This is absolutely insane:

The US just revised the June jobs report lower for a SECOND time for a total of -160,000 jobs.

Now, the US has officially LOST -13,000 jobs in June, the first negative month since July 2021.

What just happened? Let us explain.

(a thread)

The US just revised the June jobs report lower for a SECOND time for a total of -160,000 jobs.

Now, the US has officially LOST -13,000 jobs in June, the first negative month since July 2021.

What just happened? Let us explain.

(a thread)

Take a look at this.

The June jobs report has now been revised lower by a total of -160,000 jobs.

This is MORE than the initially reported GAIN of +147,000 jobs, a seriously concerning trend in our data.

If this is not a "broken" system, it's hard to say what is.

The June jobs report has now been revised lower by a total of -160,000 jobs.

This is MORE than the initially reported GAIN of +147,000 jobs, a seriously concerning trend in our data.

If this is not a "broken" system, it's hard to say what is.

In fact, the May and June jobs report were just revised lower by a combined -280,000 jobs.

And, every single jobs report in 2025 has been revised lower aside from July.

Not only is something wrong with our data, but the labor market is entering recession territory.

And, every single jobs report in 2025 has been revised lower aside from July.

Not only is something wrong with our data, but the labor market is entering recession territory.

Meanwhile, today's data showed the US added just 22,000 jobs in July,

This was below 79 of 80 forecasts, according to Zerohedge.

And, the unemployment rate in the US rose to 4.3%, marking the highest reading since October 2021.

Things are getting very ugly for US consumers.

This was below 79 of 80 forecasts, according to Zerohedge.

And, the unemployment rate in the US rose to 4.3%, marking the highest reading since October 2021.

Things are getting very ugly for US consumers.

Following the data, the odds of a September 17th rate cut surged to 100%.

Yields collapsed and the odds of a 50 basis point rate cut jumped to 12%.

The market went from not fully pricing-in a 25 bps cut, to increasingly calling for 50 bps.

This is a MAJOR shift.

Yields collapsed and the odds of a 50 basis point rate cut jumped to 12%.

The market went from not fully pricing-in a 25 bps cut, to increasingly calling for 50 bps.

This is a MAJOR shift.

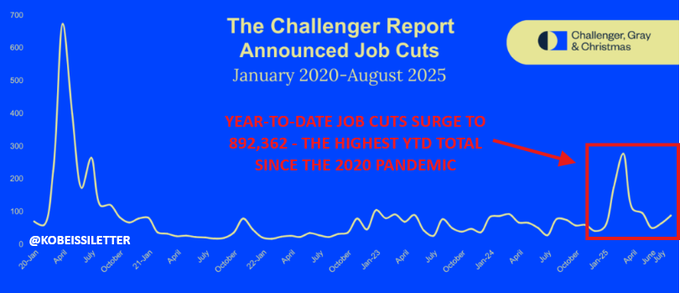

On top of this, Challenger data showed job cuts +88,736 in August 2025 alone, the highest August total since 2020.

The YTD total is at 892,362 job cuts, up +66% compared to 2024.

Aside from 2020, there has not been an August total that exceeded 85,000 job cuts since 2008.

The YTD total is at 892,362 job cuts, up +66% compared to 2024.

Aside from 2020, there has not been an August total that exceeded 85,000 job cuts since 2008.

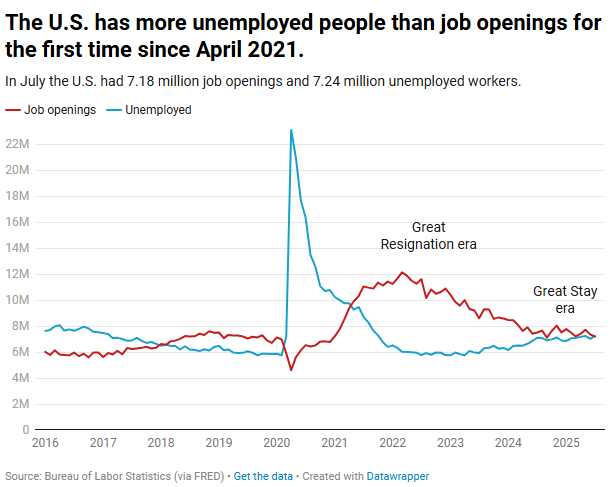

Earlier this week, another major crack appeared in the labor market.

In July, the US had 7.18 million job openings for 7.24 million unemployed people.

There are now MORE unemployed people than job openings in the US for the first time since April 2021.

In July, the US had 7.18 million job openings for 7.24 million unemployed people.

There are now MORE unemployed people than job openings in the US for the first time since April 2021.

In 4 days, this will get even worse.

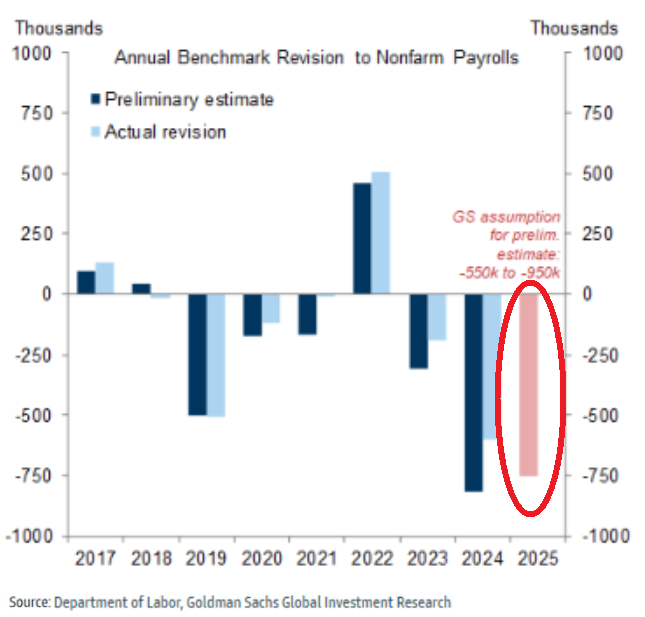

On September 9th, the BLS will revise US jobs numbers for the 12 months ending March 2025.

According to Goldman Sachs, a DOWNWARD revision of up to -950,000 jobs is coming.

This would be the biggest downward revision since 2010.

On September 9th, the BLS will revise US jobs numbers for the 12 months ending March 2025.

According to Goldman Sachs, a DOWNWARD revision of up to -950,000 jobs is coming.

This would be the biggest downward revision since 2010.

The signs have been there, markets are just finally starting to realize.

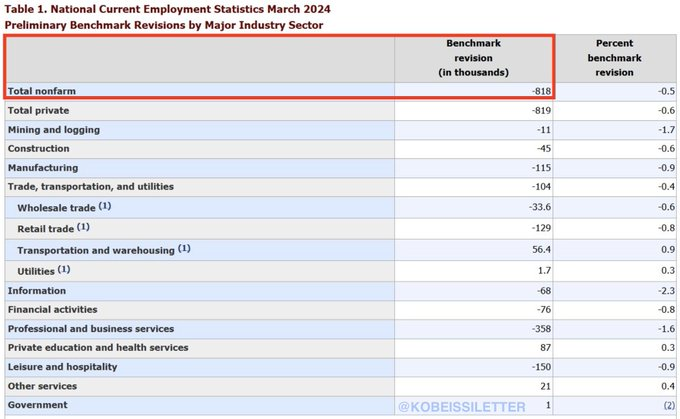

In 2024, the BLS revised 12-month job growth down by a massive -818,000 jobs.

In other words, the US economy actually created 818,000 LESS jobs than initially reported.

We will likely TOP that in 4 days.

In 2024, the BLS revised 12-month job growth down by a massive -818,000 jobs.

In other words, the US economy actually created 818,000 LESS jobs than initially reported.

We will likely TOP that in 4 days.

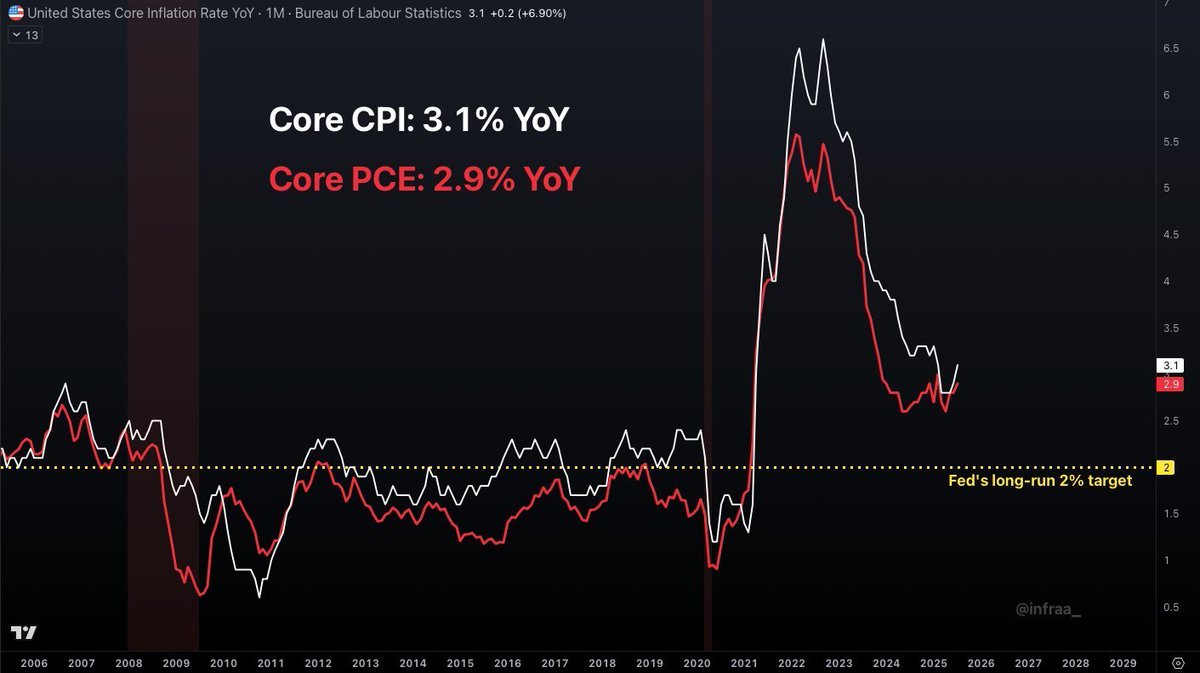

Rate cuts are now certain, in our view.

And, it's not because inflation is down, but it's because the labor market just got that much worse.

We now have Core CPI inflation rising above 3.0% with a rapidly deteriorating labor market.

Stagflation has officially arrived.

And, it's not because inflation is down, but it's because the labor market just got that much worse.

We now have Core CPI inflation rising above 3.0% with a rapidly deteriorating labor market.

Stagflation has officially arrived.

We are in the midst of another major shift in the macroeconomy.

The implications of these shifts on stocks, commodities, bonds, and crypto are investable.

Want to see how we are doing it?

Subscribe to access our premium analysis below:

thekobeissiletter.com/subscribe

The implications of these shifts on stocks, commodities, bonds, and crypto are investable.

Want to see how we are doing it?

Subscribe to access our premium analysis below:

thekobeissiletter.com/subscribe

Rate cuts are coming into rising inflation and a weakening labor market.

We expect to see more rate cuts and higher inflation ahead, and yields are reacting sharply right now.

Position accordingly.

Follow us @KobeissiLetter for real time analysis as this develops.

We expect to see more rate cuts and higher inflation ahead, and yields are reacting sharply right now.

Position accordingly.

Follow us @KobeissiLetter for real time analysis as this develops.

• • •

Missing some Tweet in this thread? You can try to

force a refresh