In this THREAD I will explain “Basic Trading Indicators”

1. MACD

2. Orderbook

3. Trend Bands

4. Volume Delta

🧵(1/15)

1. MACD

2. Orderbook

3. Trend Bands

4. Volume Delta

🧵(1/15)

1. MACD

MACD indicator is used to identify trends, potential reversals and momentum in a given asset.

MACD consists of three main parts:

- The MACD line

- The Signal line

- The Histograms

MACD indicator is used to identify trends, potential reversals and momentum in a given asset.

MACD consists of three main parts:

- The MACD line

- The Signal line

- The Histograms

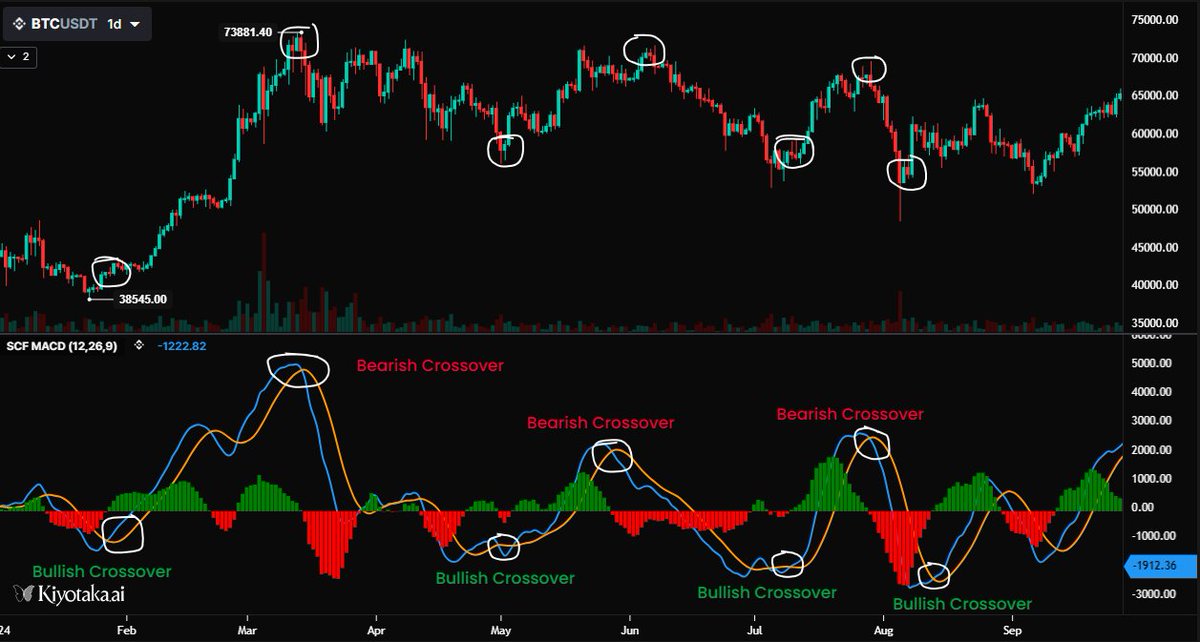

1.1 MACD

MACD Crossovers signal momentum shifts:

Bullish Crossover: Blue line crosses above orange = potential uptrend

Bearish Crossover: Blue line drops below orange = potential downtrend

MACD Crossovers signal momentum shifts:

Bullish Crossover: Blue line crosses above orange = potential uptrend

Bearish Crossover: Blue line drops below orange = potential downtrend

1.2 MACD

This chart shows a classic MACD Bullish Divergence setup:

Price makes a Lower Low

MACD makes a Higher Low

This signals weakening bearish momentum and a potential trend reversal to the upside.

The divergence + bullish MACD crossover = strong buy signal

This chart shows a classic MACD Bullish Divergence setup:

Price makes a Lower Low

MACD makes a Higher Low

This signals weakening bearish momentum and a potential trend reversal to the upside.

The divergence + bullish MACD crossover = strong buy signal

1.3 MACD

Successful BTC LONG on the 15m Timeframe:

1. Price forms a local bottom at $107k

2. A Bullish Crossover on the MACD confirms entry. Blue line crosses above orange

3. Strong momentum, price hits the target

MACD helped time the entry with trend confirmation

Successful BTC LONG on the 15m Timeframe:

1. Price forms a local bottom at $107k

2. A Bullish Crossover on the MACD confirms entry. Blue line crosses above orange

3. Strong momentum, price hits the target

MACD helped time the entry with trend confirmation

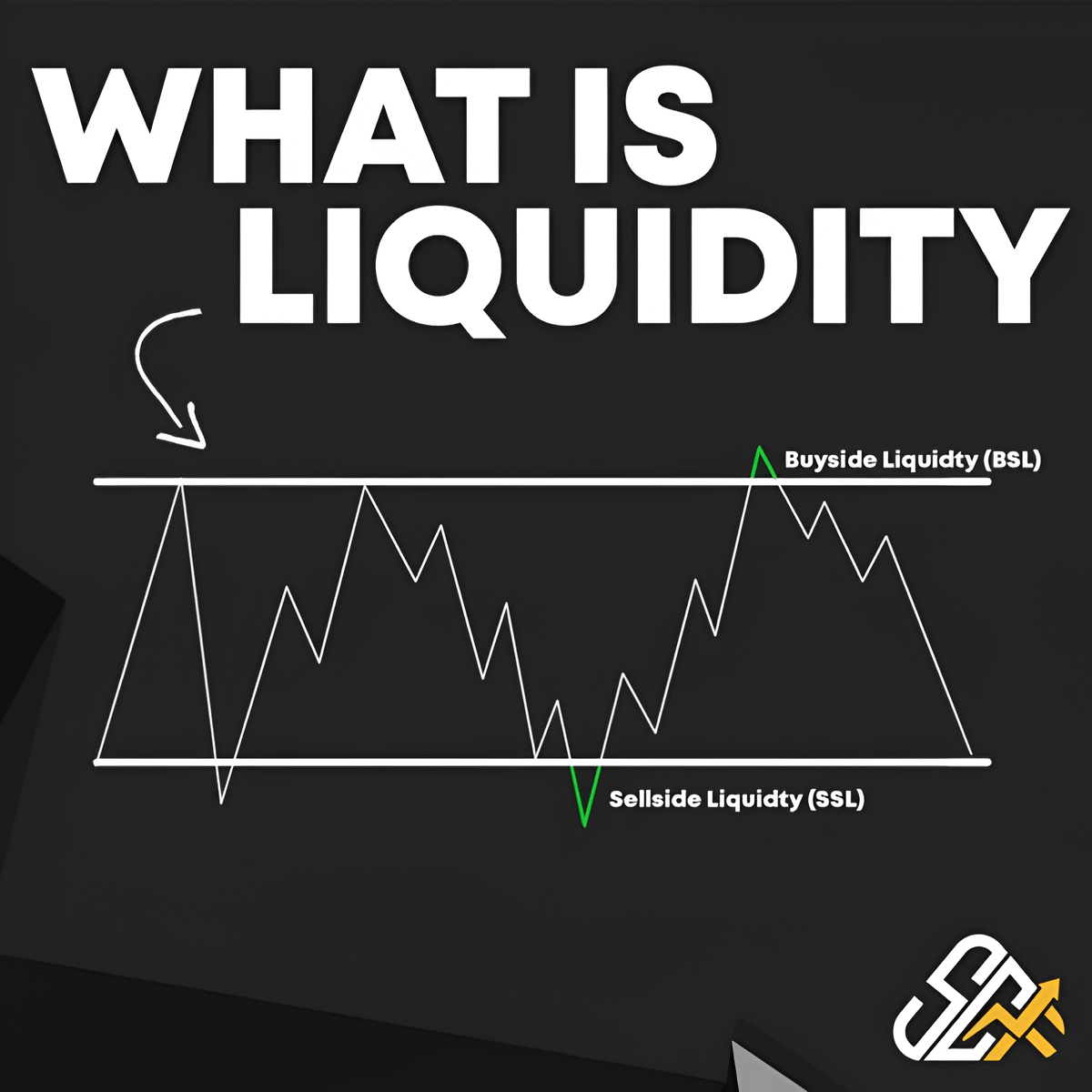

2. Orderbook

Orderbook Imbalance Indicator highlights buying vs. selling pressure using data from the Orderbook

🔴 Red bars = Sell-side dominance (more asks than bids) → Bearish pressure

🟢 Green bars = Buy-side dominance (more bids than asks) → Bullish pressure

Orderbook Imbalance Indicator highlights buying vs. selling pressure using data from the Orderbook

🔴 Red bars = Sell-side dominance (more asks than bids) → Bearish pressure

🟢 Green bars = Buy-side dominance (more bids than asks) → Bullish pressure

2.1 Orderbook

Orderbook Panel:

The Orderbook (right side) shows real-time buy (bids) and sell (asks) liquidity stacked at different price levels

🔴 Red = ask walls (sellers)

🔵 Blue = bid walls (buyers)

Above price = potential resistance

Below price = potential support

Orderbook Panel:

The Orderbook (right side) shows real-time buy (bids) and sell (asks) liquidity stacked at different price levels

🔴 Red = ask walls (sellers)

🔵 Blue = bid walls (buyers)

Above price = potential resistance

Below price = potential support

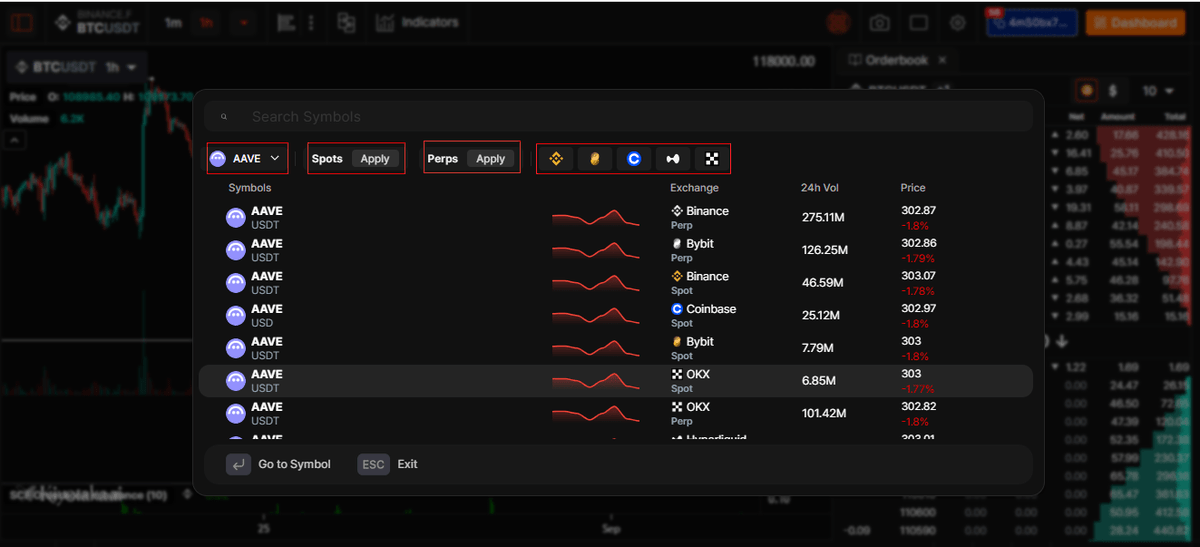

2.2 Orderbook

By accessing the Orderbook you will be able to choose the Altcoin you want.

In the Exchanges available in Kiyotaka

You can also choose whether you want to see the Spot or Perps OrderBook

By accessing the Orderbook you will be able to choose the Altcoin you want.

In the Exchanges available in Kiyotaka

You can also choose whether you want to see the Spot or Perps OrderBook

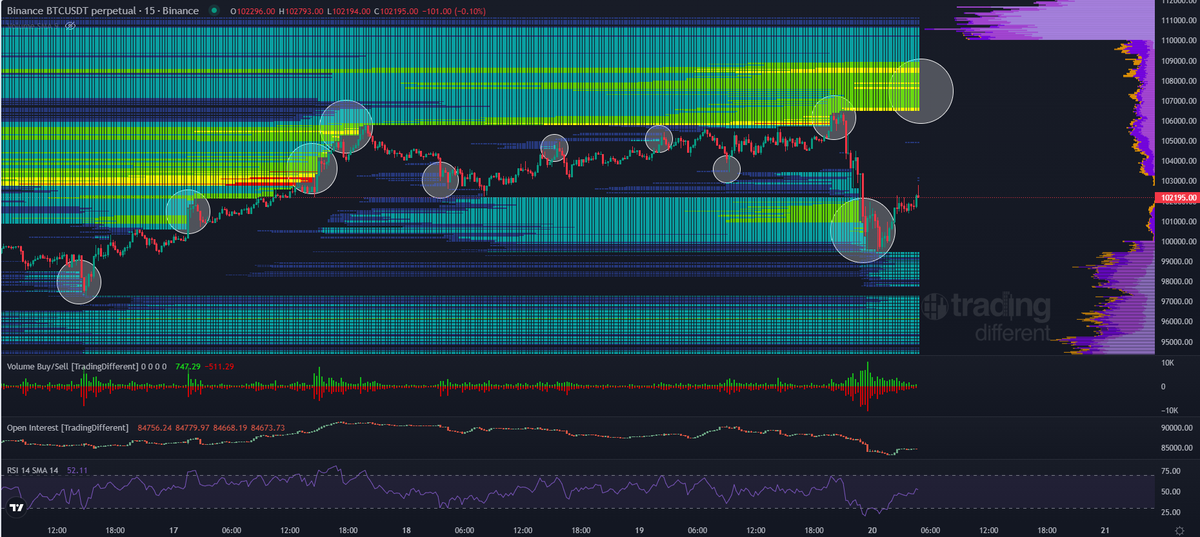

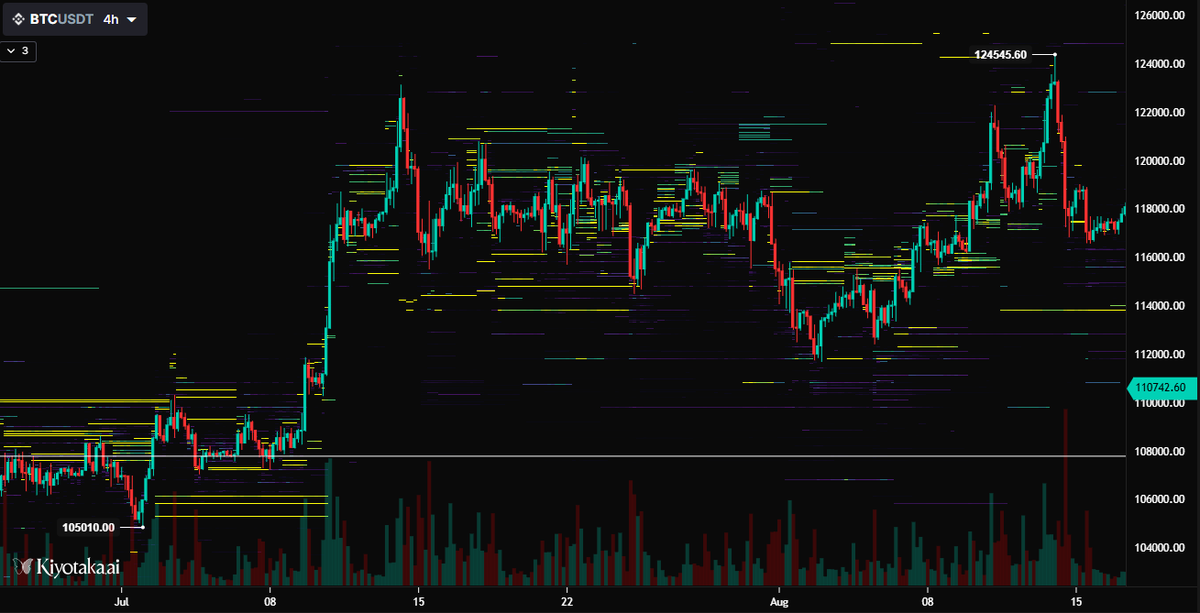

2.3 Orderbook

This chart uses an Orderbook Heatmap, which visualizes Liquidity Levels across time:

🔥 Yellow/bright zones = high resting orders (liquidity walls)

🟣 Dark zones = Low liquidity

These zones often act as Support/Resistance

This chart uses an Orderbook Heatmap, which visualizes Liquidity Levels across time:

🔥 Yellow/bright zones = high resting orders (liquidity walls)

🟣 Dark zones = Low liquidity

These zones often act as Support/Resistance

3. Trend Bands

Trend Band Indicator is used to visualize trend direction with moving averages and color shading:

📈 When green appears, it signals upward momentum: Good spot for long setups.

📉 Red shading shows sellers in control: Time to avoid longs and look for shorts.

Trend Band Indicator is used to visualize trend direction with moving averages and color shading:

📈 When green appears, it signals upward momentum: Good spot for long setups.

📉 Red shading shows sellers in control: Time to avoid longs and look for shorts.

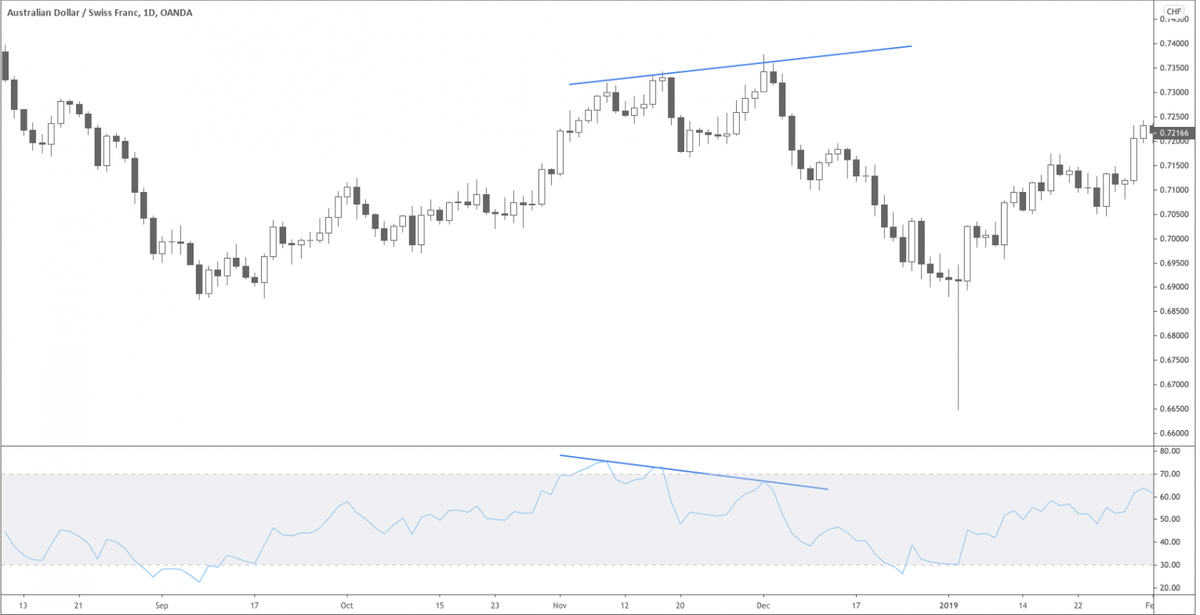

3.1 Trend Bands

The Trend Band turned green, confirming the start of a Bullish trend with successive Higher Lows.

Momentum stayed intact until the band flipped red near the peak.

Signaling a bearish reversal with lower highs forming.

The Trend Band turned green, confirming the start of a Bullish trend with successive Higher Lows.

Momentum stayed intact until the band flipped red near the peak.

Signaling a bearish reversal with lower highs forming.

3.2 Trend Bands

Short trade in AAVE

The Trend Band shows a failed breakout with deviation above range.

Followed by a color shift that confirms the change of trend.

The band turns red as bearish volume increases, with stop loss above range and taking profit at support.

Short trade in AAVE

The Trend Band shows a failed breakout with deviation above range.

Followed by a color shift that confirms the change of trend.

The band turns red as bearish volume increases, with stop loss above range and taking profit at support.

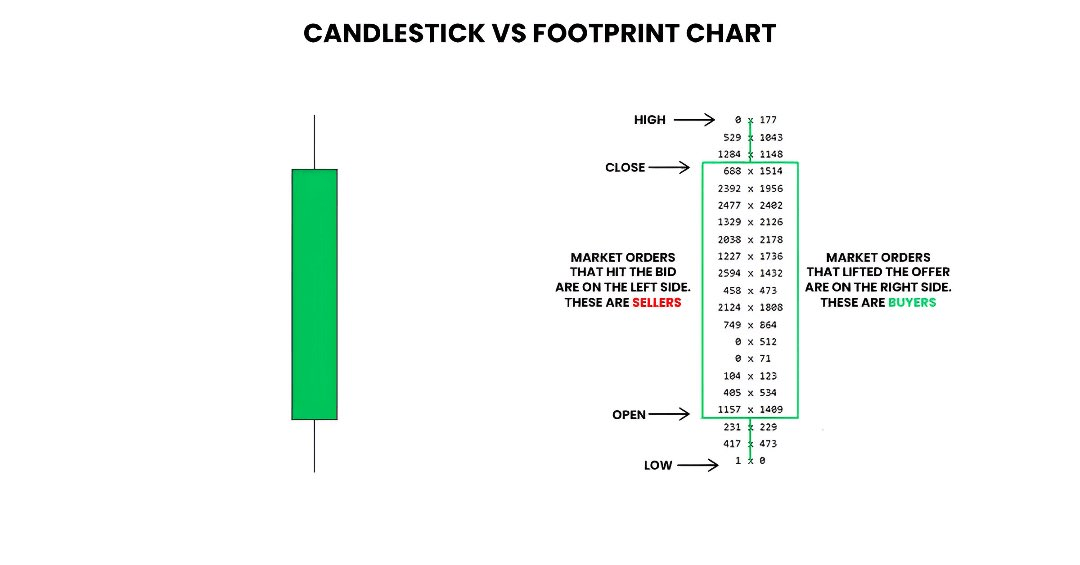

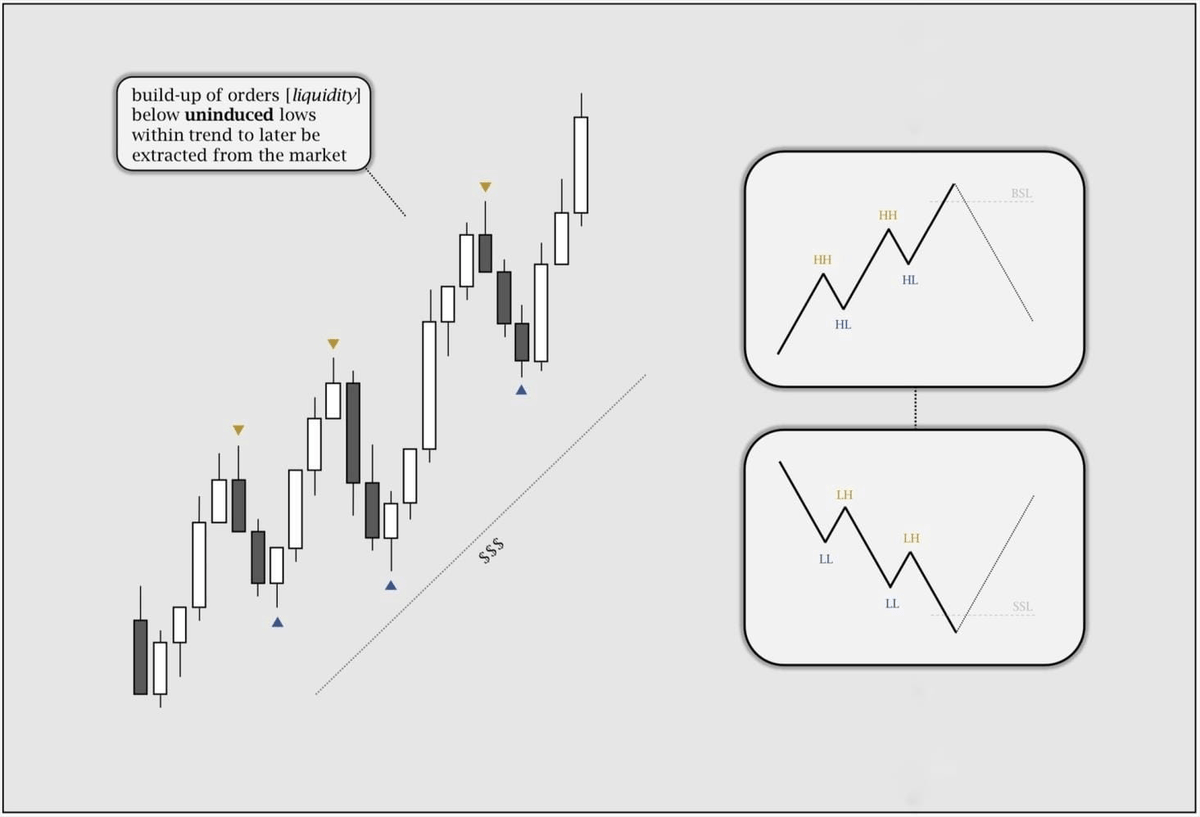

4. Volume Delta

Volume Delta tracks the imbalance between aggressive buyers and sellers.

In this chart, a strong positive delta spike confirmed accumulation before the breakout.

This validates the bullish move and signals real demand behind the price rally.

Volume Delta tracks the imbalance between aggressive buyers and sellers.

In this chart, a strong positive delta spike confirmed accumulation before the breakout.

This validates the bullish move and signals real demand behind the price rally.

4.1 Volume Delta

Bearish volume delta shows big negative delta bars at the peak while volume climbs.

Meaning aggressive sellers outnumbered buyers.

Price failed to hold highs and the Trend indicator rolled over

Bearish volume delta shows big negative delta bars at the peak while volume climbs.

Meaning aggressive sellers outnumbered buyers.

Price failed to hold highs and the Trend indicator rolled over

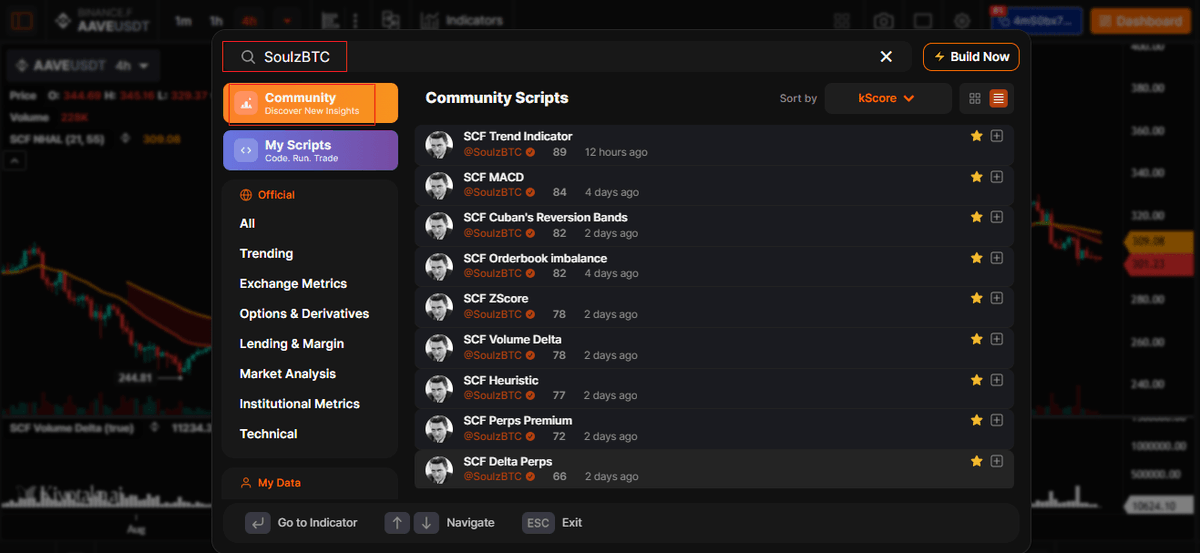

This Thread has been a brief explanation of the indicators I created.

To access them, register here:

I will publish a complete and free PDF today on how to use these indicators. kiyotaka.ai/ref=4mS0bx7xQg

To access them, register here:

I will publish a complete and free PDF today on how to use these indicators. kiyotaka.ai/ref=4mS0bx7xQg

• • •

Missing some Tweet in this thread? You can try to

force a refresh