The US labor market is in trouble:

Job cuts just surged by +88,736 in August 2025 alone, the highest August total since 2020.

This brings the YTD total up to 892,362 job cuts, up a whopping +66% compared to 2024.

What's happening to the labor market?

(a thread)

Job cuts just surged by +88,736 in August 2025 alone, the highest August total since 2020.

This brings the YTD total up to 892,362 job cuts, up a whopping +66% compared to 2024.

What's happening to the labor market?

(a thread)

Aside from 2020, there has not been an August total that exceeded 85,000 job cuts since 2008.

We are seeing 2020 and 2008-like job cuts in what many have called a "strong" economy.

The YTD total is already 17% ABOVE the FULL YEAR total of 761,358 seen in 2024.

We are seeing 2020 and 2008-like job cuts in what many have called a "strong" economy.

The YTD total is already 17% ABOVE the FULL YEAR total of 761,358 seen in 2024.

And, it's not all DOGE anymore.

While DOGE cuts have accounted for a massive 292,279 job cuts YTD, it's also the economy.

The 2nd most cited reason for workforce cuts, responsible for 199,297 cuts, is "market and economic conditions."

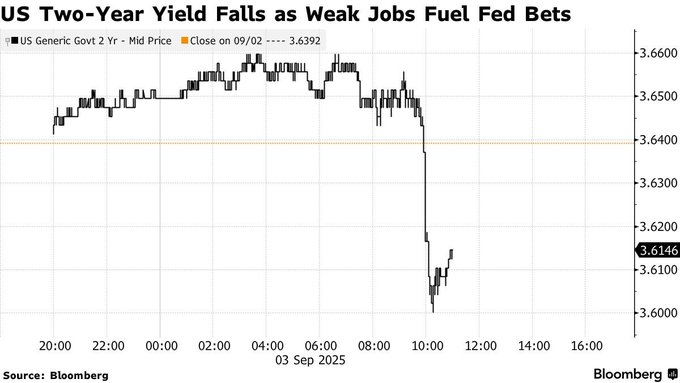

The Fed will lean on this in September.

While DOGE cuts have accounted for a massive 292,279 job cuts YTD, it's also the economy.

The 2nd most cited reason for workforce cuts, responsible for 199,297 cuts, is "market and economic conditions."

The Fed will lean on this in September.

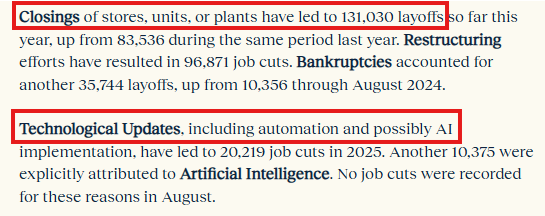

Store closures led to 131,030 layoffs, up nearly 50,000 YoY.

Furthermore, cost cutting through restructuring led to 96,871 cuts and Bankruptcies for a massive 35,744 cuts.

Last but not least?

We have clear data that AI is beginning to replace humans, at 20,219 cuts.

Furthermore, cost cutting through restructuring led to 96,871 cuts and Bankruptcies for a massive 35,744 cuts.

Last but not least?

We have clear data that AI is beginning to replace humans, at 20,219 cuts.

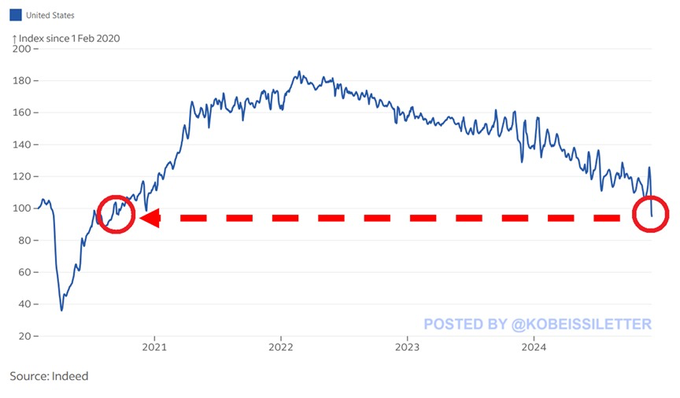

As we have been writing for a few months, all of the leading indicators were there.

In December 2024, new job postings on Indeed fell -38% year-over-year.

Job postings fell for 3 years straight and fell -49% since the February 2022 peak.

Economic uncertainty made this worse.

In December 2024, new job postings on Indeed fell -38% year-over-year.

Job postings fell for 3 years straight and fell -49% since the February 2022 peak.

Economic uncertainty made this worse.

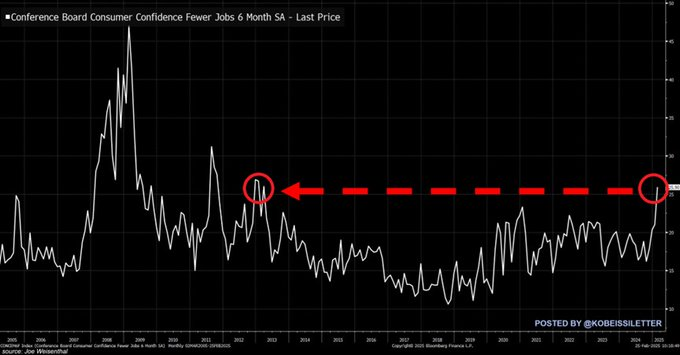

In February, the share of US consumers saying there will be fewer jobs over the next 6 months spiked to 26%, the highest in 12 years.

This percentage exceeded 2020 levels and was in-line with 2001 levels.

The share of Americans claiming jobs are "hard to get" jumped to 16%.

This percentage exceeded 2020 levels and was in-line with 2001 levels.

The share of Americans claiming jobs are "hard to get" jumped to 16%.

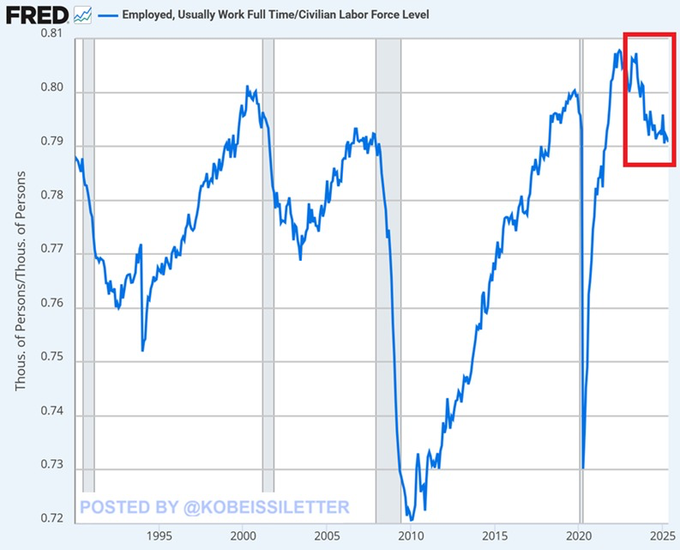

Then, in May 2025, full-time employment fell by 623,000 jobs.

This was the 4th largest monthly decline since 2020.

As a result, full-time employment's share of the labor force fell to 79%, the lowest since August 2021.

This ratio has been declining for 3 years now.

This was the 4th largest monthly decline since 2020.

As a result, full-time employment's share of the labor force fell to 79%, the lowest since August 2021.

This ratio has been declining for 3 years now.

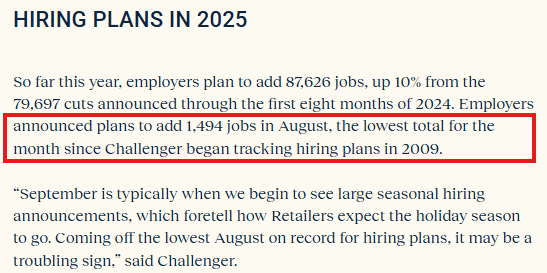

Looking ahead, there are no signs of improvement for the labor market.

Employers announced plans to add just 1,494 jobs in August.

This is the lowest total for any August since the data began in 2009.

The labor market and the stock market are moving in opposite directions.

Employers announced plans to add just 1,494 jobs in August.

This is the lowest total for any August since the data began in 2009.

The labor market and the stock market are moving in opposite directions.

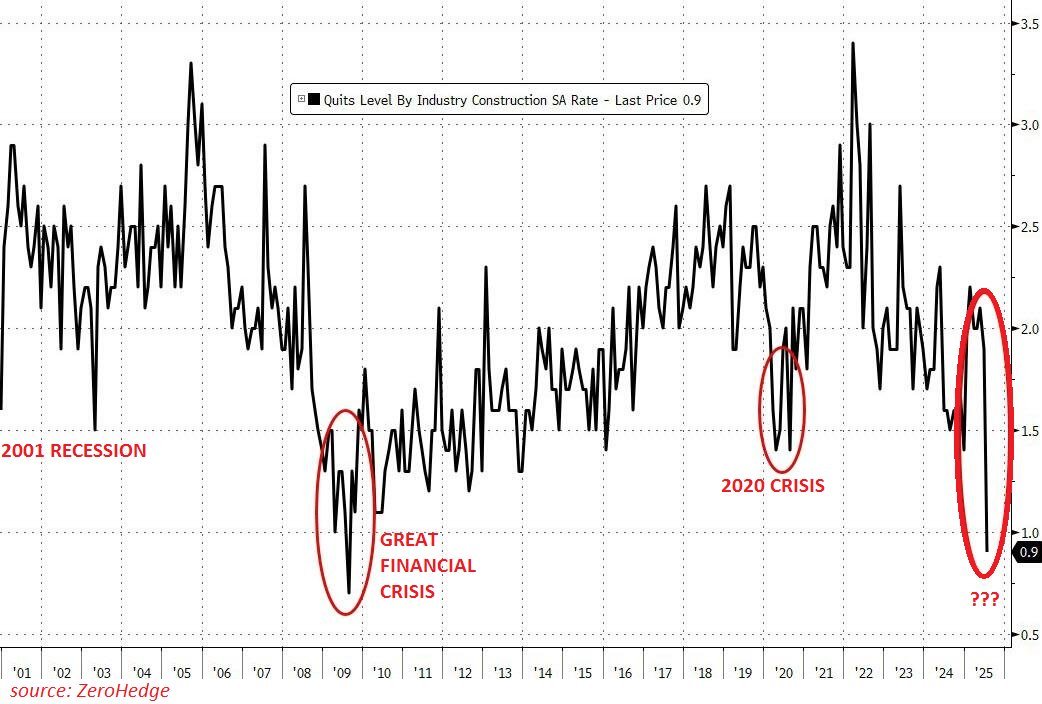

On top of this, the US quits rate is collapsing.

The share of US workers voluntarily leaving their jobs just fell to 0.9%.

This marks the lowest level since the 2008 Financial Crisis and is below 2020 lows.

Consumers can't find another job if they lose their current one.

The share of US workers voluntarily leaving their jobs just fell to 0.9%.

This marks the lowest level since the 2008 Financial Crisis and is below 2020 lows.

Consumers can't find another job if they lose their current one.

We are in the midst of another major shift in the macroeconomy.

The implications of these shifts on stocks, commodities, bonds, and crypto are investable.

Want to see how we are doing it?

Subscribe to access our premium analysis below:

thekobeissiletter.com/subscribe

The implications of these shifts on stocks, commodities, bonds, and crypto are investable.

Want to see how we are doing it?

Subscribe to access our premium analysis below:

thekobeissiletter.com/subscribe

In 13 days, the Fed will cut interest rates and blame a "weaker labor market."

All as Core CPI inflation has risen back above 3% and is 110 bps above the 2.0% target.

It's an exciting time to be an investor.

Follow us @KobeissiLetter for real time analysis as this develops.

All as Core CPI inflation has risen back above 3% and is 110 bps above the 2.0% target.

It's an exciting time to be an investor.

Follow us @KobeissiLetter for real time analysis as this develops.

• • •

Missing some Tweet in this thread? You can try to

force a refresh