There it is:

The US Labor Department just revised -911,000 jobs out of 12 months of already reported data, the largest revision in history.

This is officially ABOVE 2009 levels, with jobs data overstated by ~76,000 PER MONTH.

What's next? Let us explain.

(a thread)

The US Labor Department just revised -911,000 jobs out of 12 months of already reported data, the largest revision in history.

This is officially ABOVE 2009 levels, with jobs data overstated by ~76,000 PER MONTH.

What's next? Let us explain.

(a thread)

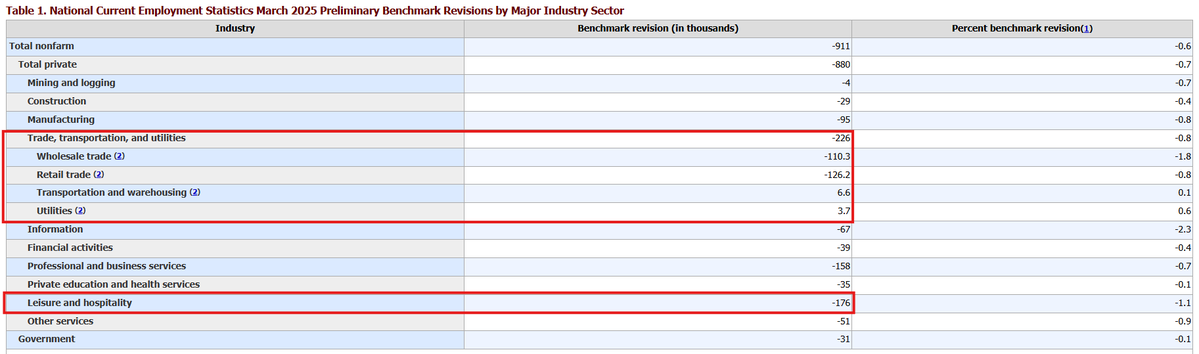

Here's the data itself.

We are seeing large revisions in consumer-oriented categories.

This includes -176,000 jobs in Leisure and Hospitality, and -226,000 jobs in Trade, Transportation, and Utilities.

Total private hiring was overstated by a massive -880,000 jobs.

We are seeing large revisions in consumer-oriented categories.

This includes -176,000 jobs in Leisure and Hospitality, and -226,000 jobs in Trade, Transportation, and Utilities.

Total private hiring was overstated by a massive -880,000 jobs.

This now marks the largest revision in history, even above 2009 levels.

In 2009, the US revised -902,000 jobs out of 12 months of already reported data.

We are now seeing revisions that are larger than the largest financial crisis outside of the US Great Depression.

In 2009, the US revised -902,000 jobs out of 12 months of already reported data.

We are now seeing revisions that are larger than the largest financial crisis outside of the US Great Depression.

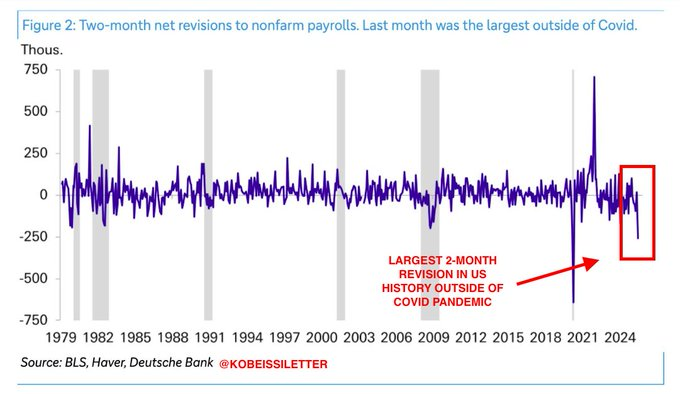

Last month, the US revised -258,000 jobs out of the June and May jobs report.

If you factor in the revisions from yesterday, June fell by another -27,000 jobs, for a total of -285,000.

This also marks the LARGEST negative 2-month net revision in US history, outside of 2020.

If you factor in the revisions from yesterday, June fell by another -27,000 jobs, for a total of -285,000.

This also marks the LARGEST negative 2-month net revision in US history, outside of 2020.

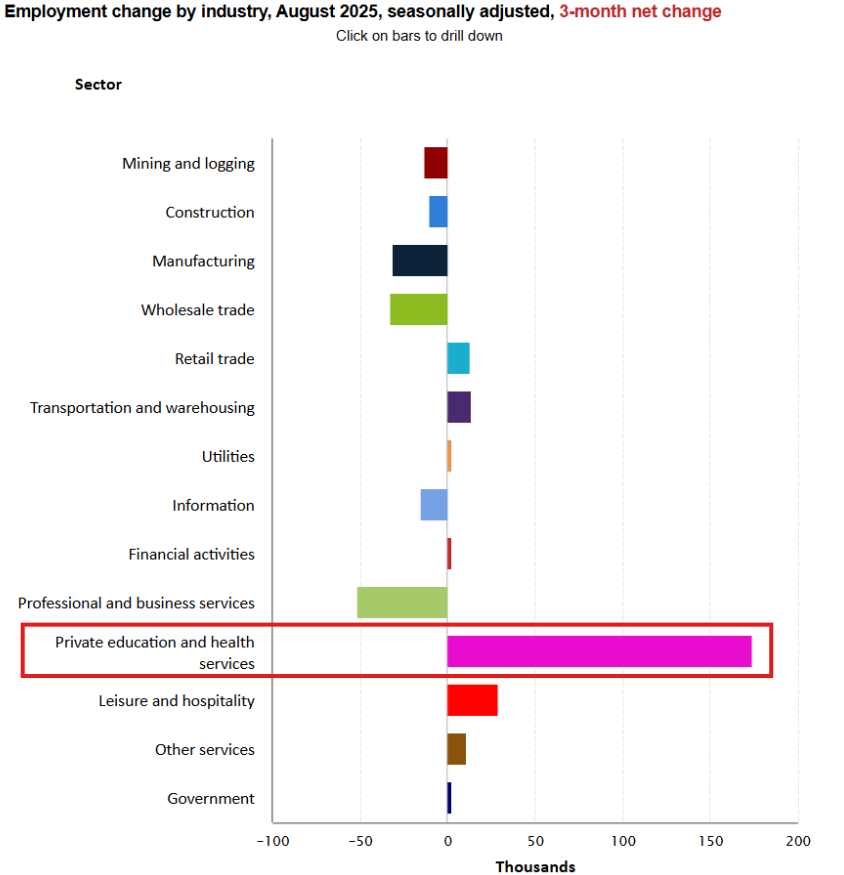

Furthermore, take a look at the data if you exclude health care.

Excluding health care, the US economy has lost -142,200 jobs over the last 4 months.

June 2025 was the first month in 4+ years to see a net loss of jobs after 2-consecutive monthly downward revisions.

Excluding health care, the US economy has lost -142,200 jobs over the last 4 months.

June 2025 was the first month in 4+ years to see a net loss of jobs after 2-consecutive monthly downward revisions.

In fact, the US Labor Market is entirely dependent on health care job gains.

Look at how many industries have LOST jobs in the past 3 months.

Business and professional services along with manufacturing have lost -82,000 jobs in 3 months.

This will likely be revised too.

Look at how many industries have LOST jobs in the past 3 months.

Business and professional services along with manufacturing have lost -82,000 jobs in 3 months.

This will likely be revised too.

Take a look at gold this year, now officially up more than +40%.

Gold miners are now up nearly 100% YTD, or ~10 TIMES the S&P 500's return.

Weakness in the labor market is not new to gold, this has been priced-in for months now.

Gold knows the Fed will be forced to cut rates.

Gold miners are now up nearly 100% YTD, or ~10 TIMES the S&P 500's return.

Weakness in the labor market is not new to gold, this has been priced-in for months now.

Gold knows the Fed will be forced to cut rates.

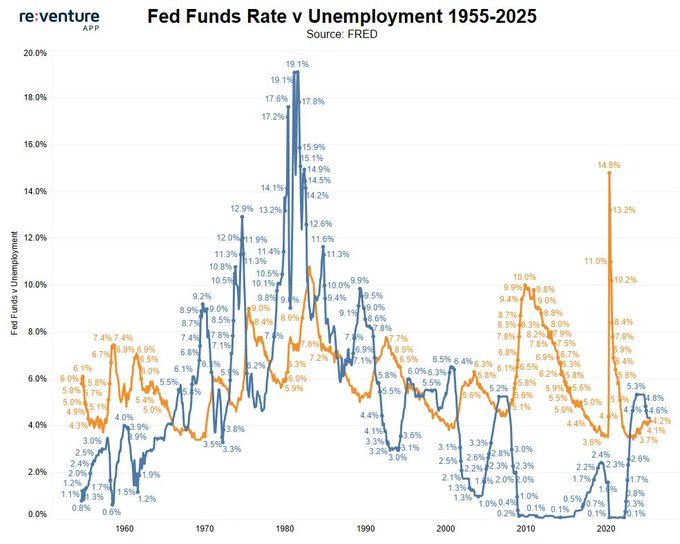

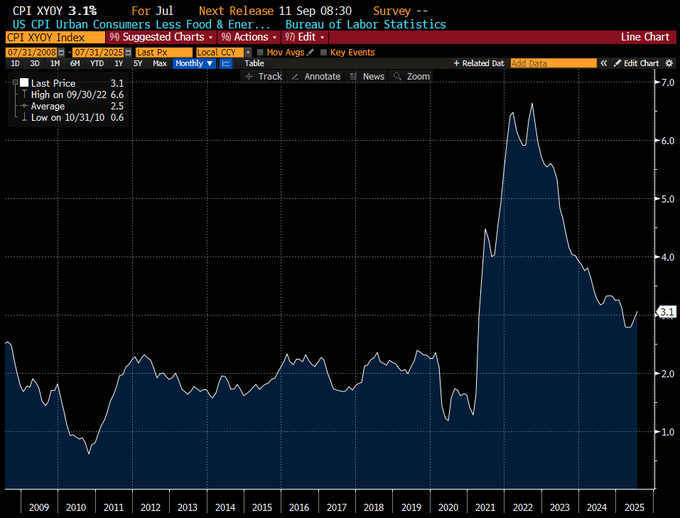

The Fed's purpose is to reduce unemployment and avoid inflation/deflation.

This is the Fed's "dual mandate."

Since 2021, the Fed has been laser-focused on the inflation side of this mandate.

Now, it's not that inflation is gone, it's just that the labor market is worse.

This is the Fed's "dual mandate."

Since 2021, the Fed has been laser-focused on the inflation side of this mandate.

Now, it's not that inflation is gone, it's just that the labor market is worse.

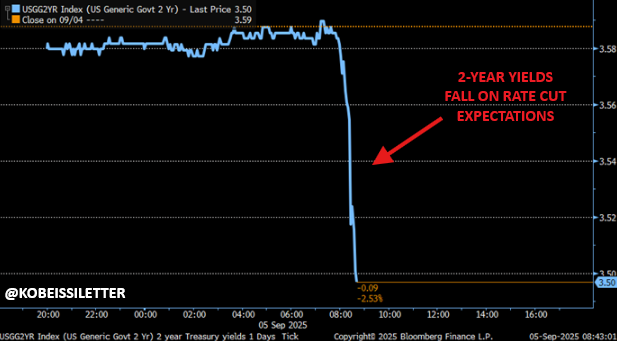

In 8 days, we expect the Fed to cut rates by 25 basis points.

This will mark the first Fed rate cut in 30+ years with PCE inflation at or above 2.9%.

The Fed will be cutting rates into hot inflation because the labor market is weak.

Asset owners will reap the rewards.

This will mark the first Fed rate cut in 30+ years with PCE inflation at or above 2.9%.

The Fed will be cutting rates into hot inflation because the labor market is weak.

Asset owners will reap the rewards.

Because inflation is on the rise, the Fed will take a "dovish but cautious" tone.

Core CPI inflation is back above 3.0% and never neared the Fed's 2.0% target.

This will be the first rate cut in history with stocks at record highs, Core CPI at 3.0%+, and GDP growth at 3.0%+.

Core CPI inflation is back above 3.0% and never neared the Fed's 2.0% target.

This will be the first rate cut in history with stocks at record highs, Core CPI at 3.0%+, and GDP growth at 3.0%+.

The market is entering a new era of monetary policy.

The macroeconomy is shifting and its implications on stocks, commodities, bonds, and crypto are investable.

Want to see our outlook on the market?

Subscribe to access our premium analysis below:

thekobeissiletter.com/subscribe

The macroeconomy is shifting and its implications on stocks, commodities, bonds, and crypto are investable.

Want to see our outlook on the market?

Subscribe to access our premium analysis below:

thekobeissiletter.com/subscribe

Today's BLS revision came in nearly -230,000 jobs worse than expected.

This 12-month revision of -911,000 jobs is more than the entire population of San Francisco, CA.

Interest rate cuts are coming next.

Follow us @KobeissiLetter for real time analysis as this develops.

This 12-month revision of -911,000 jobs is more than the entire population of San Francisco, CA.

Interest rate cuts are coming next.

Follow us @KobeissiLetter for real time analysis as this develops.

• • •

Missing some Tweet in this thread? You can try to

force a refresh