Treasury auctions sound like "the market funding the government."

But peel back the layers, and you'll see: all primary auctions are settled with reserves created by the Fed.

A thread.

🧵1/13

But peel back the layers, and you'll see: all primary auctions are settled with reserves created by the Fed.

A thread.

🧵1/13

Every week, the Treasury issues new securities at auction.

Primary Dealers are OBLIGATED to bid. Indirect bidders (pension funds, foreign central banks, asset managers) now take 90% of the allocations.

🧵2/13

Primary Dealers are OBLIGATED to bid. Indirect bidders (pension funds, foreign central banks, asset managers) now take 90% of the allocations.

🧵2/13

But here's the key: all bids clear through Primary Dealers with accounts with the Fed.

Indirect bidders and some Primary Dealers don’t have accounts at the Fed. They place orders through dealers.

Settlement happens inside the Federal Reserve’s payment system.

🧵3/13

Indirect bidders and some Primary Dealers don’t have accounts at the Fed. They place orders through dealers.

Settlement happens inside the Federal Reserve’s payment system.

🧵3/13

Who can settle directly with the Fed?

Only institutions with Fed accounts: commercial banks and designated primary dealers (many of which are subsidiaries of big banks).

Only institutions with Fed accounts: commercial banks and designated primary dealers (many of which are subsidiaries of big banks).

When securities are issued, they're delivered into Fedwire Securities accounts.

Payment is debited from Fedwire Funds accounts, which are reserve balances at the Fed.

🧵5/13

Payment is debited from Fedwire Funds accounts, which are reserve balances at the Fed.

🧵5/13

So whether bids come from JPMorgan itself, or from BlackRock through JPMorgan as intermediary, final settlement is the same: a debit of reserves to the Treasury's account at the Fed.

🧵6/13

🧵6/13

"But aren’t most primary dealers non-banks?"

True, many are broker-dealer subsidiaries.

But they clear and settle through banks with reserve accounts (e.g. JPM, BNY Mellon).

No reserves, no settlement.

🧵7/13

True, many are broker-dealer subsidiaries.

But they clear and settle through banks with reserve accounts (e.g. JPM, BNY Mellon).

No reserves, no settlement.

🧵7/13

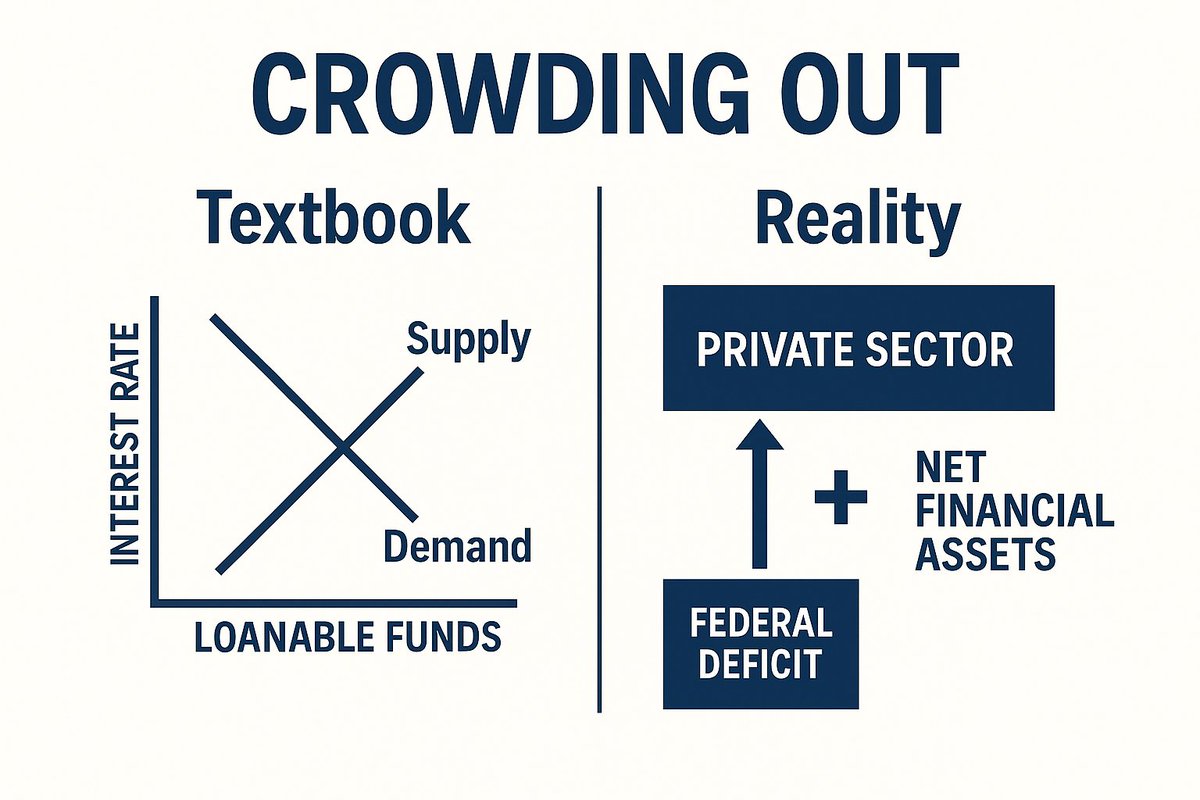

This is why saying "the market funds the government" is misleading.

Private bids are real, but the medium is reserves, and the Fed is the sole issuer of reserves.

🧵8/13

Private bids are real, but the medium is reserves, and the Fed is the sole issuer of reserves.

🧵8/13

Historically, the Treasury Tax & Loan program allowed some auction proceeds to sit in private banks temporarily.

But since 2008, with abundant reserves and interest on reserves, all auctions now settle directly in Fed balances.

🧵9/13

But since 2008, with abundant reserves and interest on reserves, all auctions now settle directly in Fed balances.

🧵9/13

So strip away the intermediaries:

–Dealers place bids

–Reserves are debited

–Treasury’s account at the Fed is credited

The Fed creates the balances that make this possible.

🧵10/13

–Dealers place bids

–Reserves are debited

–Treasury’s account at the Fed is credited

The Fed creates the balances that make this possible.

🧵10/13

Even when dealers repo or borrow to fund bids, they're still recycling reserves.

They can’t create them. Only the Fed can.

🧵11/13

They can’t create them. Only the Fed can.

🧵11/13

In other words: auctions are not the private sector "funding" government.

They're a reshuffling of Fed liabilities from dealer accounts to the Treasury’s account.

🧵12/13

They're a reshuffling of Fed liabilities from dealer accounts to the Treasury’s account.

🧵12/13

Once you see that, the picture changes:

Treasury issuance is settled in reserves, and reserves are a Fed monopoly.

The complexity obscures it, but the outcome is clear: the state funds itself nominally.

🧵13/13

patreon.com/c/relearningec…

Treasury issuance is settled in reserves, and reserves are a Fed monopoly.

The complexity obscures it, but the outcome is clear: the state funds itself nominally.

🧵13/13

patreon.com/c/relearningec…

• • •

Missing some Tweet in this thread? You can try to

force a refresh