Wall Street has one rule:

Never start what you can buy.

Here’s everything you need to know about buying a biz in 2025 (full guide):

Never start what you can buy.

Here’s everything you need to know about buying a biz in 2025 (full guide):

While 90% of startups fail, 80% of acquisitions survive the first year.

88% of people worth $30M+ have done at lease one acquisition.

That means the best way to get rich isn’t to start a business like they love to tell us.

The best way to wealth with the highest degree of certainty is through acquisitions.

88% of people worth $30M+ have done at lease one acquisition.

That means the best way to get rich isn’t to start a business like they love to tell us.

The best way to wealth with the highest degree of certainty is through acquisitions.

The average small business owner in the US is 67 years old. When you’ve run a business for 10+ years, you're bound to be exhausted.

These owners are motivated to sell by what I call the 7 D's:

- Departure

• Divorce

• Disease

• Disagreement

• Distress

• Death

• Dullness

They’re desperate to exit the game but don't know how. That’s where YOU come in.

These owners are motivated to sell by what I call the 7 D's:

- Departure

• Divorce

• Disease

• Disagreement

• Distress

• Death

• Dullness

They’re desperate to exit the game but don't know how. That’s where YOU come in.

Most people think they need millions in capital to buy a businesses.

But they don't realize 60% of all business sales involve seller financing.

Instead of going to a bank for a loan, the seller becomes your bank.

You put some money down, and they get paid over time from the business profits.

There are 3 reasons why a seller would agree to this:

But they don't realize 60% of all business sales involve seller financing.

Instead of going to a bank for a loan, the seller becomes your bank.

You put some money down, and they get paid over time from the business profits.

There are 3 reasons why a seller would agree to this:

First, more cash.

Let’s say the bank offered the seller $750,000 for their biz but you offered the seller $1.15 million paid over time.

They’ll make an extra $400,000 by being the bank instead of taking the bank's lower cash offer.

Let’s say the bank offered the seller $750,000 for their biz but you offered the seller $1.15 million paid over time.

They’ll make an extra $400,000 by being the bank instead of taking the bank's lower cash offer.

Second reason is less taxes.

Lump sum payments hit the seller with massive tax bills.

Installment payments spread over 10 years means lower tax brackets and potentially hundreds of thousands saved.

The seller gets more money and pays less to Uncle Sam.

Lump sum payments hit the seller with massive tax bills.

Installment payments spread over 10 years means lower tax brackets and potentially hundreds of thousands saved.

The seller gets more money and pays less to Uncle Sam.

Third reason is speed.

Bank loans take 3-9 months to close. Seller financing can close in 2-3 weeks.

Time kills all deals.

The longer a deal drags on, the more likely something goes wrong.

Sellers know this and value certainty over a few extra dollars.

Bank loans take 3-9 months to close. Seller financing can close in 2-3 weeks.

Time kills all deals.

The longer a deal drags on, the more likely something goes wrong.

Sellers know this and value certainty over a few extra dollars.

What sellers really care about isn't always the highest price.

55% want to retire, 21% are burned out, 13% have failing health.

They want to know you'll actually close, take care of their employees, and preserve what they built.

Trust matters more than money.

55% want to retire, 21% are burned out, 13% have failing health.

They want to know you'll actually close, take care of their employees, and preserve what they built.

Trust matters more than money.

This means you want exhausted sellers, not energetic ones.

Good sellers are old, tired, running simple businesses, and want more than banks will loan.

Bad sellers are young, hungry, running sexy businesses and have multiple offers.

Good sellers are old, tired, running simple businesses, and want more than banks will loan.

Bad sellers are young, hungry, running sexy businesses and have multiple offers.

I have a 15-point checklist to evaluate sellers. I look at:

• Business duration

• Owner age

• Competition level

• Whether it's brick-and-mortar

• If they have a successor

• Profit margins

• Financial cleanliness

The higher the score, the more likely they'll seller finance.

• Business duration

• Owner age

• Competition level

• Whether it's brick-and-mortar

• If they have a successor

• Profit margins

• Financial cleanliness

The higher the score, the more likely they'll seller finance.

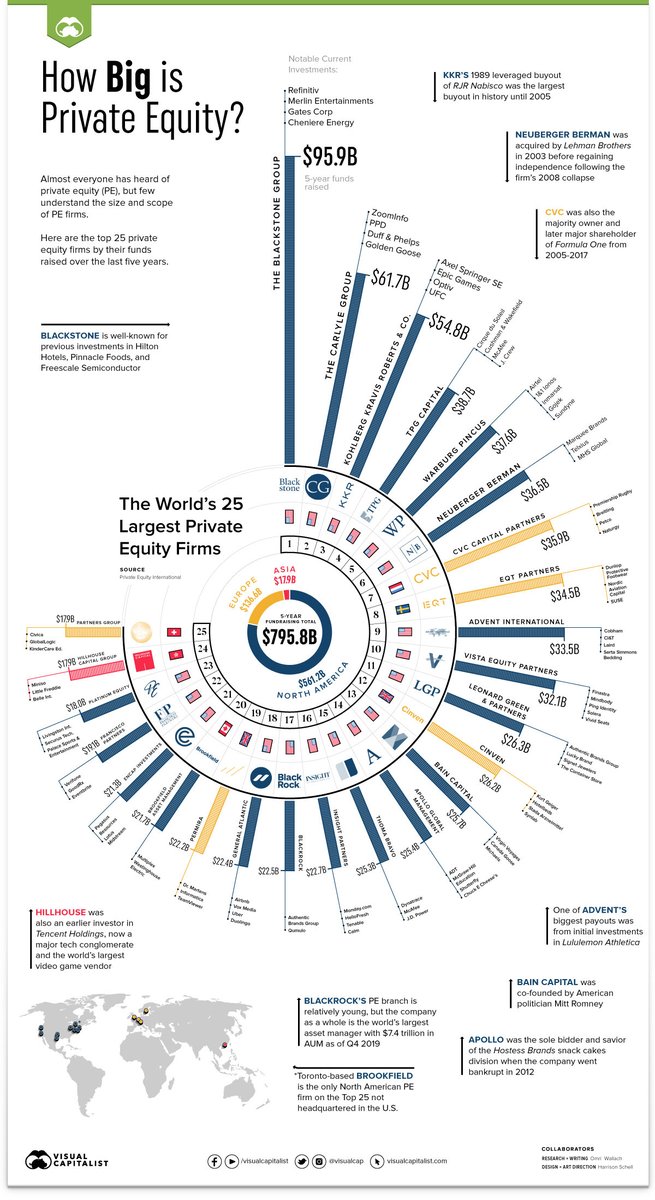

It’s best to target businesses under $10 million in revenue with at least 15% profit margins.

Blue-collar service businesses fit this bill - HVAC, landscaping, cleaning services.

They're cash-flowing, recession-resistant, and boring enough that private equity ignores them.

Blue-collar service businesses fit this bill - HVAC, landscaping, cleaning services.

They're cash-flowing, recession-resistant, and boring enough that private equity ignores them.

Before searching anywhere, create what I call a deal box. Define exactly:

• How much cash flow you need annually

• Maximum purchase price

• Geographic preferences

• Industry focus

• Must-haves and can't-stands

If you don’t know what you’re looking for, you’ll never find it.

• How much cash flow you need annually

• Maximum purchase price

• Geographic preferences

• Industry focus

• Must-haves and can't-stands

If you don’t know what you’re looking for, you’ll never find it.

You can find businesses two ways: on-market and off-market.

On-market deals are already listed publicly.

They're faster but have more competition and limited negotiating power.

Off-market deals aren't advertised. They take longer but offer better terms and less competition.

On-market deals are already listed publicly.

They're faster but have more competition and limited negotiating power.

Off-market deals aren't advertised. They take longer but offer better terms and less competition.

For on-market deals, use platforms like BizScout to filter by your criteria.

The average listing gets 100+ inquiries, so you need to stand out by:

• Verifying your identity

• Showing your financial capability upfront

• Being professional and brief

• Indicating you move quickly

The average listing gets 100+ inquiries, so you need to stand out by:

• Verifying your identity

• Showing your financial capability upfront

• Being professional and brief

• Indicating you move quickly

But the real money is off-market.

There are 11 million businesses listed for sale publicly, but I estimate 20-40 million businesses would sell at the right price and terms.

When I ask rooms of business owners who would sell, 99% of hands stay up.

There are a few ways you can access this private market:

There are 11 million businesses listed for sale publicly, but I estimate 20-40 million businesses would sell at the right price and terms.

When I ask rooms of business owners who would sell, 99% of hands stay up.

There are a few ways you can access this private market:

1. Venmo Challenge

Pull your payment history and filter out friends and big companies.

What's left are small businesses you already pay - cleaning services, handymen, landscapers.

You have direct access to these owners and know their service quality.

It's how I found out my handyman does $1M/yr.

Pull your payment history and filter out friends and big companies.

What's left are small businesses you already pay - cleaning services, handymen, landscapers.

You have direct access to these owners and know their service quality.

It's how I found out my handyman does $1M/yr.

2. Personal P&L Review.

Open your credit card statements and remove Amazon and big retailers.

Look at small businesses you spend with. These are owners you can reach out to.

I bought into a podcast production company, property management business, and consulting firm this way for <$10k each.

Open your credit card statements and remove Amazon and big retailers.

Look at small businesses you spend with. These are owners you can reach out to.

I bought into a podcast production company, property management business, and consulting firm this way for <$10k each.

3. The 9-5 Strategy:

You don't want to overlook your workplace.

• Is your boss over 60?

• Have they run the place for 10+ years?

• Do they have a succession plan?

One of our community members bought her coworker's $1.5M business with full seller financing after he decided to retire to go skiing with his wife.

You don't want to overlook your workplace.

• Is your boss over 60?

• Have they run the place for 10+ years?

• Do they have a succession plan?

One of our community members bought her coworker's $1.5M business with full seller financing after he decided to retire to go skiing with his wife.

You also can build your rolodex of potential businesses to buy by going to places where business owners hang out.

Chamber of Commerce, industry association meetings, your accountant's office.

A simple "I buy local service businesses. What do you do? How long? Ever think about selling?" will get you further than you think.

Chamber of Commerce, industry association meetings, your accountant's office.

A simple "I buy local service businesses. What do you do? How long? Ever think about selling?" will get you further than you think.

Digital prospecting works too. You can:

• Update your LinkedIn to say "I buy [specific type] businesses in [location]"

• Join Facebook groups for your target industries

• Use Reddit to find specialized forums

• Advertise in industry publications for 22 cents instead of $5 Facebook ads.

• Update your LinkedIn to say "I buy [specific type] businesses in [location]"

• Join Facebook groups for your target industries

• Use Reddit to find specialized forums

• Advertise in industry publications for 22 cents instead of $5 Facebook ads.

Technology can even eliminate networking entirely.

Use lead scraping tools to generate contact lists for specific industries.

For example, when I searched for laundromats to buy in Austin…

I found 55 prospects with owner names, their phone numbers, estimated revenue, and email addresses in minutes.

Use lead scraping tools to generate contact lists for specific industries.

For example, when I searched for laundromats to buy in Austin…

I found 55 prospects with owner names, their phone numbers, estimated revenue, and email addresses in minutes.

The question isn't whether profitable businesses for sale exist...they're everywhere.

Every room you enter has someone ready to sell.

The question is whether you'll do what's necessary instead of what's comfortable.

Every room you enter has someone ready to sell.

The question is whether you'll do what's necessary instead of what's comfortable.

And if you're still reading this, you definitely have what it takes to be an owner.

As a thank you for sticking around to the end, I put together a guide with the 5 best businesses to buy in 2025 & the common mistakes to avoid.

Here you go:) info.contrarianthinking.co/smart-buyers-g…

As a thank you for sticking around to the end, I put together a guide with the 5 best businesses to buy in 2025 & the common mistakes to avoid.

Here you go:) info.contrarianthinking.co/smart-buyers-g…

• • •

Missing some Tweet in this thread? You can try to

force a refresh