This legendary investor worth $2,200,000,000 just broke the internet.

Howard Marks dropped 79 years of his best investing wisdom in 45 minutes, and it honestly blew me away.

Here are 10 invaluable insights from one of the greatest investors in history: 🧵

Howard Marks dropped 79 years of his best investing wisdom in 45 minutes, and it honestly blew me away.

Here are 10 invaluable insights from one of the greatest investors in history: 🧵

#10: Risk lives in human behavior, not spreadsheets

Markets don't crash because of fundamentals.

They crash because of people’s behavior.

"The riskiest thing is believing there's no risk."

When euphoria peaks → danger lurks.

When panic spreads → opportunity emerges.

Markets don't crash because of fundamentals.

They crash because of people’s behavior.

"The riskiest thing is believing there's no risk."

When euphoria peaks → danger lurks.

When panic spreads → opportunity emerges.

#9: The "average" return is a dangerous myth

The S&P 500 averages 10% annually over decades.

But here’s the reality check: It's rarely between 8-12%.

Markets either soar 20%+ or crash 15%+.

The average masks the volatility, and is not often the norm.

The S&P 500 averages 10% annually over decades.

But here’s the reality check: It's rarely between 8-12%.

Markets either soar 20%+ or crash 15%+.

The average masks the volatility, and is not often the norm.

#8: Your entry price determines everything

When the S&P trades at 23-24 PE (like today)...

The next 10 years typically deliver -2% to +2% annually.

The price paid = the returns received.

No exceptions.

When the S&P trades at 23-24 PE (like today)...

The next 10 years typically deliver -2% to +2% annually.

The price paid = the returns received.

No exceptions.

#7: Think of risk as a speedometer, not an on/off switch

Every investor has a baseline risk level:

0 = zero risk

100 = maximum leverage

Know your number, and adjust it as cycles shift.

Most people are stuck at one setting, but those who can adapt become the true winners.

Every investor has a baseline risk level:

0 = zero risk

100 = maximum leverage

Know your number, and adjust it as cycles shift.

Most people are stuck at one setting, but those who can adapt become the true winners.

#6: "When it's time to buy, you won't want to"

When the markets bottom out:

- News feels apocalyptic

- Losses are everywhere

- Fear dominates headlines

That's precisely why prices are cheapest.

But your brain will say, "don't buy."

Fight that instinct.

When the markets bottom out:

- News feels apocalyptic

- Losses are everywhere

- Fear dominates headlines

That's precisely why prices are cheapest.

But your brain will say, "don't buy."

Fight that instinct.

#5: How to think logically during a true crisis

After Lehman Brothers collapsed, Oaktree had billions ready to invest.

Here’s the logic Mark used:

"If the world ends, money won't matter. If it doesn't end and we don't invest, we failed."

History rewards the action takers.

After Lehman Brothers collapsed, Oaktree had billions ready to invest.

Here’s the logic Mark used:

"If the world ends, money won't matter. If it doesn't end and we don't invest, we failed."

History rewards the action takers.

#4: Consistency beats heroics every time

General Mills' pension fund:

- Never ranked above 27th percentile

- Never fell below 47th percentile

14 years of boring, steady performance

But their final ranking? 4th overall

Compound B+ results, swing for A+ wins & avoid big losses.

General Mills' pension fund:

- Never ranked above 27th percentile

- Never fell below 47th percentile

14 years of boring, steady performance

But their final ranking? 4th overall

Compound B+ results, swing for A+ wins & avoid big losses.

#3: Always good, sometimes great, never terrible

Oaktree's 40-year mantra:

"Always good. Sometimes great. Never terrible."

Sounds boring?

This methodology compounded into elite performance.

Avoiding disasters matters more than hitting home runs.

Oaktree's 40-year mantra:

"Always good. Sometimes great. Never terrible."

Sounds boring?

This methodology compounded into elite performance.

Avoiding disasters matters more than hitting home runs.

#2: History rhymes and repeats itself

In 1999, Marks read about the 1720 South Sea Bubble, where people quit their jobs to day-trade in alehouses.

He looked around & saw identical mania.

The tech crash followed shortly after.

Human nature never changes—just the packaging

In 1999, Marks read about the 1720 South Sea Bubble, where people quit their jobs to day-trade in alehouses.

He looked around & saw identical mania.

The tech crash followed shortly after.

Human nature never changes—just the packaging

#1: The 3 questions that separate winners from losers

Before any investment decision, ask yourself:

1. Do I think I know the future? (Danger)

2. Am I assuming today's trends continue? (Mistake)

3. Are emotions driving this decision? (Expensive)

Say yes to any = setup for pain.

Before any investment decision, ask yourself:

1. Do I think I know the future? (Danger)

2. Am I assuming today's trends continue? (Mistake)

3. Are emotions driving this decision? (Expensive)

Say yes to any = setup for pain.

Here’s Howard’s 79 years of investing wisdom distilled into one paragraph:

1. Know where you are in your investing journey

2. Treat risk like a dial, not a switch

3. Zig when the crowd zags

Simple principles.

Difficult execution.

Extraordinary results.

1. Know where you are in your investing journey

2. Treat risk like a dial, not a switch

3. Zig when the crowd zags

Simple principles.

Difficult execution.

Extraordinary results.

Thanks for reading!

If you enjoyed this thread, you'll love my newsletter...

Every Friday, I share my best investing tips:

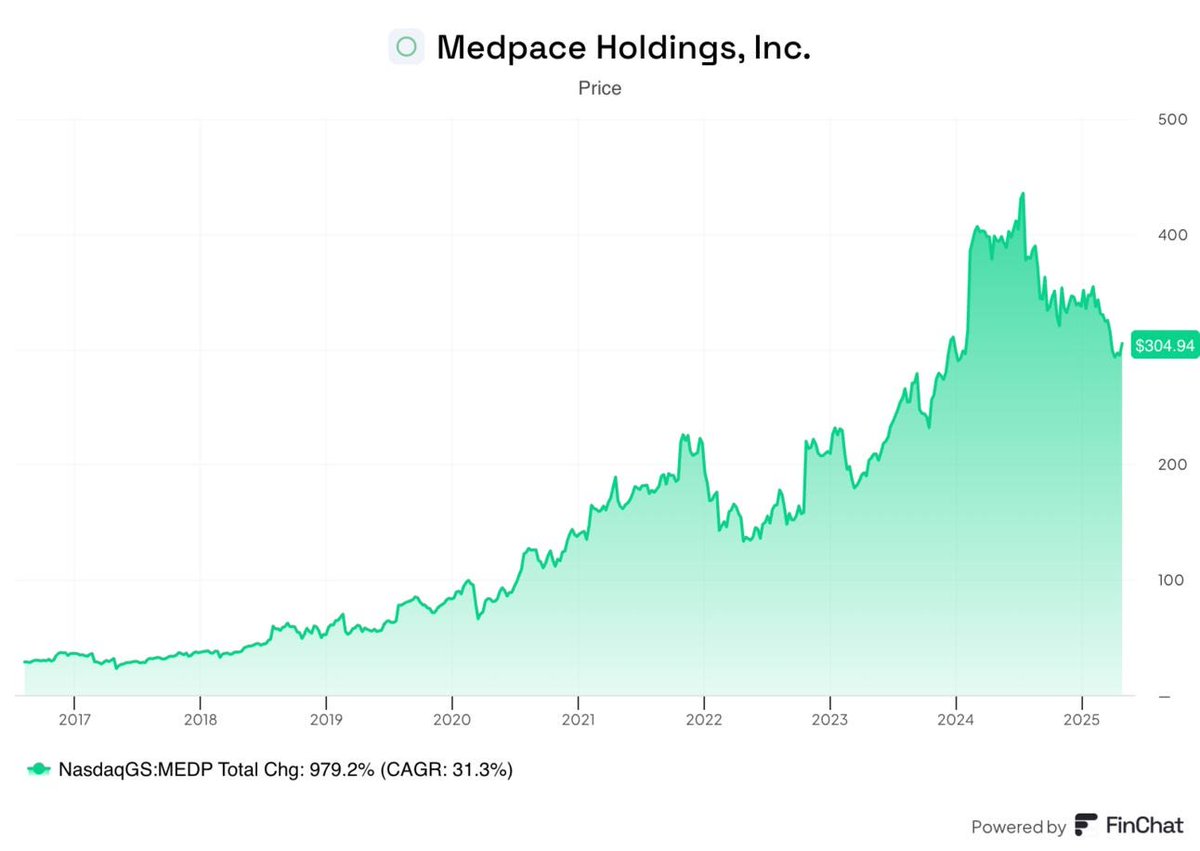

- Super investor secrets

- Multi-baggers breakdowns

- Investing frameworks

I share it all in my newsletter.

Join here for free:

100baggerhunting.com

If you enjoyed this thread, you'll love my newsletter...

Every Friday, I share my best investing tips:

- Super investor secrets

- Multi-baggers breakdowns

- Investing frameworks

I share it all in my newsletter.

Join here for free:

100baggerhunting.com

• • •

Missing some Tweet in this thread? You can try to

force a refresh