Personal account. Chief economist at @Stripe. Former Director of Economics at @The_Budget_Lab. Former Chief Economist at @WhiteHouseCEA.

4 subscribers

How to get URL link on X (Twitter) App

@The_Budget_Lab TARIFF RATE: The September 25 announcement raises the average effective tariff rate by 0.5pp to 17.9% pre-substitution (as of Oct 1), the highest since 1934. After consumers & businesses shift their spending mix, the post-substitution rate is 16.7%, highest since 1936.

@The_Budget_Lab TARIFF RATE: The September 25 announcement raises the average effective tariff rate by 0.5pp to 17.9% pre-substitution (as of Oct 1), the highest since 1934. After consumers & businesses shift their spending mix, the post-substitution rate is 16.7%, highest since 1936.

@The_Budget_Lab Under our all-tariff baseline, consumers face an effective tariff rate of 17.4%, a 15.0pp increase from 2024 & the highest since 1935. After shifts in spending in reaction to the tariffs, the effective tariff rate will be 16.4%, a 13.9pp increase & the highest since 1936

@The_Budget_Lab Under our all-tariff baseline, consumers face an effective tariff rate of 17.4%, a 15.0pp increase from 2024 & the highest since 1935. After shifts in spending in reaction to the tariffs, the effective tariff rate will be 16.4%, a 13.9pp increase & the highest since 1936

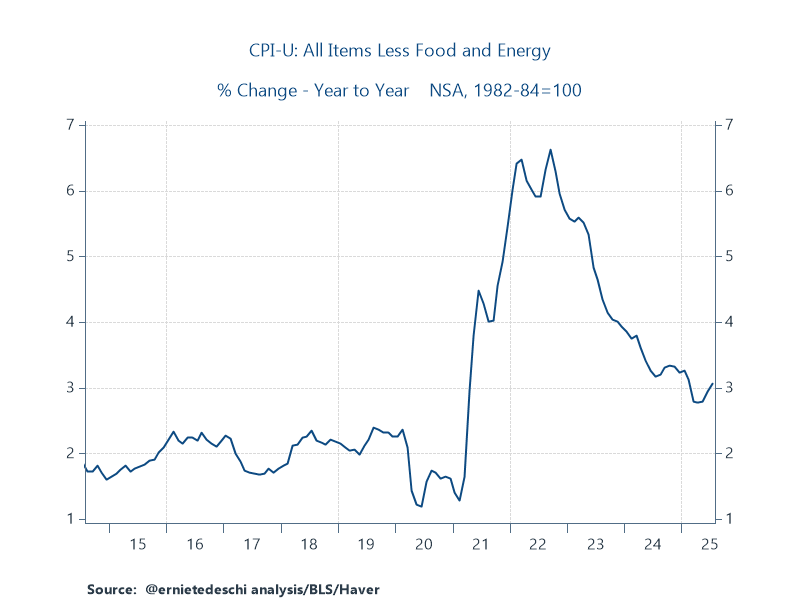

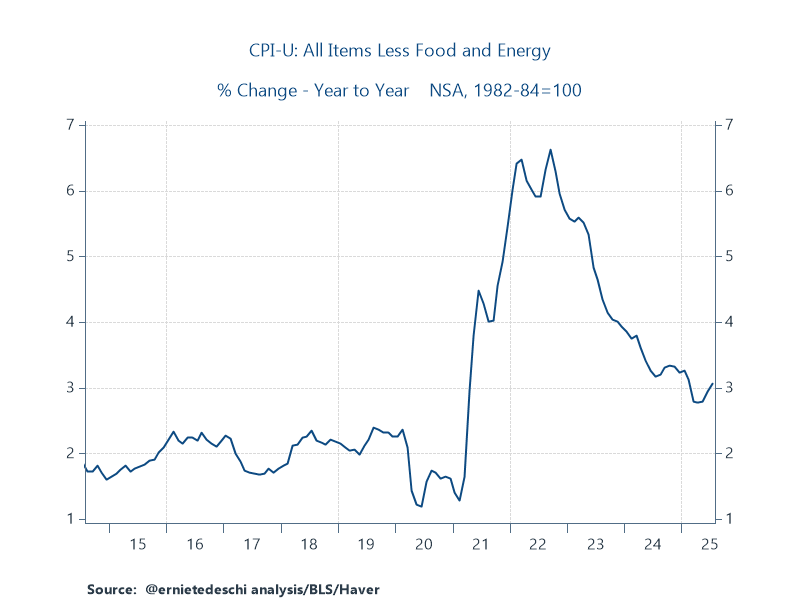

In June, excess monthly core inflation was largely a goods story, in large part driven by tariff price adjustments.

In June, excess monthly core inflation was largely a goods story, in large part driven by tariff price adjustments.

@The_Budget_Lab Consumers face an overall average effective tariff rate of 18.3%, a 15.9pp increase from 2024 & the highest since 1934. After consumers & businesses shift spending in reaction to the tariffs, the average tariff rate will be 17.3%, a 14.9pp increase & the highest since 1935

@The_Budget_Lab Consumers face an overall average effective tariff rate of 18.3%, a 15.9pp increase from 2024 & the highest since 1934. After consumers & businesses shift spending in reaction to the tariffs, the average tariff rate will be 17.3%, a 14.9pp increase & the highest since 1935

• Consumers face an overall average effective tariff rate of 18.0%, a 15.6pp increase from 2024 & the highest since 1934. After consumers & businesses shift spending in reaction to the tariffs, the average tariff rate will be 16.9%, a 14.5pp increase & the highest since 1935

• Consumers face an overall average effective tariff rate of 18.0%, a 15.6pp increase from 2024 & the highest since 1934. After consumers & businesses shift spending in reaction to the tariffs, the average tariff rate will be 16.9%, a 14.5pp increase & the highest since 1935

• Consumers face an overall average effective tariff rate of 17.6%, a 15.2pp increase from 2024 & the highest since 1934. After consumers & businesses shift spending in reaction to the tariffs, the average tariff rate will be 16.5%, a 14.1pp increase & the highest since 1936

• Consumers face an overall average effective tariff rate of 17.6%, a 15.2pp increase from 2024 & the highest since 1934. After consumers & businesses shift spending in reaction to the tariffs, the average tariff rate will be 16.5%, a 14.1pp increase & the highest since 1936

* The pre-substitution average effective US tariff rate rises from 15.4% now to 19.5%

* The pre-substitution average effective US tariff rate rises from 15.4% now to 19.5%

1. The proposal raises PCE prices by 0.76% pre-substitution (full retaliation & no Fed offset). That's the equivalent of a $1,250 per household loss in purchasing power on average in 2024$.

1. The proposal raises PCE prices by 0.76% pre-substitution (full retaliation & no Fed offset). That's the equivalent of a $1,250 per household loss in purchasing power on average in 2024$.

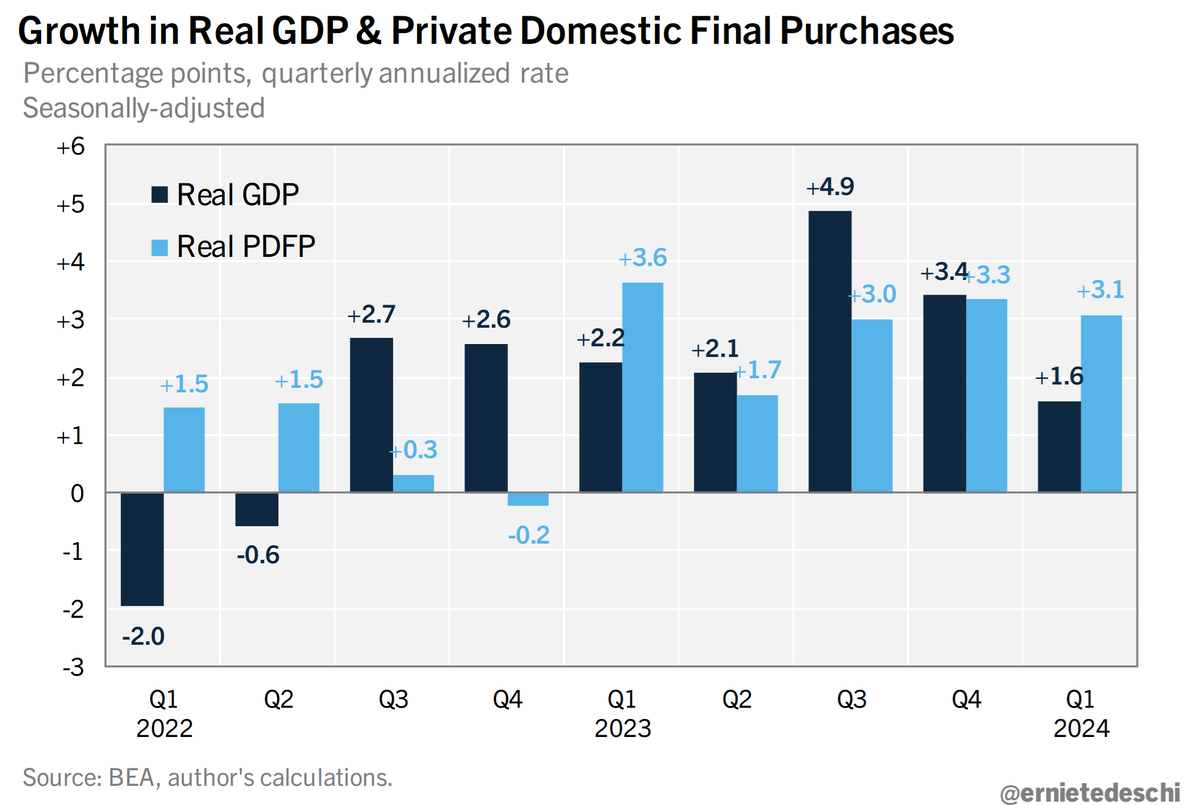

The chart below shows how much broad components of GDP contributed to grown in Q1, 2023 Q4, and on average over 2017-19. You can see the significant swing in exports. Goods consumption also cooled a bit. Services consumption and residential investment firmed.

The chart below shows how much broad components of GDP contributed to grown in Q1, 2023 Q4, and on average over 2017-19. You can see the significant swing in exports. Goods consumption also cooled a bit. Services consumption and residential investment firmed.

https://twitter.com/ernietedeschi/status/1363949305816580104First, for background on how the Fed is communicating alternatives to the headline unemployment rate, read this nice @jeannasmialek piece from the other day. /2

https://twitter.com/jeannasmialek/status/1363915202316632067