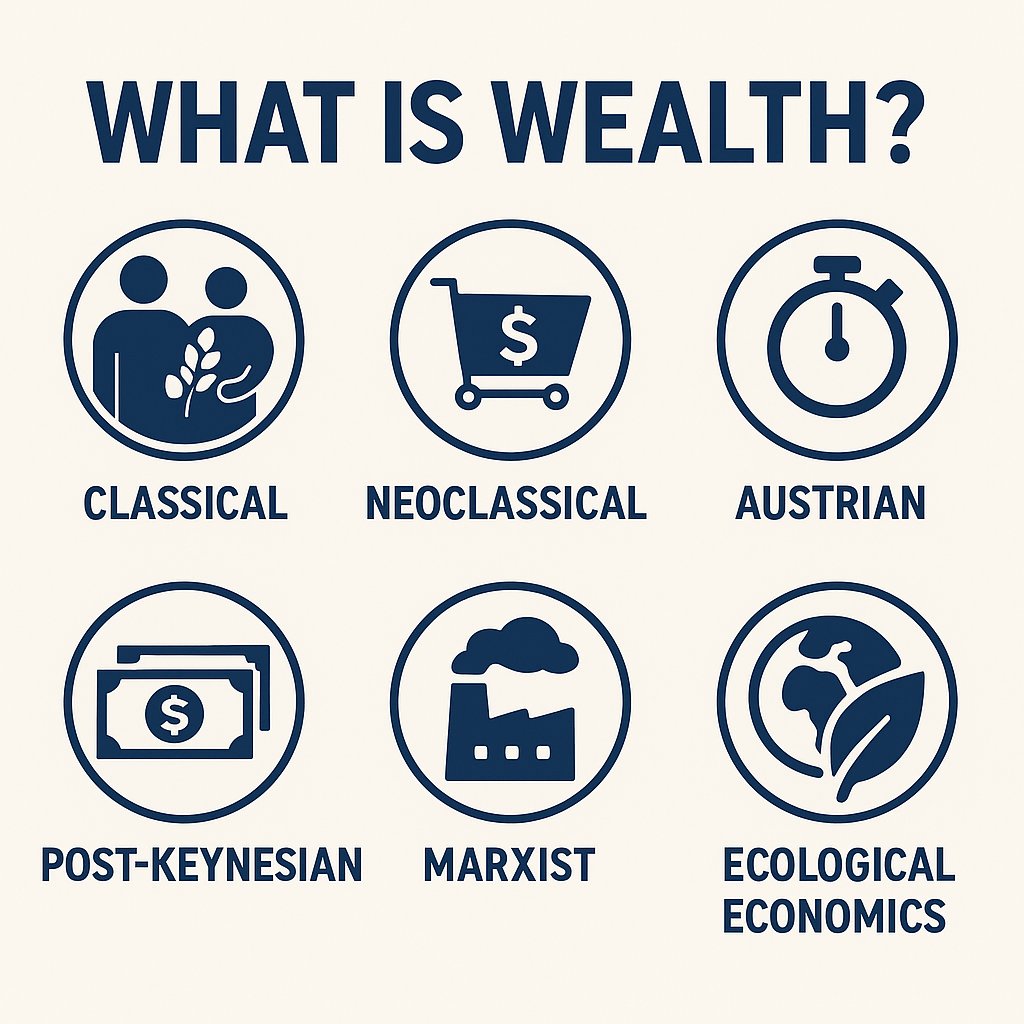

Classical economics (Smith, Ricardo):

Wealth = produced surplus.

It comes from labor applied to nature, creating output beyond subsistence.

The central issue is distribution: who gets profits, wages, and rents?

🧵2/13

Wealth = produced surplus.

It comes from labor applied to nature, creating output beyond subsistence.

The central issue is distribution: who gets profits, wages, and rents?

🧵2/13

Neoclassical economics:

Wealth = utility embodied in goods & services.

Focus shifts from production to exchange.

Here, wealth is whatever satisfies preferences, measured in prices.

🧵3/13

Wealth = utility embodied in goods & services.

Focus shifts from production to exchange.

Here, wealth is whatever satisfies preferences, measured in prices.

🧵3/13

Marginal Productivity Theory:

Each factor earns what it "contributes."

Labor → wages, capital → returns, land → rent.

It presents wealth distribution as fair, but ignores power, institutions, and inequality.

🧵4/13

Each factor earns what it "contributes."

Labor → wages, capital → returns, land → rent.

It presents wealth distribution as fair, but ignores power, institutions, and inequality.

🧵4/13

Austrian economics (Menger, Böhm-Bawerk, Hayek):

Wealth = subjective value.

Rooted in time preference, capital structure, and individual choice.

Markets reveal value through prices, but abstract away from power and institutions.

🧵5/13

Wealth = subjective value.

Rooted in time preference, capital structure, and individual choice.

Markets reveal value through prices, but abstract away from power and institutions.

🧵5/13

Keynesian economics:

Wealth isn't stockpiles, it depends on effective demand.

Idle resources aren’t wealth.

Wealth exists when demand activates production and employment.

🧵6/13

Wealth isn't stockpiles, it depends on effective demand.

Idle resources aren’t wealth.

Wealth exists when demand activates production and employment.

🧵6/13

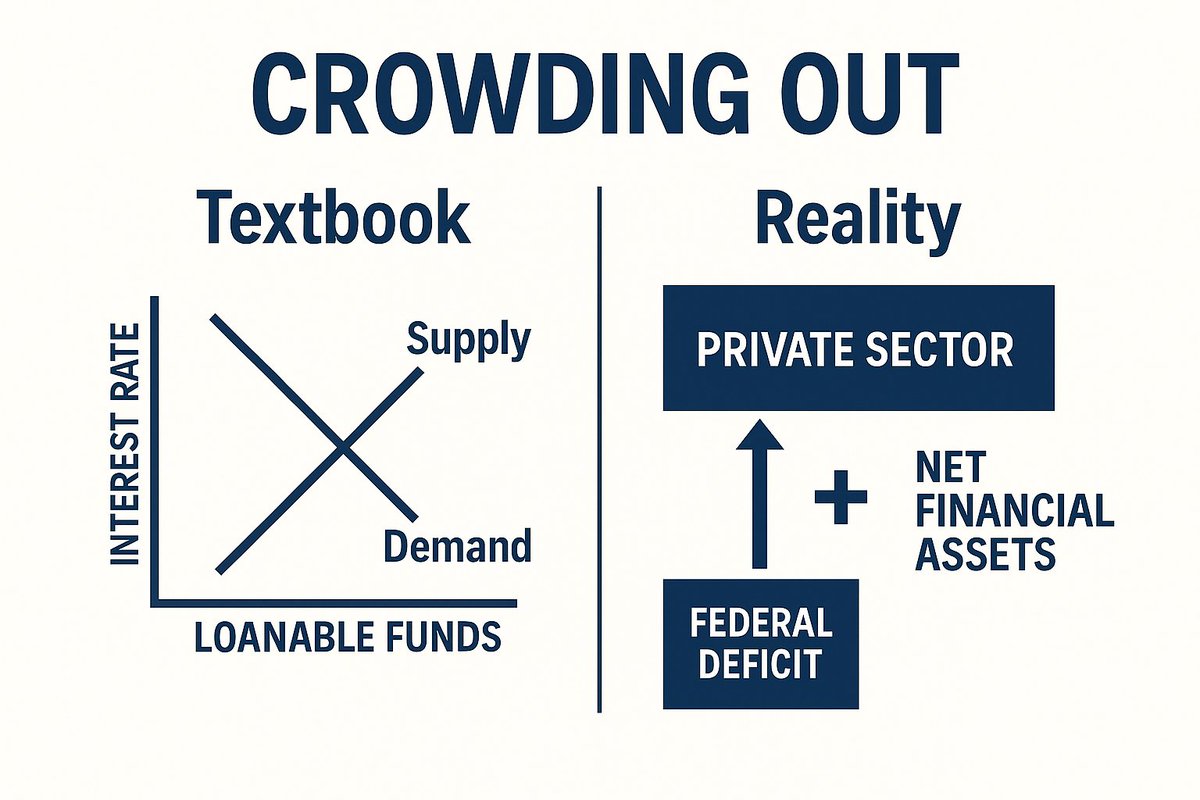

Post-Keynesian economics:

Wealth = financial claims shaped by money and credit.

Banks create assets and liabilities.

Net wealth arises when government deficits add safe financial assets to the private sector.

🧵7/13

Wealth = financial claims shaped by money and credit.

Banks create assets and liabilities.

Net wealth arises when government deficits add safe financial assets to the private sector.

🧵7/13

Marxist economics:

Wealth = surplus value extracted from labor.

Financial wealth often represents "fictitious capital" resting on real exploitation.

Wealth is inseparable from class power and control over production.

🧵8/13

Wealth = surplus value extracted from labor.

Financial wealth often represents "fictitious capital" resting on real exploitation.

Wealth is inseparable from class power and control over production.

🧵8/13

Monetary & financial perspective:

Wealth = claims on others.

Stocks, bonds, real estate are distributional, one person's asset is another’s liability.

True at both household and global balance-sheet levels.

🧵9/13

Wealth = claims on others.

Stocks, bonds, real estate are distributional, one person's asset is another’s liability.

True at both household and global balance-sheet levels.

🧵9/13

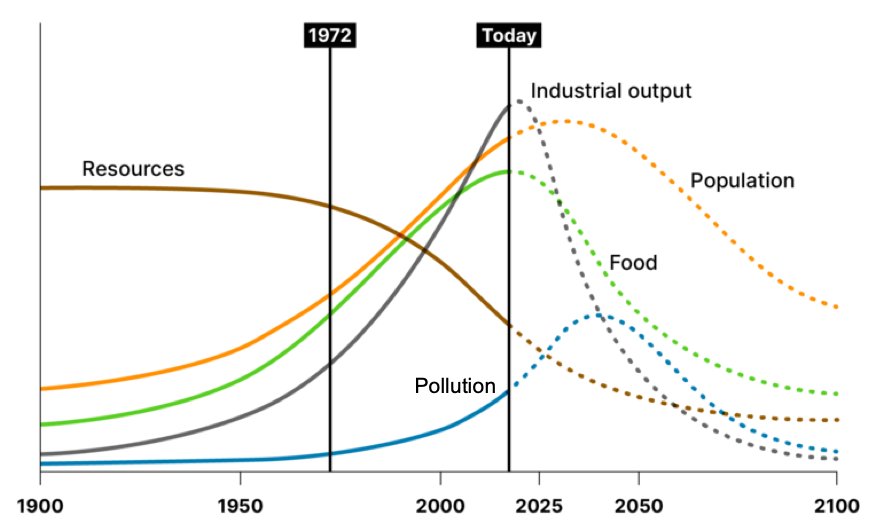

Ecological economics:

Wealth = natural + human systems capacity.

GDP can rise while soils, water, and climate collapse.

Real wealth = sustainability of the system that supports life.

🧵10/13

Wealth = natural + human systems capacity.

GDP can rise while soils, water, and climate collapse.

Real wealth = sustainability of the system that supports life.

🧵10/13

National accounts vs households:

For households, wealth = net worth.

For the nation, gov deficits = private surpluses.

But ecological wealth may shrink even as financial wealth rises.

🧵11/13

For households, wealth = net worth.

For the nation, gov deficits = private surpluses.

But ecological wealth may shrink even as financial wealth rises.

🧵11/13

So when you hear "wealth creation," ask:

–Are we talking utility?

–Surplus production?

–Financial claims?

–Ecological capacity?

The answer depends on the school — and each serves its own politics.

🧵12/13

–Are we talking utility?

–Surplus production?

–Financial claims?

–Ecological capacity?

The answer depends on the school — and each serves its own politics.

🧵12/13

Wealth isn't just numbers in accounts.

It's resources, power, and sustainability.

Textbook definitions hide this. Critical schools make it visible.

🧵13/13

patreon.com/c/relearningec…

It's resources, power, and sustainability.

Textbook definitions hide this. Critical schools make it visible.

🧵13/13

patreon.com/c/relearningec…

• • •

Missing some Tweet in this thread? You can try to

force a refresh