🚨 Tomorrow's job revisions could change everything.

Goldman expects 550k to 950k jobs erased, the biggest cut in 15 years.

Here’s why this matters more than you think.

(a thread)

Goldman expects 550k to 950k jobs erased, the biggest cut in 15 years.

Here’s why this matters more than you think.

(a thread)

What is a benchmark revision? Each month, the BLS estimates job growth by surveying ~122,000 businesses.

But surveys have limits, response rates have fallen to 43% in 2025 from 61% in 2016.

Once a year, the BLS “anchors” those estimates to harder data.

But surveys have limits, response rates have fallen to 43% in 2025 from 61% in 2016.

Once a year, the BLS “anchors” those estimates to harder data.

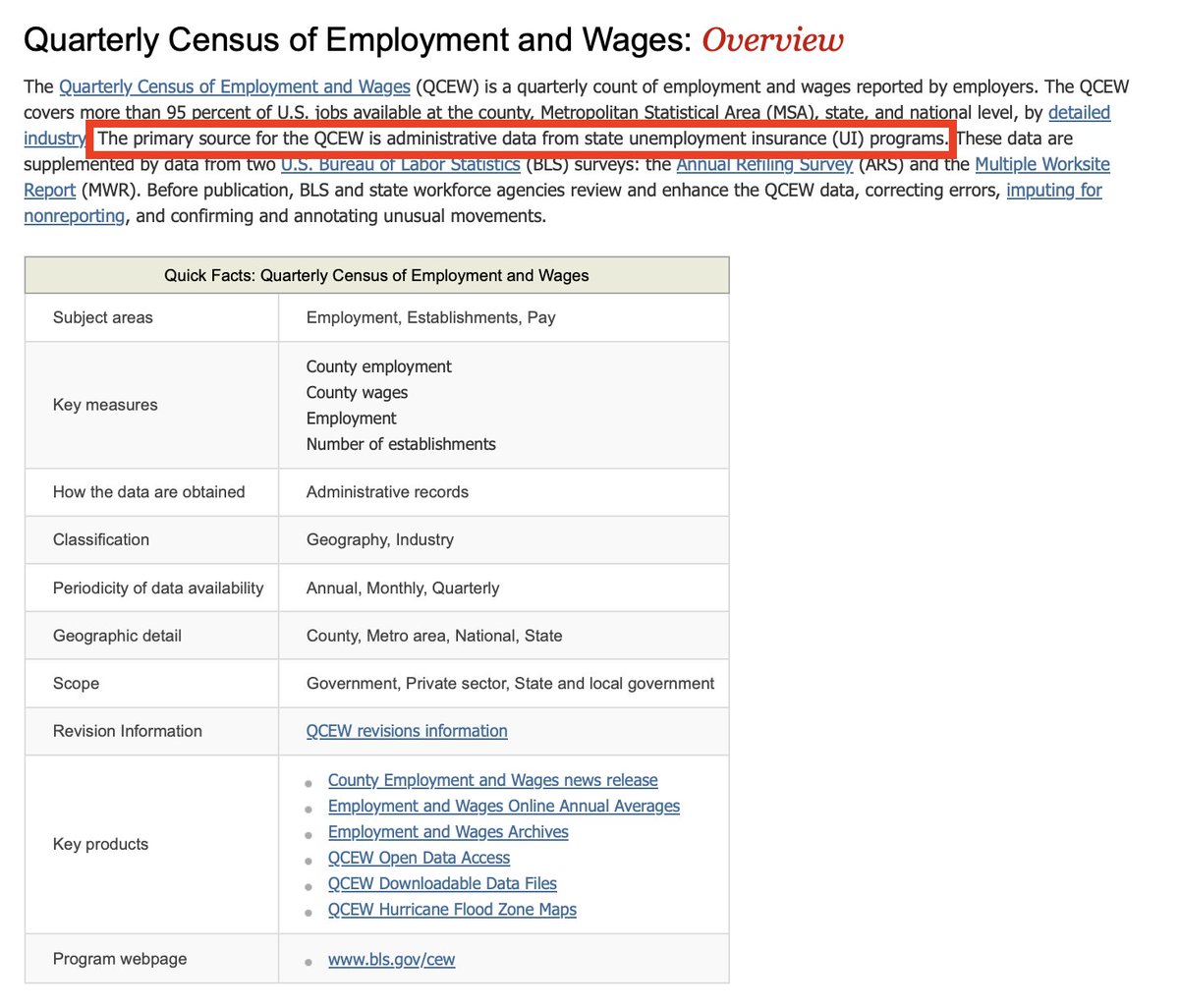

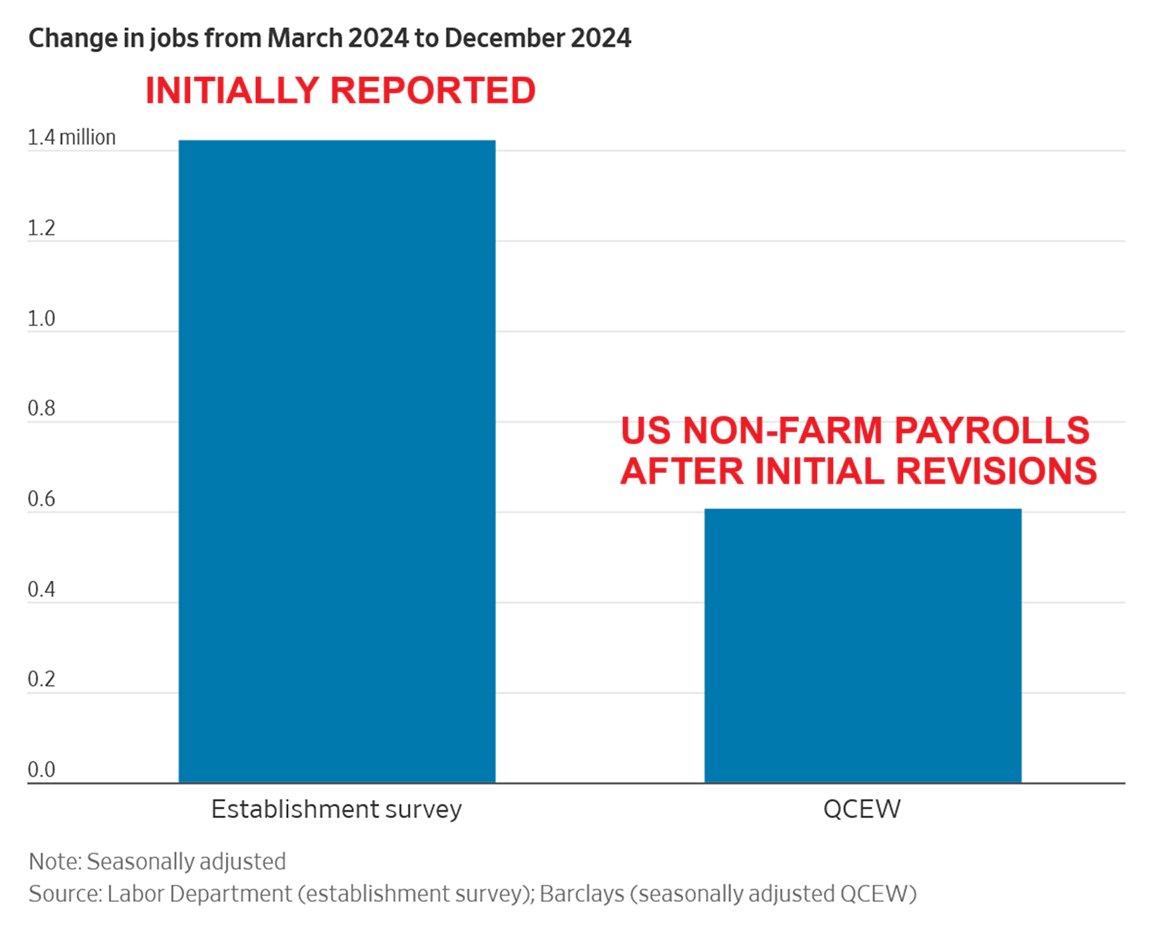

That harder data is the Quarterly Census of Employment and Wages (QCEW).

Unlike surveys, QCEW covers 95% of all U.S. jobs using unemployment insurance records.

Benchmark revisions compare the monthly survey to this census. When the gap is big, hundreds of thousands of jobs can vanish overnight.

Unlike surveys, QCEW covers 95% of all U.S. jobs using unemployment insurance records.

Benchmark revisions compare the monthly survey to this census. When the gap is big, hundreds of thousands of jobs can vanish overnight.

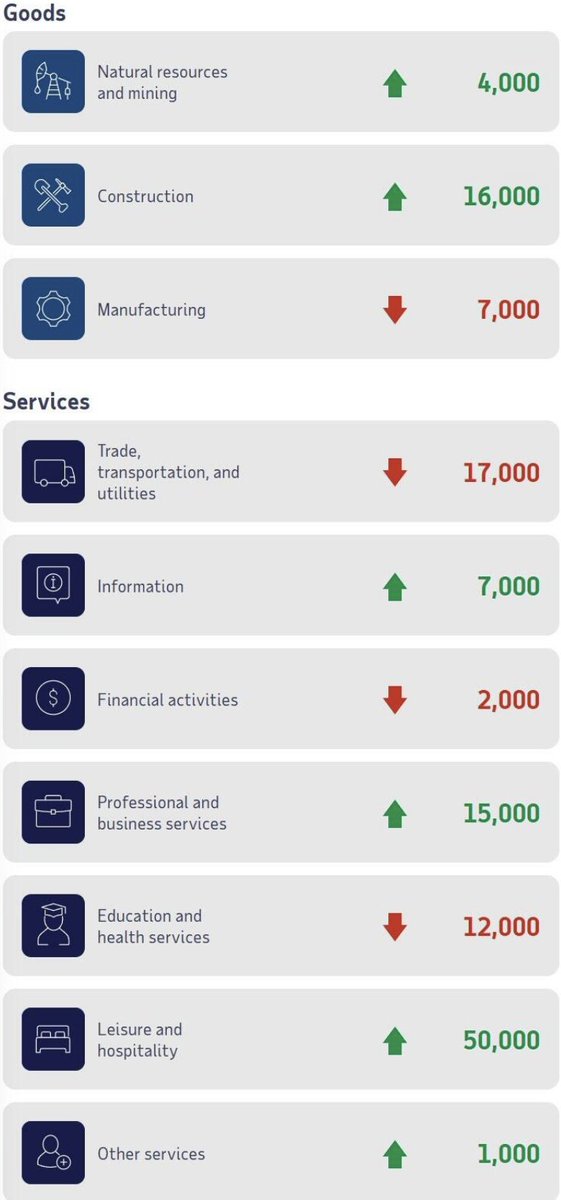

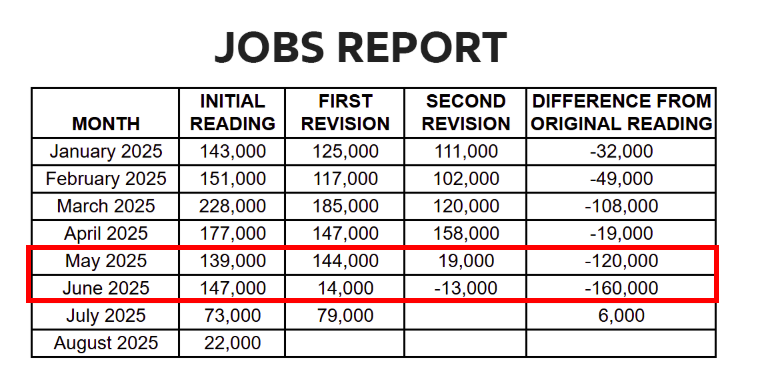

We’re already seeing cracks. In June 2025, payrolls were first reported as +147,000 jobs.

After two revisions, the gain flipped into a loss of -13,000.

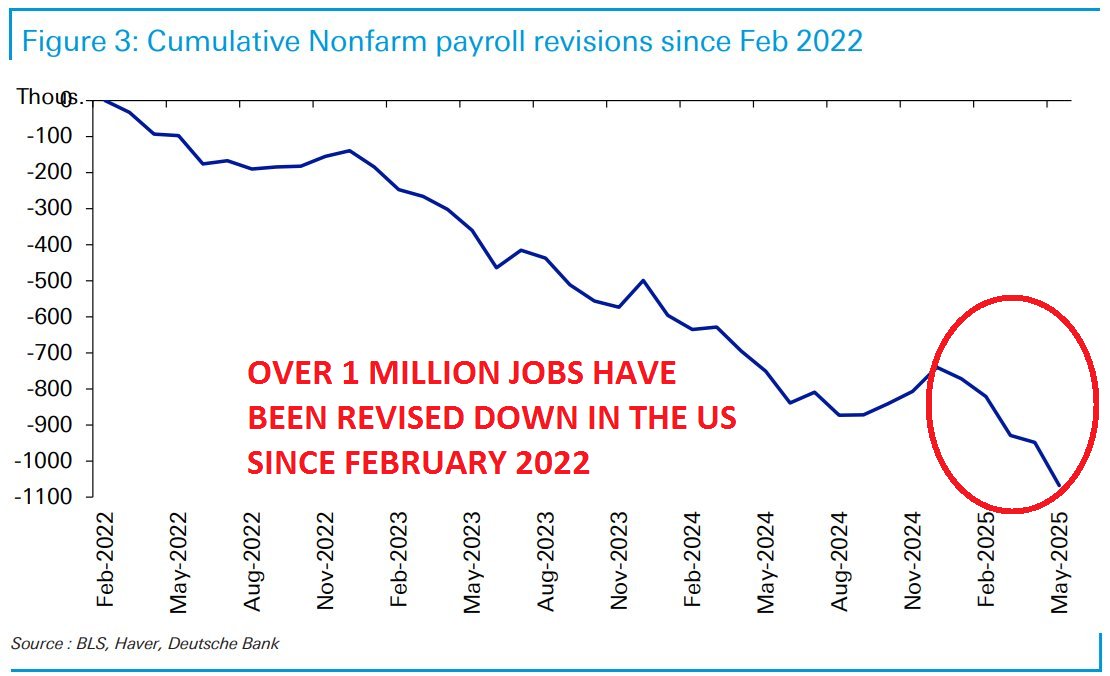

Since February 2022, total payrolls have now been revised down by -1.1 million jobs.

After two revisions, the gain flipped into a loss of -13,000.

Since February 2022, total payrolls have now been revised down by -1.1 million jobs.

This year alone, -482,000 jobs have been deleted from the official record.

That’s roughly the entire population of Atlanta, Georgia erased through revisions.

And in May–June, -280,000 jobs were cut in just two months, the largest 2-month downward revision in U.S. history outside 2020.

That’s roughly the entire population of Atlanta, Georgia erased through revisions.

And in May–June, -280,000 jobs were cut in just two months, the largest 2-month downward revision in U.S. history outside 2020.

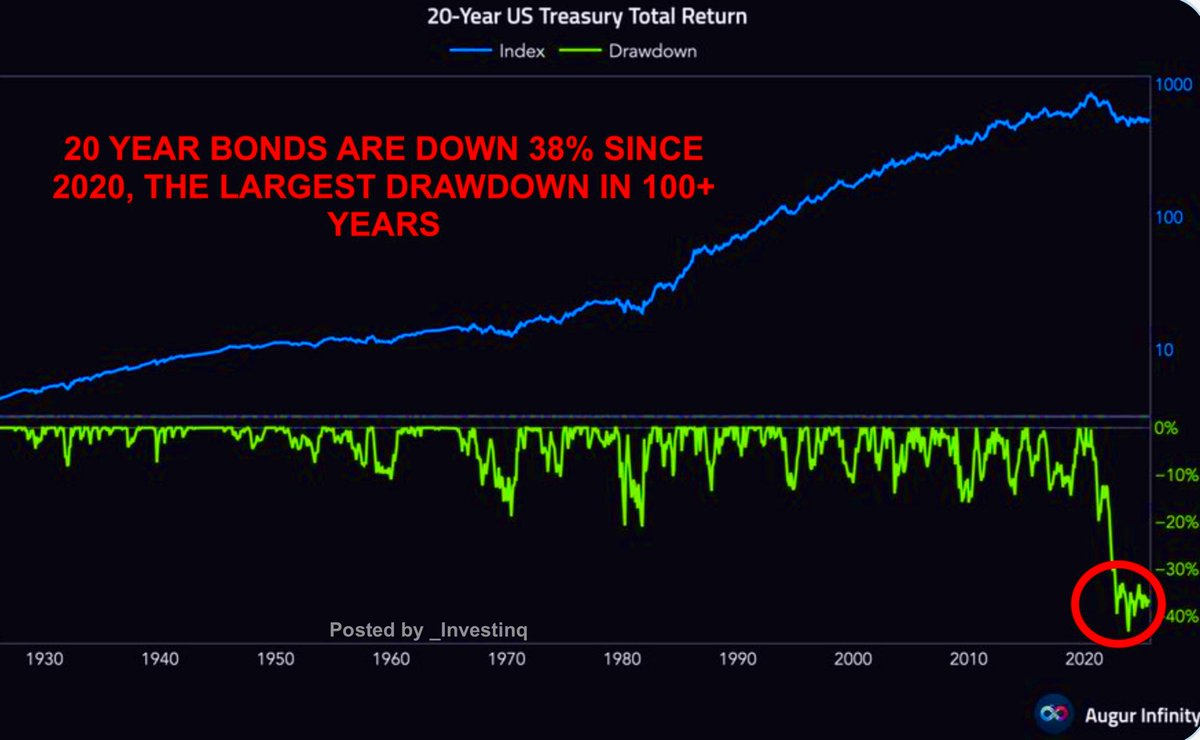

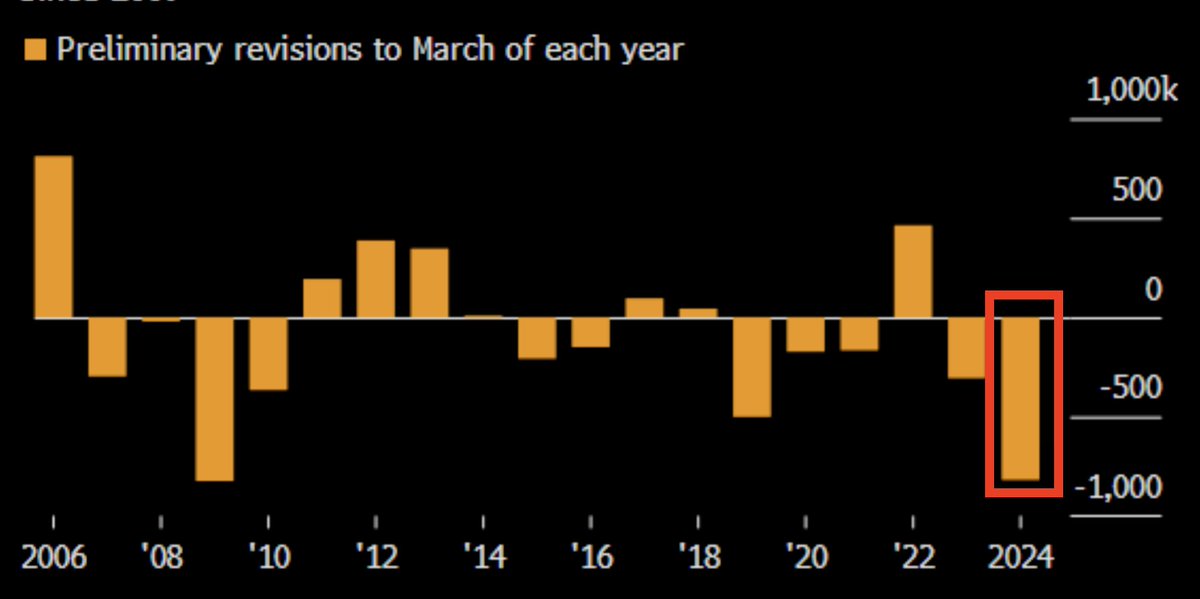

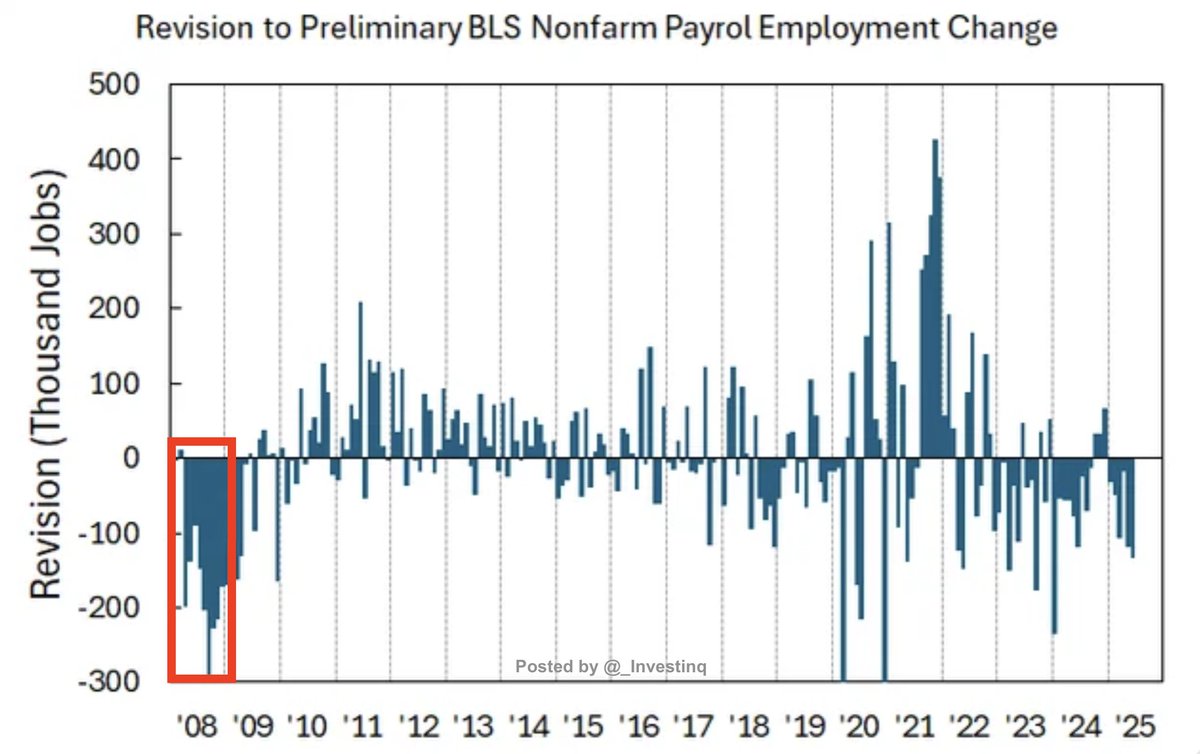

This isn’t new. In August 2024, the BLS revised away -818,000 jobs, the biggest downward cut since 2008.

At the time, the Fed was still describing the economy as a “soft landing.”

In reality, the labor market was already far weaker.

At the time, the Fed was still describing the economy as a “soft landing.”

In reality, the labor market was already far weaker.

Scott Bessent says the Biden-era jobs tally will be revised down by ~800,000 next week.

Crucially, this revision only covers payroll data through March 2025.

That means it reflects the final stretch of the Biden era not Trump’s current policies.

Crucially, this revision only covers payroll data through March 2025.

That means it reflects the final stretch of the Biden era not Trump’s current policies.

Trump has said the economy will have “tremendous job growth" in 2027 with millions of jobs created

But tomorrow’s revision is about the period ending March 2025, checking whether the jobs reported during Biden’s last year were real or inflated.

But tomorrow’s revision is about the period ending March 2025, checking whether the jobs reported during Biden’s last year were real or inflated.

If Goldman and Bessent are right, monthly job growth wasn’t ~150k, but closer to 88k–110k.

That’s a labor market cooling fast.

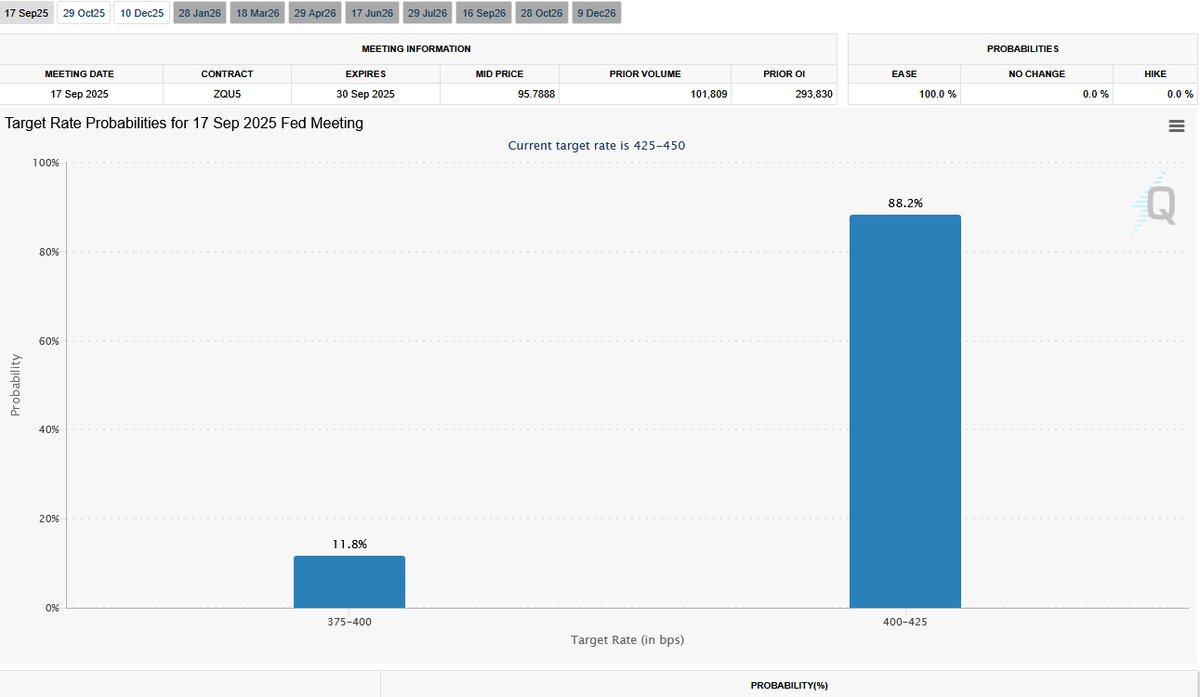

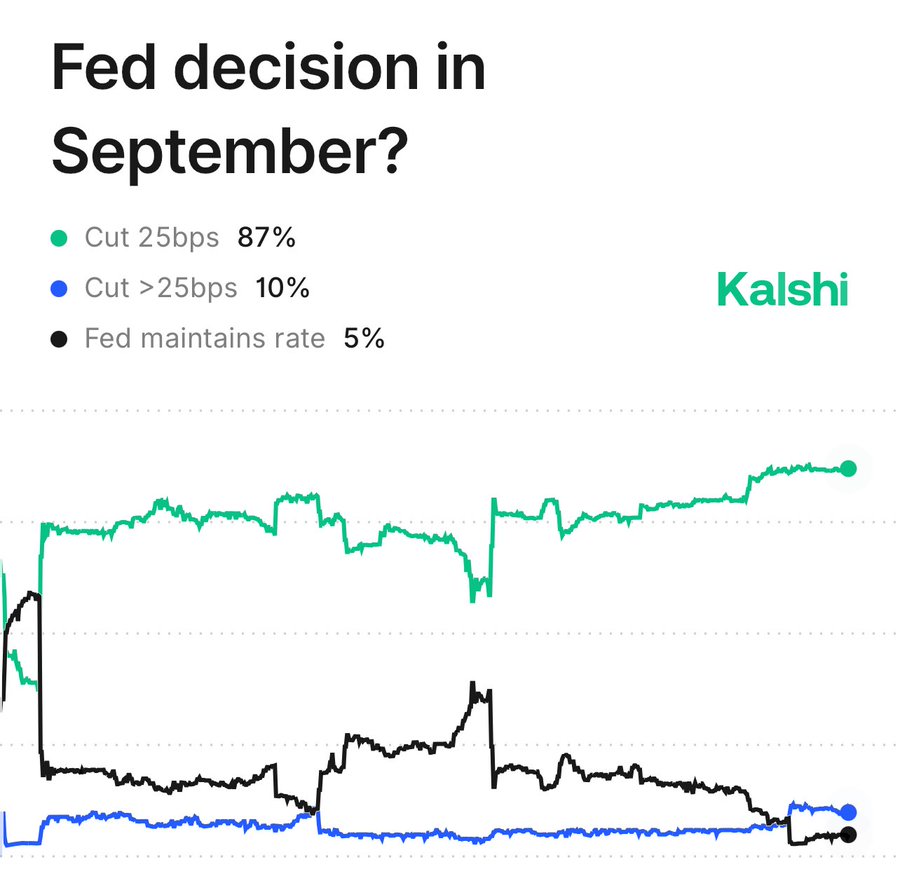

For the Fed, fewer jobs = weaker demand, raising the debate between a 25bps trim or a 50bps shock cut.

That’s a labor market cooling fast.

For the Fed, fewer jobs = weaker demand, raising the debate between a 25bps trim or a 50bps shock cut.

What’s a basis point (bp)? It’s one-hundredth of a percent.

So 25bps = 0.25%. 50bps = 0.50%.

The Fed has to decide whether to stick with the expected quarter-point cut or surprise with a half-point.

So 25bps = 0.25%. 50bps = 0.50%.

The Fed has to decide whether to stick with the expected quarter-point cut or surprise with a half-point.

We’ve seen this story before.

In 2008, benchmark revisions erased more than -900k jobs, proving the recession was far deeper than initially reported.

By the time the Fed reacted, it was already too late. The risk is repeating that mistake again.

In 2008, benchmark revisions erased more than -900k jobs, proving the recession was far deeper than initially reported.

By the time the Fed reacted, it was already too late. The risk is repeating that mistake again.

During COVID, payroll surveys undercounted job losses. Revisions later showed the collapse was even steeper.

Policy had to be scaled up dramatically to match the reality.

Revisions have a history of flipping entire narratives when it matters most.

Policy had to be scaled up dramatically to match the reality.

Revisions have a history of flipping entire narratives when it matters most.

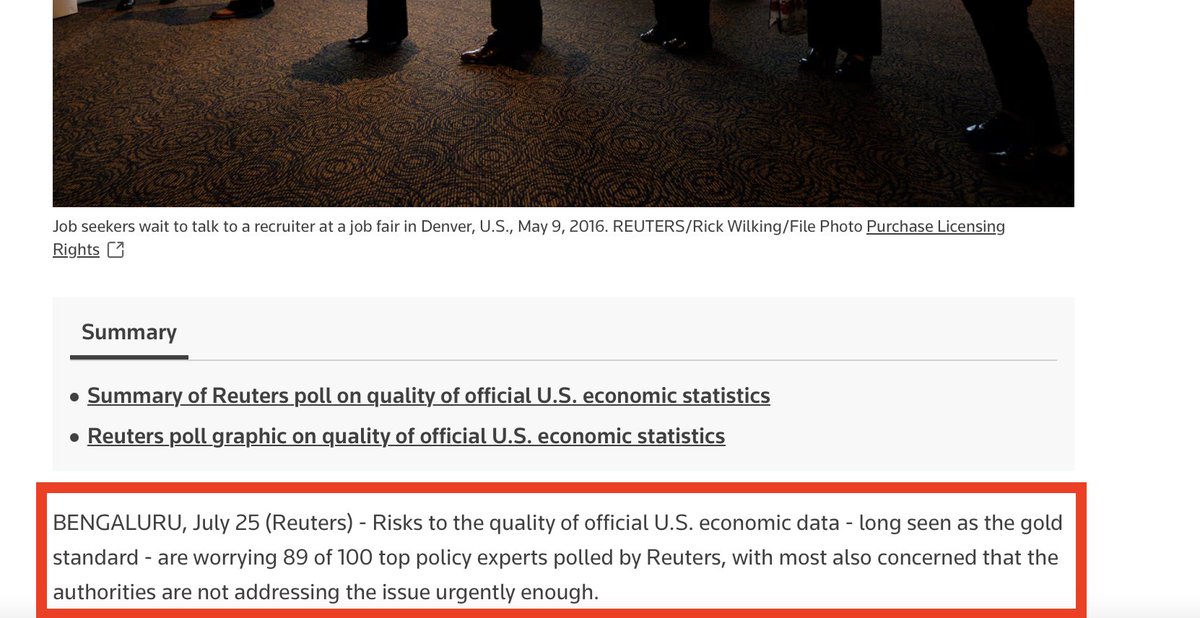

The credibility issue is growing.

After May and June’s revisions, Trump accused the BLS of “rigged” numbers and fired its commissioner.

When asked if data would be credible, he said: “The real numbers are whatever it is a year from now.”

After May and June’s revisions, Trump accused the BLS of “rigged” numbers and fired its commissioner.

When asked if data would be credible, he said: “The real numbers are whatever it is a year from now.”

Economists agree. A July poll found 89% of economists view U.S. data reliability as a “big problem.”

Nearly half said they were very concerned.

Many no longer trade on the initial payrolls release — they wait for revisions.

Nearly half said they were very concerned.

Many no longer trade on the initial payrolls release — they wait for revisions.

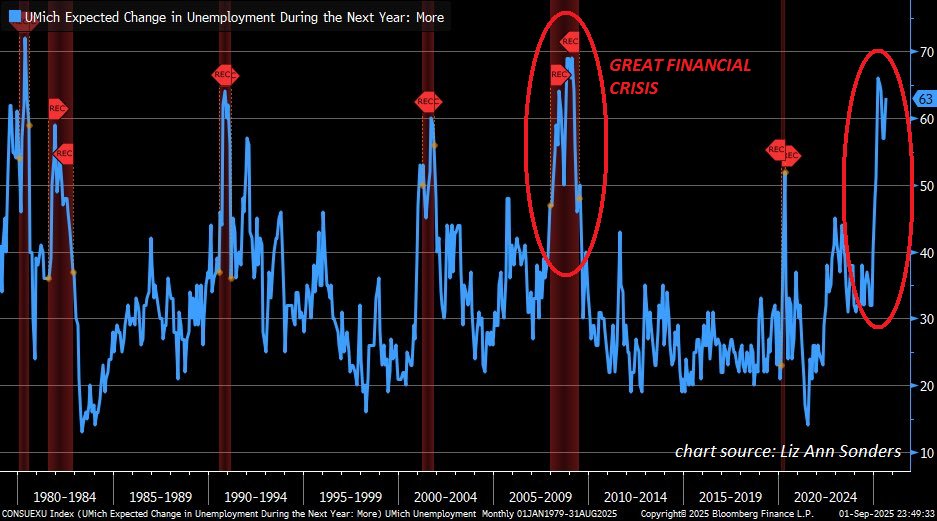

Consumers see it too. In August, 63% of Americans expected unemployment to rise in the next 12 months.

That’s the third-highest reading since 2008.

Historically, this survey has predicted downturns, hinting payrolls could soon print -50k to -100k per month.

That’s the third-highest reading since 2008.

Historically, this survey has predicted downturns, hinting payrolls could soon print -50k to -100k per month.

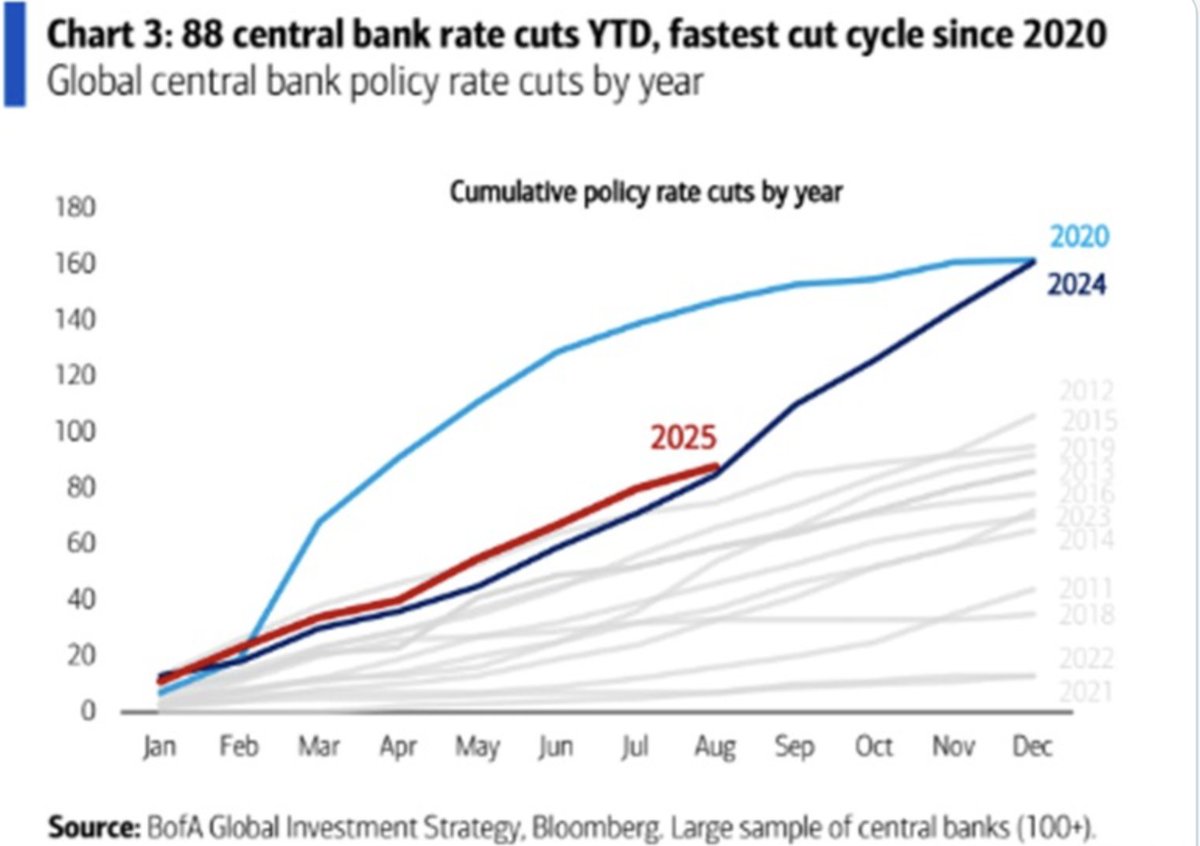

Meanwhile, the global rate cut cycle is already in motion. There have been 88 cuts worldwide in 2025, the fastest pace since 2020 and the third-fastest on record.

• ECB: 4 cuts.

• BOE: 3 cuts.

• Canada: 2 cuts.

• Switzerland: already back to 0%.

• ECB: 4 cuts.

• BOE: 3 cuts.

• Canada: 2 cuts.

• Switzerland: already back to 0%.

The Fed? Zero cuts this year.

Powell has stayed on hold even as the rest of the world eases.

But if tomorrow’s revisions reveal that job growth before March 2025 was overstated by hundreds of thousands, the Fed may have no choice but to finally join the cutting cycle.

Powell has stayed on hold even as the rest of the world eases.

But if tomorrow’s revisions reveal that job growth before March 2025 was overstated by hundreds of thousands, the Fed may have no choice but to finally join the cutting cycle.

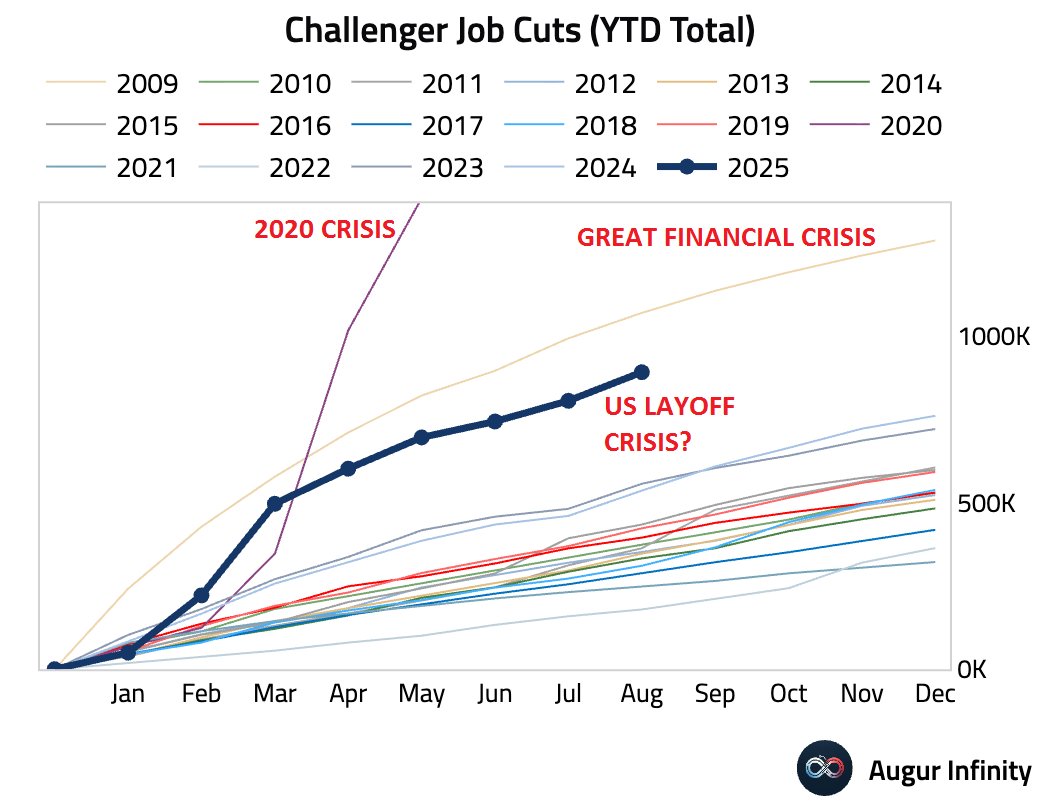

The broader jobs picture is already ugly. U.S. employers have announced 892,362 layoffs YTD, the most since 2020.

Excluding COVID, this is the worst since the Great Financial Crisis.

August hiring plans were the lowest since 2009.

Excluding COVID, this is the worst since the Great Financial Crisis.

August hiring plans were the lowest since 2009.

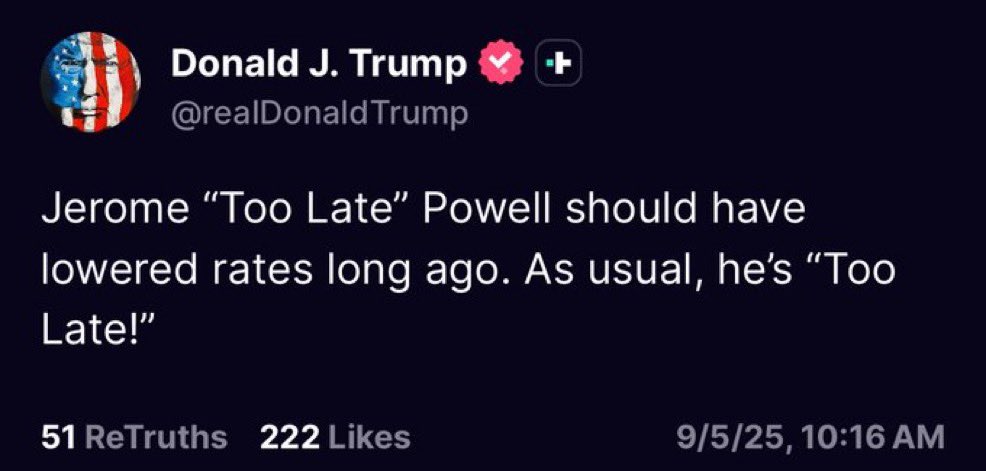

And make no mistake: Tomorrow, Trump will blame Biden and his administration for these job losses.

At the same time, he’ll attack Jerome Powell saying he was “too late” to cut, just as he has done repeatedly.

The politics will be as fierce as the data.

At the same time, he’ll attack Jerome Powell saying he was “too late” to cut, just as he has done repeatedly.

The politics will be as fierce as the data.

Bottom line: Benchmark revisions are not a sideshow. They are the truest test of U.S. payroll data

And this year’s revision only covers April 2024–March 2025

If it shows -800k or worse, it will erase much of Biden’s last year job gains, trigger a credibility crisis and push Powell into deeper cuts

And this year’s revision only covers April 2024–March 2025

If it shows -800k or worse, it will erase much of Biden’s last year job gains, trigger a credibility crisis and push Powell into deeper cuts

If you found these insights valuable: Sign up for my FREE newsletter! thestockmarket.news

I hope you've found this thread helpful.

Follow me @_Investinq for more.

Like/Repost the quote below if you:

Follow me @_Investinq for more.

Like/Repost the quote below if you:

https://x.com/_investinq/status/1965054245788373396?s=46

@VladTheInflator @FinanceLancelot @StealthQE4

@onechancefreedm

• • •

Missing some Tweet in this thread? You can try to

force a refresh