💳 Times Black ICICI Bank vs ICICI Emeralde Private Metal Credit Card.

Two of ICICI’s most premium credit cards.

Both come with travel, lifestyle, and luxury perks — but with very different structures.

Here’s a detailed breakdown🧵👇

Two of ICICI’s most premium credit cards.

Both come with travel, lifestyle, and luxury perks — but with very different structures.

Here’s a detailed breakdown🧵👇

💰 Annual Fees & Waivers

Times Black: ₹20,000 + GST

Waived on spends of ₹25,00,000 in an anniversary year

Emeralde Private: ₹12,499 + GST

Waived on spends of ₹10,00,000 in an anniversary year

Times Black: ₹20,000 + GST

Waived on spends of ₹25,00,000 in an anniversary year

Emeralde Private: ₹12,499 + GST

Waived on spends of ₹10,00,000 in an anniversary year

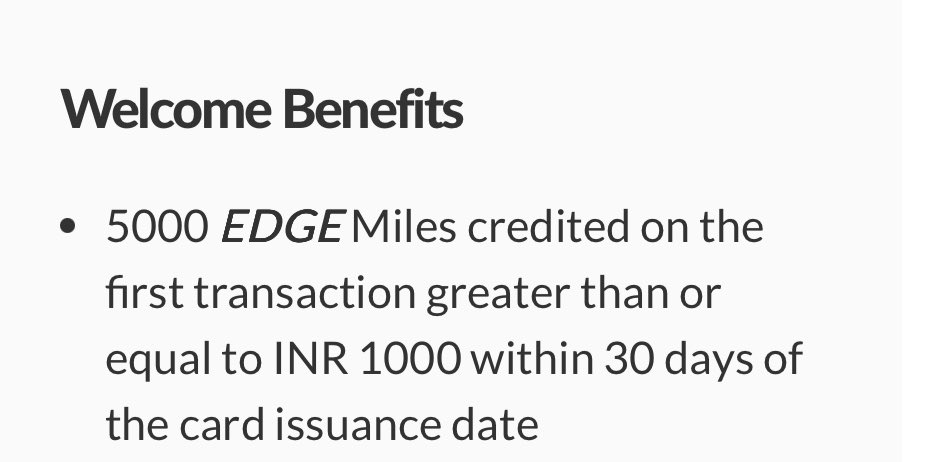

🎁 Welcome Benefits

Times Black:

₹10,000 EaseMyTrip voucher or ₹12,000 Lohono stays voucher

Travel Visa services worth ₹10,000 (Atlys/OneVasco)

Emeralde Private:

Complimentary 1-year Taj Epicure membership (includes 1 free night & other perks)

Complimentary 12-month EazyDiner Prime membership

12,500 bonus reward points on joining

Times Black:

₹10,000 EaseMyTrip voucher or ₹12,000 Lohono stays voucher

Travel Visa services worth ₹10,000 (Atlys/OneVasco)

Emeralde Private:

Complimentary 1-year Taj Epicure membership (includes 1 free night & other perks)

Complimentary 12-month EazyDiner Prime membership

12,500 bonus reward points on joining

🏆 Rewards Structure:

Times Black:

2 RP per ₹100 base rewards on spends

2.5% reward points on international spends (forex markup 1.49%)

iShop accelerated rewards:

Flights – 12 RP/₹100

Hotels – 24 RP/₹100

Vouchers – 12 RP/₹100

Reward Caps: 8,000 RP daily, 15,000 RP monthly

Times Black:

2 RP per ₹100 base rewards on spends

2.5% reward points on international spends (forex markup 1.49%)

iShop accelerated rewards:

Flights – 12 RP/₹100

Hotels – 24 RP/₹100

Vouchers – 12 RP/₹100

Reward Caps: 8,000 RP daily, 15,000 RP monthly

Emeralde Private:

6 RP per ₹200 on base rewards on spends

iShop accelerated rewards:

Flights – 36 RP/₹200

Hotels – 72 RP/₹200

Vouchers – 36 RP/₹200

Caps: 10,000 RP daily, 18,000 RP monthly

6 RP per ₹200 on base rewards on spends

iShop accelerated rewards:

Flights – 36 RP/₹200

Hotels – 72 RP/₹200

Vouchers – 36 RP/₹200

Caps: 10,000 RP daily, 18,000 RP monthly

💱 Reward Redemption:

Both Cards Offer,

Flights: 1 RP = ₹1 (up to 95% of booking value)

Hotels: 1 RP = ₹1 (up to 90% of booking value)

Luxury brand vouchers – 1 RP = upto ₹1

Statement credit – 1 RP = ₹0.40

Transfer to Air India Maharaja Club (1:1)

Both Cards Offer,

Flights: 1 RP = ₹1 (up to 95% of booking value)

Hotels: 1 RP = ₹1 (up to 90% of booking value)

Luxury brand vouchers – 1 RP = upto ₹1

Statement credit – 1 RP = ₹0.40

Transfer to Air India Maharaja Club (1:1)

🚨Currently, there are virtually no broad hotel or airline transfer partners on either cards. Air India is the only airline partner, but more partners are rumoured to come soon — which could make these cards much more rewarding in the future.

🎯 Milestone Benefits

Times Black:

₹2L spend – Voucher worth ₹10,000

₹5L spend – Luxury airport transfer (sedan/helicopter) or 10 WeWork passes (Only one of the above)

₹10L spend – Tata CliQ Luxury voucher worth ₹10,000

₹20L spend – Complimentary stay at Ayatana Resorts or Lohono worth ₹20,000

Emeralde Private:

₹4L spend – EaseMyTrip voucher worth ₹3,000

₹8L spend – EaseMyTrip voucher worth ₹3,000

Times Black:

₹2L spend – Voucher worth ₹10,000

₹5L spend – Luxury airport transfer (sedan/helicopter) or 10 WeWork passes (Only one of the above)

₹10L spend – Tata CliQ Luxury voucher worth ₹10,000

₹20L spend – Complimentary stay at Ayatana Resorts or Lohono worth ₹20,000

Emeralde Private:

₹4L spend – EaseMyTrip voucher worth ₹3,000

₹8L spend – EaseMyTrip voucher worth ₹3,000

✈️ Travel Benefits:

Both cards offer unlimited domestic airport lounge access for both pimary and add-on cardholders

Unlimited international lounge access with complimentary Priority Pass membership.

Forex markup:

Times Black – 1.49%

Emeralde Private – 2%

Both cards offer unlimited domestic airport lounge access for both pimary and add-on cardholders

Unlimited international lounge access with complimentary Priority Pass membership.

Forex markup:

Times Black – 1.49%

Emeralde Private – 2%

🍷 Lifestyle Benefits:

Times Black:

Access to The Quorum Club and its events

20% dining discount at premium restaurants (e.g., Café Reed, Zila, 689)

Complimentary Zomato Gold membership

Toni & Guy voucher worth ₹3,000

Interflora voucher worth ₹1,000

Times Black:

Access to The Quorum Club and its events

20% dining discount at premium restaurants (e.g., Café Reed, Zila, 689)

Complimentary Zomato Gold membership

Toni & Guy voucher worth ₹3,000

Interflora voucher worth ₹1,000

Emeralde Private:

Unlimited complimentary golf rounds and lessons each month

Buy-one-get-one on movies, theatre, concerts, sports via BookMyShow (up to ₹750, twice a month)

Taj Epicure membership with exclusive dining and stay perks

Unlimited complimentary golf rounds and lessons each month

Buy-one-get-one on movies, theatre, concerts, sports via BookMyShow (up to ₹750, twice a month)

Taj Epicure membership with exclusive dining and stay perks

🪪 Add-on Cards

•Times Black: Add-on cards are chargeable at ₹3,500 + GST annually

•Emeralde Private: Add-on cards are free of cost

•Times Black: Add-on cards are chargeable at ₹3,500 + GST annually

•Emeralde Private: Add-on cards are free of cost

ℹ️ The Times Black ICICI Bank Credit Card offers multiple lifestyle benefits that change from time to time.

For the most up-to-date offers, always check the official website: timesblack.com

For the most up-to-date offers, always check the official website: timesblack.com

📌 Summary:

Both cards offer strong premium benefits.

•Emeralde Private stands out with higher accelerated rewards on the iShop portal, but it is a bit difficult to get.

•Times Black is easier to access and still comes packed with milestone rewards, lifestyle benefits, and global lounge access — making it a solid alternative.

Both cards offer strong premium benefits.

•Emeralde Private stands out with higher accelerated rewards on the iShop portal, but it is a bit difficult to get.

•Times Black is easier to access and still comes packed with milestone rewards, lifestyle benefits, and global lounge access — making it a solid alternative.

💬 Want to discuss more on premium cards & rewards?

Join our Credit Card & Finance India community to connect with like-minded members.

x.com/i/communities/…

Join our Credit Card & Finance India community to connect with like-minded members.

x.com/i/communities/…

✨ If you enjoyed this thread and found it useful:

👍 Like to support

🔁 Retweet to share with others

💬 Comment your thoughts or questions

👤 Follow @amazingcreditc for more deep dives on credit cards & rewards

👍 Like to support

🔁 Retweet to share with others

💬 Comment your thoughts or questions

👤 Follow @amazingcreditc for more deep dives on credit cards & rewards

https://twitter.com/amazingcreditc/status/1965421329316024625

@threadreaderapp unroll

• • •

Missing some Tweet in this thread? You can try to

force a refresh