There's a ticking timebomb in UK offshore wind: massive decommissioning costs that aren't properly funded. Like in "The Big Short," a forensic look reveals developers might be ignoring guidelines, potentially leaving taxpayers on the hook. A thread 🧵 (1/18)

The scale is huge. In 2018, BEIS estimated £1.28-3.64bn for 37 wind farms, costs spiking from 2028. Now, with 16GW installed, my analysis shows ~£4.7bn over 10-15 years—at £293m/GW. More farms mean more costs. (2/18)

I made an FOI request to Government for the latest decommissioning cost estimates, but they won't release as "too commercially sensitive", but most windfarms show provisions in their accounts (3/18)

Regulations: BEIS (now DESNZ) guidelines say use upfront cash, ring-fenced funds, bank guarantees - not parent guarantees or insurance. Yet, no evidence of cash reserves. Companies just book provisions, relying on parents to pay later (4/18)

Provisions are discounted present values, e.g., £300m cash in 5 yrs at 5% = £235m booked. No actual cash set aside. If subsidies end and farms become uneconomic, so who pays? Orsted's rights issue shows parent finances shaky. (5/18)

Case study: Orsted's Barrow Wind Farm. 2024 accounts: £41.4m liability, cash cost £44.7m (4.25% discount). Excluding subsidies, negative EBITDA. No liabilities at UK parent level. Danish parent has DKK9.35bn (£1.1bn) provision for global fleet - but no ring-fenced cash. (6/18)

Case Study 2: Scottish Power's East Anglia One (60% owned). Discounted value £82.3m, cash ~£189m (4.24% discount rate ). Life to 2043-44, but CfD subsidies end 2034. Strike £171/MWh vs market £75/MWh—post-subsidy profits plummet. (7/18)

EA1 also 40% owned by Bilbao Offshore Holding - no mention of decomm liability. TRIG (14.3% holder) has £34.8m decomm bonds for whole portfolio, but declares as negligible fair value. No provisions reducing assets & no ring-fenced cash. (8/18)

Case Study 3: RWE's London Array (30% owned). £38.6m provision, cash cost ~£67.4m for their share (4.75% discount). Decomm after 23 year life in 2036 post-ROC end. Only £4.1m cash. Parent RWE AG: €1.36bn for portfolio—no ring-fenced cash (9/18)

Greencoat (UKW) (25% London Array) assumes 30-yr life vs RWE's 23, Govt's 20. Declare £36.8m provision with only, £4m cash. UKW parent: £280m guarantees, fair value zero - no asset reduction & no ring-fenced cash. (10/18)

Impact of decomm liabilities could be significant and come earlier. Germany's Alpha Ventus was shut down after 15 years when subsidies ran out. UK Assumptions too optimistic (11/18)

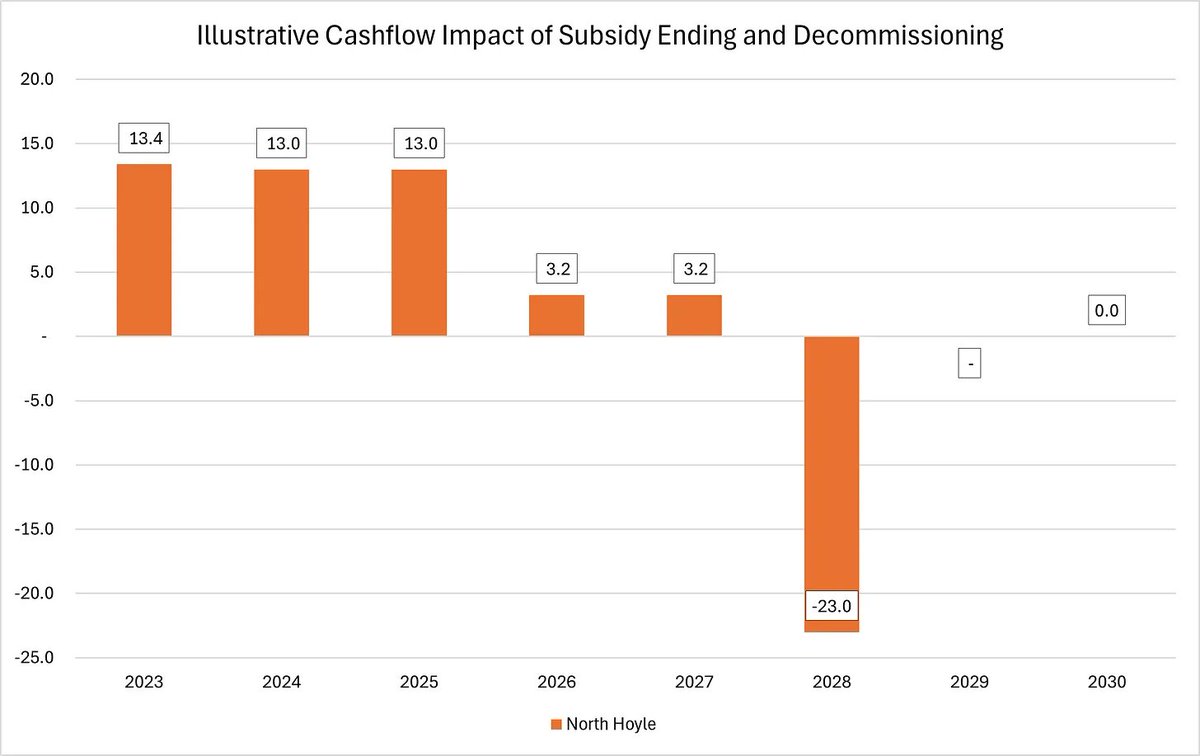

For example, Greencoat's North Hoyle generated £13m of operating cashflow in 2024 & paid £12.1m divi to parent. But earned £9.8m in subsidies. Generation declining, so when subsidies end, only marginal profitability, bringing forward decomm liability, impacting cashflow (12/18)

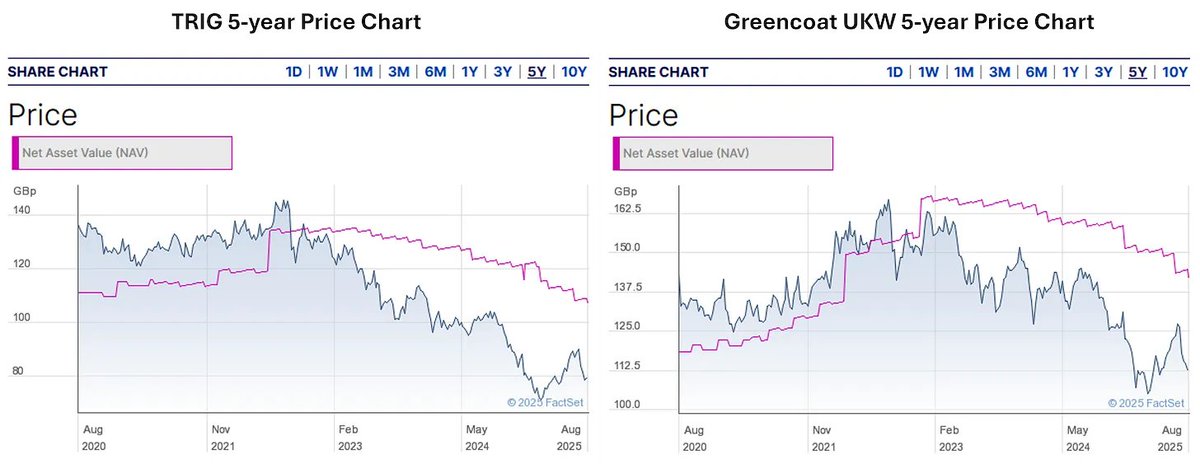

Market losing faith: TRIG & Greencoat UKW shares down from 2022 peaks, trading at discount to NAV discount. (13/18)

These investment funds declare assets as Level 3 - which means management creates its own asset value. TRIG paid £183.5m in divis & bought back £20.9m shares. UKW: £249.8m/£80.4m in 2024, no decomm cash, despite risk subsidies for older farms will end soon (14/18).

Like Big Short, Wind farms = Subsidy-Backed Securities; Funds = CDO's with embedded risks. Market waking to decomm threats. If early shutdowns, cashflows and asset values crash - can't fund decomm, potentially leaving taxpayers on the hook. (15/18)

Conclusions: Decomm not discussed enough. No ring-fenced cash; relying on frowned-upon parent guarantees. Orsted's woes show pure-play risks high. (16/18)

Funds like TRIG/UKW risky: Loose with asset lives, no proper funding, yet distributing £100s millions to shareholders. This is the timebomb—disaster ahead. Govt must tighten rules, force ring-fenced cash now.(17/18)

If you enjoyed this thread, please like and share. You can sign up for free to read the full article on the link below (18/18)

open.substack.com/pub/davidturve…

open.substack.com/pub/davidturve…

Hi @threadreaderapp unroll please.

• • •

Missing some Tweet in this thread? You can try to

force a refresh