconnect with local wages.

Hard-cap money re-anchors credit, draining speculative froth from residential property.

Risk Management Toolkit

Volatility: Smooth entries with automatic DCA, keep BTC-secured loans at conservative loan-to-value ratios (≤ 50 percent) to withstand drawdowns.

Regulation: Operate in Bitcoin-friendly jurisdictions such as El Salvador or within United States states that grant Special Purpose Depository Institution charters like Wyoming.

Liquidity: Maintain at least six months of fiat living expenses before allocating aggressively, ensuring stress events do not force untimely sales.

Volatility: Smooth entries with automatic DCA, keep BTC-secured loans at conservative loan-to-value ratios (≤ 50 percent) to withstand drawdowns.

Regulation: Operate in Bitcoin-friendly jurisdictions such as El Salvador or within United States states that grant Special Purpose Depository Institution charters like Wyoming.

Liquidity: Maintain at least six months of fiat living expenses before allocating aggressively, ensuring stress events do not force untimely sales.

Shelter should serve as a basic human utility, not a leverage trophy.

By stacking sats first, then purchasing property when fundamentals realign, Gen Z and younger Millennials reclaim financial optionality.

The broader economy benefits as trillions of dollars shift from unproductive bidding wars into entrepreneurship, energy innovation, and genuine value creation.

Start today: automate a Bitcoin savings plan, track local affordability metrics, and position yourself to buy a home priced for people rather than algorithms.

swanbitcoin.com/private?utm_ca…

By stacking sats first, then purchasing property when fundamentals realign, Gen Z and younger Millennials reclaim financial optionality.

The broader economy benefits as trillions of dollars shift from unproductive bidding wars into entrepreneurship, energy innovation, and genuine value creation.

Start today: automate a Bitcoin savings plan, track local affordability metrics, and position yourself to buy a home priced for people rather than algorithms.

swanbitcoin.com/private?utm_ca…

• • •

Missing some Tweet in this thread? You can try to

force a refresh