Ex Hedge Fund Manager; Global Macro Volatility Portfolio Manager.

Chicago Booth MBA & CFA. My views do not consist of investment advice.

3 subscribers

How to get URL link on X (Twitter) App

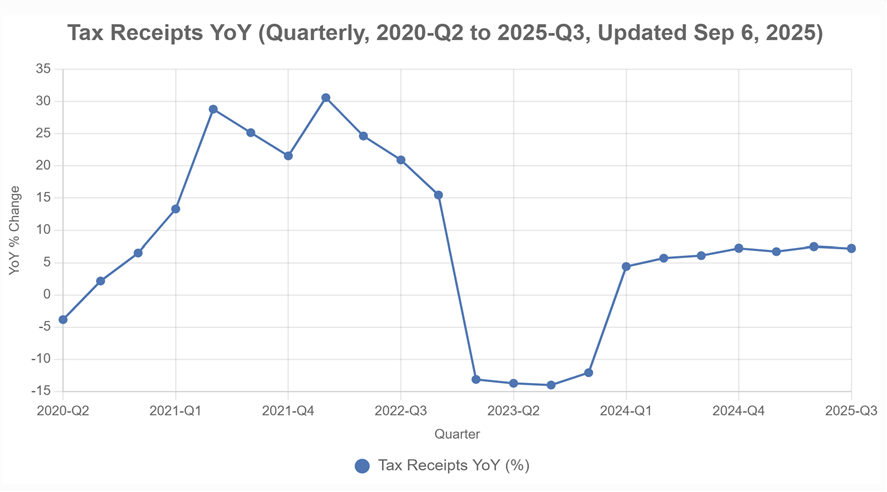

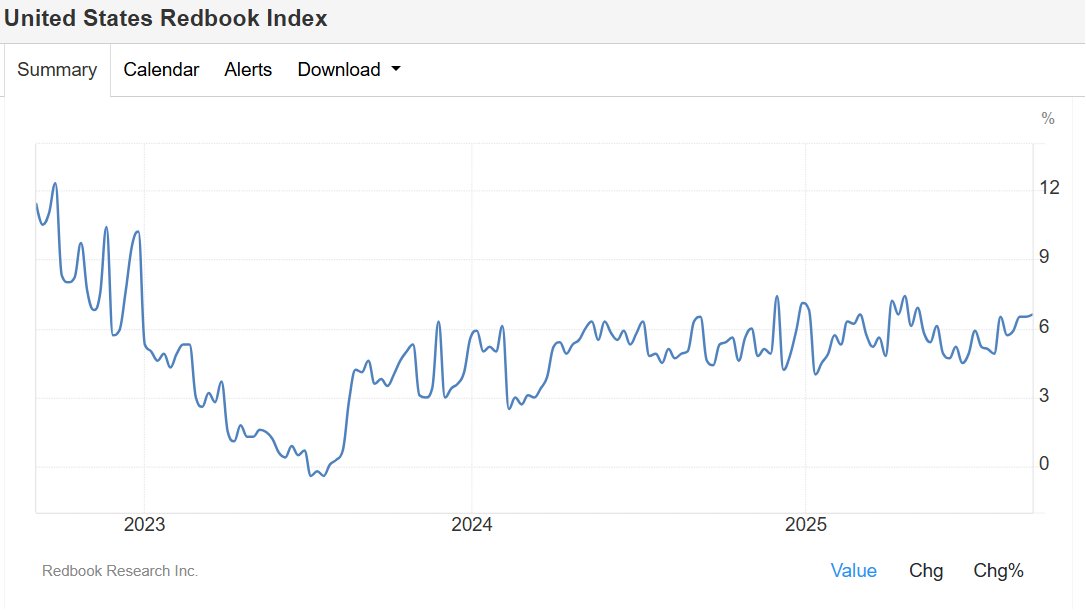

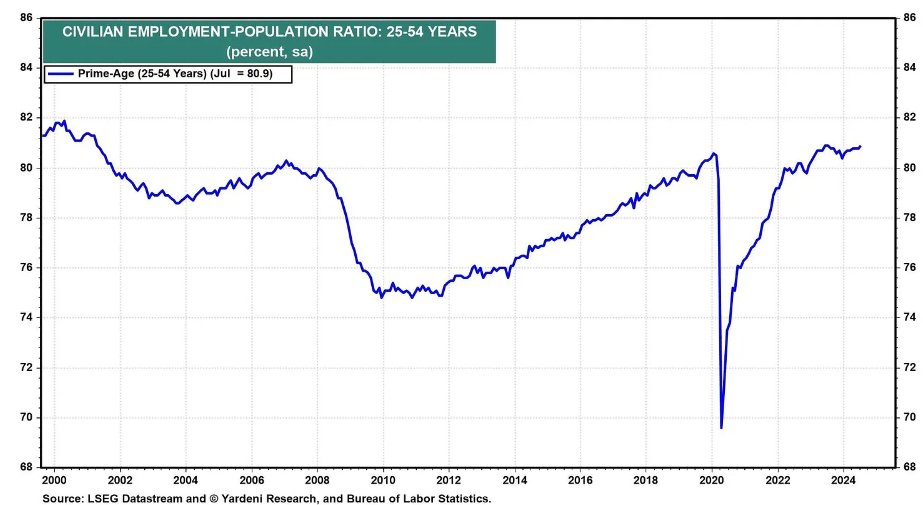

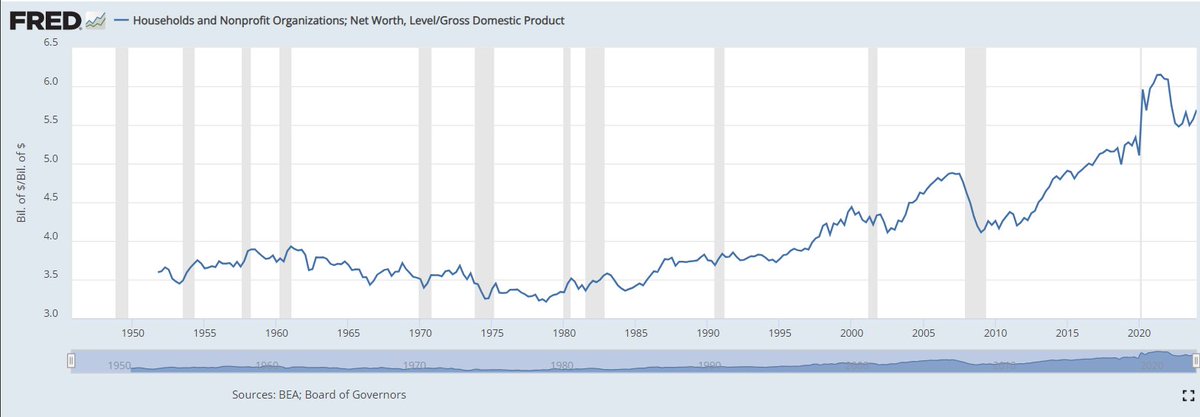

This is post COVID.

This is post COVID.

https://x.com/DannyDayan5/status/1805254002814132259

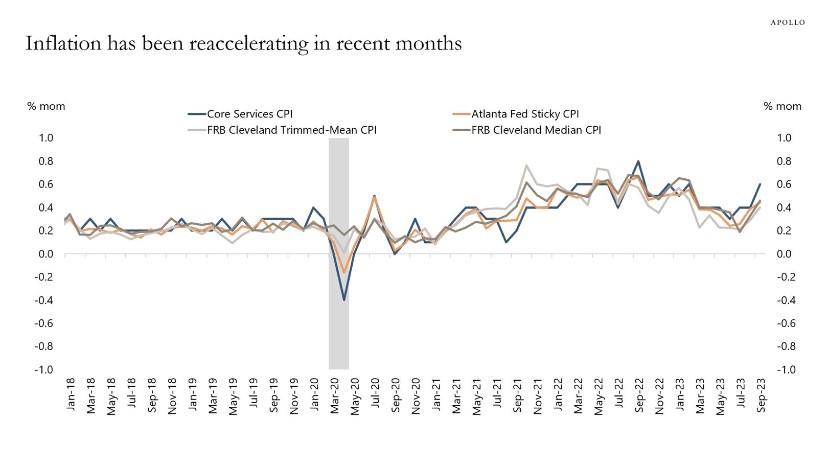

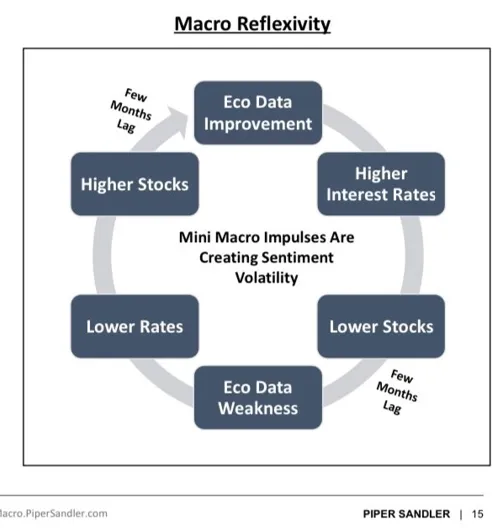

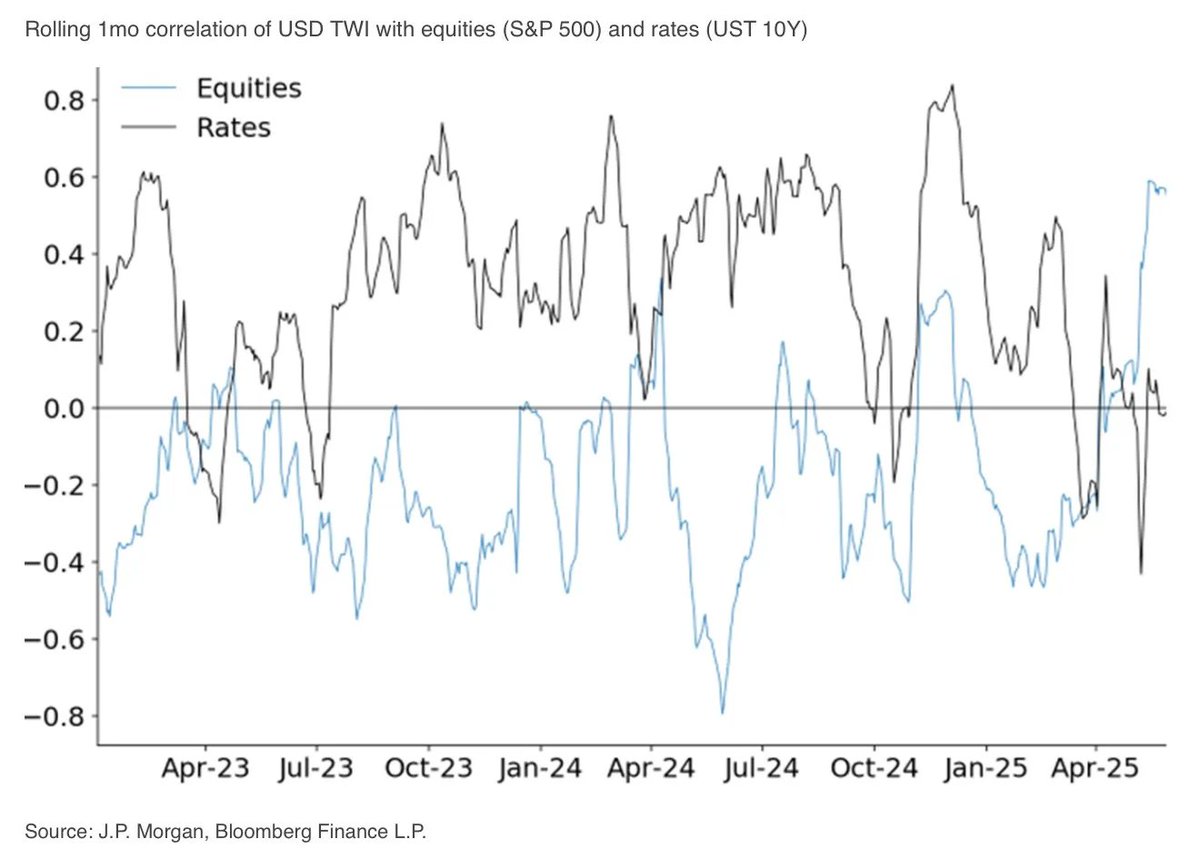

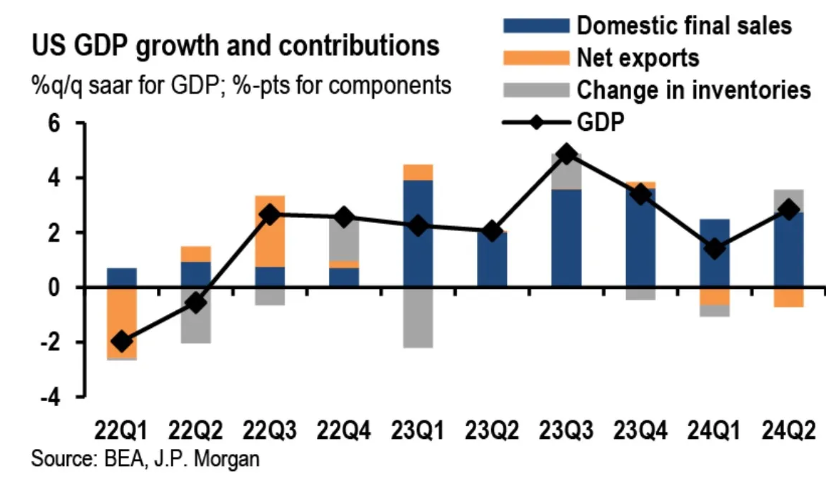

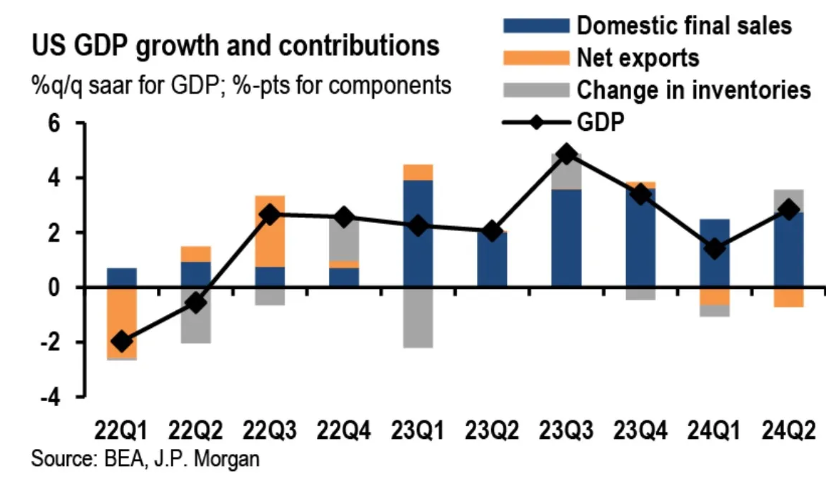

The dynamics have changed this year. We have policies that are creating impulses on growth and inflation in opposite directions. We have also seen the correlations between assets change regularly.

The dynamics have changed this year. We have policies that are creating impulses on growth and inflation in opposite directions. We have also seen the correlations between assets change regularly.

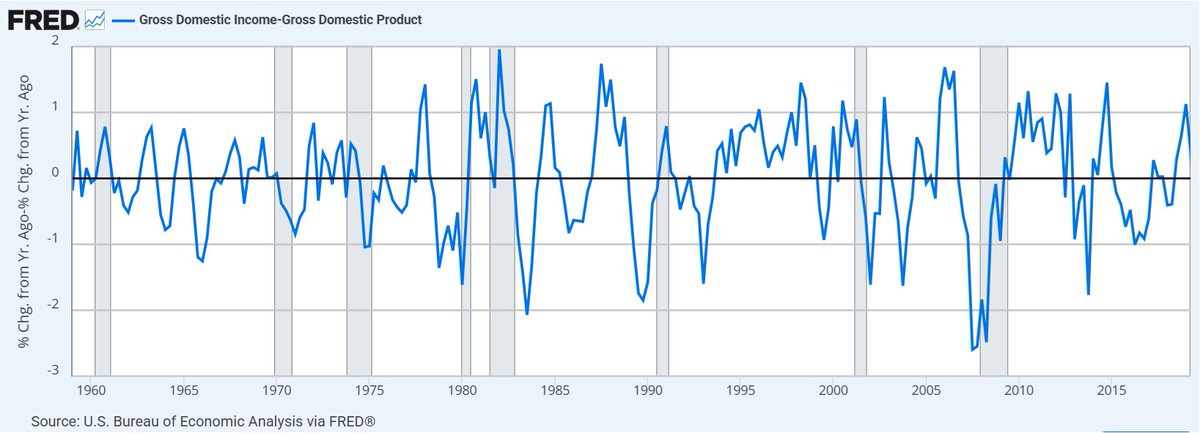

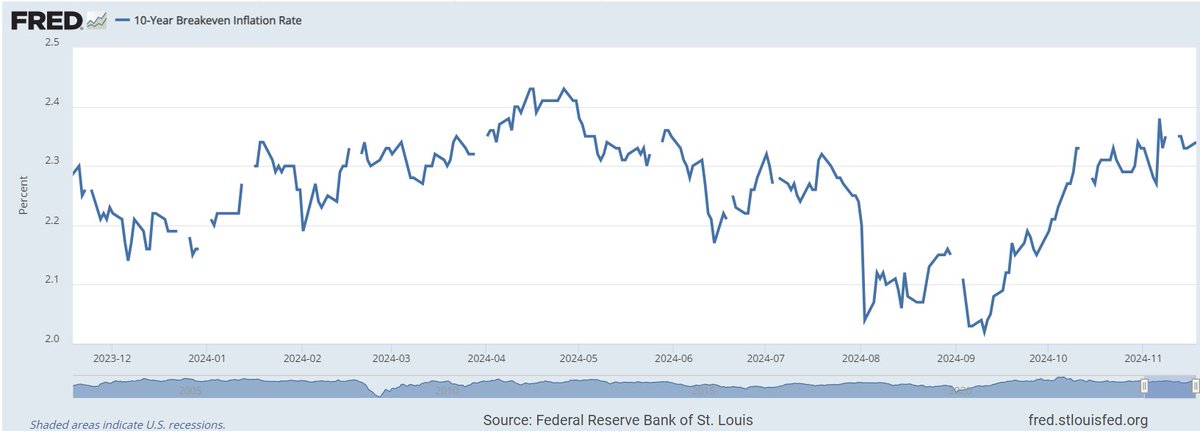

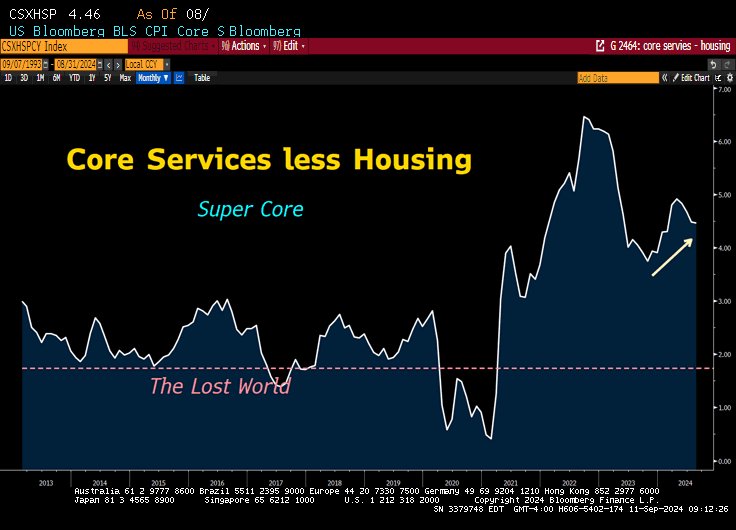

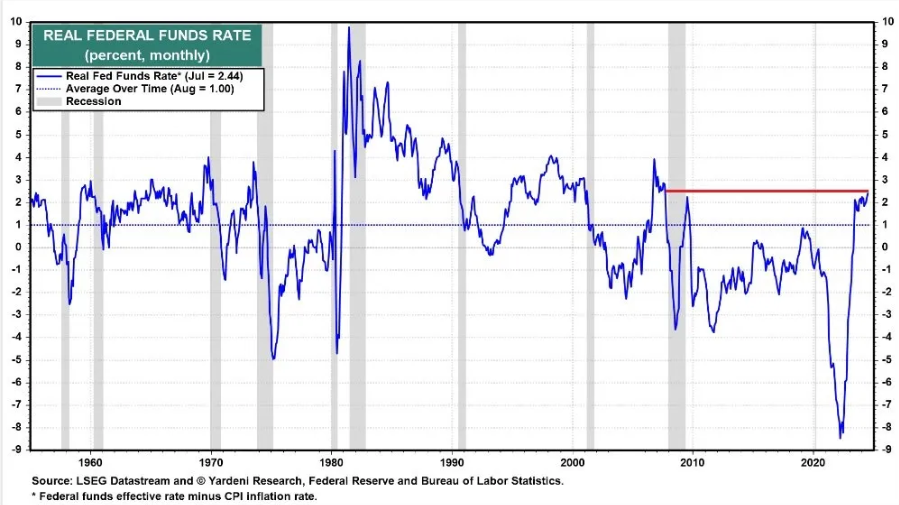

https://x.com/DannyDayan5/status/1795469428710105150However, since the Fed has not come to such a conclusion on R*, we need to look at this another way. A simple way is to look at how effective monetary policy has been in achieving its objectives thus far that puts them in a place to cut rates.

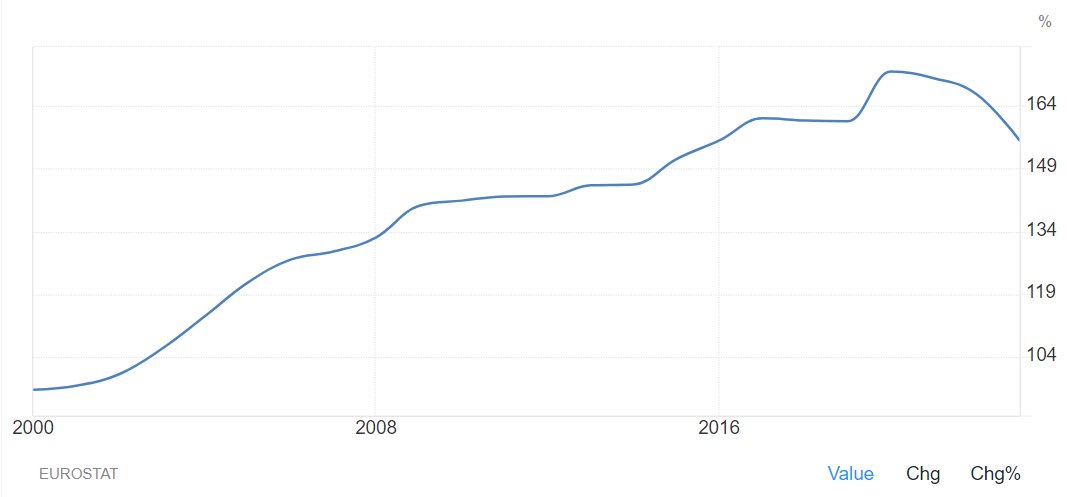

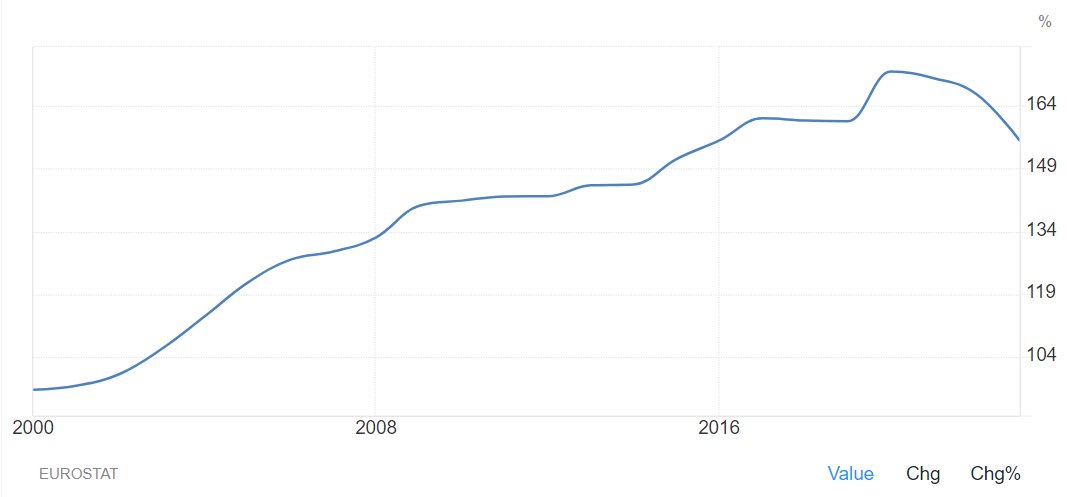

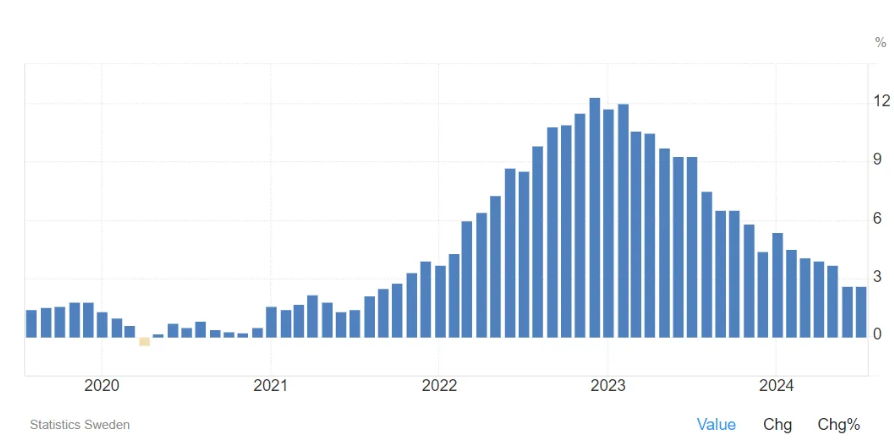

Like the rest of the world, it had a surge in inflation that peaked at 12% in late 2022.

Like the rest of the world, it had a surge in inflation that peaked at 12% in late 2022.

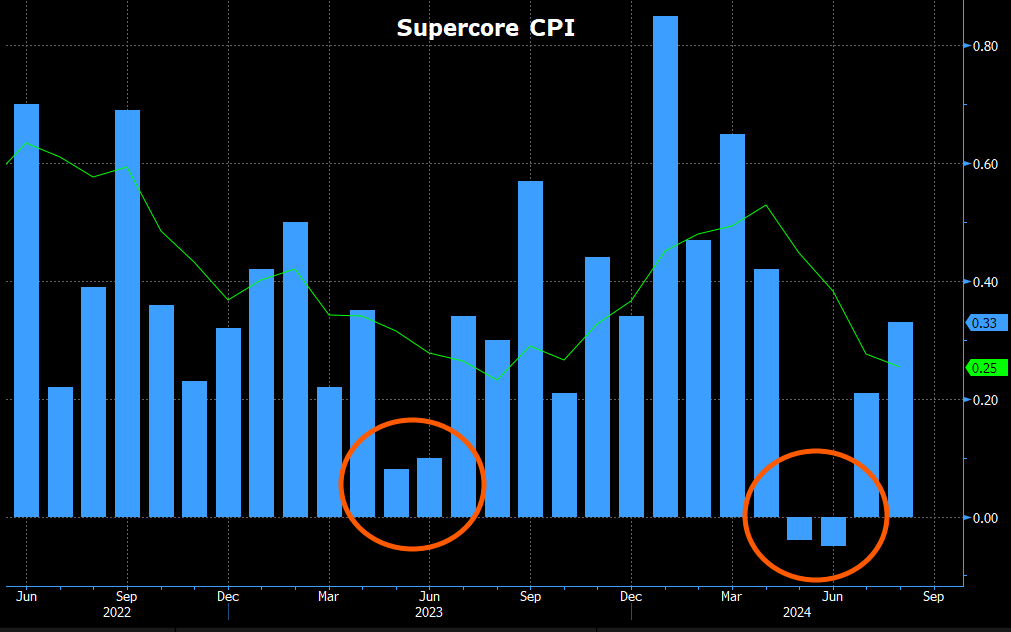

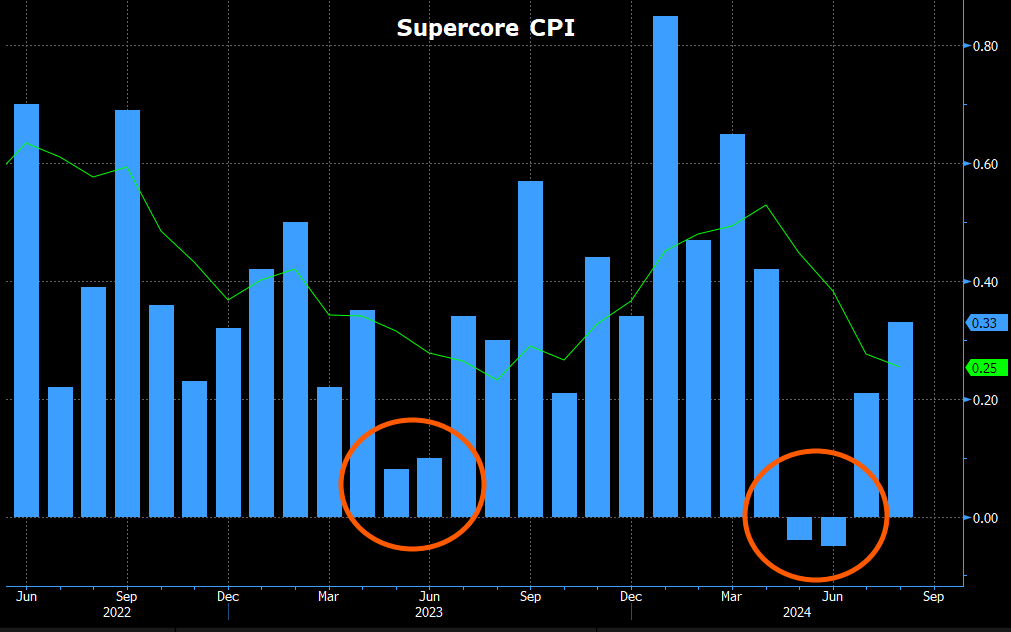

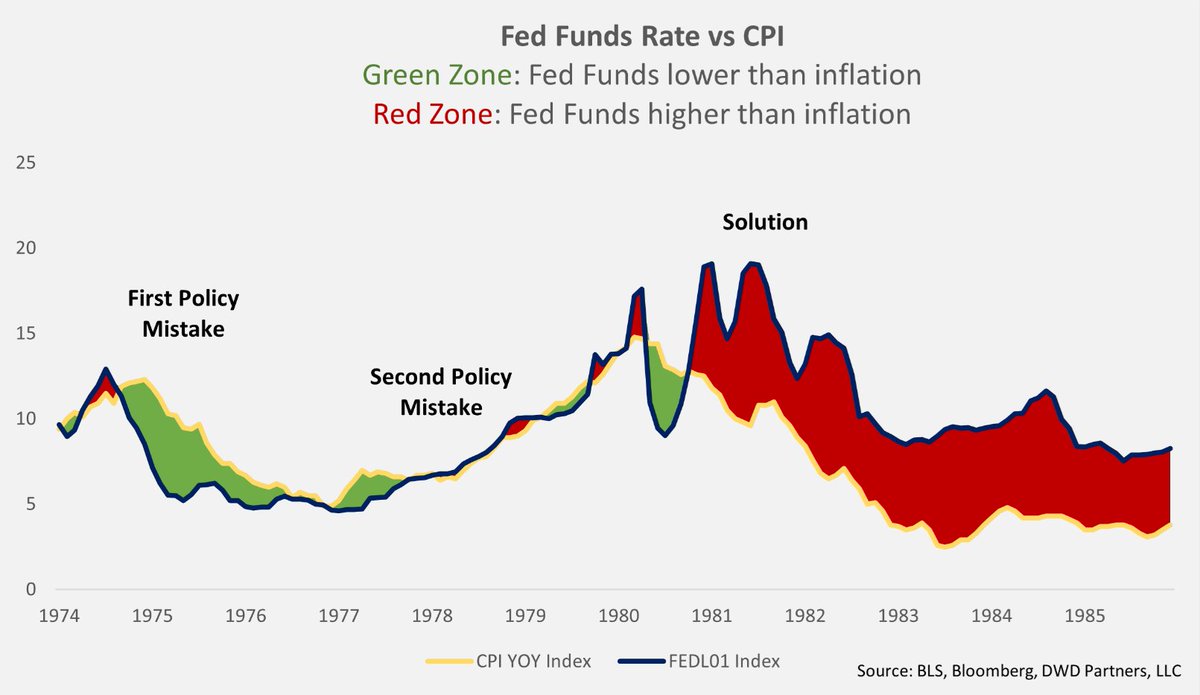

In the last 18 months, we have often had very large market movements without an economic catalyst, due to Fed speeches, dot plots and general obsession over rate cuts. These market movements have thus driven marginal change in the economy and often undermined policy makers.

In the last 18 months, we have often had very large market movements without an economic catalyst, due to Fed speeches, dot plots and general obsession over rate cuts. These market movements have thus driven marginal change in the economy and often undermined policy makers.

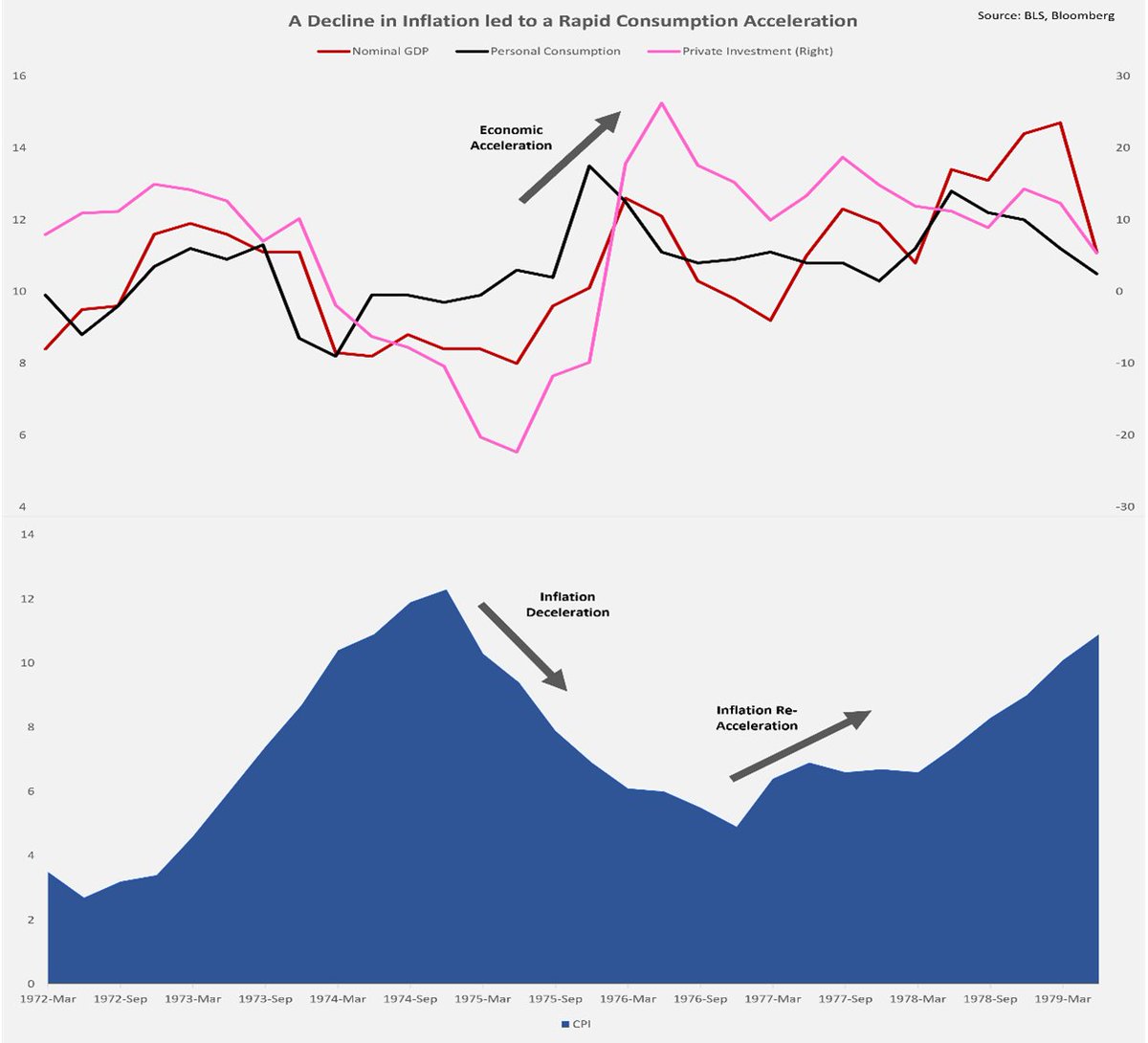

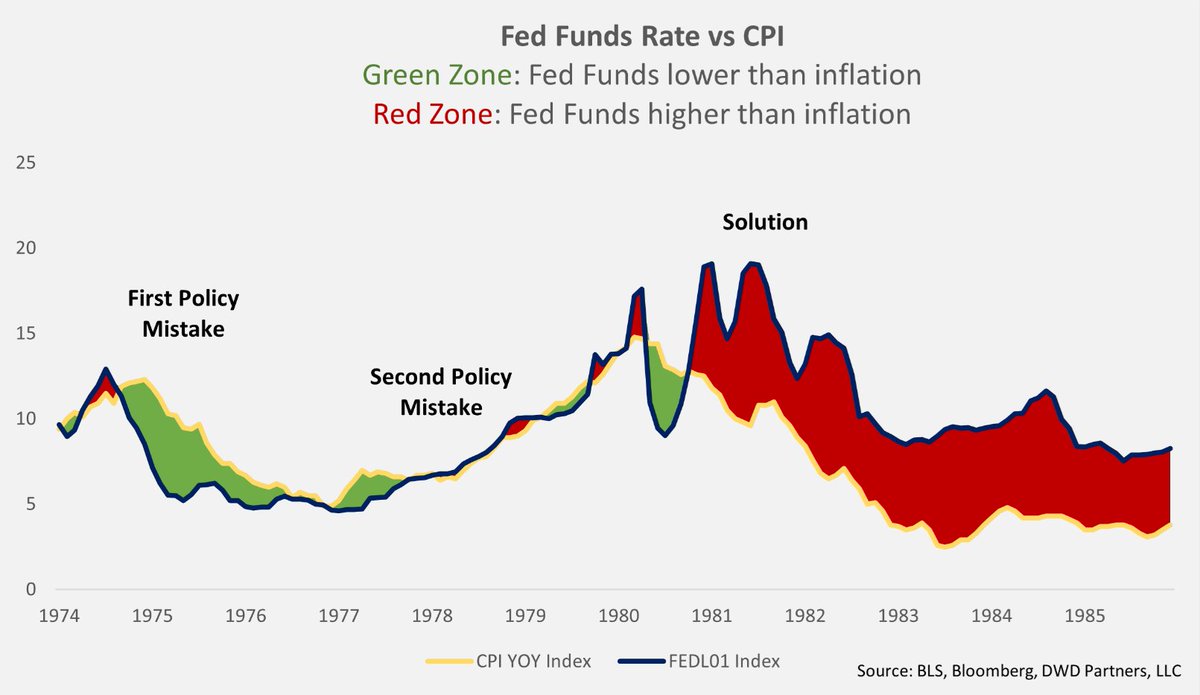

Their mistake is ignoring this key lesson. Inflation falling without economic weakness, namely job losses or credit events, simply leads to economic re-acceleration. This is exactly why I expected the economy to reaccelerate in 2023. The Fed has seemingly missed this.

Their mistake is ignoring this key lesson. Inflation falling without economic weakness, namely job losses or credit events, simply leads to economic re-acceleration. This is exactly why I expected the economy to reaccelerate in 2023. The Fed has seemingly missed this.