Believer in freedom and democracy. Opposes authoritarianism. Investor in real assets. Man Utd fan. F1 fan. Author of Eigen Values substack.

2 subscribers

How to get URL link on X (Twitter) App

AR7a awarded contracts for 4.9GW of new solar at a clearing price of £68/MWh (in 2025 prices), 1.3GW of onshore wind at £75/MWh and a further 21MW of tidal stream capacity. (2/n)

AR7a awarded contracts for 4.9GW of new solar at a clearing price of £68/MWh (in 2025 prices), 1.3GW of onshore wind at £75/MWh and a further 21MW of tidal stream capacity. (2/n)

Scroby Sands is a relatively small 60MW offshore windfarm. In 2023 one of the 30 turbines caught fire and owner RWE has decided to decommission that single turbine (2/n)

Scroby Sands is a relatively small 60MW offshore windfarm. In 2023 one of the 30 turbines caught fire and owner RWE has decided to decommission that single turbine (2/n)

Many green blobbers have got very huffy about my report for the IEA looking into the various estimates of the cost of Net Zero (2/n)

Many green blobbers have got very huffy about my report for the IEA looking into the various estimates of the cost of Net Zero (2/n)

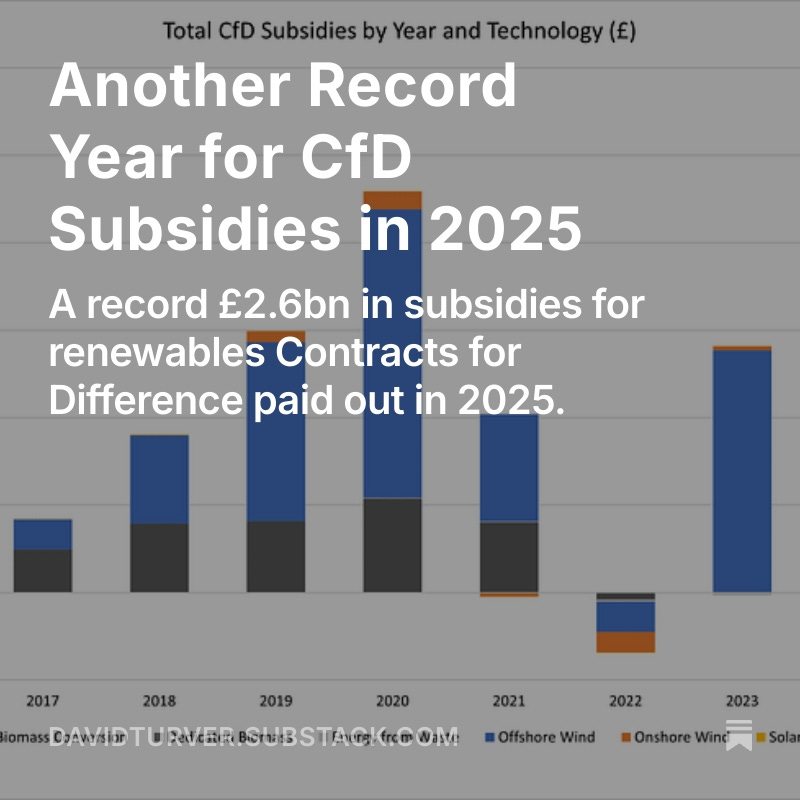

2025 was a record year, with £2.6bn paid out, up from £2.4bn in 2024. Offshore wind took the lion's share of over £2bn, with tree-burning taking £428m, dedicated biomass £118m. Onshore wind took 67m and solar £0.1m. (2/n)

2025 was a record year, with £2.6bn paid out, up from £2.4bn in 2024. Offshore wind took the lion's share of over £2bn, with tree-burning taking £428m, dedicated biomass £118m. Onshore wind took 67m and solar £0.1m. (2/n)

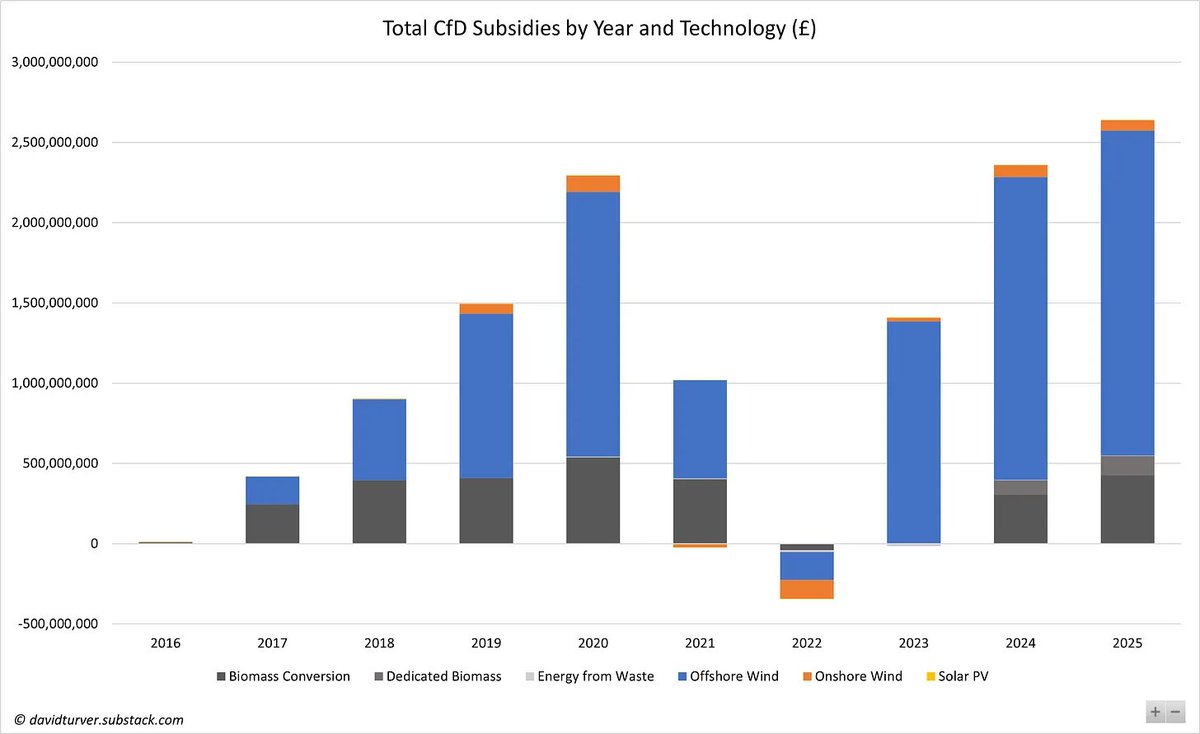

So, what happened? A total of 8.4GW of offshore wind was awarded contracts. Of this 8.2GW was fixed-bottom at an average of £91/MWh in 2024 prices, with 0.2GW of floating at £216/MWh. But these prices show the price of offshore wind is rising (2/n)

So, what happened? A total of 8.4GW of offshore wind was awarded contracts. Of this 8.2GW was fixed-bottom at an average of £91/MWh in 2024 prices, with 0.2GW of floating at £216/MWh. But these prices show the price of offshore wind is rising (2/n)

The central claim of their clip was that solar is a “very cheap and affordable way to generate electricity”. But in the UK at least, that claim is manifestly untrue. Solar is in fact very expensive (2/n)

The central claim of their clip was that solar is a “very cheap and affordable way to generate electricity”. But in the UK at least, that claim is manifestly untrue. Solar is in fact very expensive (2/n)https://x.com/RestIsPolitics/status/2002035470943854731?s=20

As it's Christmas, the season of goodwill, we should begin with the Prince Charming, Snow White and Cinderella of energy policy, namely Richard Tice, Kemi Badenoch and Claire Coutinho who together have collapsed the cosy consensus supporting Net Zero (2/n)

As it's Christmas, the season of goodwill, we should begin with the Prince Charming, Snow White and Cinderella of energy policy, namely Richard Tice, Kemi Badenoch and Claire Coutinho who together have collapsed the cosy consensus supporting Net Zero (2/n)

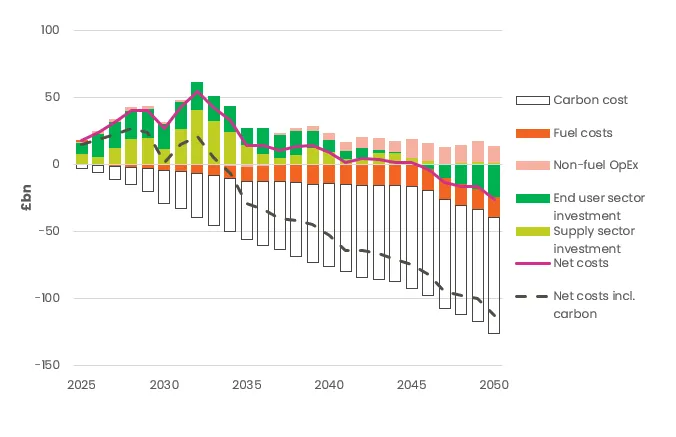

The press reported that NESO's Holistic Transition to Net Zero would cost £350bn more than Falling Behind. The used this chart as evidence (2/n)

The press reported that NESO's Holistic Transition to Net Zero would cost £350bn more than Falling Behind. The used this chart as evidence (2/n)

The Climate Change Act contains important safeguards that allow for emissions reduction targets and carbon budgets to be altered if The Science™ changes (2/n)

The Climate Change Act contains important safeguards that allow for emissions reduction targets and carbon budgets to be altered if The Science™ changes (2/n)

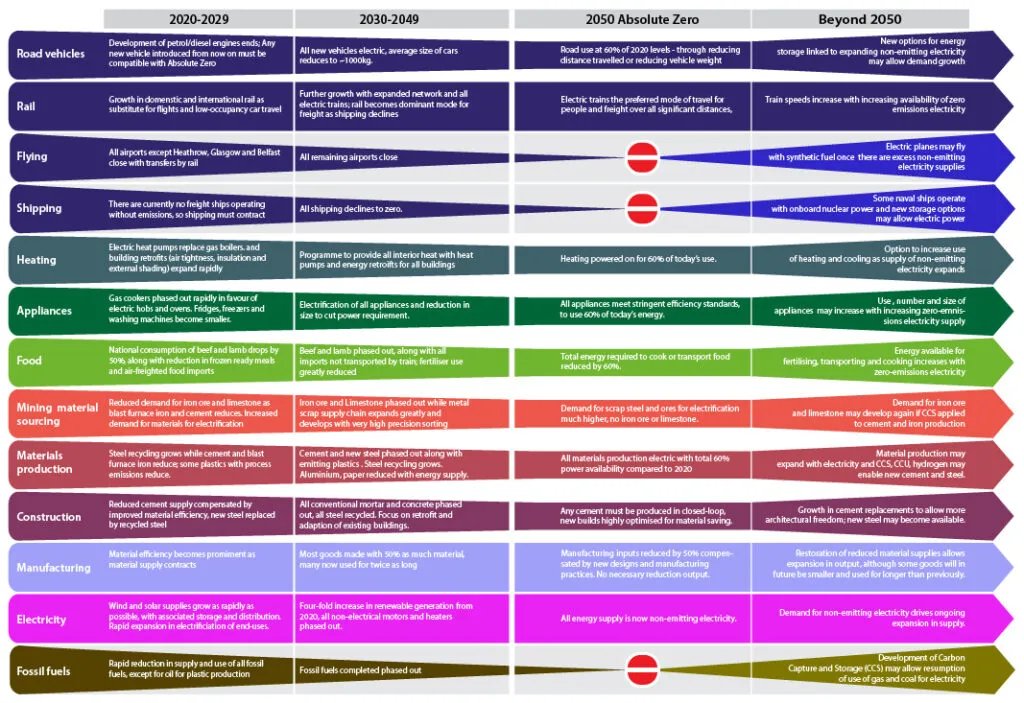

Bovaer is a product of the Net Zero cult that has seen UK FIRES call for beef and lamb to eliminated by 2050. Of course they want to reduce methane emissions as well as CO2 (2/n)

Bovaer is a product of the Net Zero cult that has seen UK FIRES call for beef and lamb to eliminated by 2050. Of course they want to reduce methane emissions as well as CO2 (2/n)

Consumer energy debt is rising. The amount outstanding for people under formal repayment arrangements rose to a record £1.1bn in 2Q25. Arrears past due for >91 days rose to £3.32bn, giving total debt of £4.43bn (2/n)

Consumer energy debt is rising. The amount outstanding for people under formal repayment arrangements rose to a record £1.1bn in 2Q25. Arrears past due for >91 days rose to £3.32bn, giving total debt of £4.43bn (2/n)

First up, cutting carbon taxes on gas-fired electricity and ending Renewables Obligation subsidies early will cut revenues for these generators and asset values will collapse (2/n)

First up, cutting carbon taxes on gas-fired electricity and ending Renewables Obligation subsidies early will cut revenues for these generators and asset values will collapse (2/n)

First up he has set the budget for offshore wind at £1,080m, split £900m for fixed-bottom and £180m for floating offshore wind. In essence this means the Government expects this auction to add £1.08bn to our bills, which compares to the £2.4bn total CfD cost in 2024/25 (2/n)

First up he has set the budget for offshore wind at £1,080m, split £900m for fixed-bottom and £180m for floating offshore wind. In essence this means the Government expects this auction to add £1.08bn to our bills, which compares to the £2.4bn total CfD cost in 2024/25 (2/n)

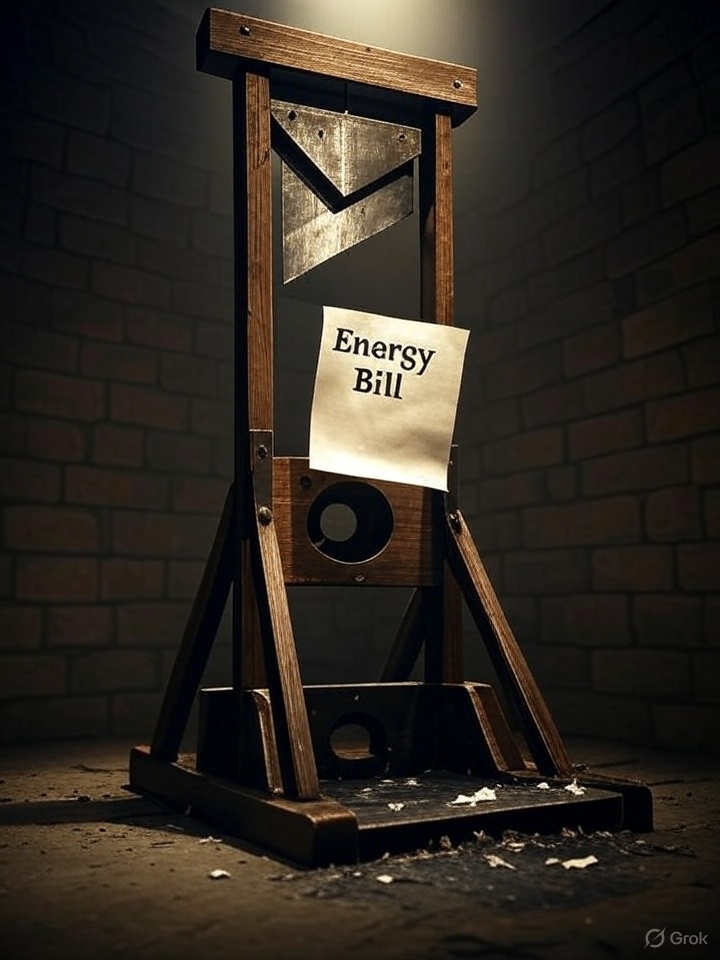

First, there is widespread concern and stress about energy bills across all income groups, even those households earning >£100,000/yr (2/n)

First, there is widespread concern and stress about energy bills across all income groups, even those households earning >£100,000/yr (2/n)

First off, we have the highest industrial electricity prices in the developed world and the second highest domestic prices. Prices like this represent an existential threat to the economy (2/n)

First off, we have the highest industrial electricity prices in the developed world and the second highest domestic prices. Prices like this represent an existential threat to the economy (2/n)

The UKW share price has been on a downward trend since peaking in September 2022 despite paying large dividends and buying back shares (2/n)

The UKW share price has been on a downward trend since peaking in September 2022 despite paying large dividends and buying back shares (2/n)

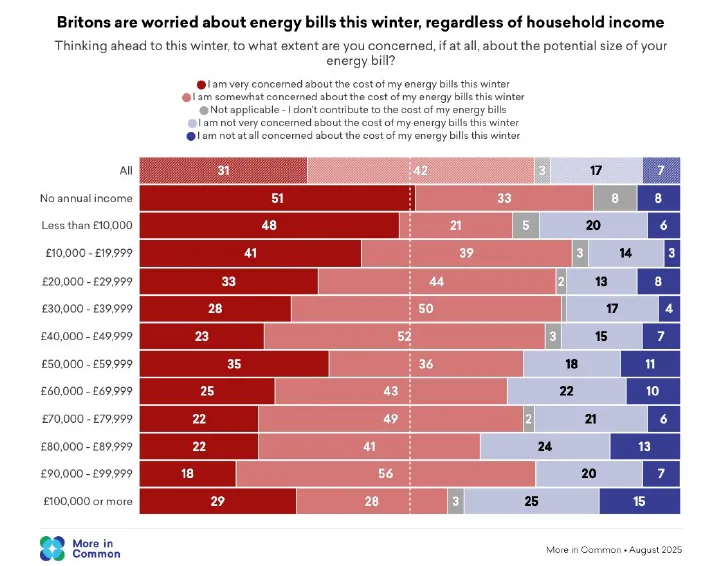

Not too long ago, the Climate Change and Net Zero agenda was seemingly impregnable. Party leaders agreed to put the agenda outside democratic control (2/n)

Not too long ago, the Climate Change and Net Zero agenda was seemingly impregnable. Party leaders agreed to put the agenda outside democratic control (2/n)

Industrial electricity prices are indeed the highest in the IEA, 63% higher than the median and 3.5X more than Canada (2/n)

Industrial electricity prices are indeed the highest in the IEA, 63% higher than the median and 3.5X more than Canada (2/n)