Europe’s second-largest economy just plunged into chaos.

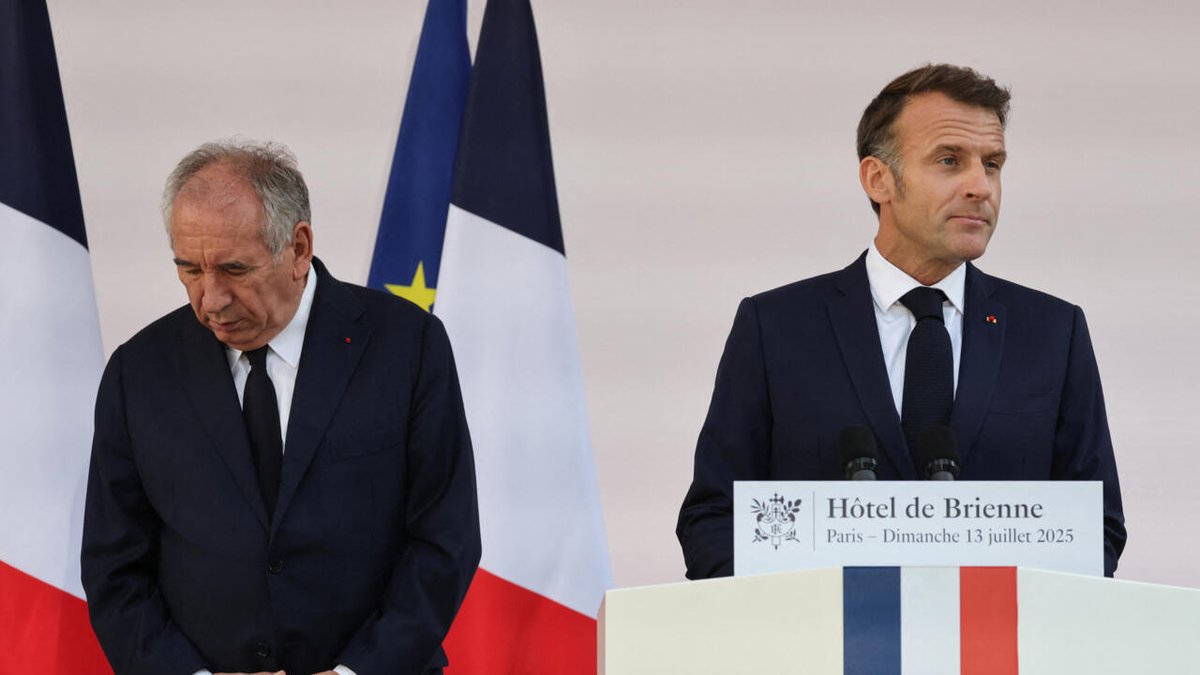

For the second time in under a year, France’s government has collapsed.

Macron is now the first president since 1953 to suffer two collapses in 12 months.

(a thread)

For the second time in under a year, France’s government has collapsed.

Macron is now the first president since 1953 to suffer two collapses in 12 months.

(a thread)

Prime Minister François Bayrou was toppled after losing a no-confidence vote 364–194.

In France, if 280 or more lawmakers vote “no confidence,” the government falls.

Bayrou’s crime? A €44B savings plan with tax hikes, a spending freeze, and scrapping two public holidays. He lasted only 9 months.

In France, if 280 or more lawmakers vote “no confidence,” the government falls.

Bayrou’s crime? A €44B savings plan with tax hikes, a spending freeze, and scrapping two public holidays. He lasted only 9 months.

France’s system splits power: the President sets strategy, but the Prime Minister runs daily government affairs.

If parliament pulls support, the PM must resign.

Macron now faces the impossible task of appointing another PM who won’t be immediately rejected by a fractured chamber.

If parliament pulls support, the PM must resign.

Macron now faces the impossible task of appointing another PM who won’t be immediately rejected by a fractured chamber.

Macron’s options are grim.

(1) Pick another centrist PM, but parliament likely rejects them.

(2) Strike a “confidence-and-supply” deal, where a rival party allows budgets but stays out of government.

(3) Dissolve parliament and call elections.

None guarantee stability.

(1) Pick another centrist PM, but parliament likely rejects them.

(2) Strike a “confidence-and-supply” deal, where a rival party allows budgets but stays out of government.

(3) Dissolve parliament and call elections.

None guarantee stability.

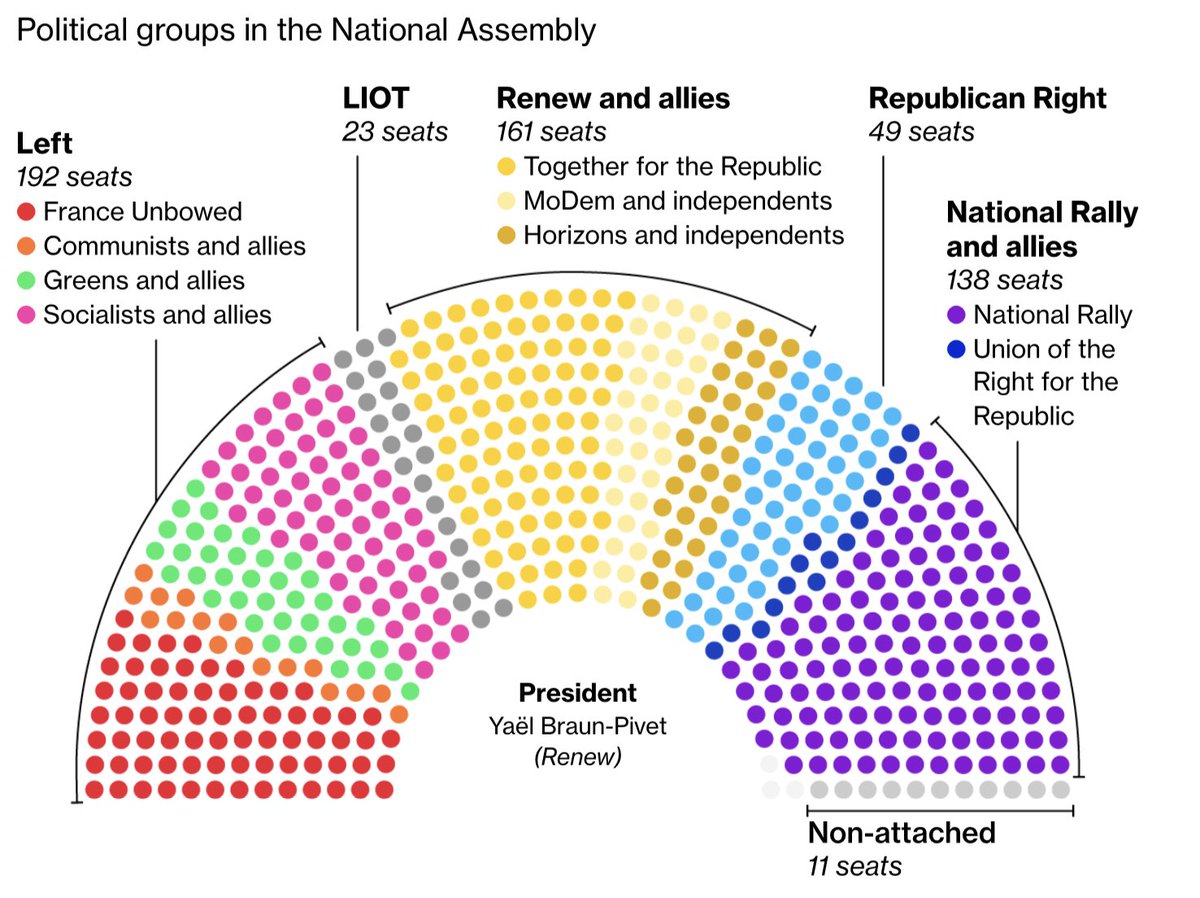

This deadlock began in 2024, when Macron called snap elections after far-right gains.

The result was a hung parliament split into three blocs: far right, far left, and centrists.

No side controls a majority. That gridlock has chewed through four prime ministers in just 20 months.

The result was a hung parliament split into three blocs: far right, far left, and centrists.

No side controls a majority. That gridlock has chewed through four prime ministers in just 20 months.

Why it matters: France must submit its annual budget to the EU in October.

If parliament fails to approve it within 70 days, the government can force it through by decree.

A decree means bypassing lawmakers. Legal, but deeply controversial, and signals instability to investors.

If parliament fails to approve it within 70 days, the government can force it through by decree.

A decree means bypassing lawmakers. Legal, but deeply controversial, and signals instability to investors.

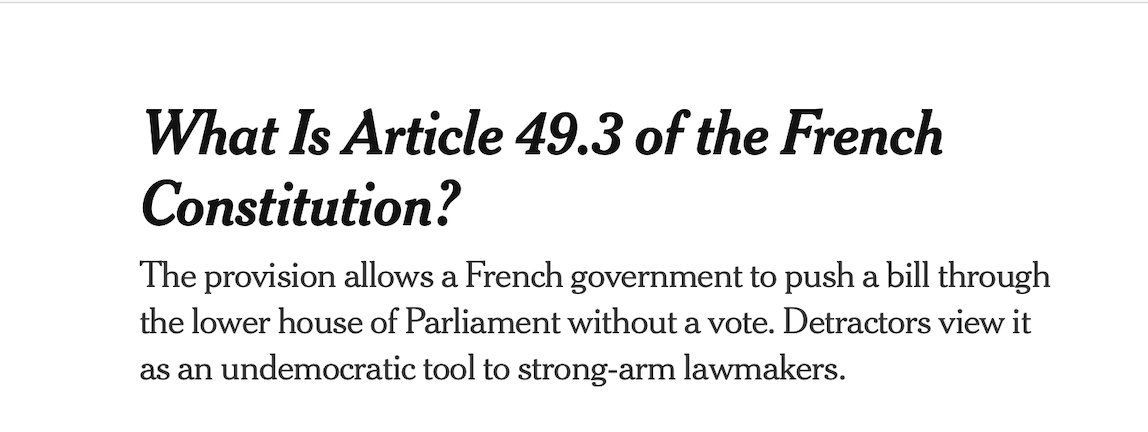

France also has Article 49.3, a constitutional tool allowing the government to pass laws without a vote.

But lawmakers can retaliate with a no-confidence motion.

Overusing 49.3 is political suicide: each attempt risks collapsing the government instantly.

But lawmakers can retaliate with a no-confidence motion.

Overusing 49.3 is political suicide: each attempt risks collapsing the government instantly.

The fiscal math is brutal.

France runs a deficit of nearly 6% of GDP. A deficit means the country spends more than it collects in taxes.

Debt now exceeds 110% of GDP. Investors demand higher interest rates called yields on French bonds to keep lending.

France runs a deficit of nearly 6% of GDP. A deficit means the country spends more than it collects in taxes.

Debt now exceeds 110% of GDP. Investors demand higher interest rates called yields on French bonds to keep lending.

French 10-year bonds, called OATs, now yield ~3.4%.

A yield is the return investors require to lend money.

For decades, France’s bonds were almost as trusted as Germany’s but today, France pays more to borrow than Spain or Portugal. A shocking reversal for a former safe haven.

A yield is the return investors require to lend money.

For decades, France’s bonds were almost as trusted as Germany’s but today, France pays more to borrow than Spain or Portugal. A shocking reversal for a former safe haven.

The “spread” is the gap between what France pays to borrow and what Germany pays.

Germany is Europe’s gold standard.

France’s spread has jumped from 0.30 to nearly 0.80 percentage points. Markets are saying: France is riskier, and lenders want extra compensation.

Germany is Europe’s gold standard.

France’s spread has jumped from 0.30 to nearly 0.80 percentage points. Markets are saying: France is riskier, and lenders want extra compensation.

Investors also use Credit Default Swaps (CDS), insurance contracts against a government default.

When CDS prices rise, it means investors see more risk. France’s CDS has ticked higher.

Not panic yet, but the trend is worrying. Risk perception is quietly climbing.

When CDS prices rise, it means investors see more risk. France’s CDS has ticked higher.

Not panic yet, but the trend is worrying. Risk perception is quietly climbing.

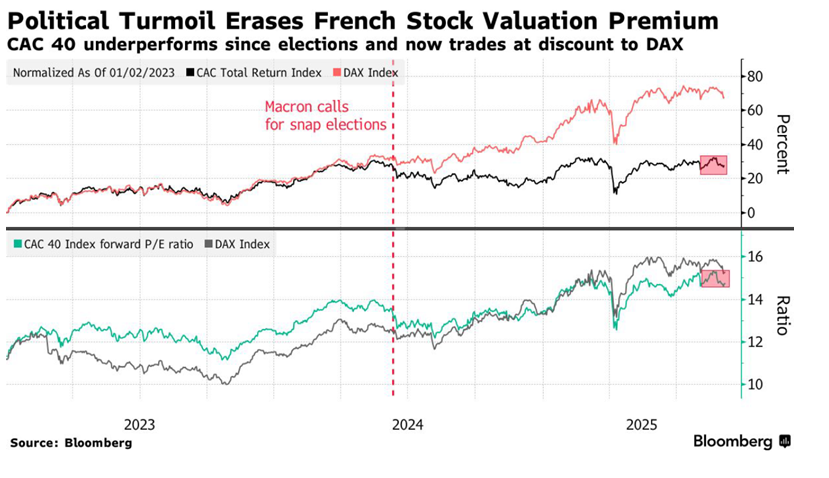

The market reaction is clear. France’s CAC 40 stock index has underperformed European peers.

Banks, telecoms, real estate, and construction companies with heavy domestic exposure are suffering the most.

Investors are applying what’s now called a “France discount.”

Banks, telecoms, real estate, and construction companies with heavy domestic exposure are suffering the most.

Investors are applying what’s now called a “France discount.”

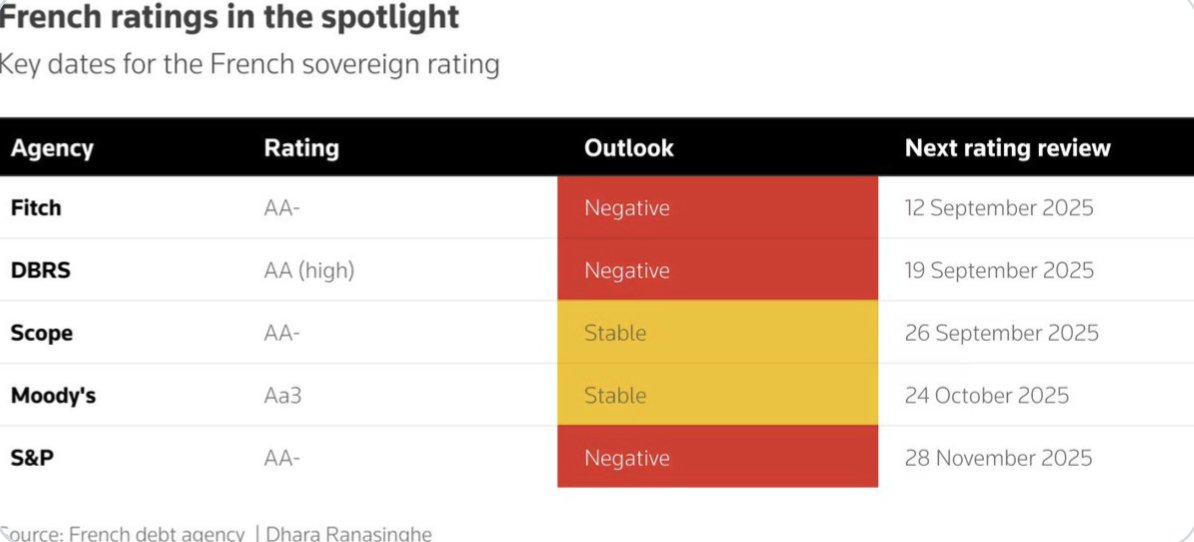

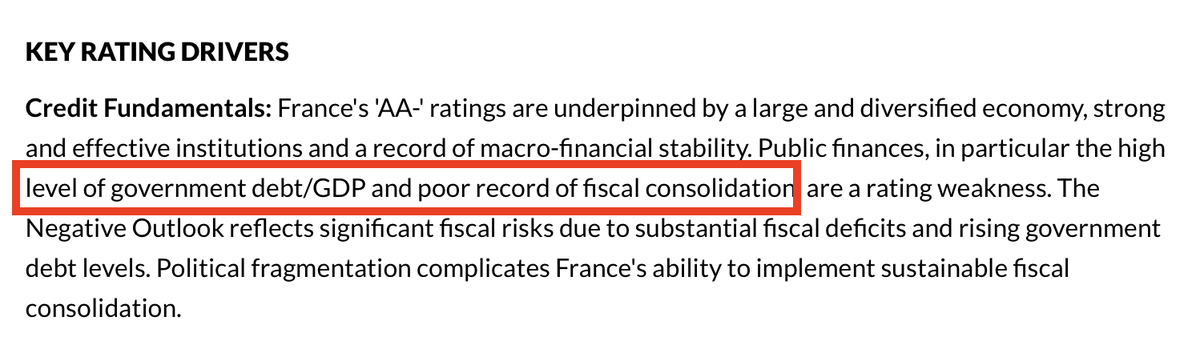

Credit rating agencies are circling. France is on negative watch

• Fitch rules Sept 12.

• DBRS on Sept 19.

• Moody’s on Oct 24.

• S&P on Nov 28.

A downgrade could force funds to sell French debt. Bayrou’s fall raises the odds, and markets are already pricing it in.

• Fitch rules Sept 12.

• DBRS on Sept 19.

• Moody’s on Oct 24.

• S&P on Nov 28.

A downgrade could force funds to sell French debt. Bayrou’s fall raises the odds, and markets are already pricing it in.

Fitch last warned that France has a “poor record of fiscal consolidation.”

Translation: governments promise savings but rarely deliver.

Debt keeps rising, deficits stay wide, and reforms stall. Without credibility, ratings fall and borrowing costs rise further.

Translation: governments promise savings but rarely deliver.

Debt keeps rising, deficits stay wide, and reforms stall. Without credibility, ratings fall and borrowing costs rise further.

Bayrou’s €44B plan was supposed to narrow the deficit from 5.4% this year to 4.6% in 2026.

But the medicine, tax hikes, cuts, scrapped holidays was politically toxic.

The plan failed, proving French politics can’t solve the math, even when the math is urgent.

But the medicine, tax hikes, cuts, scrapped holidays was politically toxic.

The plan failed, proving French politics can’t solve the math, even when the math is urgent.

The numbers are staggering.

France’s debt rises by €5,000 every second. Interest costs alone will hit €75B next year. That’s more than the education budget.

Debt service is becoming the second-largest item in the budget. Debt is eating policy space alive.

France’s debt rises by €5,000 every second. Interest costs alone will hit €75B next year. That’s more than the education budget.

Debt service is becoming the second-largest item in the budget. Debt is eating policy space alive.

Unions are planning mass strikes for Sept 10, vowing to “block everything.”

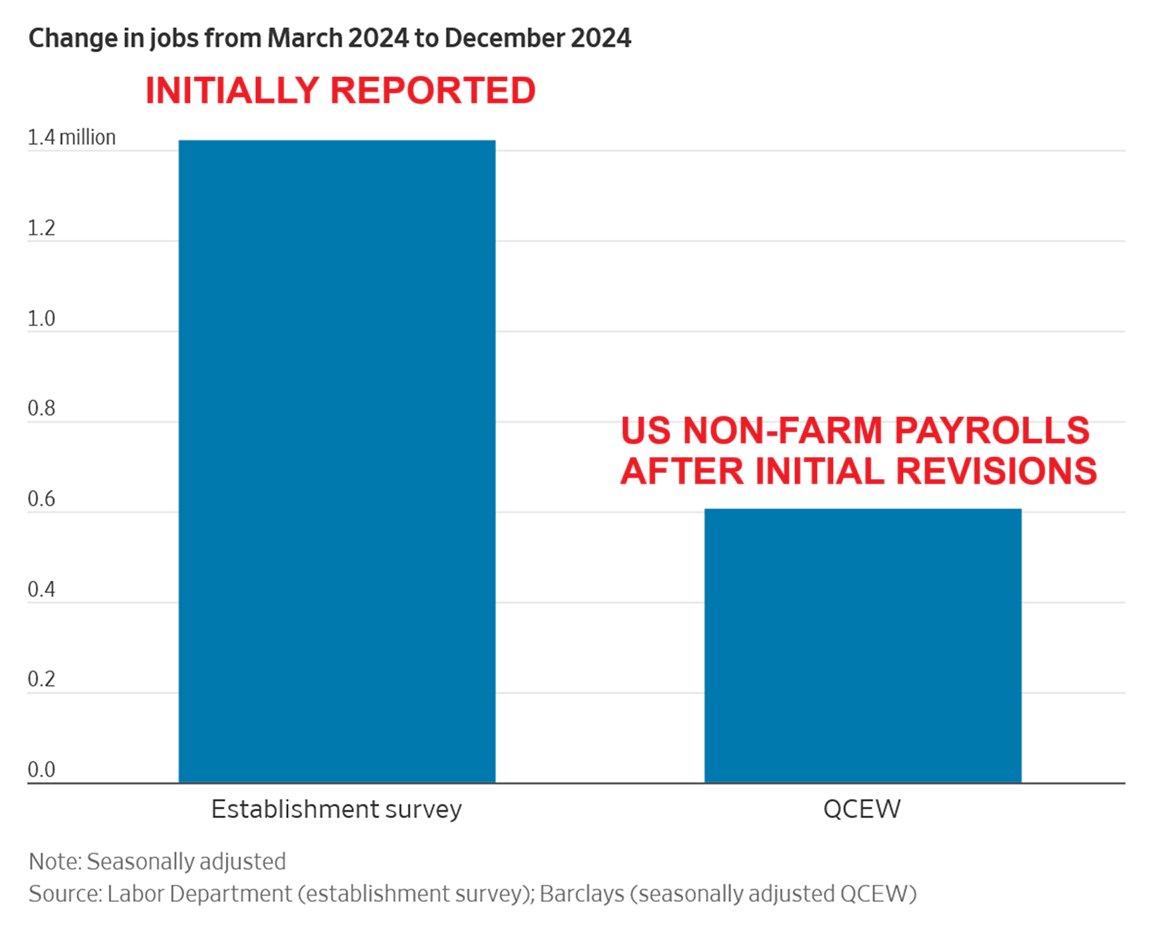

France protests budgets in the streets. The U.S. does the same through shutdowns and debt ceiling fights.

Different theater, same investor signal: dysfunction is structural, not temporary.

France protests budgets in the streets. The U.S. does the same through shutdowns and debt ceiling fights.

Different theater, same investor signal: dysfunction is structural, not temporary.

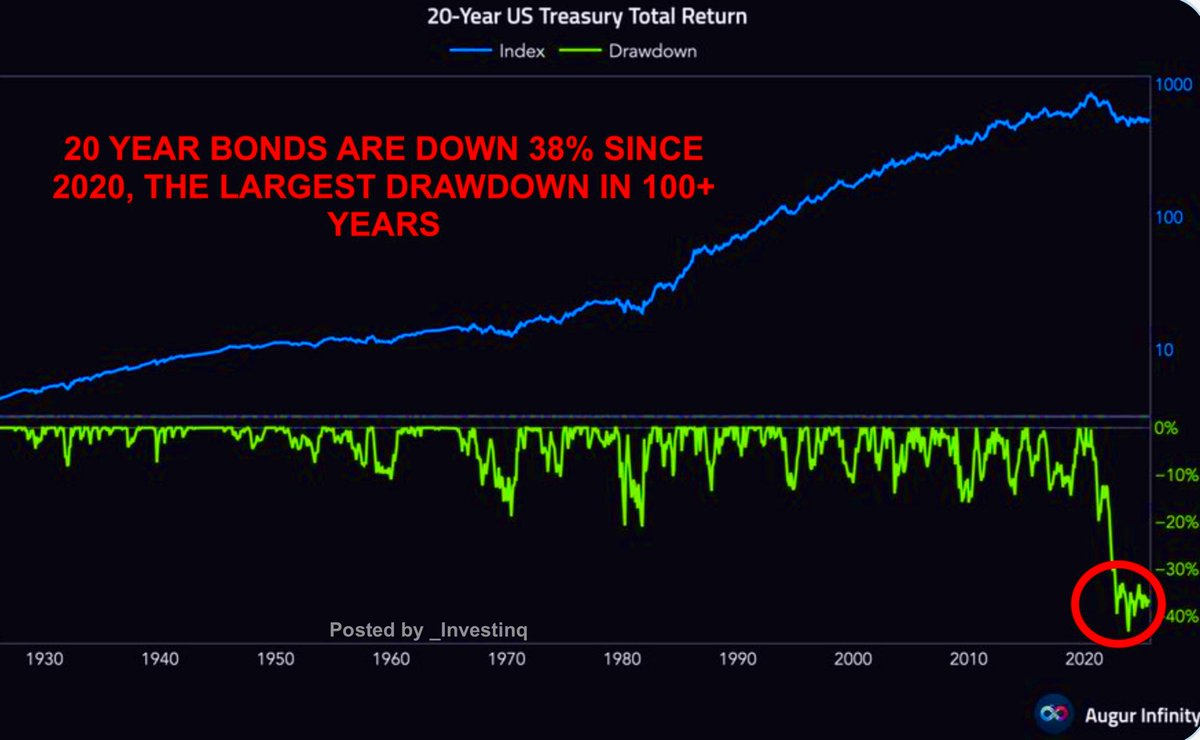

The global angle: stress in French bonds doesn’t stay in Paris.

Investors often reassess U.S. Treasuries too.

U.S. debt is the “world’s safe asset " but global finance is a single plumbing system when trust erodes in Europe, the tremors reach Washington.

Investors often reassess U.S. Treasuries too.

U.S. debt is the “world’s safe asset " but global finance is a single plumbing system when trust erodes in Europe, the tremors reach Washington.

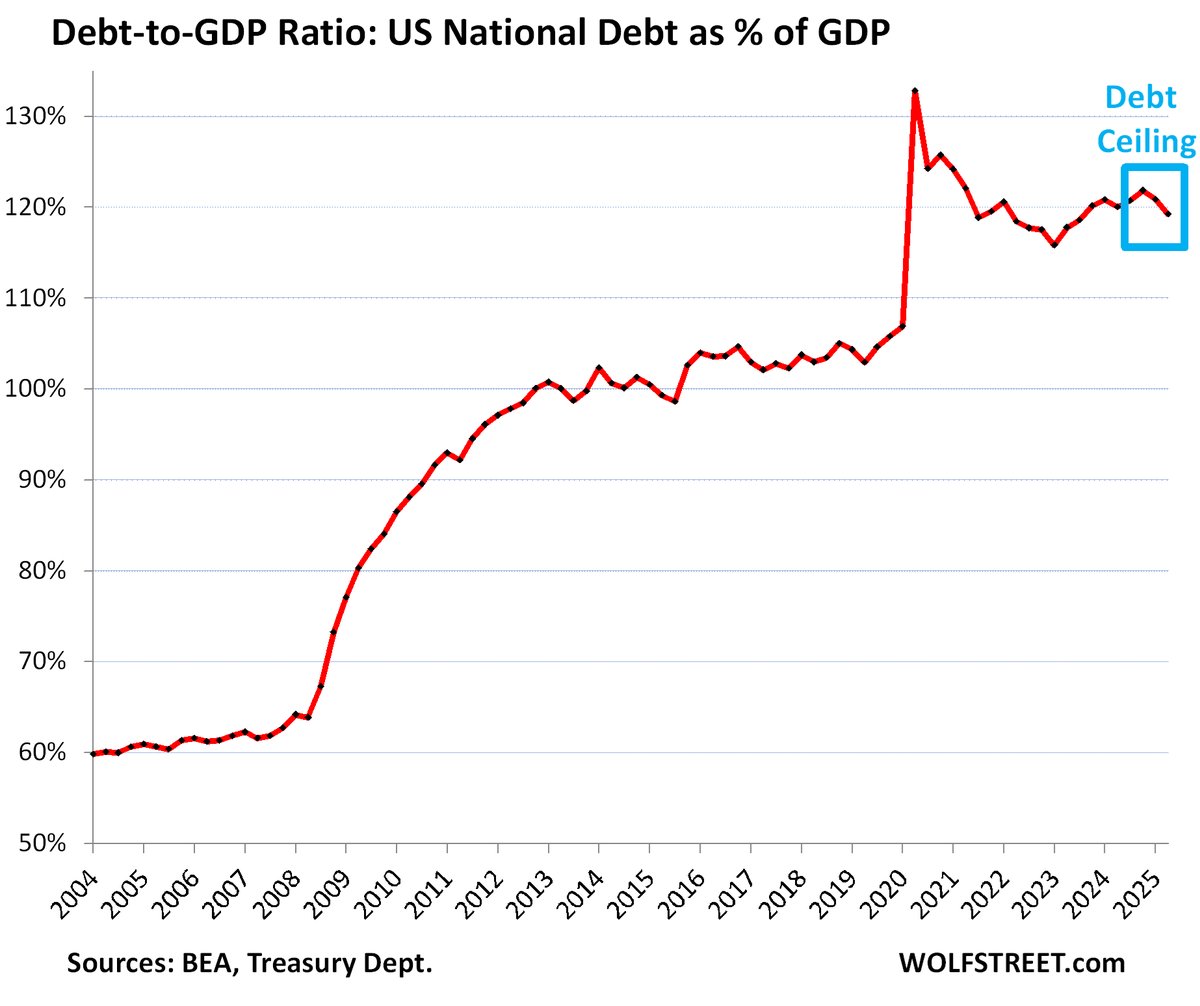

The U.S. isn’t immune.

Its deficit is even larger than France’s, above 6% of GDP. Its debt is near 120% of GDP.

For now, the dollar’s reserve status keeps borrowing costs low. But political dysfunction shutdowns, debt fights erodes even dollar privilege over time.

Its deficit is even larger than France’s, above 6% of GDP. Its debt is near 120% of GDP.

For now, the dollar’s reserve status keeps borrowing costs low. But political dysfunction shutdowns, debt fights erodes even dollar privilege over time.

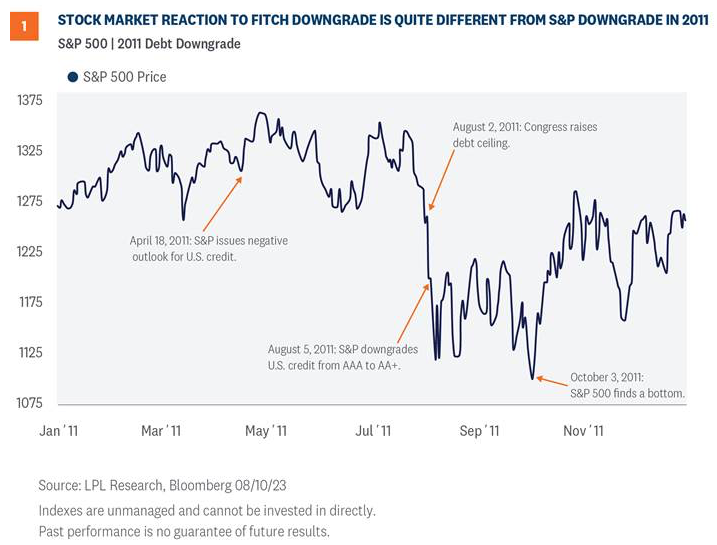

The U.S. already saw a downgrade in 2011 after a debt ceiling standoff.

That wasn’t just about numbers, it was about politics.

France today risks the same credibility hit. Ratings agencies judge both fiscal math and whether leaders can make tough decisions.

That wasn’t just about numbers, it was about politics.

France today risks the same credibility hit. Ratings agencies judge both fiscal math and whether leaders can make tough decisions.

Neither central banks nor markets can save politicians from themselves.

The ECB can buy bonds if panic sets in, and the Fed can provide liquidity.

But neither can fix deficits. They can buy time, not credibility. Without reforms, yields rise and trust erodes.

The ECB can buy bonds if panic sets in, and the Fed can provide liquidity.

But neither can fix deficits. They can buy time, not credibility. Without reforms, yields rise and trust erodes.

France’s futures are all uncertain.

Another centrist PM with no majority. A technocratic cabinet of experts. Snap elections empowering far right or far left or “cohabitation,” where Macron rules alongside an opposition PM.

Every path signals instability.

Another centrist PM with no majority. A technocratic cabinet of experts. Snap elections empowering far right or far left or “cohabitation,” where Macron rules alongside an opposition PM.

Every path signals instability.

Cohabitation is France’s form of divided government.

The PM runs domestic policy, while the President handles foreign affairs.

The U.S. equivalent is when Congress is controlled by the opposition. In both cases, political gridlock is the baseline, not the exception.

The PM runs domestic policy, while the President handles foreign affairs.

The U.S. equivalent is when Congress is controlled by the opposition. In both cases, political gridlock is the baseline, not the exception.

The lesson is simple but harsh.

Politics can flip overnight. Debt math never changes.France is the warning shot.

If Europe’s #2 economy can lose investor trust, so can the U.S. Reserve currency status buys time, not immunity. Ignore the math long enough, and markets raise the price.

Politics can flip overnight. Debt math never changes.France is the warning shot.

If Europe’s #2 economy can lose investor trust, so can the U.S. Reserve currency status buys time, not immunity. Ignore the math long enough, and markets raise the price.

If you found these insights valuable: Sign up for my FREE newsletter! thestockmarket.news

I hope you've found this thread helpful.

Follow me @_Investinq for more.

Like/Repost the quote below if you:

Follow me @_Investinq for more.

Like/Repost the quote below if you:

https://x.com/_investinq/status/1965157157004890196?s=46

• • •

Missing some Tweet in this thread? You can try to

force a refresh