I’m obsessed with laundromats.

I've made more money from dirty laundry than most finance bros make on Wall Street.

Here’s the playbook I always use to find profitable laundromats:

I've made more money from dirty laundry than most finance bros make on Wall Street.

Here’s the playbook I always use to find profitable laundromats:

Quick disclaimer…we’re going to skip a few steps today.

We’re jumping right into the part of the biz buying process where you’ve found a biz that you could buy…

Now we’re going to check if you SHOULD buy it.

Follow these 5 steps:

We’re jumping right into the part of the biz buying process where you’ve found a biz that you could buy…

Now we’re going to check if you SHOULD buy it.

Follow these 5 steps:

Step 1. Use my deal calculator

The difference between buying a cashflowing biz & a lemon:

Good financials.

Most buyers get emotional and skip the numbers.

But that's how you end up with a $200K washing machine graveyard.

The difference between buying a cashflowing biz & a lemon:

Good financials.

Most buyers get emotional and skip the numbers.

But that's how you end up with a $200K washing machine graveyard.

Buyers typically negotiate the value of the biz on three variables:

- EBITDA/SDE (actual cash flow)

- Multiple (risk level)

- Terms (how you pay, not just how much).

Here's our simplified calculator:

- EBITDA/SDE (actual cash flow)

- Multiple (risk level)

- Terms (how you pay, not just how much).

Here's our simplified calculator:

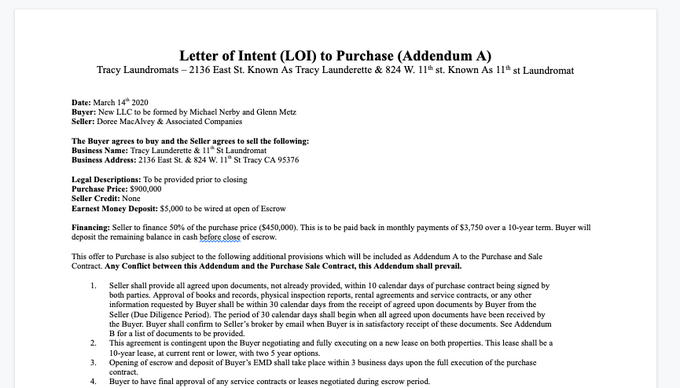

Step 2. Send a letter of intent (LOI)

If the numbers look good, you send an LOI.

Think of it as asking someone on a date, not proposing.

You're saying "Hey, I'm interested, but we're not exclusive yet."

This keeps you from getting locked into a bad deal while giving the seller confidence you're serious.

If the numbers look good, you send an LOI.

Think of it as asking someone on a date, not proposing.

You're saying "Hey, I'm interested, but we're not exclusive yet."

This keeps you from getting locked into a bad deal while giving the seller confidence you're serious.

You can even take things a step further with what I call a ‘Blank Page Start’.

Before lawyers complicate everything, send a paper over that says:

"I want to buy your business for X amount, using Y financing, based on Z conditions."

Get both parties to sign this simple version first.

Once you get the first yes, the next one is always easier.

Before lawyers complicate everything, send a paper over that says:

"I want to buy your business for X amount, using Y financing, based on Z conditions."

Get both parties to sign this simple version first.

Once you get the first yes, the next one is always easier.

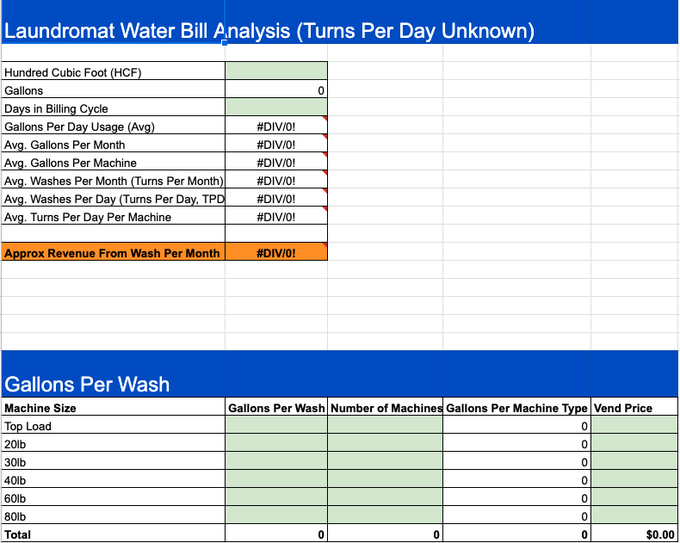

Step 3. Understand the business model

Especially with laundromats, you need to understand what your costs are.

Your biggest expenses will always be water and rent.

Control these two and you can likely handle any trivial costs that pop up.

The #1 killer in business is running out of cash so track these costs like your biz depends on it.

Especially with laundromats, you need to understand what your costs are.

Your biggest expenses will always be water and rent.

Control these two and you can likely handle any trivial costs that pop up.

The #1 killer in business is running out of cash so track these costs like your biz depends on it.

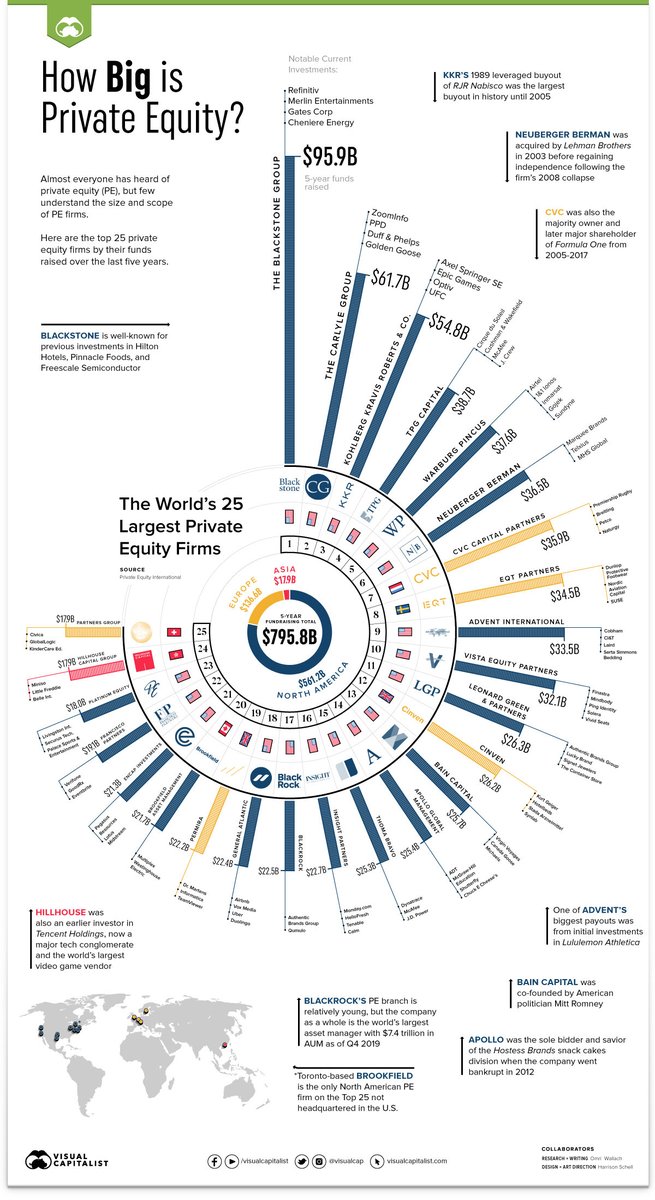

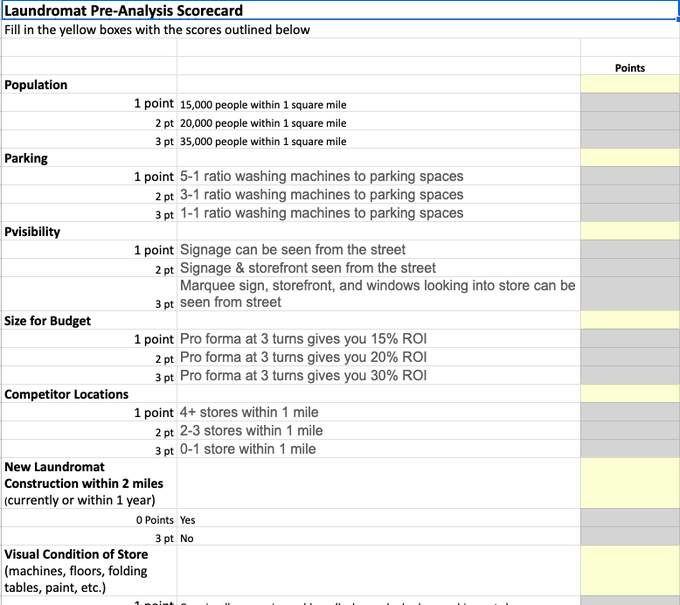

Step 4. Dive into due diligence

This is where we dig into deals to see if they'll actually have an ROI.

Private equity taught me one thing: emotions kill deals.

When you have a checklist, you can't get emotionally attached to a pretty storefront and forget to check if the business actually makes money.

Here's my actual DD template:

This is where we dig into deals to see if they'll actually have an ROI.

Private equity taught me one thing: emotions kill deals.

When you have a checklist, you can't get emotionally attached to a pretty storefront and forget to check if the business actually makes money.

Here's my actual DD template:

Something else that's important is that you have to understand why they're really selling.

Most sellers are motivated by one of 7 Ds:

Death, Divorce, Disease, Distress, Dullness, Departure, or Disagreement.

Understanding their motivation lets you structure an offer that appeals to their actual problem, not just throw money at them.

Most sellers are motivated by one of 7 Ds:

Death, Divorce, Disease, Distress, Dullness, Departure, or Disagreement.

Understanding their motivation lets you structure an offer that appeals to their actual problem, not just throw money at them.

Step 5. Create your projections

Once you know how much revenue is on the table, adjust for the cash flow you'll ACTUALLY get:

- Salary to replace owner

- Revenue concentration risks

- One-time contracts that won't repeat

Prepare for the worst case scenario because best scenario never happens…

Once you know how much revenue is on the table, adjust for the cash flow you'll ACTUALLY get:

- Salary to replace owner

- Revenue concentration risks

- One-time contracts that won't repeat

Prepare for the worst case scenario because best scenario never happens…

Based on these projections, can you run this business and actually profit?

Throw it in a spreadsheet and let math decide.

Include everything: water, rent, maintenance, management, emergencies…all of it.

Throw it in a spreadsheet and let math decide.

Include everything: water, rent, maintenance, management, emergencies…all of it.

If all of that checks out, you likely have a winner on your hands.

But even so, there's still tons of ways a deal can go wrong that I haven't mentioned in this thread.

That's why I put together this resource on the top 5 mistakes I see in biz buying.

But even so, there's still tons of ways a deal can go wrong that I haven't mentioned in this thread.

That's why I put together this resource on the top 5 mistakes I see in biz buying.

It's free & something I wish I had access to when buying my first biz.

Grab it here: info.contrarianthinking.co/top-business-b…

Grab it here: info.contrarianthinking.co/top-business-b…

• • •

Missing some Tweet in this thread? You can try to

force a refresh