Urban Company is coming up with a ₹1,900 crore IPO.

It will be the first-of-its-kind listed business in India.

Is it worth investing in?

Let’s find out. A🧵

It will be the first-of-its-kind listed business in India.

Is it worth investing in?

Let’s find out. A🧵

We will cover 5 key aspects in this analysis:

- Business Model of Urban Company

- Financials

- Valuations

- Key IPO details

- Strengths and challenges

Let’s start.

- Business Model of Urban Company

- Financials

- Valuations

- Key IPO details

- Strengths and challenges

Let’s start.

𝟏. 𝐁𝐔𝐒𝐈𝐍𝐄𝐒𝐒 𝐌𝐎𝐃𝐄𝐋

Urban Company makes money in 3 ways:

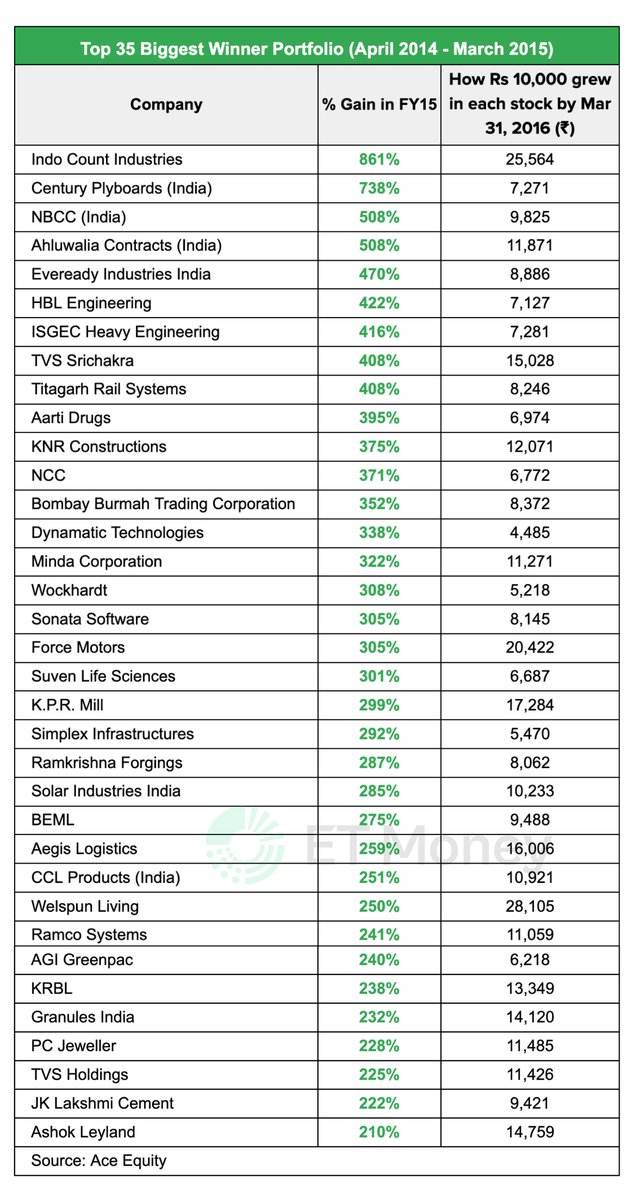

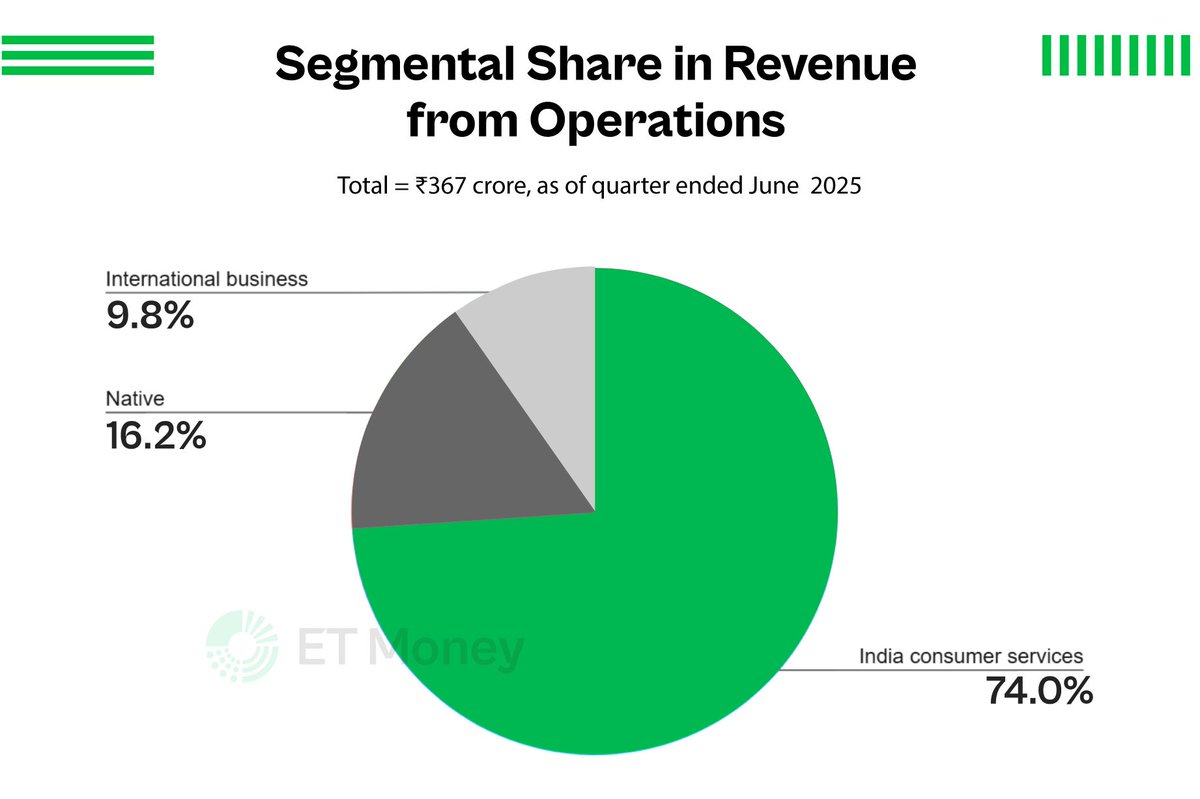

𝐀. 𝐈𝐧𝐝𝐢𝐚𝐧 𝐂𝐨𝐧𝐬𝐮𝐦𝐞𝐫 𝐒𝐞𝐫𝐯𝐢𝐜𝐞𝐬 (𝟕𝟒% 𝐫𝐞𝐯𝐞𝐧𝐮𝐞): Cleaning, pest control, electrician, plumbing, carpentry, painting, skincare, hair grooming, massage therapy, and more

Urban Company makes money in 3 ways:

𝐀. 𝐈𝐧𝐝𝐢𝐚𝐧 𝐂𝐨𝐧𝐬𝐮𝐦𝐞𝐫 𝐒𝐞𝐫𝐯𝐢𝐜𝐞𝐬 (𝟕𝟒% 𝐫𝐞𝐯𝐞𝐧𝐮𝐞): Cleaning, pest control, electrician, plumbing, carpentry, painting, skincare, hair grooming, massage therapy, and more

𝐁. 𝐍𝐚𝐭𝐢𝐯𝐞 (𝟏𝟔% 𝐫𝐞𝐯𝐞𝐧𝐮𝐞): Sells water purifiers and electronic doorlocks

𝐂. 𝐈𝐧𝐭𝐞𝐫𝐧𝐚𝐭𝐢𝐨𝐧𝐚𝐥 𝐁𝐮𝐬𝐢𝐧𝐞𝐬𝐬 (𝟏𝟎% 𝐫𝐞𝐯𝐞𝐧𝐮𝐞): Services in the UAE, Singapore, and the Kingdom of Saudi Arabia

𝐂. 𝐈𝐧𝐭𝐞𝐫𝐧𝐚𝐭𝐢𝐨𝐧𝐚𝐥 𝐁𝐮𝐬𝐢𝐧𝐞𝐬𝐬 (𝟏𝟎% 𝐫𝐞𝐯𝐞𝐧𝐮𝐞): Services in the UAE, Singapore, and the Kingdom of Saudi Arabia

𝟐. 𝐅𝐈𝐍𝐀𝐍𝐂𝐈𝐀𝐋𝐒

The financials show a strong turnaround in the business.

In the last two years, revenue and profits have shown impressive growth.

Even margins saw an improvement from FY23.

Also, the company is debt-free and has positive cash flows in FY25.

The financials show a strong turnaround in the business.

In the last two years, revenue and profits have shown impressive growth.

Even margins saw an improvement from FY23.

Also, the company is debt-free and has positive cash flows in FY25.

To study company financials, you can visit the 𝐄𝐓 𝐌𝐨𝐧𝐞𝐲 website or log in to the app.

Under the 𝐬𝐭𝐨𝐜𝐤𝐬 𝐬𝐞𝐜𝐭𝐢𝐨𝐧, you get a whole host of data 𝐢𝐧 𝐨𝐧𝐞 𝐩𝐥𝐚𝐜𝐞.

You can look at financials, comparison with peers, technicals, key metrics, and a lot more.

Under the 𝐬𝐭𝐨𝐜𝐤𝐬 𝐬𝐞𝐜𝐭𝐢𝐨𝐧, you get a whole host of data 𝐢𝐧 𝐨𝐧𝐞 𝐩𝐥𝐚𝐜𝐞.

You can look at financials, comparison with peers, technicals, key metrics, and a lot more.

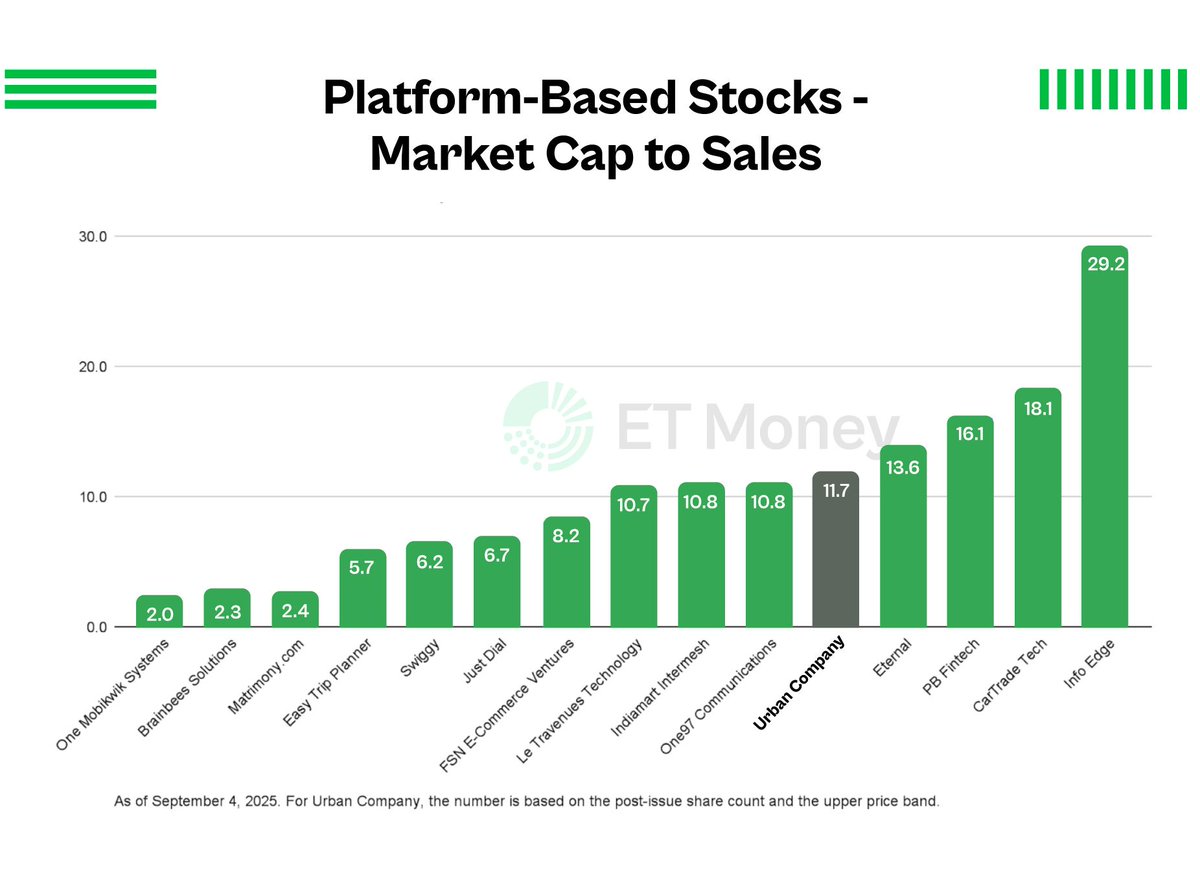

𝟑. 𝐇𝐎𝐖 𝐄𝐗𝐏𝐄𝐍𝐒𝐈𝐕𝐄 𝐈𝐒 𝐔𝐑𝐁𝐀𝐍 𝐂𝐎𝐌𝐏𝐀𝐍𝐘 𝐕𝐒 𝐏𝐄𝐄𝐑𝐒?

There are no direct listed competitors.

We have compared UC with major listed tech platforms using the Price-to-Sales Ratio.

Price to Sales = Market Cap ÷ Sales

The IPO appears to be overpriced.

There are no direct listed competitors.

We have compared UC with major listed tech platforms using the Price-to-Sales Ratio.

Price to Sales = Market Cap ÷ Sales

The IPO appears to be overpriced.

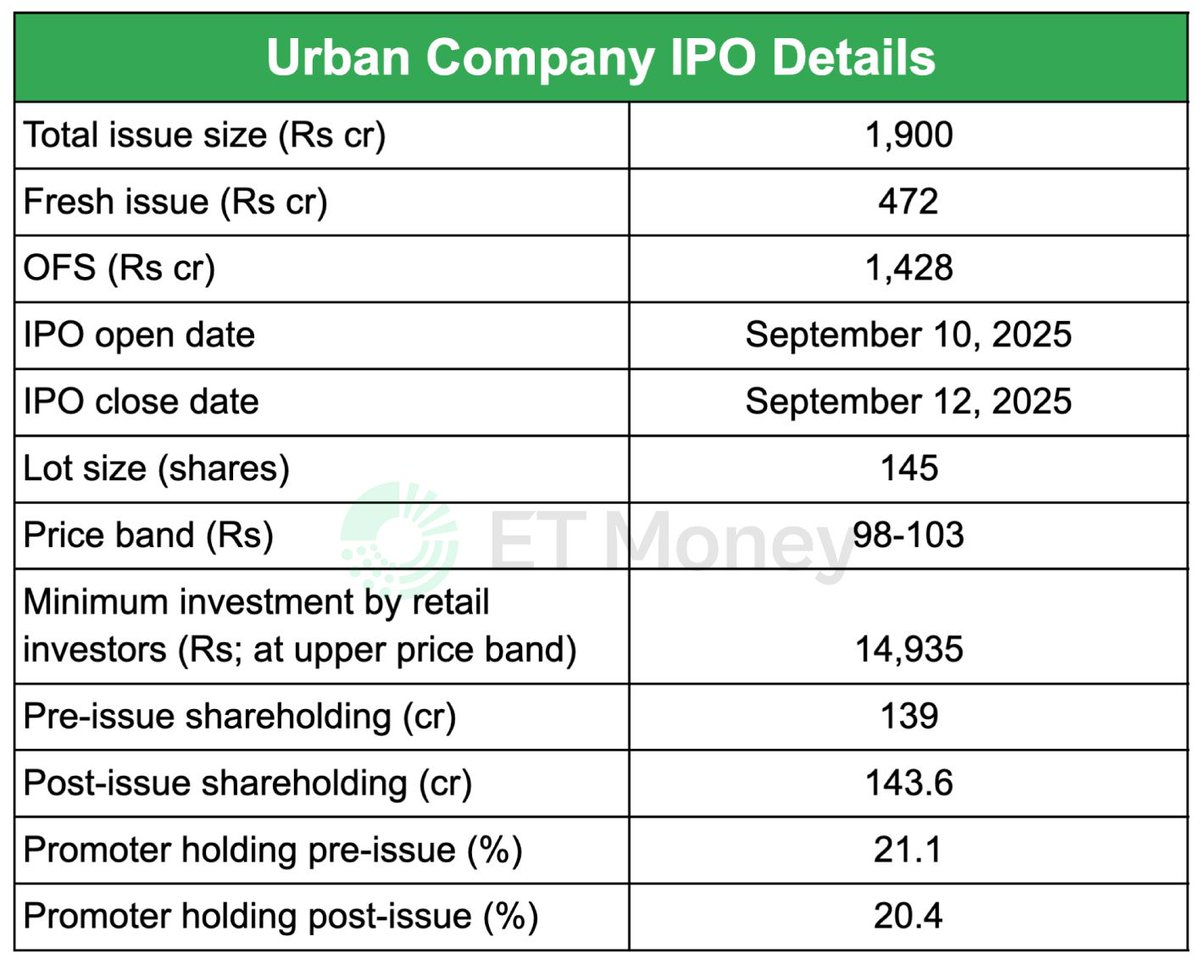

𝟒. 𝐊𝐄𝐘 𝐈𝐏𝐎 𝐃𝐄𝐓𝐀𝐈𝐋𝐒

The Company is raising ₹1,900 Cr via IPO.

Of this, only ₹472 Cr is fresh capital for the company.

The remaining ₹1,428 Cr is an Offer for Sale (OFS), which means existing shareholders are selling their shares.

Here are other key details. 👇

The Company is raising ₹1,900 Cr via IPO.

Of this, only ₹472 Cr is fresh capital for the company.

The remaining ₹1,428 Cr is an Offer for Sale (OFS), which means existing shareholders are selling their shares.

Here are other key details. 👇

𝟓. 𝐒𝐓𝐑𝐄𝐍𝐆𝐓𝐇𝐒 𝐀𝐍𝐃 𝐂𝐎𝐍𝐂𝐄𝐑𝐍𝐒

𝐏𝐨𝐬𝐢𝐭𝐢𝐯𝐞𝐬

The company is growing fast and has ample headroom for growth.

It is debt-free and turned profitable in FY25.

𝐏𝐨𝐬𝐢𝐭𝐢𝐯𝐞𝐬

The company is growing fast and has ample headroom for growth.

It is debt-free and turned profitable in FY25.

𝐍𝐞𝐠𝐚𝐭𝐢𝐯𝐞𝐬

The competition from offline service providers and the unorganised space is immense, and the entry barriers in this segment are low.

The valuations appear to be expensive from the perspective of other tech-based platform stocks.

The competition from offline service providers and the unorganised space is immense, and the entry barriers in this segment are low.

The valuations appear to be expensive from the perspective of other tech-based platform stocks.

𝐖𝐢𝐥𝐥 𝐲𝐨𝐮 𝐢𝐧𝐯𝐞𝐬𝐭 𝐢𝐧 𝐭𝐡𝐢𝐬 𝐈𝐏𝐎?

- Yes

- No

- Yes

- No

If you find this useful, show some love. ❤️

Please like, share, and retweet the first tweet.

Please like, share, and retweet the first tweet.

https://x.com/ETMONEY/status/1965442938562867691

• • •

Missing some Tweet in this thread? You can try to

force a refresh