In 1998, 16 very high-IQ people almost ended capitalism.

Not through war or terrorism...

But through mathematics.

Here's the untold story of how Nobel Prize winners used "risk-free" formulas to create the biggest financial bomb in history: 🧵

Not through war or terrorism...

But through mathematics.

Here's the untold story of how Nobel Prize winners used "risk-free" formulas to create the biggest financial bomb in history: 🧵

Meet the legend John Meriwether.

At Salomon Brothers, his bond arbitrage desk generated 80-100% of the firm's profits.

In 1994, he launched Long-Term Capital Management with a simple promise:

Use mathematical models to eliminate risk.

The team he assembled was unmatched:

At Salomon Brothers, his bond arbitrage desk generated 80-100% of the firm's profits.

In 1994, he launched Long-Term Capital Management with a simple promise:

Use mathematical models to eliminate risk.

The team he assembled was unmatched:

Nobel Prize winner Myron Scholes.

Nobel Prize winner Robert Merton.

Former Fed Vice Chairman David Mullins.

Harvard professors and Wall Street veterans.

Warren Buffett said: "16 people with the highest IQ of any 16 people working together in one business in the country."

Nobel Prize winner Robert Merton.

Former Fed Vice Chairman David Mullins.

Harvard professors and Wall Street veterans.

Warren Buffett said: "16 people with the highest IQ of any 16 people working together in one business in the country."

LTCM called itself a "financial technology company."

Their strategy? Find tiny pricing differences between similar bonds.

Buy the cheap ones, sell the expensive ones.

When they converged, profit was guaranteed.

At least, that's what their models said...

Their strategy? Find tiny pricing differences between similar bonds.

Buy the cheap ones, sell the expensive ones.

When they converged, profit was guaranteed.

At least, that's what their models said...

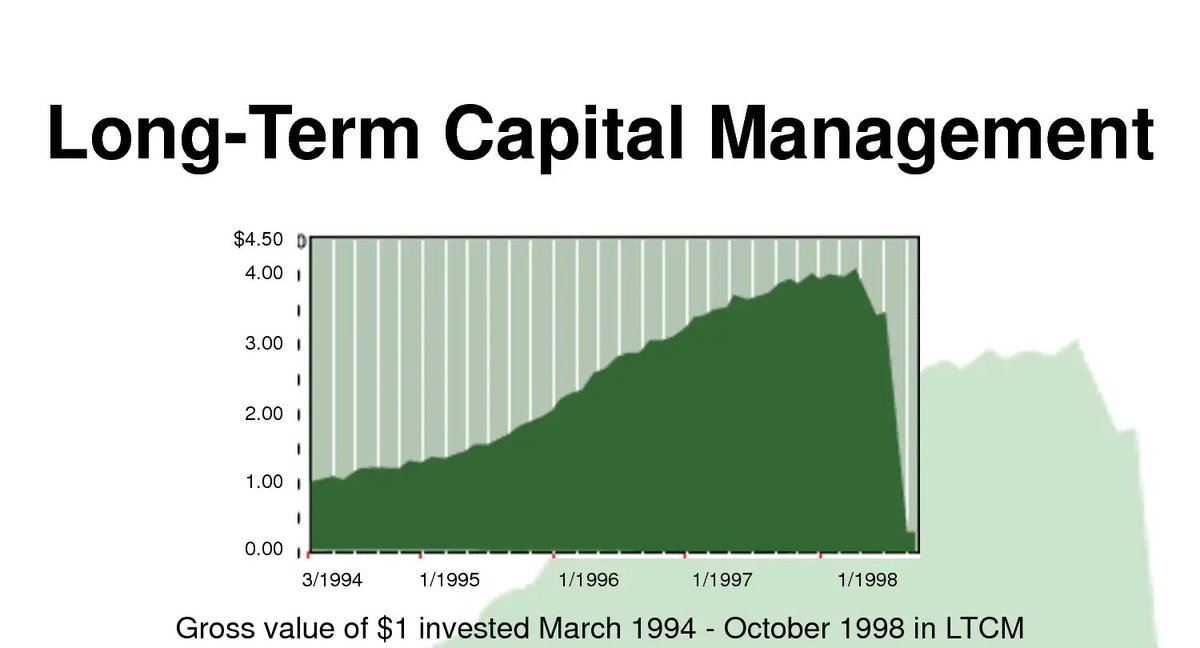

The results seemed magical:

1994: 20% returns

1995: 43% returns

1996: 41% returns

1997: 17% returns

Wall Street was amazed.

Investors begged to get in with $10 million minimums.

But there was a problem:

1994: 20% returns

1995: 43% returns

1996: 41% returns

1997: 17% returns

Wall Street was amazed.

Investors begged to get in with $10 million minimums.

But there was a problem:

To make big profits from tiny differences, they needed massive leverage.

By early 1998, they controlled $125 billion in assets with just $5 billion in capital.

That's 25:1 leverage.

Their derivatives exposure? $1.25 trillion.

Then it happened:

By early 1998, they controlled $125 billion in assets with just $5 billion in capital.

That's 25:1 leverage.

Their derivatives exposure? $1.25 trillion.

Then it happened:

August 17, 1998: Russia devalued the ruble and defaulted on its bonds.

LTCM's models never predicted this.

Their "risk-free" trades all moved in the same direction.

Down.

LTCM's models never predicted this.

Their "risk-free" trades all moved in the same direction.

Down.

In August alone, LTCM lost $1.8 billion.

September brought another $1.9 billion loss.

Their equity dropped from $4.8 billion to $600 million.

But their debt remained at $100 billion.

Leverage ratio: 167:1.

The mathematical probability of these losses?

September brought another $1.9 billion loss.

Their equity dropped from $4.8 billion to $600 million.

But their debt remained at $100 billion.

Leverage ratio: 167:1.

The mathematical probability of these losses?

According to their models, it shouldn't happen once in the life of the universe.

But it happened in 36 days.

Nobel Prize-winning theories met market reality.

Reality won and Banks started to panic:

But it happened in 36 days.

Nobel Prize-winning theories met market reality.

Reality won and Banks started to panic:

If LTCM collapsed, they'd have to dump $100 billion in assets.

This would crash bond markets worldwide.

The Federal Reserve stepped in.

Not with taxpayer money, but by organizing a private bailout:

This would crash bond markets worldwide.

The Federal Reserve stepped in.

Not with taxpayer money, but by organizing a private bailout:

September 23, 1998: Fourteen banks contributed $3.6 billion.

They took 90% ownership of LTCM.

Warren Buffett had offered to buy the fund for $250 million but got rejected.

The partners, who started the year worth $4.7 billion, got almost nothing.

They took 90% ownership of LTCM.

Warren Buffett had offered to buy the fund for $250 million but got rejected.

The partners, who started the year worth $4.7 billion, got almost nothing.

The aftermath was brutal:

- Meriwether's reputation was destroyed

- The Nobel laureates faced public humiliation

- Merrill Lynch warned against over-reliance on mathematical models

- David Mullins lost his chance to lead the Federal Reserve

Absolut meltdown.

- Meriwether's reputation was destroyed

- The Nobel laureates faced public humiliation

- Merrill Lynch warned against over-reliance on mathematical models

- David Mullins lost his chance to lead the Federal Reserve

Absolut meltdown.

By 2000, LTCM was completely liquidated.

The bailout investors were repaid.

But the damage to quantitative finance was lasting.

Wall Street learned that even the smartest models can fail catastrophically.

The bailout investors were repaid.

But the damage to quantitative finance was lasting.

Wall Street learned that even the smartest models can fail catastrophically.

The lessons are clear:

Mathematical models can't predict human panic.

Leverage amplifies both gains and devastating losses.

Even Nobel Prize winners aren't immune to market forces.

And when "impossible" events happen, they tend to happen all at once.

Mathematical models can't predict human panic.

Leverage amplifies both gains and devastating losses.

Even Nobel Prize winners aren't immune to market forces.

And when "impossible" events happen, they tend to happen all at once.

Follow @InsiderTrackers for more content like this:

https://twitter.com/1872841572984758272/status/1963572789199454527

• • •

Missing some Tweet in this thread? You can try to

force a refresh