Consider whether your actions actually let probability do its work 🧵

Probability is slow.

It only begins to work for those who can keep their discipline long before the results are visible, as if it were already in effect.

🧵1/5

Probability is slow.

It only begins to work for those who can keep their discipline long before the results are visible, as if it were already in effect.

🧵1/5

2/5

Consistency is indispensable for probability to play out.

For example, even with a 40% win rate, a strategy with a strong risk‑reward profile can be profitable if you keep repeating it. (This is only an example, so the figure 40% has no special meaning, and I am not recommending a 40% win rate strategy, to be clear.)

Run a simple simulation and generate about 1,000 random trials at a 40% win probability, then look at the results.

You will see five straight losses happen frequently, and ten straight losses occur more often than you expect.

Even then, can you maintain consistency all the way through, as the simulation implies?

This is where trading is hard.

No matter how much edge there is, many traders overthink and fail to stay consistent to the end, and in the name of “improvement” they end up breaking that consistency.

Consistency is indispensable for probability to play out.

For example, even with a 40% win rate, a strategy with a strong risk‑reward profile can be profitable if you keep repeating it. (This is only an example, so the figure 40% has no special meaning, and I am not recommending a 40% win rate strategy, to be clear.)

Run a simple simulation and generate about 1,000 random trials at a 40% win probability, then look at the results.

You will see five straight losses happen frequently, and ten straight losses occur more often than you expect.

Even then, can you maintain consistency all the way through, as the simulation implies?

This is where trading is hard.

No matter how much edge there is, many traders overthink and fail to stay consistent to the end, and in the name of “improvement” they end up breaking that consistency.

3/5

Maintaining consistency is a skill in its own right.

In the end, trading hinges on this capability.

Every strategy will face losing streaks, and what you think, feel, and do during them is decisive.

In the end, no matter what happens, you must not change anything, and you must remain consistent.

If doubt or anxiety creeps in there, you will not stay consistent, and your trading will suffer.

That simply means you have not prepared enough to eliminate doubt.

Maintaining consistency is a skill in its own right.

In the end, trading hinges on this capability.

Every strategy will face losing streaks, and what you think, feel, and do during them is decisive.

In the end, no matter what happens, you must not change anything, and you must remain consistent.

If doubt or anxiety creeps in there, you will not stay consistent, and your trading will suffer.

That simply means you have not prepared enough to eliminate doubt.

4/5

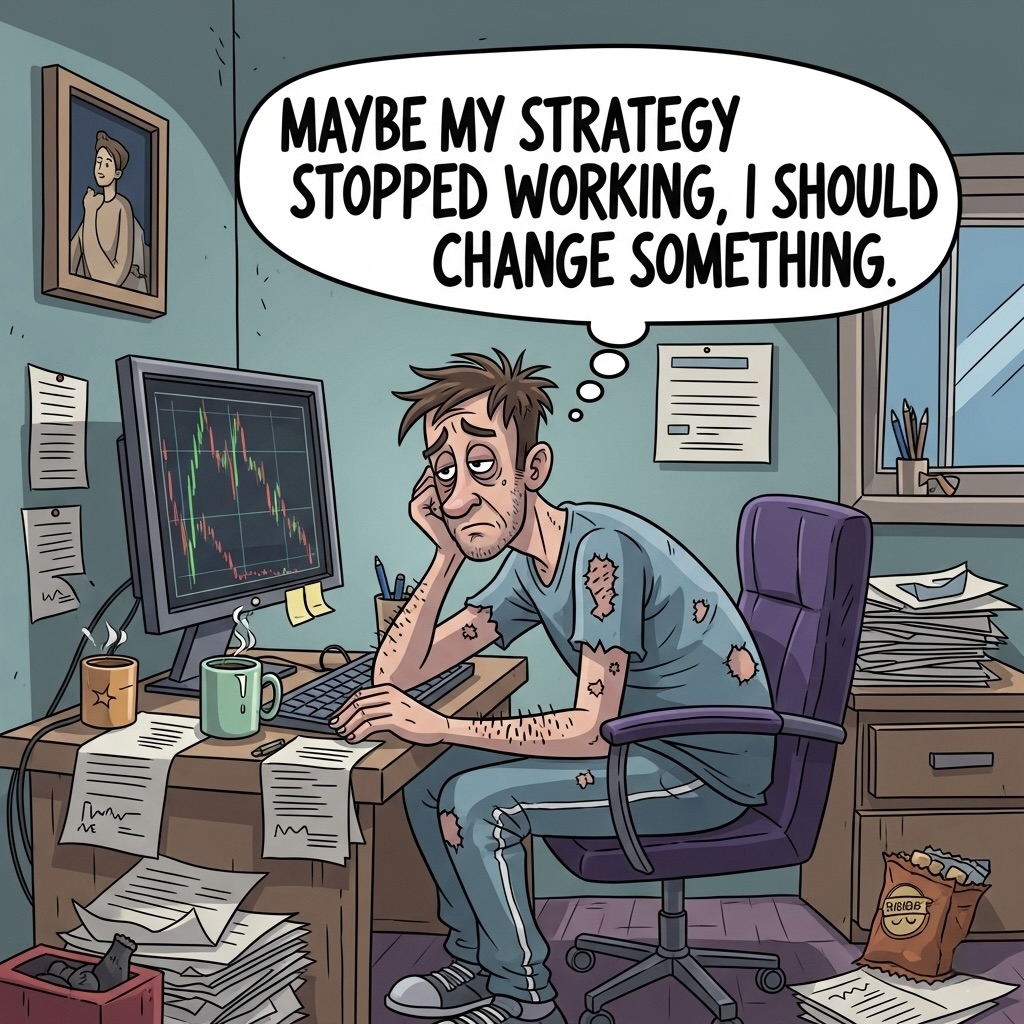

“But isn’t it bad to ignore the possibility that the strategy has stopped working and just keep going when you’re losing?”

That way of thinking is mistaken.

If every losing streak leads you to consider that the strategy may have stopped working and to break consistency, you will never succeed in trading.

Every strategy has losing streaks, no one can know in the moment how long a streak will last, and the time when you could know it with certainty will never come.

In other words, as long as you trade, the future is never guaranteed.

It ultimately comes down to whether you can trust it through to the end.

That trust rests on how large a sample size you tested beforehand, how much you practiced, and how much experience you accumulated, not on blind faith.

You need to think in a long‑term frame so that the losing streak itself becomes part of the statistics.

“But isn’t it bad to ignore the possibility that the strategy has stopped working and just keep going when you’re losing?”

That way of thinking is mistaken.

If every losing streak leads you to consider that the strategy may have stopped working and to break consistency, you will never succeed in trading.

Every strategy has losing streaks, no one can know in the moment how long a streak will last, and the time when you could know it with certainty will never come.

In other words, as long as you trade, the future is never guaranteed.

It ultimately comes down to whether you can trust it through to the end.

That trust rests on how large a sample size you tested beforehand, how much you practiced, and how much experience you accumulated, not on blind faith.

You need to think in a long‑term frame so that the losing streak itself becomes part of the statistics.

5/5

Probability asserts itself more slowly than you think.

Many people cannot keep following the same rules for even a single year.

If you operate only over such short periods with only a small sample size, even an excellent strategy will struggle to reveal its edge.

You will keep searching for a strategy that delivers results you like within a small sample size, and even if it looks as though you have found one, you will soon abandon it again.

Short‑term outcomes are driven by randomness.

Adopt a long‑term perspective.

Prepare accordingly.

Act from that foundation.

Thank you for reading!

If you enjoyed this thread, I’d encourage you to also read my two books, which I wrote to help you develop probabilistic thinking and consistency.

They will fundamentally change the way you trade.

E-book

payhip.com/YumiSakura/col…

Paperback

【THE PATH TO SUCCESS IN TRADING】

a.co/d/fXmRhIa

【Trading Psychology】

a.co/d/d0QJMxK

Hope these insights help your trading journey😊

Probability asserts itself more slowly than you think.

Many people cannot keep following the same rules for even a single year.

If you operate only over such short periods with only a small sample size, even an excellent strategy will struggle to reveal its edge.

You will keep searching for a strategy that delivers results you like within a small sample size, and even if it looks as though you have found one, you will soon abandon it again.

Short‑term outcomes are driven by randomness.

Adopt a long‑term perspective.

Prepare accordingly.

Act from that foundation.

Thank you for reading!

If you enjoyed this thread, I’d encourage you to also read my two books, which I wrote to help you develop probabilistic thinking and consistency.

They will fundamentally change the way you trade.

E-book

payhip.com/YumiSakura/col…

Paperback

【THE PATH TO SUCCESS IN TRADING】

a.co/d/fXmRhIa

【Trading Psychology】

a.co/d/d0QJMxK

Hope these insights help your trading journey😊

• • •

Missing some Tweet in this thread? You can try to

force a refresh