1/9: We believe $SUPX is a textbook China Hustle: Their stock has been ripping after announcing “new” servers, we found that these were logo-swapped products, we also found multiple undisclosed related-party deals, and a CEO with a history of regulatory trouble. Full report on our website.

Shoutout to @JCap_Research for getting to this before us.

Shoutout to @JCap_Research for getting to this before us.

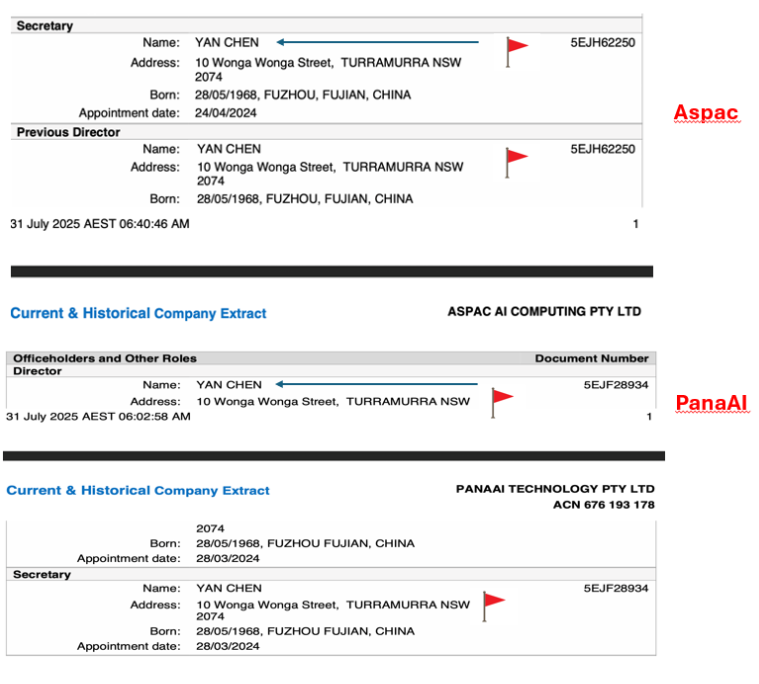

2/9: Our research found that SUPX engaged in multiple undisclosed related-party transactions. On August 27, 2024, SUPX claimed that its Australian subsidiary, ASPAC AI, was going to partner with PanaAI to build a $200 million data center. Not mentioned was that Yan Chen was both PanaAI director & ASPAC secretary, and that PanaAI, ASPAC, and Yan Chen all listed the same luxury home as their address.

3/9: We believe $SUPX’s $3m payment to PanaAI’s parent entity in September 2024 was an attempt by insiders to funnel money out of the company. The deal was announced as a “service fee” for a purported $100m “AI superfactory.” However, we have found no evidence of this project advancing.

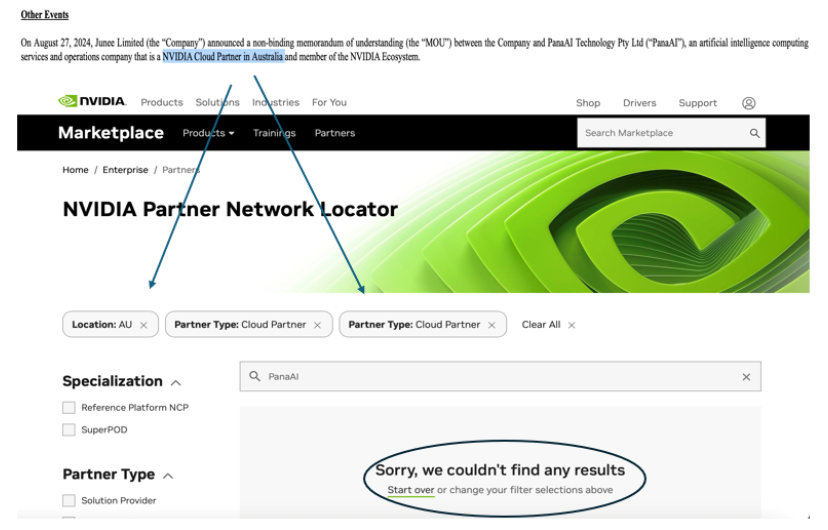

4/9: $SUPX had also claimed that PanaAI had NVIDIA partner status; the NVIDIA partner search also came up empty for “PanaAI”.

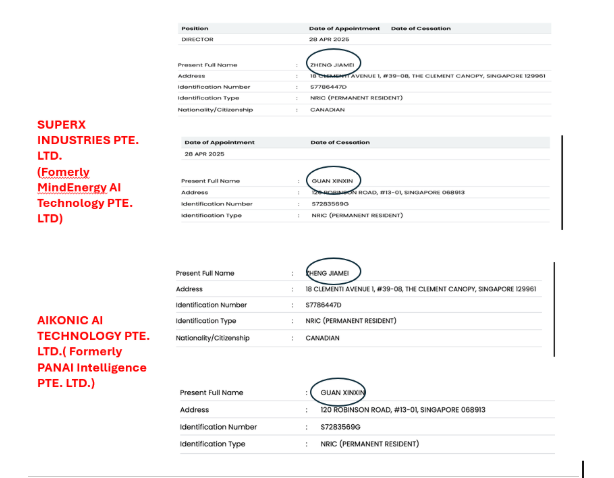

5/9: We believe $SUPX’s acquisition of Mindenergy AI (Now SUPERX Industries) in 2025 was another undisclosed related party transaction. Singaporean entity filings revealed that Mindenergy shared directors, Zheng Jiamei and Guan Xinxin, with PanaAI, the same “partner” that had already received $3m for the “AI superfactory”. We believe this deal was just another way for insiders to funnel money out of the company.

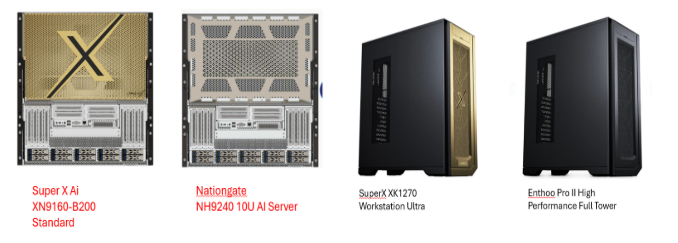

6/9: We believe $SUPX is passing off third-party hardware as its own. The company’s “servers” appear identical to products from actual NVIDIA OEM partner Nationgate, with descriptions copied nearly word-for-word. On Aug 7, 2025, $SUPX even announced a “Workstation” that looks to be just a rebranded Phanteks Enthoo tower.

7/9: The $SUPX AI pivot was led by CEO Ho Wai “Howard” Tang. Tang previously ran Ample Capital, which was fined $5.5m by Hong Kong financial regulators in 2016-2017 for failing to conduct adequate due diligence, and Tang was suspended for 17 months. These facts were conveniently omitted from his $SUPX biography, Howard has since been fired and has not been replaced. We also found that $SUPX CFO Hing Wah “Raymond” Tong overlapped with Tang at Ample, where he served as “VP of Transaction Risk Management”.

8/9: $SUPX appears to be jumping from one shady auditor to another. SUPX has had three auditors in the last 3 years. The most recent auditor (KD & Co - HK-based, hired this year) only registered with the PCAOB in 2024. SUPX’s prior auditor (CT International - hired 2024, fired 2025) had registered with the PCAOB in 2023. CT International operates out of a strip mall in San Francisco, where it is sandwiched between a massage parlor and a hair salon. Enough Said.

9/9: We believe $SUPX is a classic China Hustle: misleading press releases, multiple undisclosed related party transactions, a chairman/CEO who was sanctioned by regulators, and a weak auditor. We don't see any reason why $SUPX should be listed on the Nasdaq, and believe it likely won't be in the near future.

@NateHindenburg

@StockJabber

@BreakoutPoint

@ParrotCapital

@RealJimChanos

@WolfpackReports

@muddywatersre

@ursustrades

@StockJabber

@BreakoutPoint

@ParrotCapital

@RealJimChanos

@WolfpackReports

@muddywatersre

@ursustrades

• • •

Missing some Tweet in this thread? You can try to

force a refresh