🔋Battery Energy Storage System (BESS)

🔋Battery Energy Storage System: Storage capacity is projected to grow 12X by FY32

A detailed overview of growth plans and listed companies poised to benefit from India’s Battery Energy Storage System sector. 🧵👇

🔋Battery Energy Storage System: Storage capacity is projected to grow 12X by FY32

A detailed overview of growth plans and listed companies poised to benefit from India’s Battery Energy Storage System sector. 🧵👇

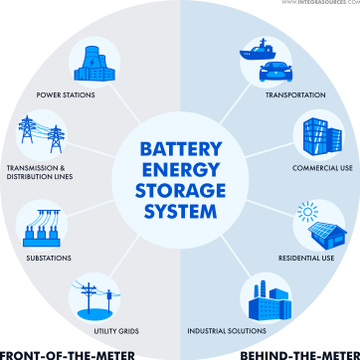

✍️Battery Energy Storage System:

🔹This is an advanced technological solution that allows energy storage in multiple ways for later use.

🔹Given the possibility that an energy supply can experience fluctuations due to weather, blackouts, or geopolitical reasons, battery systems are vital for utilities, businesses, and homes to achieve a continual power flow.

🔹This is an advanced technological solution that allows energy storage in multiple ways for later use.

🔹Given the possibility that an energy supply can experience fluctuations due to weather, blackouts, or geopolitical reasons, battery systems are vital for utilities, businesses, and homes to achieve a continual power flow.

🔹By combining battery energy storage with PV solutions, the batteries can mitigate the intermittent nature of renewable power by storing solar power produced during the day for nighttime use, thus guaranteeing a steady supply of power at all times.

🔶Types:

🔹“Behind-the-Meter” (BTM) systems, also known as small-scale battery storage, refer to residential-level solar PV installations and battery units located on the consumer's premises.

🔹These systems help reduce stress on the public grid by storing energy for use when solar power generation is not possible, such as during nighttime or cloudy weather.

🔹“Behind-the-Meter” (BTM) systems, also known as small-scale battery storage, refer to residential-level solar PV installations and battery units located on the consumer's premises.

🔹These systems help reduce stress on the public grid by storing energy for use when solar power generation is not possible, such as during nighttime or cloudy weather.

🔹“Front-of-the-Meter” (FTM) systems are located on the utility side of the energy distribution network. They include large-scale energy generation and storage facilities such as power plants, solar farms, and utility-scale battery storage systems.

🔹 These systems are primarily used to support grid stability, manage peak demand, and integrate renewable energy into the grid.

🔹 These systems are primarily used to support grid stability, manage peak demand, and integrate renewable energy into the grid.

✍️How the Battery Energy Storage System works:

🔹A Battery Energy Storage System (BESS) stores electricity from the grid or renewable sources like solar panels and releases it when needed.

🔹With AI and data-driven software, it smartly manages energy usage, balancing demand and supply. BESS supports renewable energy adoption, reduces carbon emissions, and can lower energy costs.

🔹A Battery Energy Storage System (BESS) stores electricity from the grid or renewable sources like solar panels and releases it when needed.

🔹With AI and data-driven software, it smartly manages energy usage, balancing demand and supply. BESS supports renewable energy adoption, reduces carbon emissions, and can lower energy costs.

✍️How BESS Flattens the Duck Curve:

🔹By FY32, rising solar generation will create midday oversupply and steep evening shortfalls. BESS provides the solution by storing surplus solar during the day and releasing it during evening peaks.

🔹By FY32, rising solar generation will create midday oversupply and steep evening shortfalls. BESS provides the solution by storing surplus solar during the day and releasing it during evening peaks.

🔶Key benefits include:

🔹Reduces renewable curtailment.

🔹Balances supply-demand mismatch.

🔹Provides grid stability and frequency regulation.

🔹Defers costly transmission and backup investments.

🔹Cuts fossil fuel dependence during peak hours.

🔹Reduces renewable curtailment.

🔹Balances supply-demand mismatch.

🔹Provides grid stability and frequency regulation.

🔹Defers costly transmission and backup investments.

🔹Cuts fossil fuel dependence during peak hours.

🔹Flexibility: Can be deployed anywhere, near demand centers.

🔹Growing EV Adoption: India’s expanding EV ecosystem is driving demand for BESS to support charging infrastructure and manage peak loads.

🔹Response Time: Ramp up in milliseconds, crucial for balancing fluctuations.

🔹Modular Design: Scalable from kW to GW levels.

🔹Multi-Use Applications: Frequency regulation, peak shifting, black-start capability, microgrid operations, and reduced curtailment of renewables.

🔹Growing EV Adoption: India’s expanding EV ecosystem is driving demand for BESS to support charging infrastructure and manage peak loads.

🔹Response Time: Ramp up in milliseconds, crucial for balancing fluctuations.

🔹Modular Design: Scalable from kW to GW levels.

🔹Multi-Use Applications: Frequency regulation, peak shifting, black-start capability, microgrid operations, and reduced curtailment of renewables.

✍️Market Size & Growth:

🔹India is undergoing a rapid transition towards renewable energy (RE), particularly solar and wind. By FY32, Variable Renewable Energy (VRE) generation is expected to triple, creating challenges for grid stability due to diurnal mismatch (the “duck curve”). BESS emerges as the dominant solution to smooth VRE supply, ensuring stability, reducing curtailment, and cutting fossil fuel reliance.

🔹India is undergoing a rapid transition towards renewable energy (RE), particularly solar and wind. By FY32, Variable Renewable Energy (VRE) generation is expected to triple, creating challenges for grid stability due to diurnal mismatch (the “duck curve”). BESS emerges as the dominant solution to smooth VRE supply, ensuring stability, reducing curtailment, and cutting fossil fuel reliance.

🔹Capacity Growth: BESS capacity is expected to grow 375x, from 0.1 GW in FY24 to 42 GW by FY32. PSPs will expand 4x to 19 GW in the same period.

🔹Investment Opportunity: The BESS ecosystem presents a ₹3.5 trillion funding opportunity by FY32, with an additional ₹800 billion medium-term boost from cell manufacturing capex. PSPs could attract investments worth ₹1.2 trillion.

🔹Policy Support: Government incentives like PLI for Advanced Cell Chemistry (55 GWh capacity), Viability Gap Funding (40% capital cost support), and Energy Storage Obligations (ESO) for DISCOMs provide strong tailwinds.

✍️Industry Drivers:

🔶Renewable Energy Growth

🔹India’s renewable capacity is projected to rise 2.5x between FY24 and FY30, led by solar PV and wind.

🔹As RE’s share in capacity and generation rises, grid variability increases since peak demand often occurs in the evening when solar output is minimal.

🔶Renewable Energy Growth

🔹India’s renewable capacity is projected to rise 2.5x between FY24 and FY30, led by solar PV and wind.

🔹As RE’s share in capacity and generation rises, grid variability increases since peak demand often occurs in the evening when solar output is minimal.

🔶Policy-Driven Push:

🔹Renewable Purchase Obligation (RPO): Rising from ~25% in FY25 to 40%+ in FY30.

🔹Energy Storage Obligation (ESO): Requires that a portion of DISCOMs’ RE purchases be linked to storage. At least 85% of stored energy must be procured from renewable sources.

🔹Renewable Purchase Obligation (RPO): Rising from ~25% in FY25 to 40%+ in FY30.

🔹Energy Storage Obligation (ESO): Requires that a portion of DISCOMs’ RE purchases be linked to storage. At least 85% of stored energy must be procured from renewable sources.

🔹Tender Evolution: Share of tenders with storage rose from 5% in FY20 to 23% in FY24. India has moved from plain RE projects to hybrid + ESS, Round-The-Clock (RTC), and Firm Dispatchable RE (FDRE) models.

✍️Indian government announcements on BESS (2025):

🔹VGF Scheme Expanded – ₹5,400 Cr support for 30 GWh BESS; 25 GWh across states, 5 GWh for NTPC; disbursement linked to COD.

🔹VGF Scheme Expanded – ₹5,400 Cr support for 30 GWh BESS; 25 GWh across states, 5 GWh for NTPC; disbursement linked to COD.

🔹This initiative complements an existing ₹3,700 crore incentive for 13.2 GWh of storage. The total investment is expected to reach ₹33,000 crore. The initiative aims to ensure a round-the-clock renewable energy supply and enhance grid stability.

🔹ISTS Waiver Extended – 100% waiver on transmission charges for BESS & pumped hydro till June 2028.

🔹ISTS Waiver Extended – 100% waiver on transmission charges for BESS & pumped hydro till June 2028.

🔹Domestic Manufacturing – 5 GWh/year BESS plant launched in Bengaluru (Lineage Power).

🔹Coal Plant Pilots – NTPC to deploy 1.7 GW BESS across 11 coal plants to balance solar surges.

🔹Delhi Project – South Asia’s largest 20 MW / 40 MWh BESS inaugurated at Kilokari.

🔹State-Level Push – Rajasthan allocated 4 GWh BESS with ₹720 Cr central support.

🔹Coal Plant Pilots – NTPC to deploy 1.7 GW BESS across 11 coal plants to balance solar surges.

🔹Delhi Project – South Asia’s largest 20 MW / 40 MWh BESS inaugurated at Kilokari.

🔹State-Level Push – Rajasthan allocated 4 GWh BESS with ₹720 Cr central support.

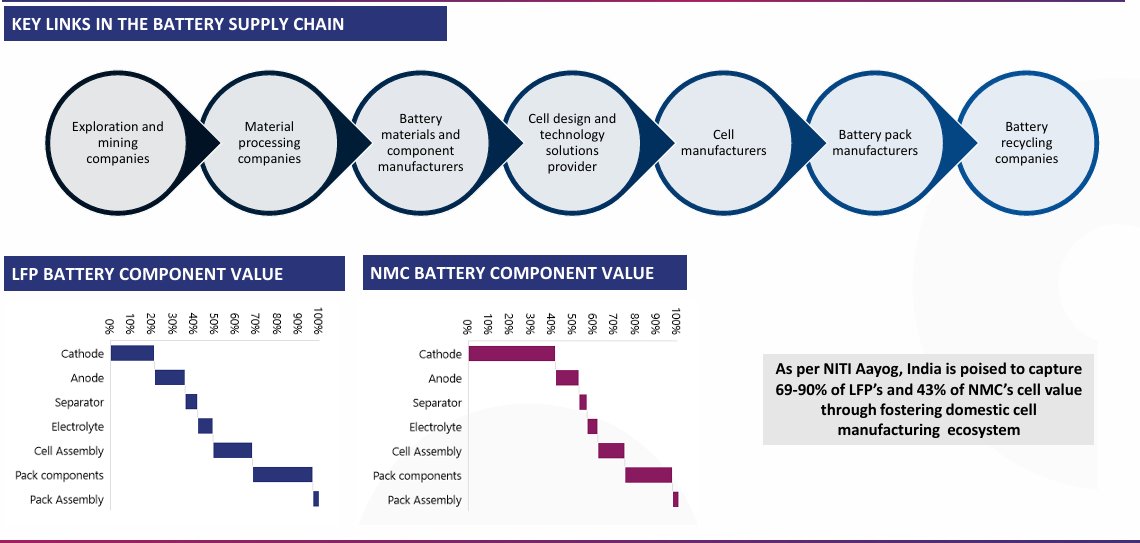

✍️Supply Chain & Ecosystem:

🔹Battery Chemistry Shift: From NMC (Nickel-Manganese-Cobalt) to LFP (Lithium Iron Phosphate) due to safety, cost, and life-cycle advantages for stationary storage.

🔹Battery Chemistry Shift: From NMC (Nickel-Manganese-Cobalt) to LFP (Lithium Iron Phosphate) due to safety, cost, and life-cycle advantages for stationary storage.

🔹Domestic Capex Announcements: Reliance, Ola, Exide, Amara Raja, GODI, JBM, among others, are committing to large-scale cell manufacturing.

🔹Upstream Ecosystem:

🔸Cathode: ₹50 bn investments announced.

🔸Anode: Plans to expand to 100,000 tonnes by 2028.

🔸Electrolytes & Separators: Large capacity expansion underway.

📌PLI Scheme: 55 GWh capacity, with a minimum 60% domestic value addition in 5 years.

🔹Upstream Ecosystem:

🔸Cathode: ₹50 bn investments announced.

🔸Anode: Plans to expand to 100,000 tonnes by 2028.

🔸Electrolytes & Separators: Large capacity expansion underway.

📌PLI Scheme: 55 GWh capacity, with a minimum 60% domestic value addition in 5 years.

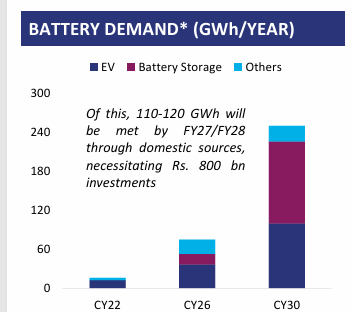

✍️Battery Demand Outlook (GWh/Year)

🔹India’s battery demand will rise from a negligible base in CY22 to 275–300 GWh annually by CY30, led by EVs and battery storage.

🔹EVs remain the largest driver.

🔹Battery Storage (BESS) emerges as the second-largest segment by 2030, reflecting rising renewable integration.

🔹India’s battery demand will rise from a negligible base in CY22 to 275–300 GWh annually by CY30, led by EVs and battery storage.

🔹EVs remain the largest driver.

🔹Battery Storage (BESS) emerges as the second-largest segment by 2030, reflecting rising renewable integration.

🔹Domestic Manufacturing: 110–120 GWh to be met by FY27/28, requiring ₹800 bn investments in gigafactories and supply chains.

📌 In short: Battery demand is set to explode, with EVs leading and BESS becoming a mainstream growth driver by 2030.

📌 In short: Battery demand is set to explode, with EVs leading and BESS becoming a mainstream growth driver by 2030.

✍️Here are the listed companies engaged in battery storage systems:

🔶Prostarm Info Systems Ltd:

🔹Prostarm Info Systems Ltd has won an LOA from KPTCL to set up a 150 MW/300 MWh BESS at Doni Substation, Gadag, on a 12-year BOO basis under TBCB with VGF support, ensuring ₹45.7 crore annual rental.

🔶Prostarm Info Systems Ltd:

🔹Prostarm Info Systems Ltd has won an LOA from KPTCL to set up a 150 MW/300 MWh BESS at Doni Substation, Gadag, on a 12-year BOO basis under TBCB with VGF support, ensuring ₹45.7 crore annual rental.

🔶ACME Solar Holdings Ltd:

🔹ACME Solar secured its first 550 MWh standalone BESS project with NHPC, marking its foray into pure storage contracts, and additionally placed a 2 GWh BESS order with Chuzhou Lishen (through POSCO International) for deployment across FDRE and standalone projects within the next 12–18 months.

🔹ACME Solar secured its first 550 MWh standalone BESS project with NHPC, marking its foray into pure storage contracts, and additionally placed a 2 GWh BESS order with Chuzhou Lishen (through POSCO International) for deployment across FDRE and standalone projects within the next 12–18 months.

🔶Oriana Power Ltd:

🔹The company entered the BESS space in 2024, securing 400 MW orders across four states and targeting 1 GW by FY26, while also offering solar + storage hybrid solutions to large consumers.

🔹The company entered the BESS space in 2024, securing 400 MW orders across four states and targeting 1 GW by FY26, while also offering solar + storage hybrid solutions to large consumers.

🔶JSW Energy Ltd:

🔹The company operates power generation assets across Karnataka, Maharashtra, Nandyal, and Salboni, and has a 500 MW/1 GWh BESS project awarded by SECI, which is currently under appeal at APTEL.

🔹The company operates power generation assets across Karnataka, Maharashtra, Nandyal, and Salboni, and has a 500 MW/1 GWh BESS project awarded by SECI, which is currently under appeal at APTEL.

🔶Sterling & Wilson Renewable Energy Ltd:

🔹The company has forayed into BESS and wind EPC, securing its first 127 MW AC solar-wind hybrid project along with a BESS contract from JSW.

🔹It aims to focus on solar EPC, BESS, and select wind projects, with its order book including a ~₹250 crore JSW BESS project.

🔹The company has forayed into BESS and wind EPC, securing its first 127 MW AC solar-wind hybrid project along with a BESS contract from JSW.

🔹It aims to focus on solar EPC, BESS, and select wind projects, with its order book including a ~₹250 crore JSW BESS project.

🔶Waaree Energies Ltd:

🔹The company is entering the battery storage space by developing lithium-ion storage cells and energy storage systems (BESS). It is setting up a 3.5 GWh battery plant with ₹2,073 Cr investment, expected to be operational by Q2 FY27, supporting solar and green hydrogen integration.

🔹The company is entering the battery storage space by developing lithium-ion storage cells and energy storage systems (BESS). It is setting up a 3.5 GWh battery plant with ₹2,073 Cr investment, expected to be operational by Q2 FY27, supporting solar and green hydrogen integration.

🔶NTPC Ltd:

🔹 The company is implementing a 500 kW solar-based off-grid power generation system, coupled with a 250 kW/1200 kWh BESS, to supply construction power for its ongoing solar project in the Khavda region, eliminating the need for DG sets.

🔹 The company is implementing a 500 kW solar-based off-grid power generation system, coupled with a 250 kW/1200 kWh BESS, to supply construction power for its ongoing solar project in the Khavda region, eliminating the need for DG sets.

🔶Amara Raja Energy & Mobility Ltd:

🔹The company installed its first Battery Energy Storage System (BESS) in the Commercial & Industrial (C&I) segment with a 389 kWh battery in Tamil Nadu and solarised over 25 health centres in Nagaland through OEM partners.

🔹The company installed its first Battery Energy Storage System (BESS) in the Commercial & Industrial (C&I) segment with a 389 kWh battery in Tamil Nadu and solarised over 25 health centres in Nagaland through OEM partners.

🔶SPML Infra Ltd:

🔹SPML Infra has entered the BESS segment through a tie-up with Energy Vault, setting up a 5 GW plant in Pune by FY28 with ~₹175 crore capex.

🔹SPML Infra has entered the BESS segment through a tie-up with Energy Vault, setting up a 5 GW plant in Pune by FY28 with ~₹175 crore capex.

🔶Cummins India Ltd

🔹Cummins India has launched advanced Battery Energy Storage Systems (BESS) under its Destination Zero strategy, integrating renewables with power infrastructure to support peak shaving, energy shifting, and reliability for sectors like manufacturing, data centers, commercial real estate, and mining.

🔹Cummins India has launched advanced Battery Energy Storage Systems (BESS) under its Destination Zero strategy, integrating renewables with power infrastructure to support peak shaving, energy shifting, and reliability for sectors like manufacturing, data centers, commercial real estate, and mining.

🔶Exide Industries Ltd:

🔹Exide Industries is expanding into lithium-ion cell manufacturing with a planned 12 GWh gigafactory in Bengaluru (₹60–70 bn capex), targeting both EVs and grid-scale BESS applications, alongside its leadership in lead-acid batteries.

🔹Exide Industries is expanding into lithium-ion cell manufacturing with a planned 12 GWh gigafactory in Bengaluru (₹60–70 bn capex), targeting both EVs and grid-scale BESS applications, alongside its leadership in lead-acid batteries.

🔶HBL Engineering Ltd:

🔹HBL Engineering Ltd leverages its battery expertise to offer containerized Li-ion BESS solutions from kW to MW scale and has recently secured ₹500 crore BESS projects, marking its strong entry into the storage EPC space.

🔹HBL Engineering Ltd leverages its battery expertise to offer containerized Li-ion BESS solutions from kW to MW scale and has recently secured ₹500 crore BESS projects, marking its strong entry into the storage EPC space.

🔶Servotech Renewable Power System Ltd:

🔹The company has partnered with Zhuhai Piwin New Energy to combine Piwin’s BESS technology with its domestic manufacturing strength for producing advanced battery storage systems in India.

🔹The company has partnered with Zhuhai Piwin New Energy to combine Piwin’s BESS technology with its domestic manufacturing strength for producing advanced battery storage systems in India.

🔶KPI Green Energy Ltd

🔹KPI Green (via Sundrop Energia) is entering the BESS segment with standalone build-own-operate projects.

🔹The company has partnered with Delta Electronics to co-develop scalable storage solutions, combining KPI’s project development with Delta’s inverter and energy management technologies.

🔹KPI Green (via Sundrop Energia) is entering the BESS segment with standalone build-own-operate projects.

🔹The company has partnered with Delta Electronics to co-develop scalable storage solutions, combining KPI’s project development with Delta’s inverter and energy management technologies.

🔶Himadri Speciality Chemical Ltd:

🔹Himadri Speciality is building India’s first large-scale LFP cathode plant in Odisha (200,000 MT by 2030), partnering with Sicona to bring silicon-carbon anode technology to India, and has invested in International Battery Company (IBC) to integrate into the global battery cell ecosystem.

🔹Himadri Speciality is building India’s first large-scale LFP cathode plant in Odisha (200,000 MT by 2030), partnering with Sicona to bring silicon-carbon anode technology to India, and has invested in International Battery Company (IBC) to integrate into the global battery cell ecosystem.

⚡️Disclaimer: The above data should not be considered as a Buy or Sell recommendation. The analysis has been done for educational and learning purpose only.

✅Follow <@raghavwadhwa> for more insights on micro-cap companies and various sectors.

✅Like & Retweet♻️

✅Subscribe to our YouTube Channel youtube.com/@raghav.wadhwa

✅Like & Retweet♻️

✅Subscribe to our YouTube Channel youtube.com/@raghav.wadhwa

• • •

Missing some Tweet in this thread? You can try to

force a refresh