The U.S., China, and Japan all have stock markets at record highs.

At the same time, their economies face weak growth, layoffs, property crises, and stagnant wages.

Markets are soaring while households struggle. What’s driving this split?

(a thread)

At the same time, their economies face weak growth, layoffs, property crises, and stagnant wages.

Markets are soaring while households struggle. What’s driving this split?

(a thread)

Let's start with the U.S.

The Federal Reserve cut rates close to zero and launched massive Quantitative Easing (QE).

QE is when the Fed buys bonds with newly created reserves, pushing yields lower. With bonds unattractive, investors shifted heavily into stocks.

The Federal Reserve cut rates close to zero and launched massive Quantitative Easing (QE).

QE is when the Fed buys bonds with newly created reserves, pushing yields lower. With bonds unattractive, investors shifted heavily into stocks.

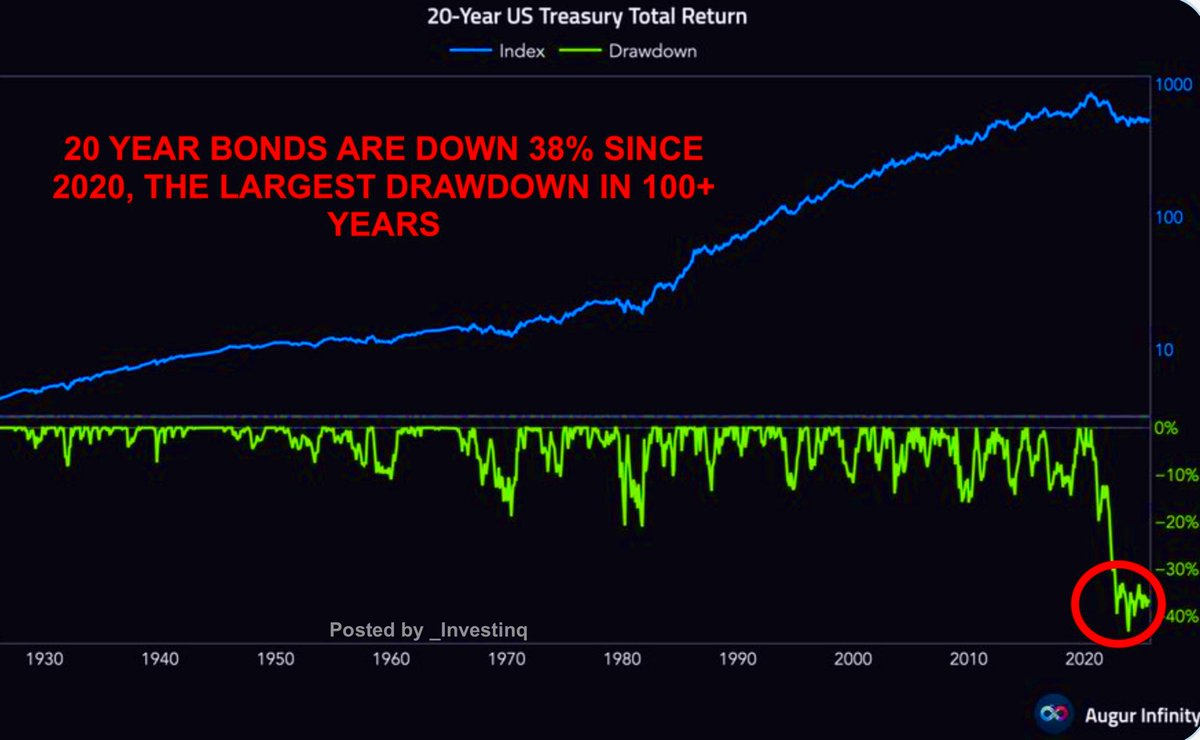

But here’s the paradox. We are living through the largest U.S. Treasury collapse on record.

20-year bonds are down nearly 38% since 2020, the steepest decline in over 100 years.

The bond market screams distress, yet equities are at record highs.

20-year bonds are down nearly 38% since 2020, the steepest decline in over 100 years.

The bond market screams distress, yet equities are at record highs.

This created TINA: “There Is No Alternative.”

Savings accounts paid almost nothing, bonds lost historic value, and equities became the only place to chase returns.

The “Fed put”, the belief that the Fed would never allow a full crash reinforced the rally.

Savings accounts paid almost nothing, bonds lost historic value, and equities became the only place to chase returns.

The “Fed put”, the belief that the Fed would never allow a full crash reinforced the rally.

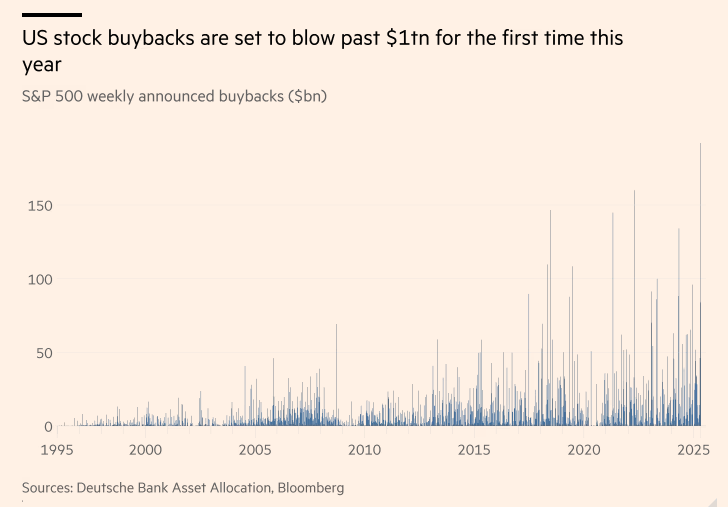

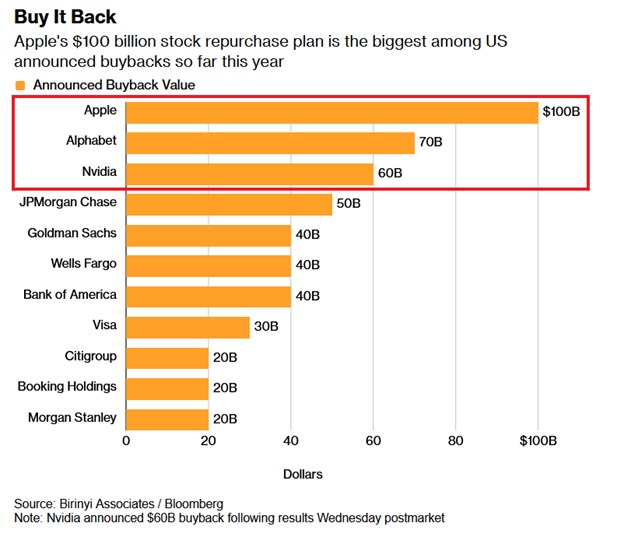

Corporate buybacks then turned a rally into a frenzy.

U.S. companies have announced over $1 trillion in buybacks this year alone, the fastest pace to ever reach that threshold.

In July, announced repurchases totaled $166 billion, a record for that month.

U.S. companies have announced over $1 trillion in buybacks this year alone, the fastest pace to ever reach that threshold.

In July, announced repurchases totaled $166 billion, a record for that month.

Apple and Alphabet alone announced $100 billion and $70 billion.

JPMorgan, Goldman Sachs, Wells Fargo, and Bank of America each pledged $40 billion or more.

Nvidia just added another $60 billion. Corporations cannot get enough of their own stock.

JPMorgan, Goldman Sachs, Wells Fargo, and Bank of America each pledged $40 billion or more.

Nvidia just added another $60 billion. Corporations cannot get enough of their own stock.

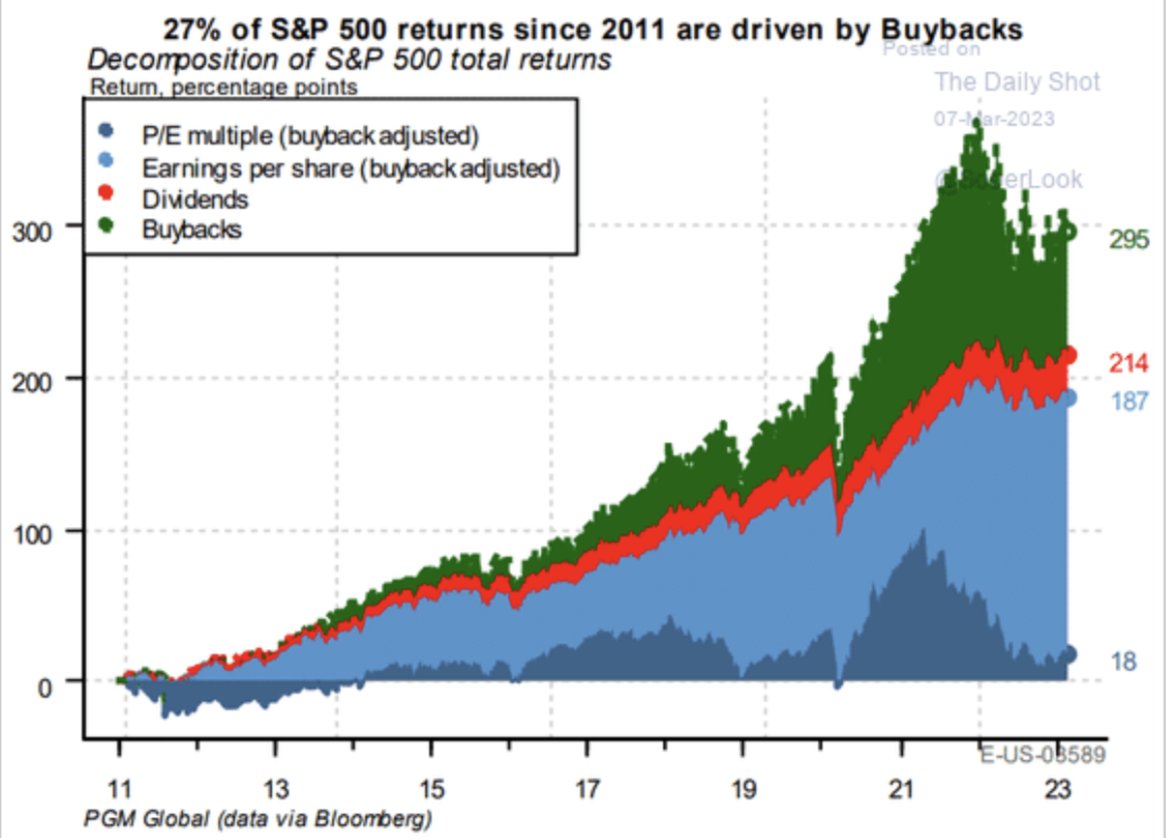

Why does this matter? Buybacks shrink the supply of shares in the market.

That pushes prices higher and boosts earnings-per-share mechanically, even if profits don’t grow.

This effect is so large that since 2011, 27% of all S&P 500 returns have come directly from buybacks.

That pushes prices higher and boosts earnings-per-share mechanically, even if profits don’t grow.

This effect is so large that since 2011, 27% of all S&P 500 returns have come directly from buybacks.

Market concentration amplifies it further. The S&P 500’s rise has been carried almost entirely by 10 companies.

The other 490 stocks have had virtually no earnings growth since 2022.

Indexes look strong. The broader corporate economy does not.

The other 490 stocks have had virtually no earnings growth since 2022.

Indexes look strong. The broader corporate economy does not.

Speculation fills the gap.

Stimulus checks, commission-free apps, and passive flows all funneled money into the largest names.

Algorithms reinforced momentum. Rising prices led to more buying, creating a feedback loop disconnected from economic reality.

Stimulus checks, commission-free apps, and passive flows all funneled money into the largest names.

Algorithms reinforced momentum. Rising prices led to more buying, creating a feedback loop disconnected from economic reality.

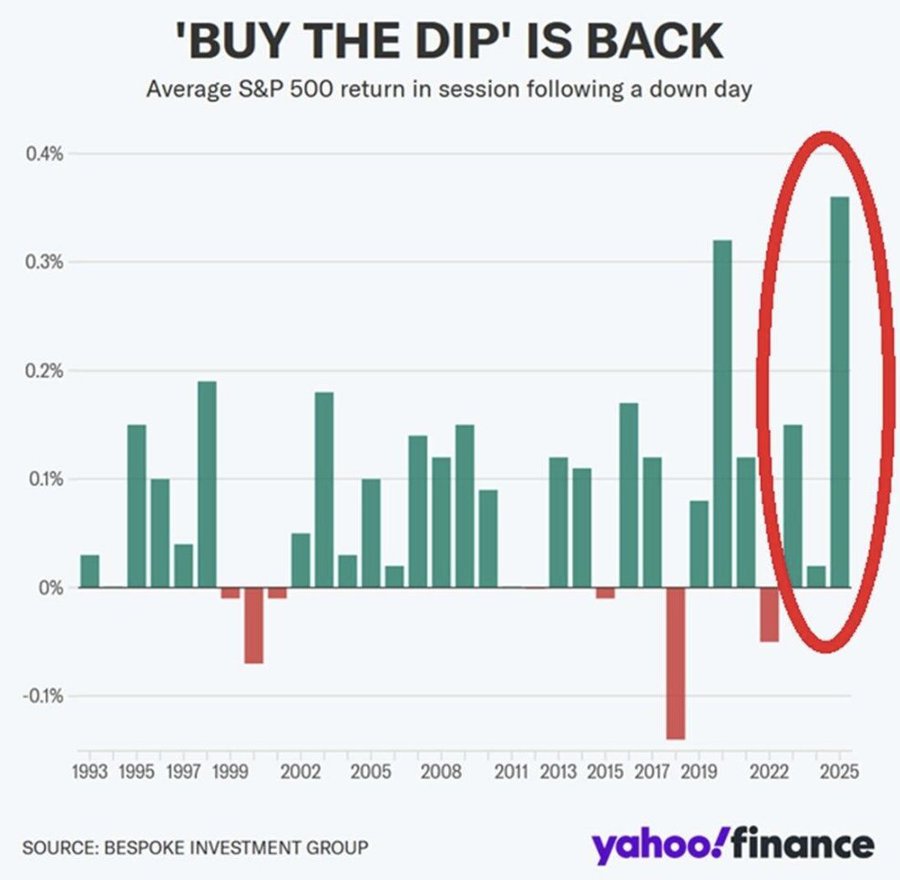

Investor psychology made it stick. “Buy the dip” became gospel.

FOMO (fear of missing out) kept capital chasing mega-caps.

But this optimism was fueled by price action, not wage growth or household security.

FOMO (fear of missing out) kept capital chasing mega-caps.

But this optimism was fueled by price action, not wage growth or household security.

Meanwhile, inequality soared. The top 10% of Americans own 88% of equities.

The next 40% split the remaining 12%. The bottom 50%? They hold debt, not stock.

Market highs increasingly enrich the wealthy few, while the majority feel squeezed.

The next 40% split the remaining 12%. The bottom 50%? They hold debt, not stock.

Market highs increasingly enrich the wealthy few, while the majority feel squeezed.

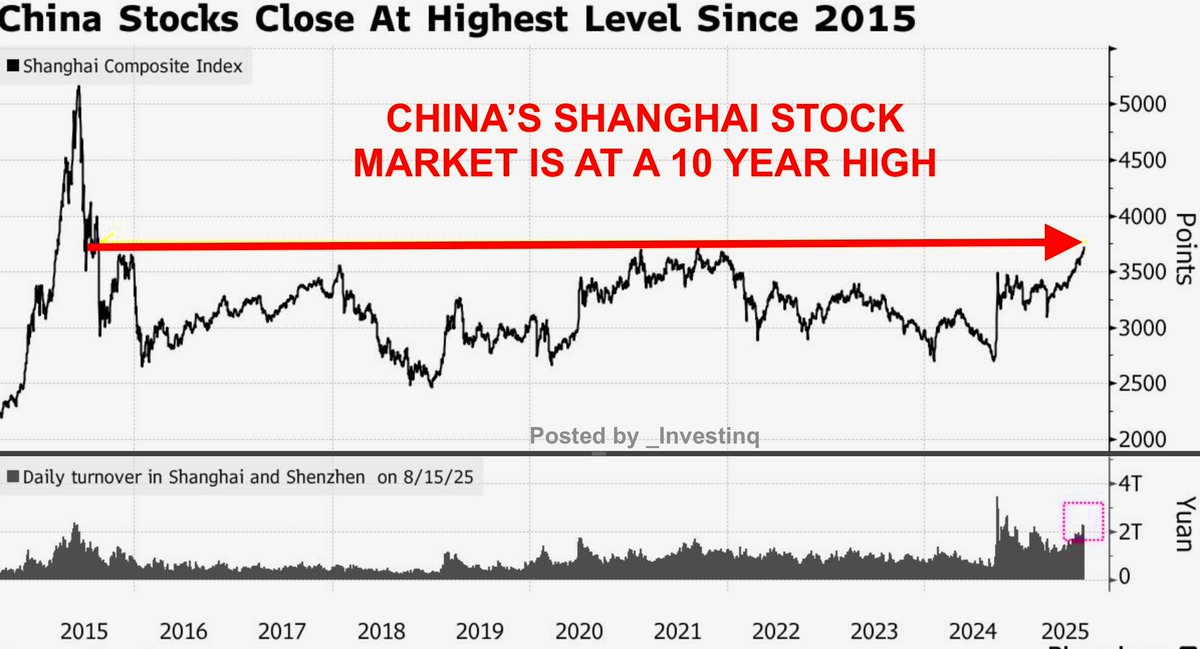

Now look at China.

The economy faces a property crisis, deflation pressure, and youth unemployment so severe the government stopped publishing the figure.

Yet stocks rose, driven by liquidity injections, lower trading taxes, and the “national team” buying shares to stabilize sentiment.

The economy faces a property crisis, deflation pressure, and youth unemployment so severe the government stopped publishing the figure.

Yet stocks rose, driven by liquidity injections, lower trading taxes, and the “national team” buying shares to stabilize sentiment.

Retail speculation plays a huge role. Up to 80% of daily turnover comes from individuals, many leveraging on margin.

Optimism around AI, EVs, and semiconductors fueled rallies.

But as 2015 showed, these frenzies can collapse almost instantly.

Optimism around AI, EVs, and semiconductors fueled rallies.

But as 2015 showed, these frenzies can collapse almost instantly.

Now Japan. The Nikkei hit heights not seen since the 1980s bubble.

The Bank of Japan fueled this by buying ETFs for years, at one point owning more than 70% of the ETF market.

A weak yen boosted exporters, while record buybacks and foreign inflows carried the index higher.

The Bank of Japan fueled this by buying ETFs for years, at one point owning more than 70% of the ETF market.

A weak yen boosted exporters, while record buybacks and foreign inflows carried the index higher.

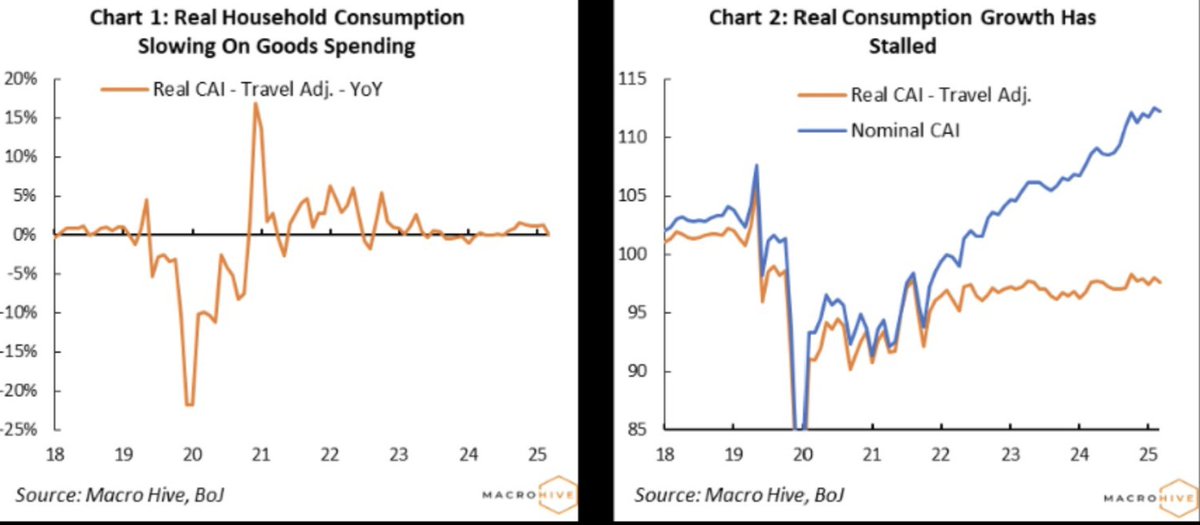

But here too, households saw little.

Domestic demand stayed weak. Real wages barely moved.

The rally was powered by policy support, capital flows, and corporate engineering, not grassroots prosperity.

Domestic demand stayed weak. Real wages barely moved.

The rally was powered by policy support, capital flows, and corporate engineering, not grassroots prosperity.

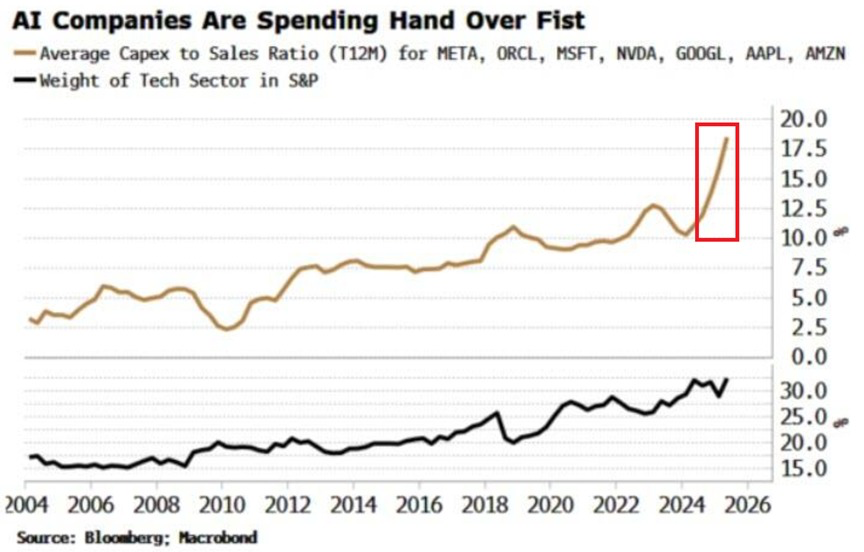

Now, add the AI boom.

CapEx spending by the largest AI players has skyrocketed. Their CapEx-to-sales ratio has doubled in just 18 months to 18%, a record high.

Before 2020, it was just 8%.This is a corporate arms race unlike anything in decades.

CapEx spending by the largest AI players has skyrocketed. Their CapEx-to-sales ratio has doubled in just 18 months to 18%, a record high.

Before 2020, it was just 8%.This is a corporate arms race unlike anything in decades.

Tech giants Amazon, Apple, Google, Meta, Microsoft, Nvidia, and Oracle now make up a record 33% of the entire technology sector’s market cap.

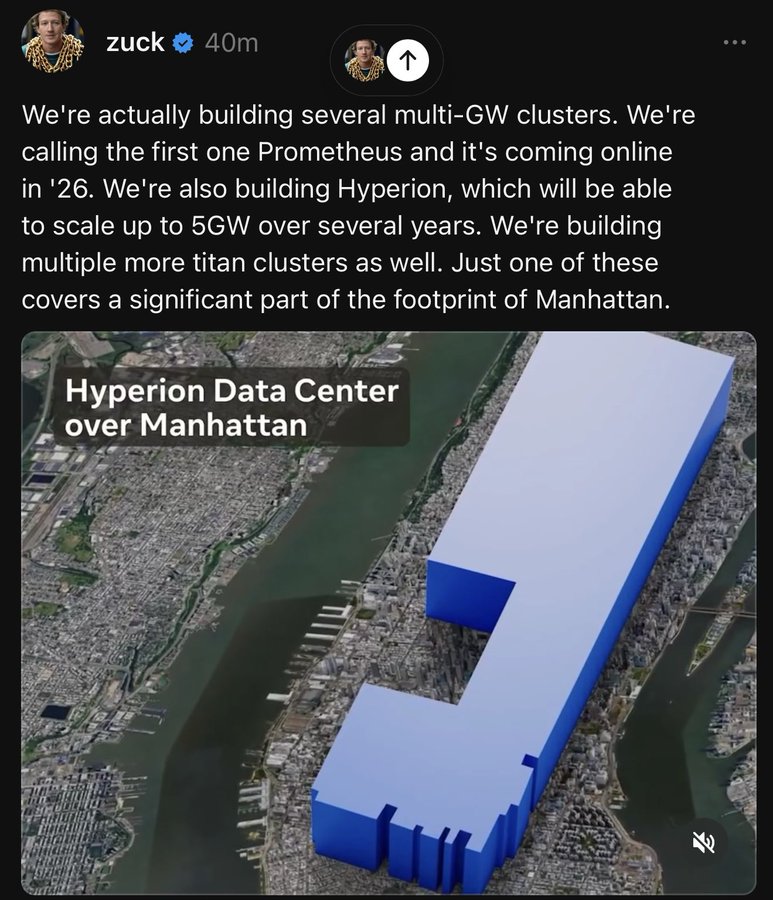

Meta is building a data center the size of Manhattan for AI.

Meta is building a data center the size of Manhattan for AI.

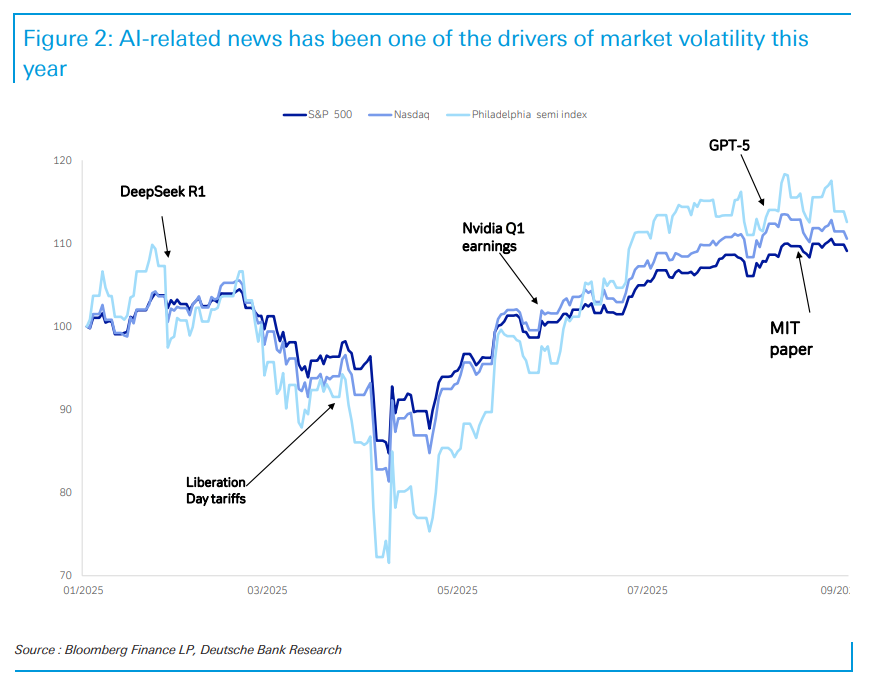

AI optimism is now the narrative carrying global markets higher.

Investors trade the promise of future productivity, not today’s economic data.

Markets are pricing tomorrow’s breakthroughs while households live today’s affordability crisis.

Investors trade the promise of future productivity, not today’s economic data.

Markets are pricing tomorrow’s breakthroughs while households live today’s affordability crisis.

My personal thoughts: I don’t think markets crash tomorrow.

The run-up likely continues for another 1–2 years, driven by liquidity, record buybacks, speculation, and the AI arms race.

But the real economy will keep weakening, and the gap between Wall Street and Main Street will only widen.

The run-up likely continues for another 1–2 years, driven by liquidity, record buybacks, speculation, and the AI arms race.

But the real economy will keep weakening, and the gap between Wall Street and Main Street will only widen.

If you found these insights valuable: Sign up for my FREE newsletter! thestockmarket.news

I hope you've found this thread helpful.

Follow me @_Investinq for more.

Like/Repost the quote below if you can:

Follow me @_Investinq for more.

Like/Repost the quote below if you can:

https://x.com/_investinq/status/1964407558375964985?s=46

@VladTheInflator @StealthQE4

• • •

Missing some Tweet in this thread? You can try to

force a refresh