In India, millions chase thousands of seats in elite institutions like IITs, IIMs, AIIMS. This brutal competition created the perfect opportunity for PhysicsWallah, from scrappy YouTube channel to ₹3,820 crore IPO filing. Here's how they built an edtech empire 🧵👇

India's ₹15 lakh crore education market breaks down into clear segments. K-12 dominates with over half the market, serving 37 crore school children. Higher education handles formal degrees, while test prep operates as a parallel industry unlocking competitive exam success.

The final segment, upskilling, is rapidly growing as working professionals need job-ready skills. But one theme runs deep across all segments, fragmentation. India's education market remains dominated by standalone institutions with limited franchise networks.

This contrasts sharply with the US, where public schools alone account for 76% of K-12. A consolidated system drives efficiency and scale, though whether it leads to better societal outcomes remains debatable. India's slow consolidation is clearest in test-prep.

For decades, coaching was dominated by small local centres. Now national players like PhysicsWallah snap up regional brands, standardise delivery, and scale offline networks. This consolidation has been the core investment thesis for most edtech startups.

Operating in India's education market offers different approaches. Go direct-to-student (B2C) through digital platforms or brick-and-mortar centres, or choose B2B routes with schools and corporates. Delivery modes range from traditional offline to fully online to hybrid models.

Regardless of model choice, building a strong education business requires mastering four fundamentals. First, figure out scale, education is one-to-many where costs shouldn't rise in step with revenues. This is the real key to making profits.

Second, keep customer acquisition costs in check. In education, word-of-mouth is powerful. Build an engaged community and students start marketing you to friends, keeping organic growth expenses controlled while driving sustainable expansion.

Third, the secret sauce is always great teachers. Platforms live or die on whether students feel engaged and understood. Good teachers build trust and keep learners coming back, making them the most critical component of any education business.

Finally, know who you're building for. A low-cost online package caters to one type of student, a high-priced offline centre to another. Each choice defines the boundaries of your addressable market and determines business model viability.

PW's story starts with engineering dropout Alakh Pandey, deeply unhappy with college teaching methods. He began teaching physics in small Allahabad coaching centres, then uploaded free lectures to his YouTube channel PhysicsWallah in 2016, a decision that became a force multiplier.

Curious students came for clarity, stayed, and spread the word. The channel gained traction, grew into millions of followers, ventured beyond physics. By 2018 it became an app, by 2020 the hustle formalised into a registered edtech company with Pandey as the face.

Today PW is a B2C powerhouse offering test-prep across every delivery method. Online students access live lectures, recorded sessions, doubt-solving through the website (2018) or app (2020). This low-cost, high-scale model first put PW on the map.

But PW diversified heavily into offline, mirroring industry trends. Offline channels have much higher ARPU, resulting in fatter margins. Pandey claimed the company would open "as many offline centres as it can" in FY25, even if it eats into profits.

The shift shows in numbers, what was a 60:40 revenue split favouring online two years ago is now almost 50:50. PW built two physical centre types: PW Vidyapeeths (large coaching hubs in tier-1/2 cities) and PW Paathshaala (smaller setups for tier-3/4 towns).

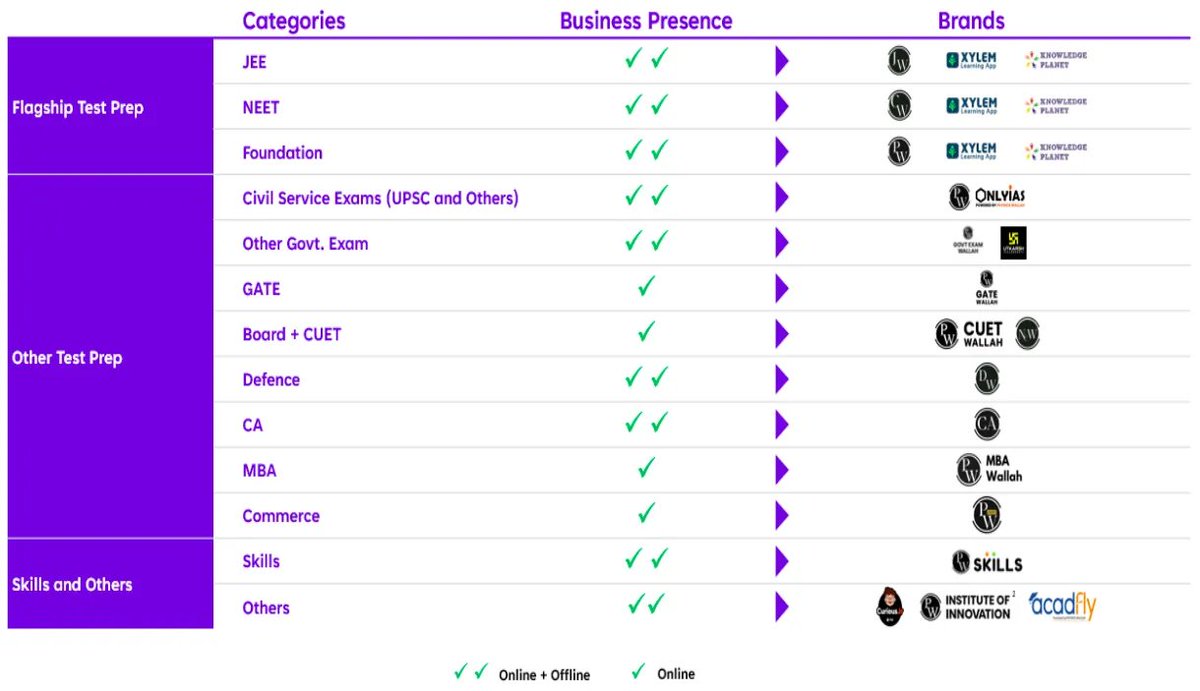

Diversification extended beyond delivery channels. Starting with NEET and JEE, PW replicated its playbook for post-graduate non-science exams like CAT and UPSC. Within 2 years, NEET and JEE's share in user-base fell by nearly half to 35% as other subjects increased.

Growth across channels and categories was powered by acquisition sprees starting 2022. iNeuron (online IT skilling) failed, forcing loss booking. OnlyIAS captured UPSC test-prep. Xylem Learning (2024) gave strong South India presence through multilingual capabilities. Put together, these deals show a clear strategy: go deeper into competitive exams, diversify into skilling, and expand offline across India.

Despite diversification, PW retained its YouTube channel soul. About 95% of 46 million students first signed up online. Cofounder Prateek Maheshwari calls it the 3C principle: content, community, commerce. Nail the first two, and the third follows naturally.

The funnel is real, about 70% of offline students had already engaged online before joining centres. Marketing eats 10% of revenue, moderate for an industry where ad spends spiral. Fun fact: ~23% of new IPO money will specifically target marketing efforts.

Teachers are the biggest cost at over 55% of revenue, whether booked under employee benefits or professional fees. Attrition runs 25-35% annually. In March 2023, five JEE/NEET faculty left for rivals. January 2024 saw eleven GATE faculty defect to competitors.

Revenue hit ₹2,887 crore in FY25, up 49% year-on-year. Offline contributed ₹1,352 crore vs just ₹281 crore two years prior. But costs grew nearly as fast, employee expenses rose 21% to ₹1,401 crore, advertising jumped 41% to ₹276 crore.

Despite losses, the IPO story is compelling. ₹3,820 crore raise: ₹3,100 crore fresh equity, ₹720 crore founder exit (₹360 crore each). External investors WestBridge, GSV, Lightspeed, Hornbill staying put. Fresh money targets offline expansion, South India growth via Xylem, server capacity.

India's brutal university system creates millions chasing few reputed seats. PW went from YouTube channel to listed education empire, a rare feat. The IPO will be market's verdict, is this the next great Indian education story or ambitious coaching company riding on hype?

We cover this and one more interesting story in today's edition of The Daily Brief. Watch on YouTube, read on Substack, or listen on Spotify, Apple Podcasts, or wherever you get your podcasts.

All links here:thedailybrief.zerodha.com/p/from-a-youtu…

All links here:thedailybrief.zerodha.com/p/from-a-youtu…

• • •

Missing some Tweet in this thread? You can try to

force a refresh