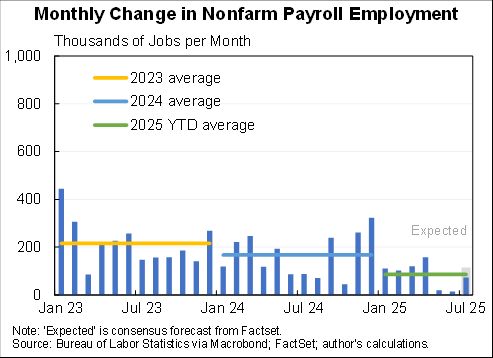

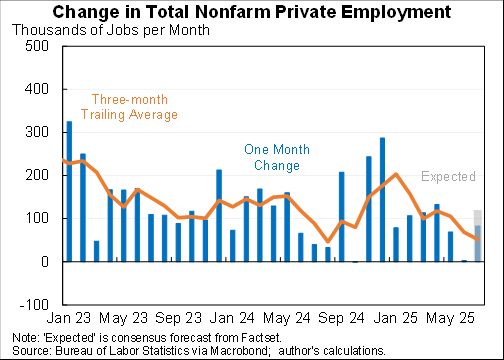

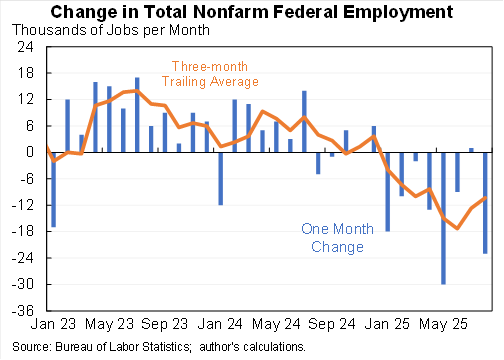

A market slowdown in the pace of job gains, with 22K added in August, bringing the three month average to 29K.

On a percentage basis have not seen job growth this slow outside of recessionary periods in more than sixty years.

On a percentage basis have not seen job growth this slow outside of recessionary periods in more than sixty years.

The unemployment rate rose from 4.2% to 4.3% (unrounded was a smaller increase).

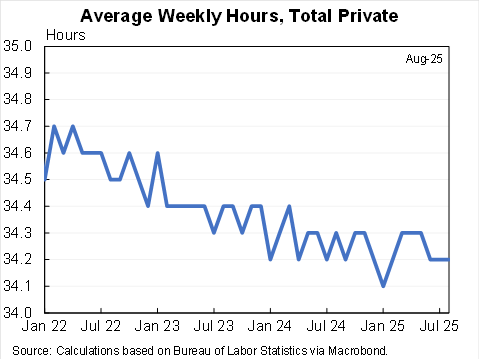

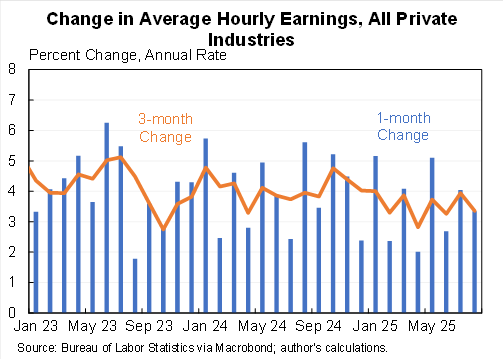

Wage growth was strong and average hours steady.

Wage growth was strong and average hours steady.

All of these are consistent with a marked slowdown in labor supply (due to immigration policy) combined with a continued slight softness in labor demand (as evidenced by the unemployment rate which has been steadily rising at about 0.03 percentage point per month for 2-1/2 years.

Here are the wage data which is another piece of evidence that the labor market is not markedly loosing but instead what is a "normal" labor market is much lower than the job growth we had been used to.

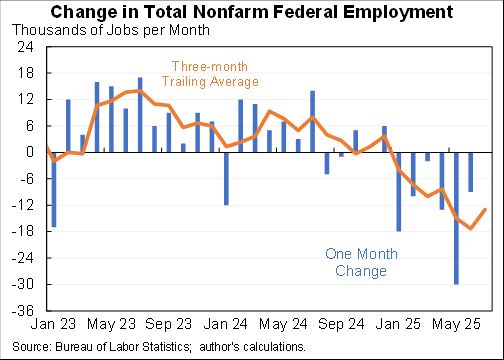

As an aside, a portion of what we're seeing is Federal job cuts. But the number is quite small compared to everything else.

In sum, we are seeing a big slowdown in labor supply and some weakness in labor demand. Not a whole lot the Fed can do when the biggest problem is not enough people. But it can and will cut rates, given inflation risks I would limit that to 25bp at the next meeting.

• • •

Missing some Tweet in this thread? You can try to

force a refresh