New @The_Budget_Lab tariff analysis incorporating all tariffs through Sept 3. This is a major update. We:

• incorporate higher assumptions about Canada & Mexico tariff-free import shares;

• show 2 scenarios: all tariffs & no IEEPA tariffs after Jun 2026.

In brief...

1/12

• incorporate higher assumptions about Canada & Mexico tariff-free import shares;

• show 2 scenarios: all tariffs & no IEEPA tariffs after Jun 2026.

In brief...

1/12

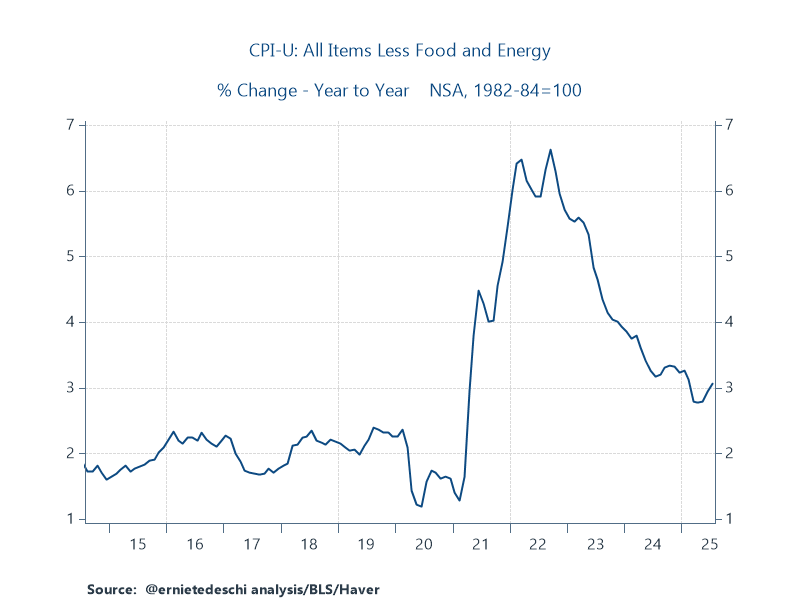

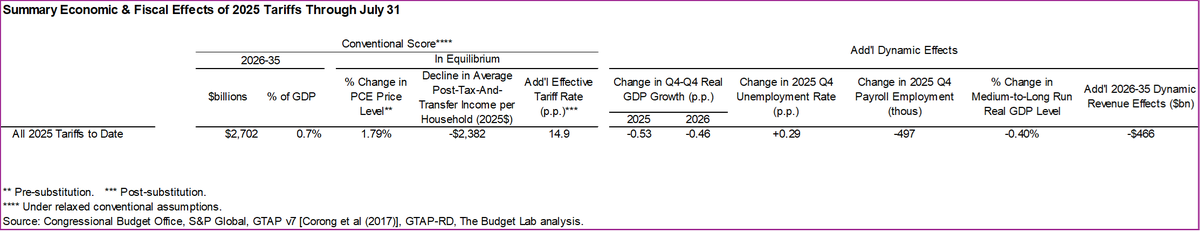

@The_Budget_Lab Under our all-tariff baseline, consumers face an effective tariff rate of 17.4%, a 15.0pp increase from 2024 & the highest since 1935. After shifts in spending in reaction to the tariffs, the effective tariff rate will be 16.4%, a 13.9pp increase & the highest since 1936

2/12

2/12

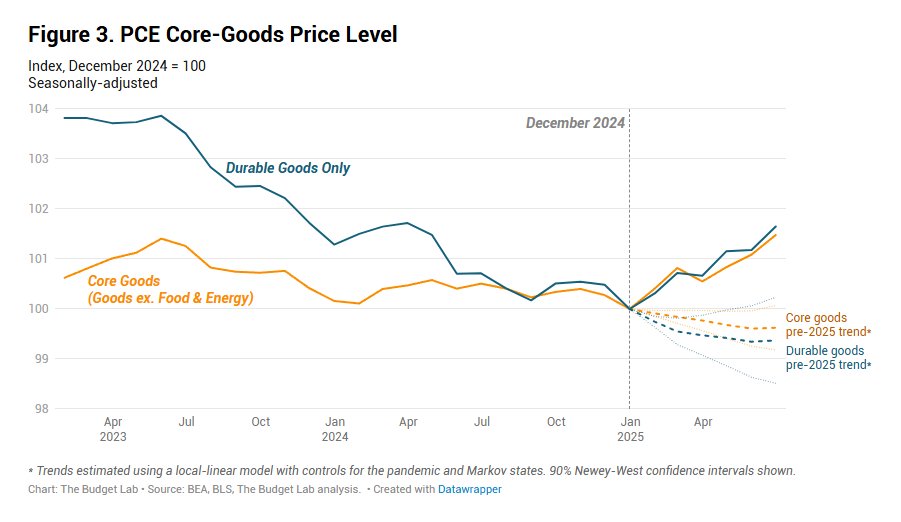

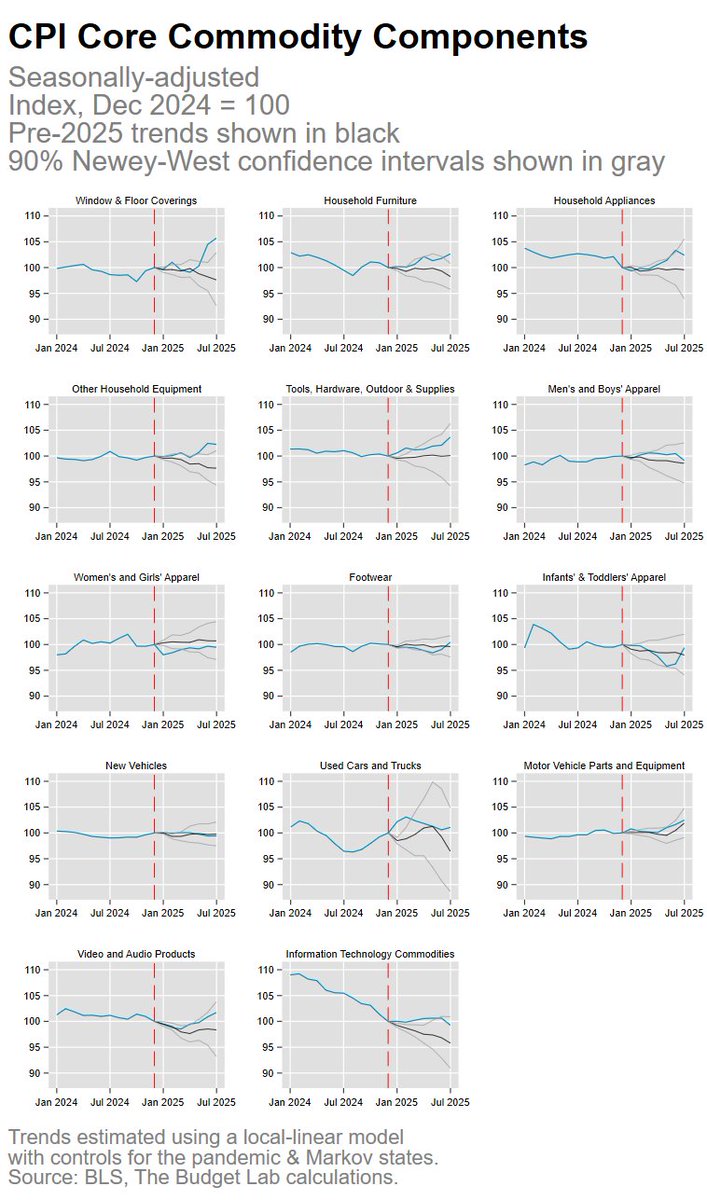

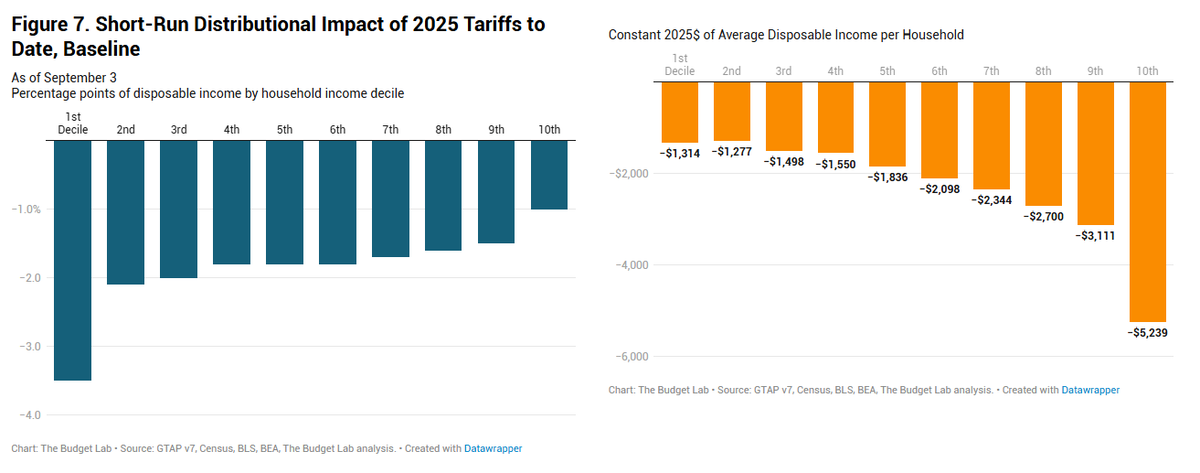

@The_Budget_Lab The price level from all 2025 tariffs rises by 1.7% in the short-run under our all-tariff baseline, an average per-household income loss of $2,300 in 2025$. The post-substitution price increase settles at 1.4%, a $1,900 loss per household.

3/12

3/12

@The_Budget_Lab Tariffs are a regressive tax, especially in the short-run. The short-run burden on 1st decile households (as a % of income) is >3x that of the top decile (-3.5% versus -1.0%). The average annual cost to the 1st & top decile are $1,300 & $5,200 respectively; median is $2,000.

4/12

4/12

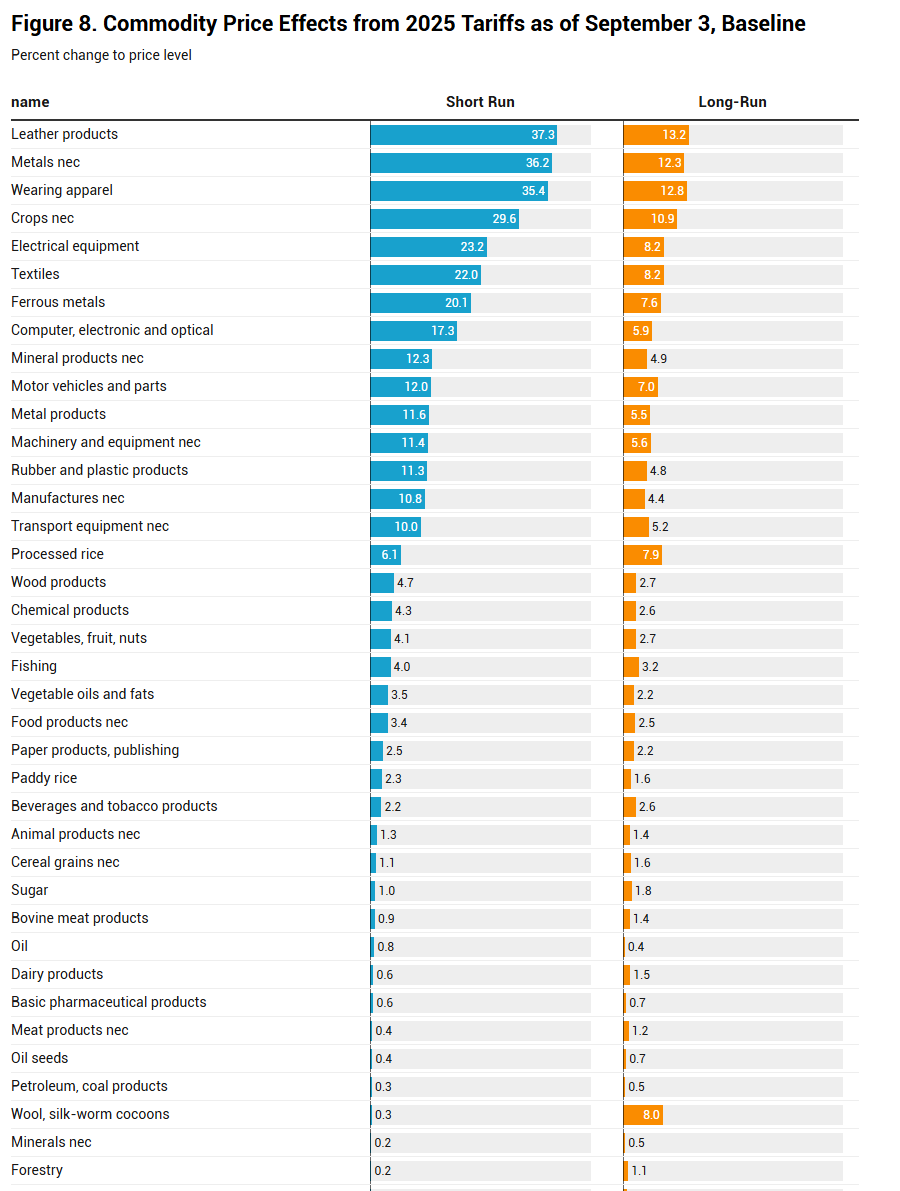

@The_Budget_Lab The 2025 tariffs disproportionately affect clothing and textiles, with consumers facing 37% higher shoe prices and 35% higher apparel prices in the short-run. Shoes and apparel prices stay 13% higher in the long-run.

5/12

5/12

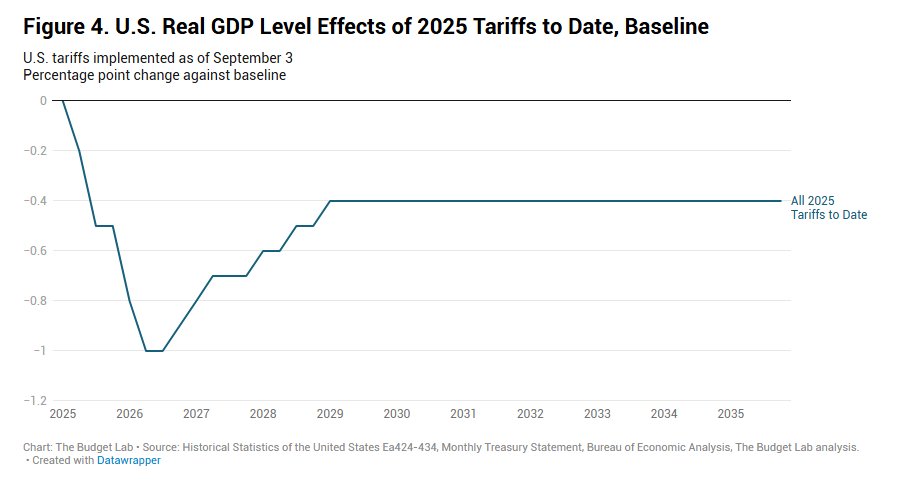

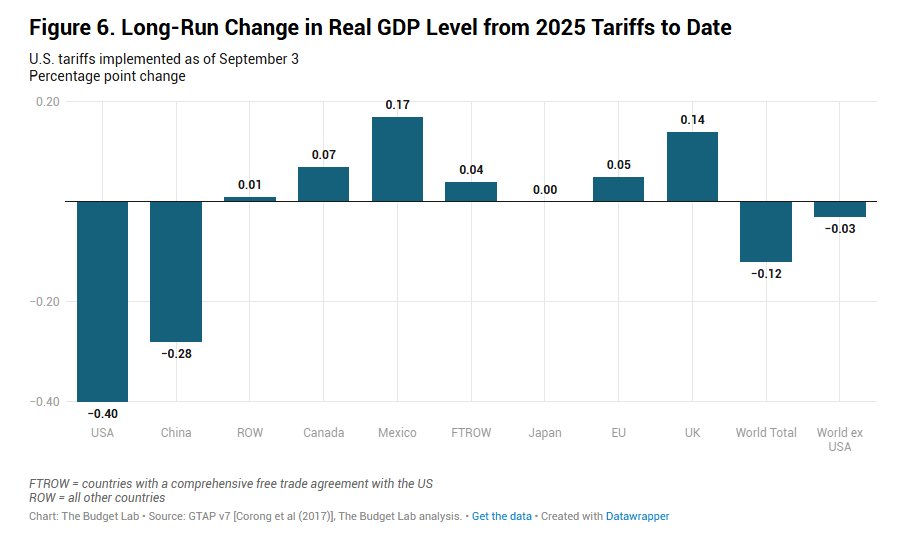

@The_Budget_Lab US real GDP growth over 2025 & 2026 is 0.5pp & 0.4pp lower respectively from all 2025 tariffs. In the long-run, the US economy is persistently 0.4% smaller, the equivalent of $120B annually in 2024$.

The unemployment rate rises 0.3pp by the end of 2025, & 0.7pp by end-2026.

6/12

The unemployment rate rises 0.3pp by the end of 2025, & 0.7pp by end-2026.

6/12

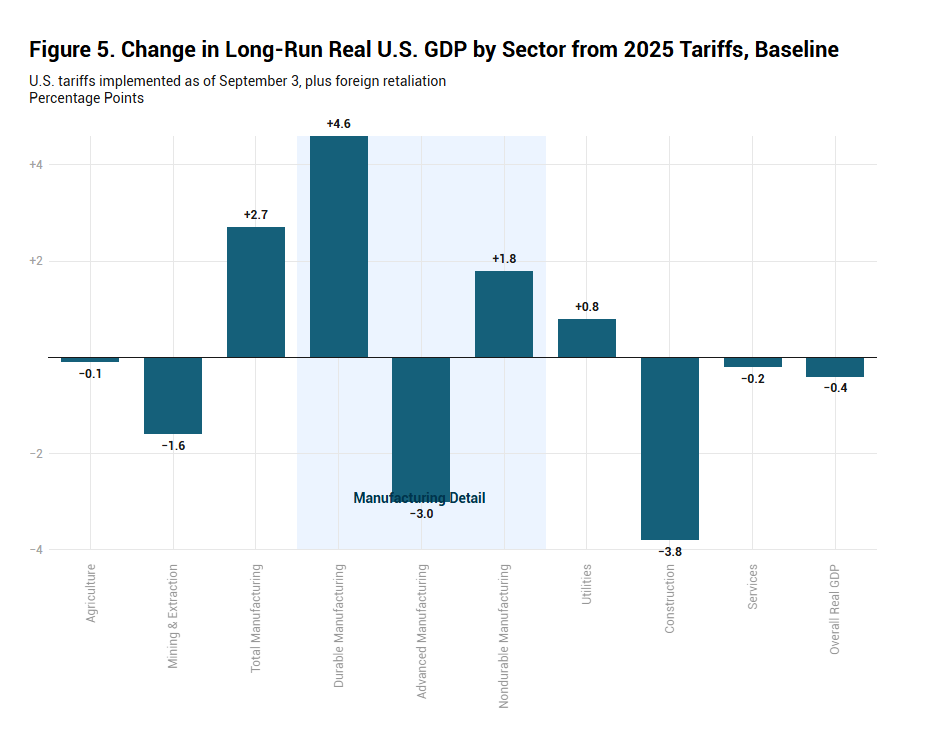

@The_Budget_Lab In the long-run, tariffs present a trade-off. US manufacturing output expands by 2.7%, but these gains are more than crowded out by other sectors: construction output contracts by 3.8% and mining declines by 1.6%.

7/12

7/12

@The_Budget_Lab Canada cessation of most retaliation significantly eases the economic burden they bear relative to our prior estimates: long-run Canadian real GDP is now 0.1% higher. China’s economy is -0.3% smaller, nearly 3/4 as large as the hit to the US.

8/12

8/12

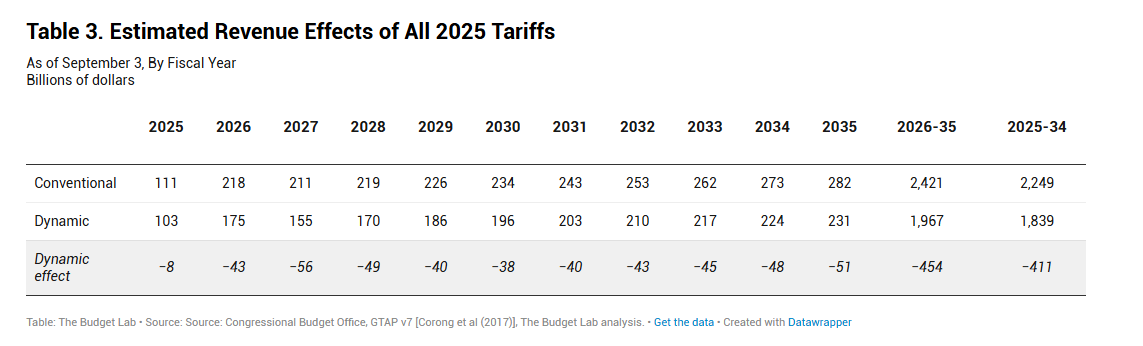

@The_Budget_Lab All tariffs to date in 2025 raise $2.4 trillion over 2026-35, with $454 billion in negative dynamic revenue effects, bringing dynamic revenues to $2.0 trillion.

9/12

9/12

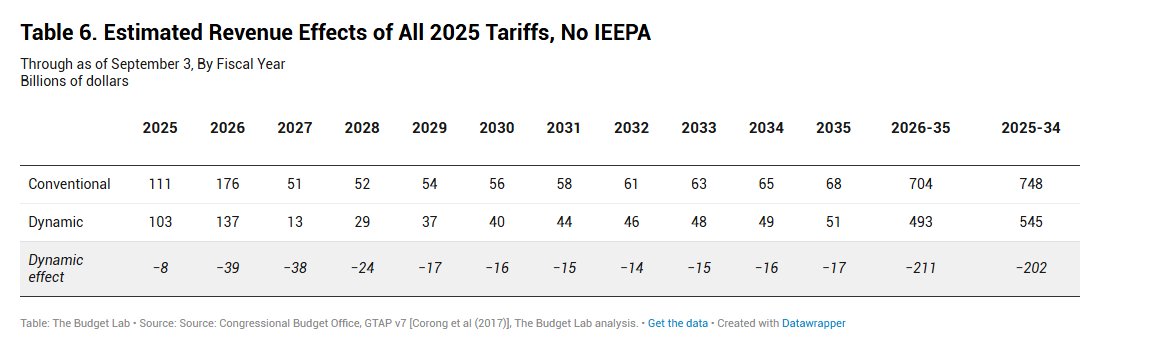

@The_Budget_Lab But what if the IEEPA tariffs were both 1) overturned, & 2) not replaced? We show a "No IEEPA" scenario assuming a SCOTUS decision in June 2026. A few highlights:

1. IEEPA tariffs make up ~70% of the 2025 tariffs to date.

2. Revenues shrink to $700B over 2026-2035.

10/12

1. IEEPA tariffs make up ~70% of the 2025 tariffs to date.

2. Revenues shrink to $700B over 2026-2035.

10/12

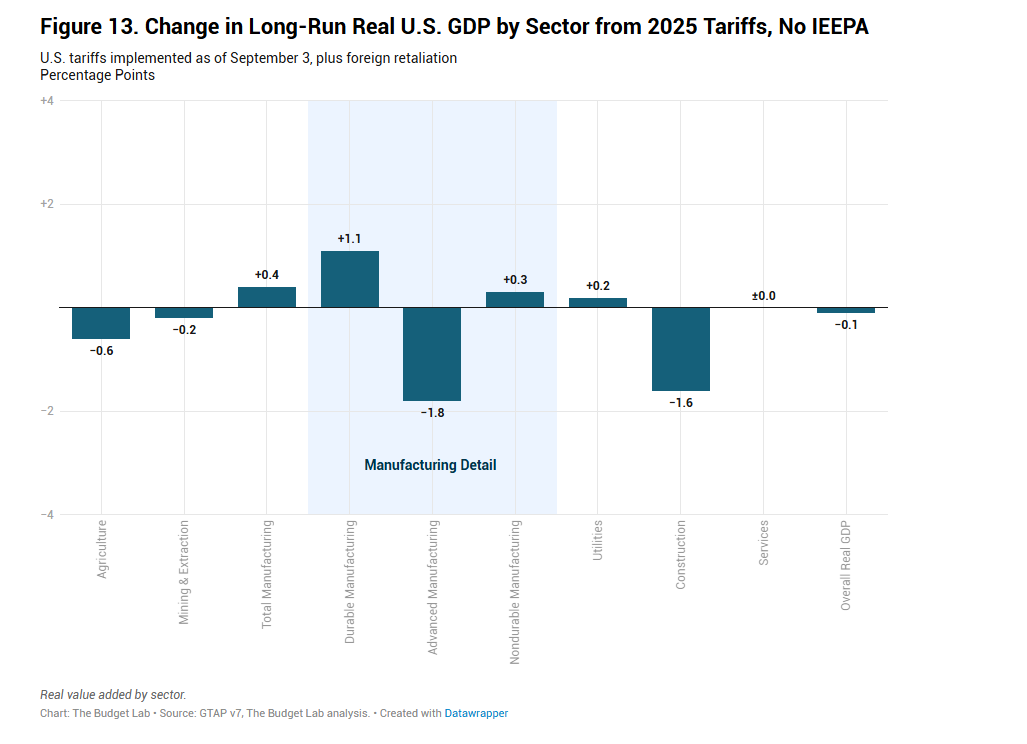

@The_Budget_Lab 3. The long-run hit to US real GDP levels is now only -0.1%, but there is still an outsized negative effect on advanced manufacturing (due to the remaining 232 tariffs).

4. The effective tariff rate would be 6.8%, still the highest since 1969.

11/12

4. The effective tariff rate would be 6.8%, still the highest since 1969.

11/12

@The_Budget_Lab Full report here:

12/12budgetlab.yale.edu/research/state…

12/12budgetlab.yale.edu/research/state…

• • •

Missing some Tweet in this thread? You can try to

force a refresh