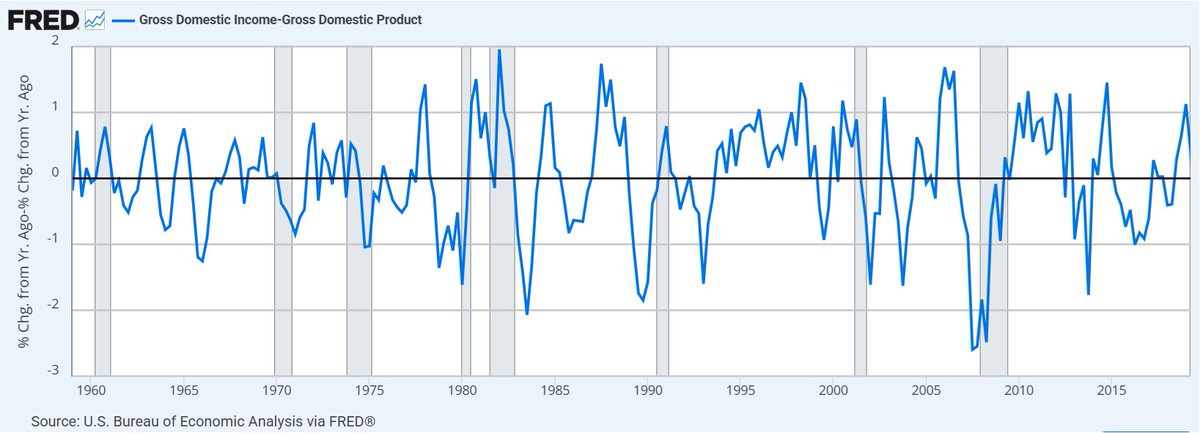

At turning points, I like to compare GDI to GDP. GDP has trade, inventories and large revisions. GDI is income.

If GDI is falling relative to GDP, bad things tend to happen. This is pre-COVID.

If GDI is falling relative to GDP, bad things tend to happen. This is pre-COVID.

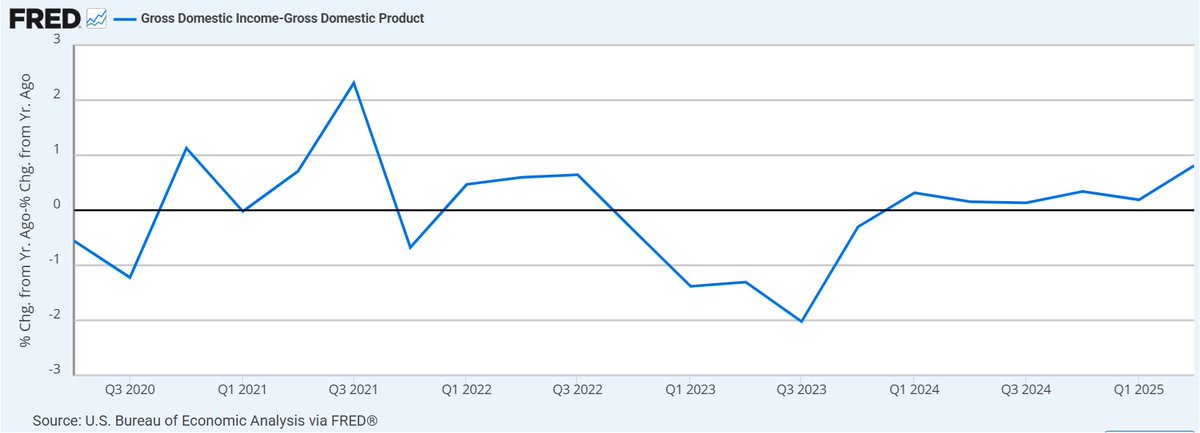

This is post COVID.

GDI printed 5.34% nominal in Q2.

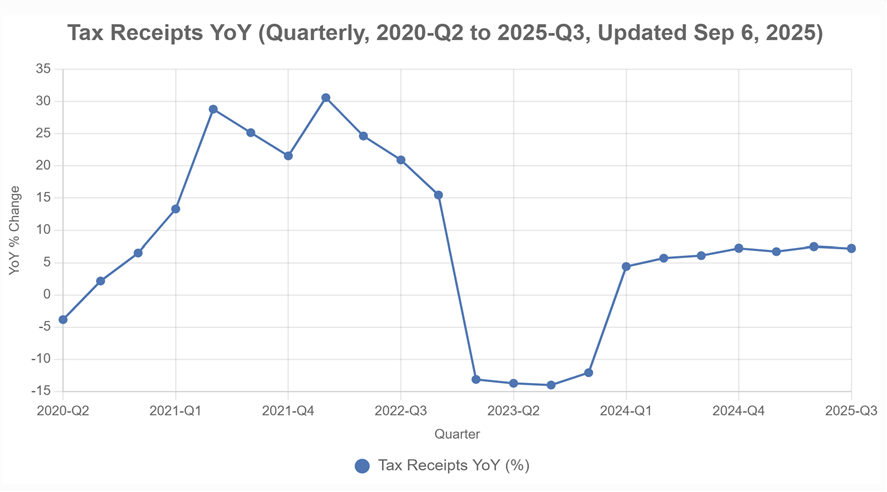

Tax Receipts are 7% YoY.

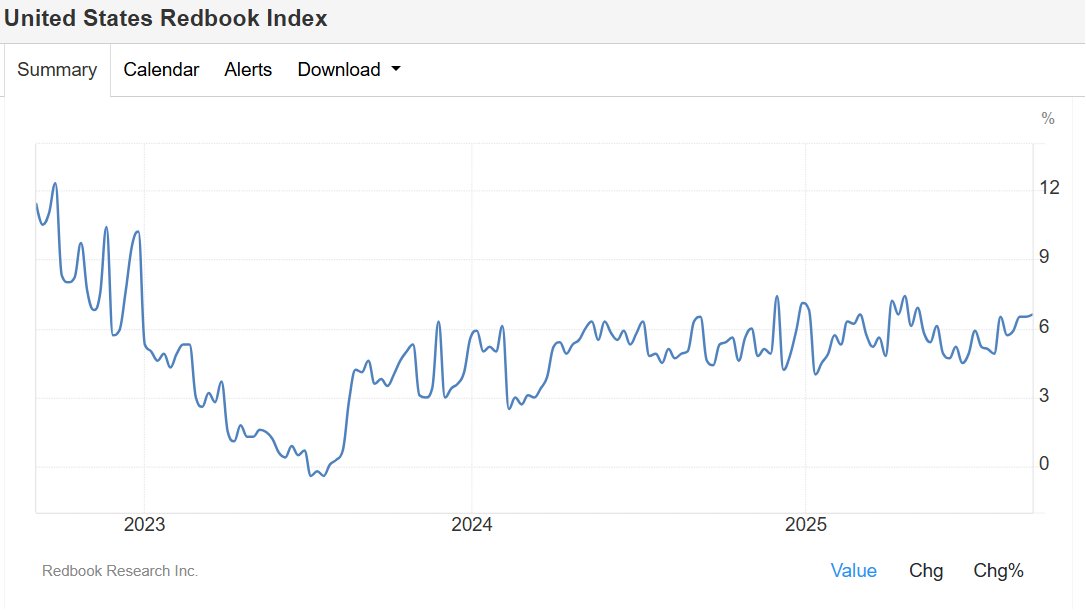

Redbook sales are 6.6% YoY now.

My base case is people are really struggling to digest the collapse in supply side potential for the economy and it's a strange adjustment.

GDI printed 5.34% nominal in Q2.

Tax Receipts are 7% YoY.

Redbook sales are 6.6% YoY now.

My base case is people are really struggling to digest the collapse in supply side potential for the economy and it's a strange adjustment.

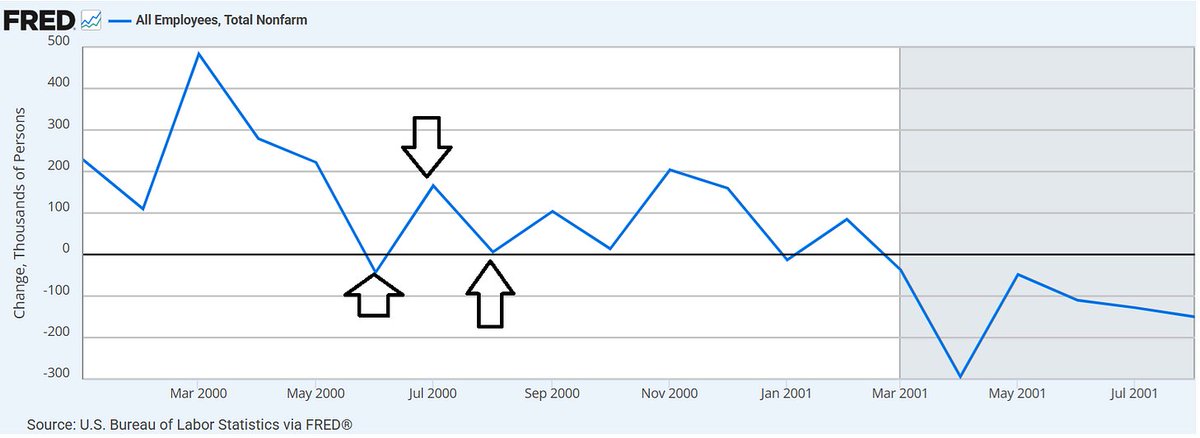

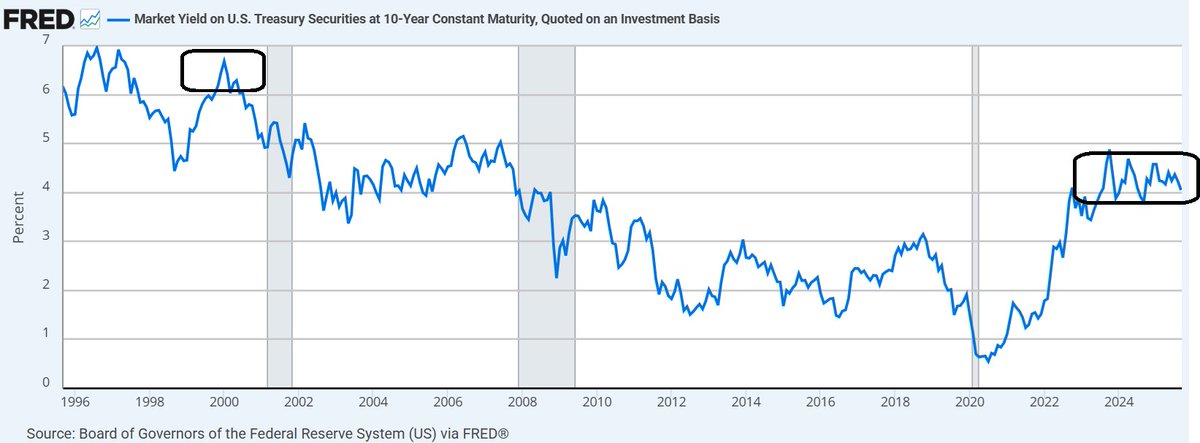

The Bear Case? May 2000.

NFP printed 222k, economy on fire! June? -43k. Market shrugged it off. July came in at 166k, all good!

Then by August it became clear labor had stalled and weakened before long.

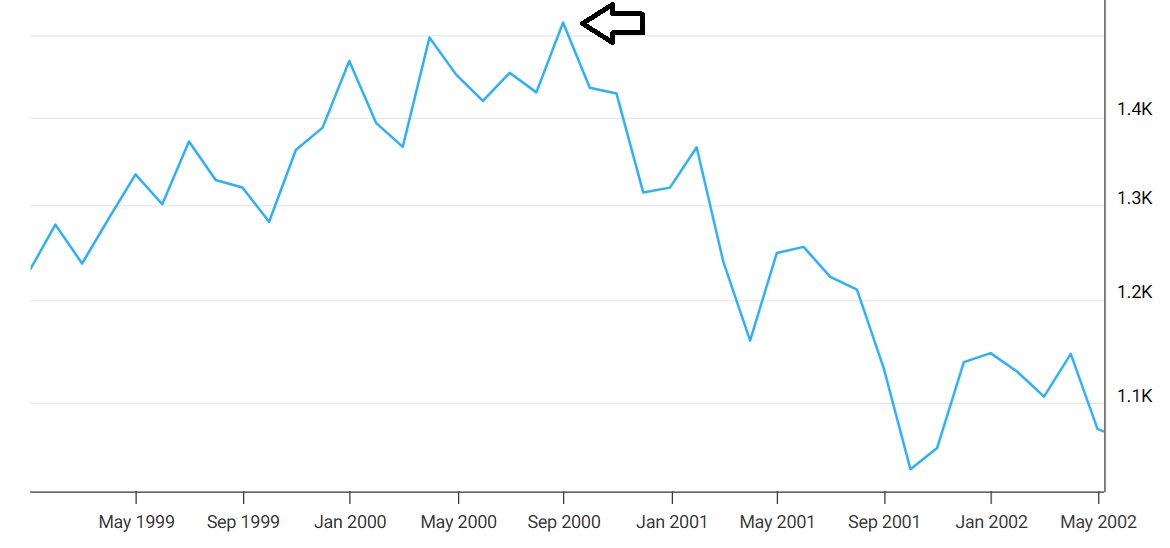

This started the epic market correction to end that cycle.

NFP printed 222k, economy on fire! June? -43k. Market shrugged it off. July came in at 166k, all good!

Then by August it became clear labor had stalled and weakened before long.

This started the epic market correction to end that cycle.

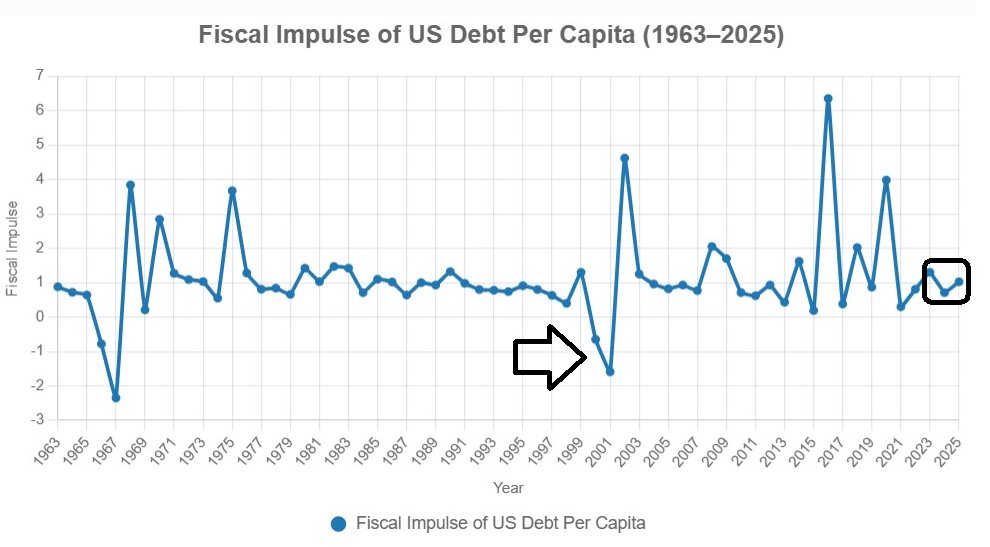

Govt was running a budget surplus, which had a large negative fiscal impulse. Today modest positive, but larger next year.

Fed had hiked 200 bps over prior year, will cut now.

10yr was between 6.5-7%, now 4%.

Choose your scenario wisely!

Fed had hiked 200 bps over prior year, will cut now.

10yr was between 6.5-7%, now 4%.

Choose your scenario wisely!

• • •

Missing some Tweet in this thread? You can try to

force a refresh