Reliance & Meta are together investing ₹855 crores to build AI Infra in India

RIL is also partnering with Google to build an AI data center in Jamnagar

At RIL’s 48th AGM, Mukesh bhai stated: “Jio promised and delivered digital everywhere and for every Indian. Similarly, Reliance Intelligence promises to deliver AI everywhere for every Indian”

“Reliance Intelligence” is RIL’s next bold bet after Jio ⤵️

RIL is also partnering with Google to build an AI data center in Jamnagar

At RIL’s 48th AGM, Mukesh bhai stated: “Jio promised and delivered digital everywhere and for every Indian. Similarly, Reliance Intelligence promises to deliver AI everywhere for every Indian”

“Reliance Intelligence” is RIL’s next bold bet after Jio ⤵️

Remember: RIL has partnered with both Meta & Google in the past for Jio

Jio raised ~₹150,000 crore from strategic & PE investors in early 2020 which included:

(1) Meta, who invested ₹43,574 crore (~$5.7bn) for 9.99% (announced April 22, 2020)

(2) Alphabet, who invested ₹33,737 crore (~$4.5bn) for 7.73% (announced July 15, 2020)

Btw, these two investments were strategic in nature e.g.

JioPhone Next was built with Pragati OS - a collaboration with Alphabet in Oct ‘21

Meta owned WhatsApp launched a deep e-commerce integration with JioMart in Oct ‘22

Jio is expected to IPO in the ~$110bn valuation range i.e. an acceptable 13% $ IRR for Meta & Alphabet

Meta & Alphabet may sell down some stake in the IPO (liquidity always helps drive re-investment decisions)

Btw, I had written about Jio’s upcoming IPO almost a year ago (nothing much has changed in the analysis) - bookmark for future reading:

x.com/Rahul_J_Mathur…

Jio raised ~₹150,000 crore from strategic & PE investors in early 2020 which included:

(1) Meta, who invested ₹43,574 crore (~$5.7bn) for 9.99% (announced April 22, 2020)

(2) Alphabet, who invested ₹33,737 crore (~$4.5bn) for 7.73% (announced July 15, 2020)

Btw, these two investments were strategic in nature e.g.

JioPhone Next was built with Pragati OS - a collaboration with Alphabet in Oct ‘21

Meta owned WhatsApp launched a deep e-commerce integration with JioMart in Oct ‘22

Jio is expected to IPO in the ~$110bn valuation range i.e. an acceptable 13% $ IRR for Meta & Alphabet

Meta & Alphabet may sell down some stake in the IPO (liquidity always helps drive re-investment decisions)

Btw, I had written about Jio’s upcoming IPO almost a year ago (nothing much has changed in the analysis) - bookmark for future reading:

x.com/Rahul_J_Mathur…

So, what is this collab b/w Meta and RIL?

RIL and Meta are forming a JV with 70:30 split to create a platform targeting Indian businesses to offer AI services billed on a monthly basis. Meta is the Tech partner offering its open-source Llama models & deep integrations with the Meta ecosystem products (e.g. WhatsApp)

Key features are:

(i) Local data residency

Indian user queries will hit local data centers & data won’t moved to SG/USA. We have already seen the RBI Mandate which requires payment related data to be stored within India; so there is clear biz rationale for the same

(ii) SMB focused products | WhatsApp focused

SMBs in India prefer Zoho & other SaaS partners who offer low cost products for tracking inventory, analyzing sales data & managing relationships.

RIL Intelligence plans to offer AI solutions like an automated sales analyzer which can scan bills & run customer campaigns on WA

(iii) India pricing

Since OpenAI has led the way here with ChatGPT Go - RIL Intelligence will aim to provide business solutions at an affordable India specific pricing (esp. since the underlying models are hosted in their own cloud)

RIL and Meta are forming a JV with 70:30 split to create a platform targeting Indian businesses to offer AI services billed on a monthly basis. Meta is the Tech partner offering its open-source Llama models & deep integrations with the Meta ecosystem products (e.g. WhatsApp)

Key features are:

(i) Local data residency

Indian user queries will hit local data centers & data won’t moved to SG/USA. We have already seen the RBI Mandate which requires payment related data to be stored within India; so there is clear biz rationale for the same

(ii) SMB focused products | WhatsApp focused

SMBs in India prefer Zoho & other SaaS partners who offer low cost products for tracking inventory, analyzing sales data & managing relationships.

RIL Intelligence plans to offer AI solutions like an automated sales analyzer which can scan bills & run customer campaigns on WA

(iii) India pricing

Since OpenAI has led the way here with ChatGPT Go - RIL Intelligence will aim to provide business solutions at an affordable India specific pricing (esp. since the underlying models are hosted in their own cloud)

RIL Intelligence is part of a wider RIL Group strategy - “Own The Stack”

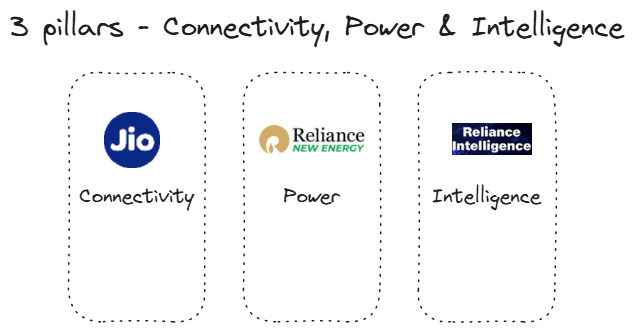

The 3 principles of the “stack” are Intelligence, Connectivity & Power

RIL’s core business (>60% revenue contribution) lies in oil & petrochemicals

(1) Jio was core to building the Connectivity pillar for RIL

(2) Reliance New Energy was launched 4 years ago to be the “Power” pillar

PS: RIL has invested ₹70,000 crore to build a complex a 5000 acre complex to produce solar panels , batteries, green hydrogen and wind turbines (!)

RIL believes that data & energy is the “new” oil - hence investing behind this.

The 3 principles of the “stack” are Intelligence, Connectivity & Power

RIL’s core business (>60% revenue contribution) lies in oil & petrochemicals

(1) Jio was core to building the Connectivity pillar for RIL

(2) Reliance New Energy was launched 4 years ago to be the “Power” pillar

PS: RIL has invested ₹70,000 crore to build a complex a 5000 acre complex to produce solar panels , batteries, green hydrogen and wind turbines (!)

RIL believes that data & energy is the “new” oil - hence investing behind this.

To emphasize the scale of the proposed Google X RIL Jamnagar 3 GW data center - it would be the biggest one globally (as of now) - would consume electricity equivalent to 6 Lakh houses

Akash Ambani mentioned ”We want to complete it true Jamnagar style in record time - as we have always done in Jamnagar - in 24 months.”

PS: I had explained the “Jio Stack” strategy 2 years ago in a post (again, bookmark for future):

x.com/Rahul_J_Mathur…

Akash Ambani mentioned ”We want to complete it true Jamnagar style in record time - as we have always done in Jamnagar - in 24 months.”

PS: I had explained the “Jio Stack” strategy 2 years ago in a post (again, bookmark for future):

x.com/Rahul_J_Mathur…

Important note for RIL shareholders:

(1) RIL Intelligence is incorporated as a subsidiary of the RIL Industries and NOT a subsidiary of Jio

(2) Unlike Jio Financial Services - for the Jio IPO, you won’t get allocated Jio shares - however you can buy Jio shares during & post IPO

(3) Given Jio’s journey, you can expect that RIL Industries will try to list RIL Intelligence in a similar fashion to Jio over a 3 to 5 year window - especially if it raises capital from PE investors

In short, if you have RIL Industry shares then you get proxy exposure to this new business unit & should benefit from the upside

(1) RIL Intelligence is incorporated as a subsidiary of the RIL Industries and NOT a subsidiary of Jio

(2) Unlike Jio Financial Services - for the Jio IPO, you won’t get allocated Jio shares - however you can buy Jio shares during & post IPO

(3) Given Jio’s journey, you can expect that RIL Industries will try to list RIL Intelligence in a similar fashion to Jio over a 3 to 5 year window - especially if it raises capital from PE investors

In short, if you have RIL Industry shares then you get proxy exposure to this new business unit & should benefit from the upside

It took me some time to go through the AGM notes since I’m in SFO right now - the “India question” (about both AI & geopolitics) has come up several times.

It is clear that AI Infra is a sovereign responsibility (hence IndiaAI Mission) and a hyperscaler opportunity (due to CAPEX requirements)

There are few deep pocketed & risk taking Indian conglomerates who can pursue this opportunity - RIL & Bharti Enterprises are two frontrunners here - expecting to see a LOT more in the next 18-24 months! Will write about the AI efforts from Bharti Enterprises in the coming days too!

Discl: Views are my own. Not an endorsement or promotion. Family & affiliates are shareholders of RIL.

It is clear that AI Infra is a sovereign responsibility (hence IndiaAI Mission) and a hyperscaler opportunity (due to CAPEX requirements)

There are few deep pocketed & risk taking Indian conglomerates who can pursue this opportunity - RIL & Bharti Enterprises are two frontrunners here - expecting to see a LOT more in the next 18-24 months! Will write about the AI efforts from Bharti Enterprises in the coming days too!

Discl: Views are my own. Not an endorsement or promotion. Family & affiliates are shareholders of RIL.

• • •

Missing some Tweet in this thread? You can try to

force a refresh