Activist investment firm. Nothing is financial advice, all views are our own, see our disclaimer on our website. Get in touch: info@pelicanway-research.com

How to get URL link on X (Twitter) App

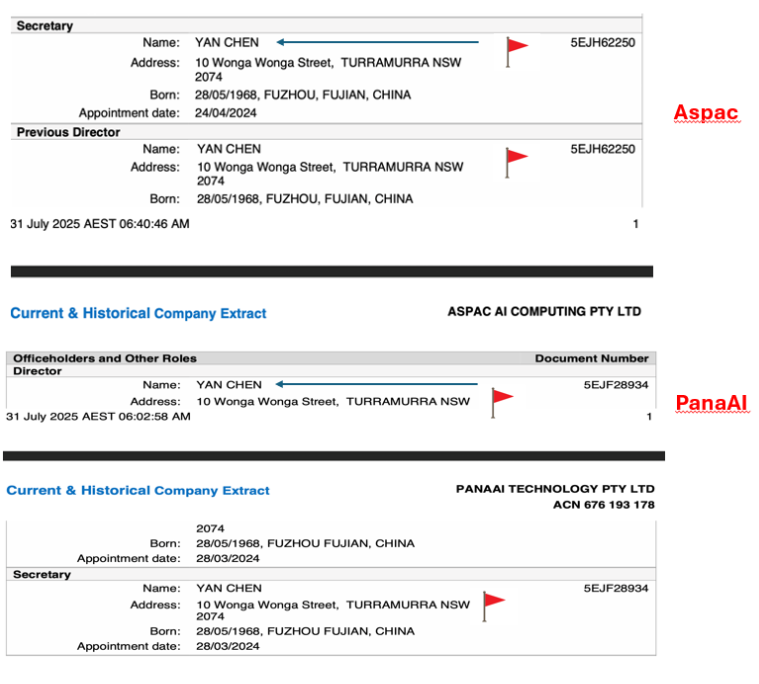

2/9: Our research found that SUPX engaged in multiple undisclosed related-party transactions. On August 27, 2024, SUPX claimed that its Australian subsidiary, ASPAC AI, was going to partner with PanaAI to build a $200 million data center. Not mentioned was that Yan Chen was both PanaAI director & ASPAC secretary, and that PanaAI, ASPAC, and Yan Chen all listed the same luxury home as their address.

2/9: Our research found that SUPX engaged in multiple undisclosed related-party transactions. On August 27, 2024, SUPX claimed that its Australian subsidiary, ASPAC AI, was going to partner with PanaAI to build a $200 million data center. Not mentioned was that Yan Chen was both PanaAI director & ASPAC secretary, and that PanaAI, ASPAC, and Yan Chen all listed the same luxury home as their address.