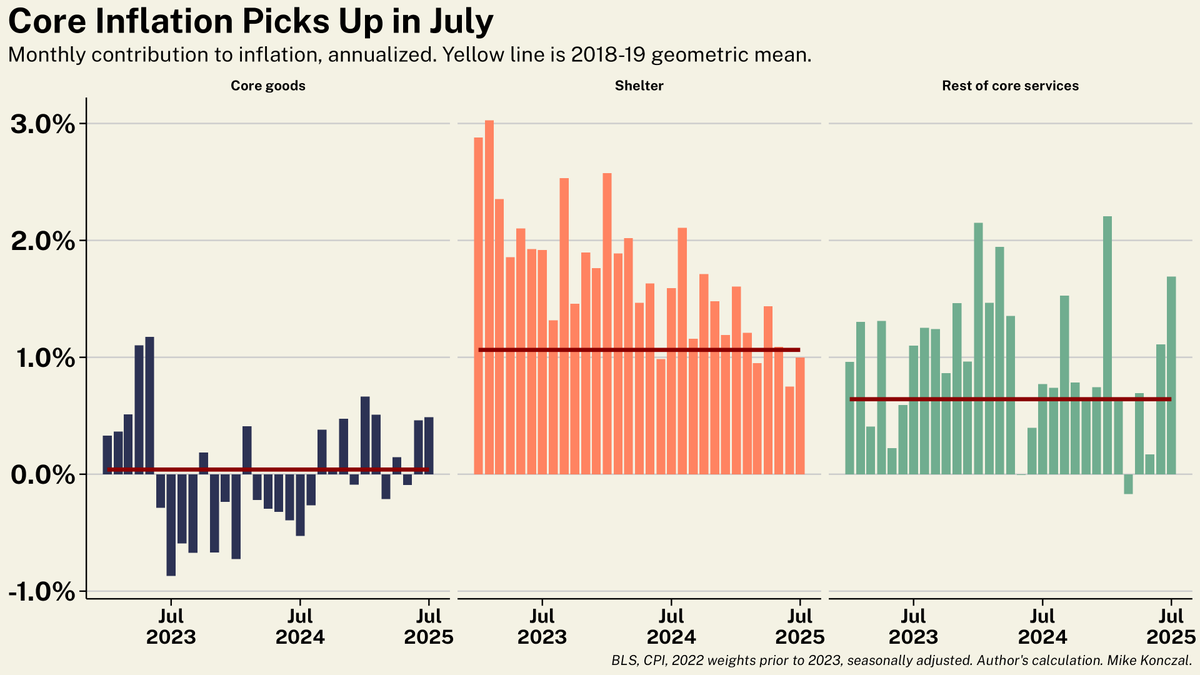

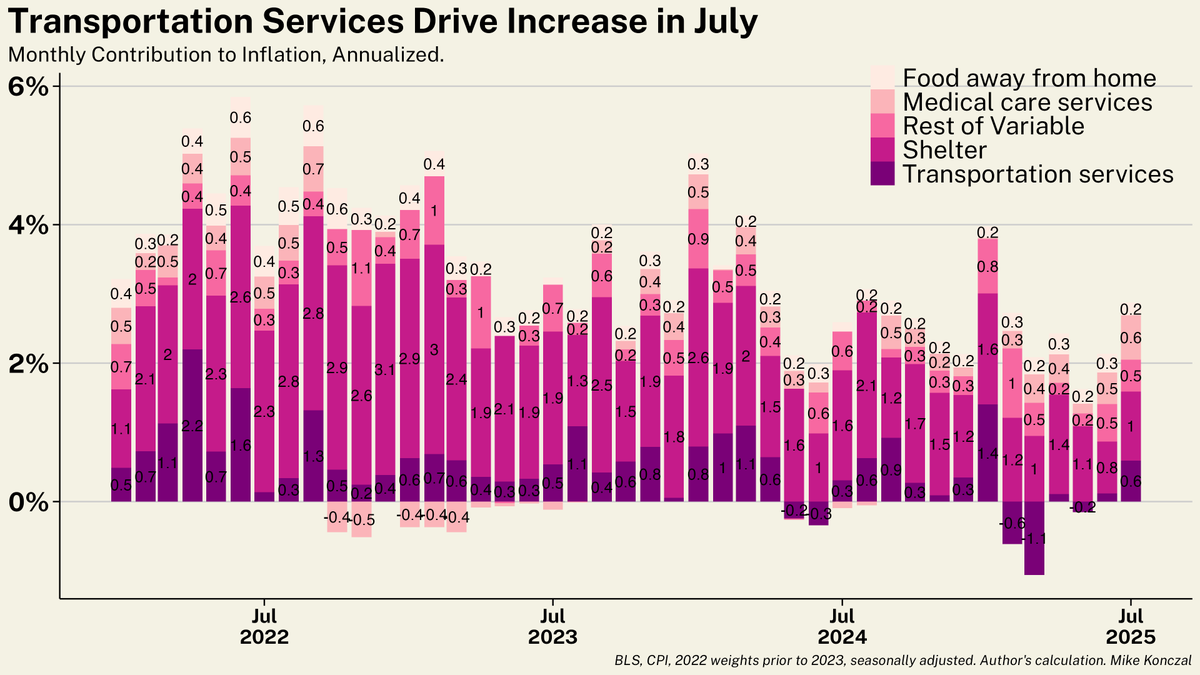

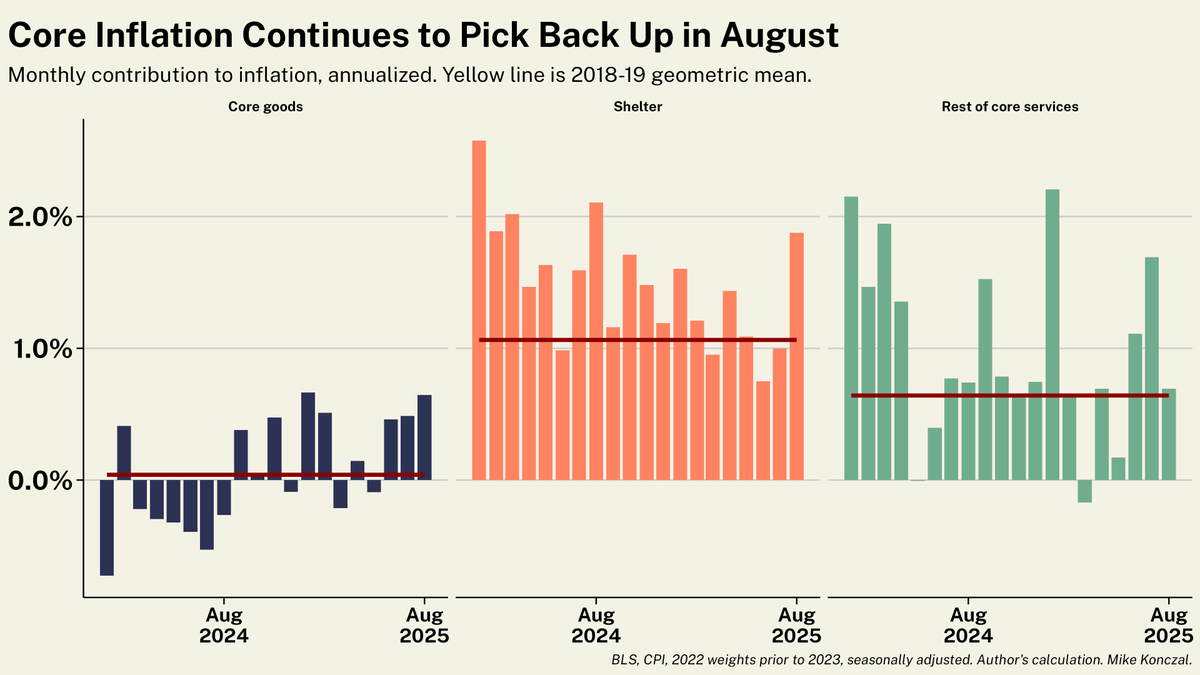

Inflation came in hot. You can see tariffs are driving the price of goods higher, while the price of non-housing services isn't falling to compensate.

Shelter had a high month as well, but that is likely noise given their more general downward trend. The tariffs are here. /1

Shelter had a high month as well, but that is likely noise given their more general downward trend. The tariffs are here. /1

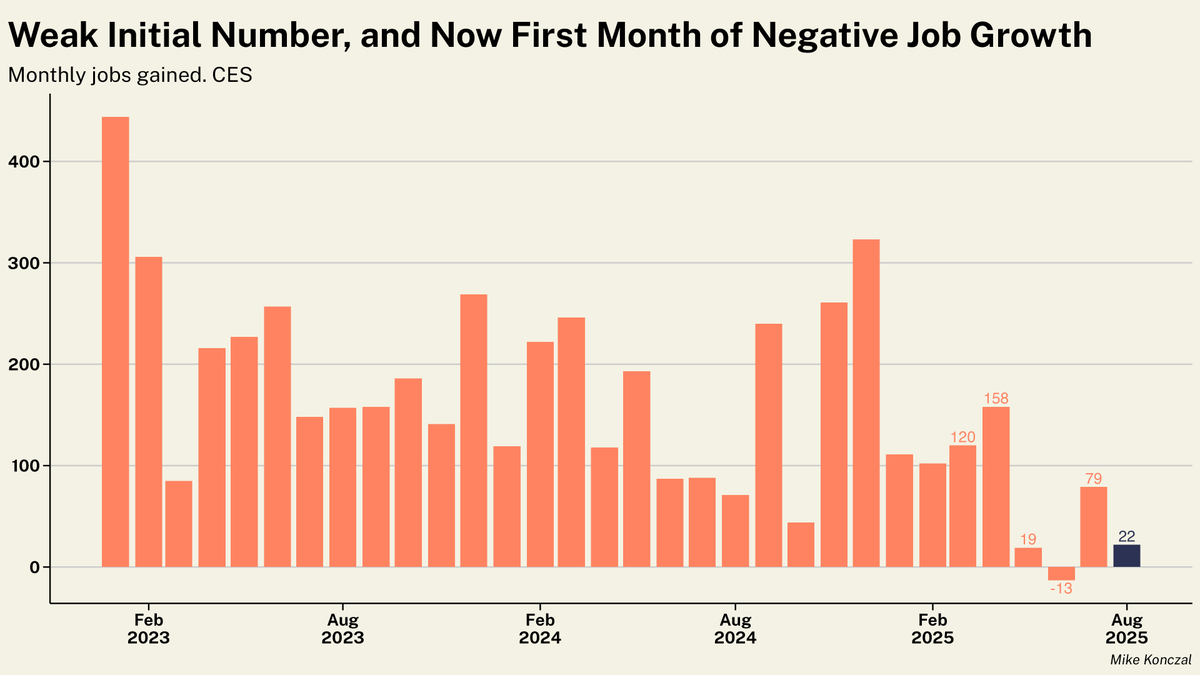

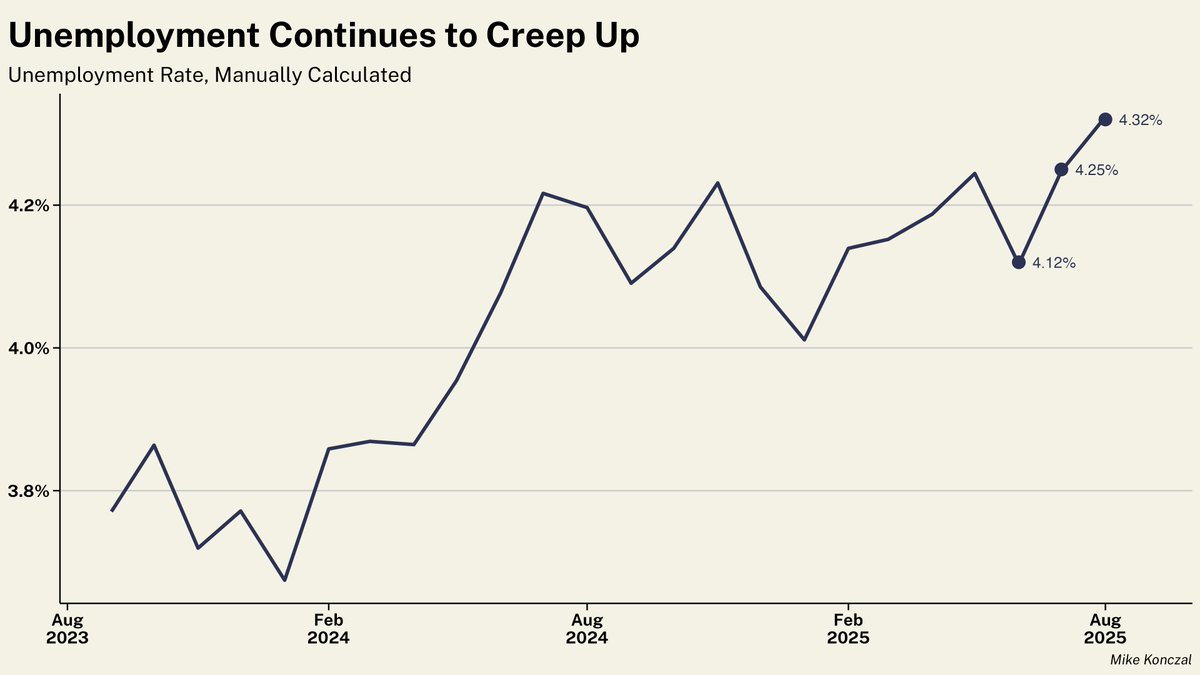

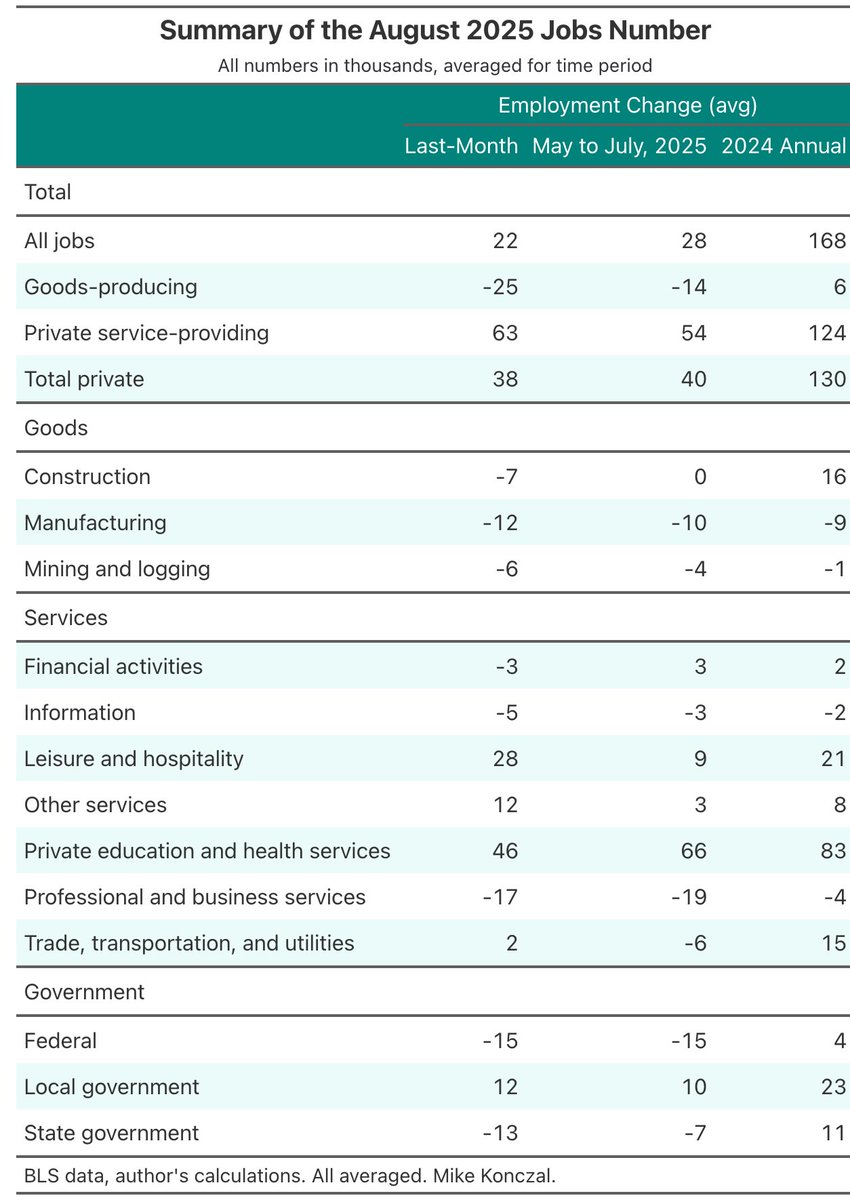

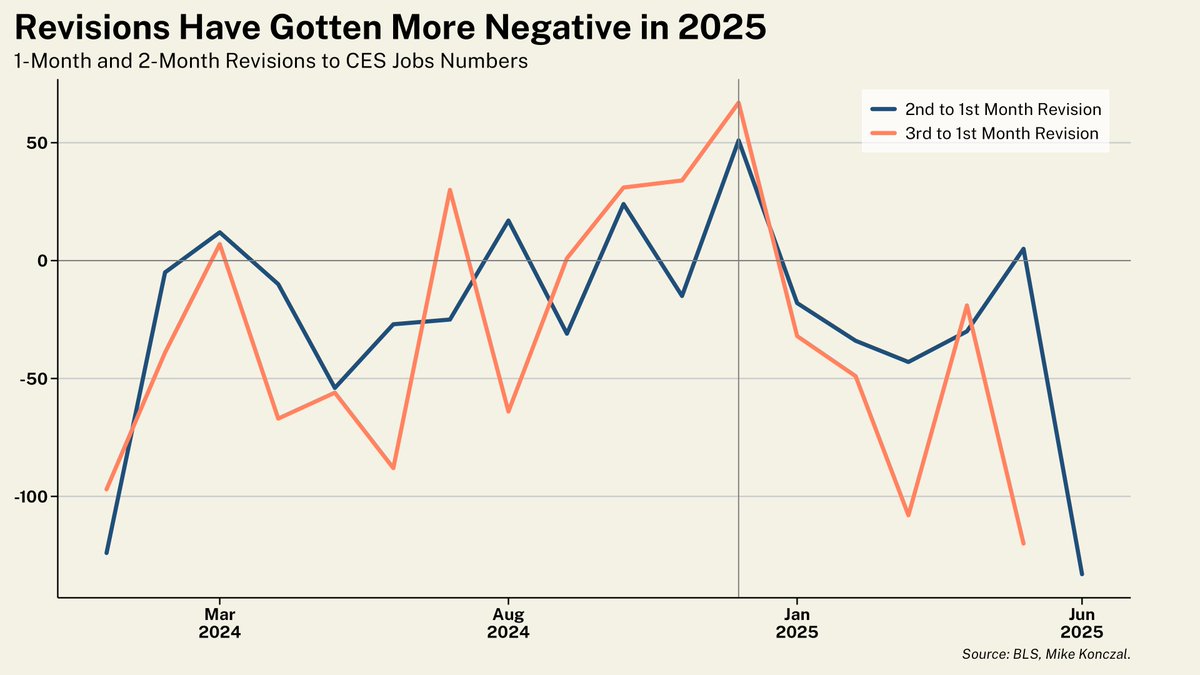

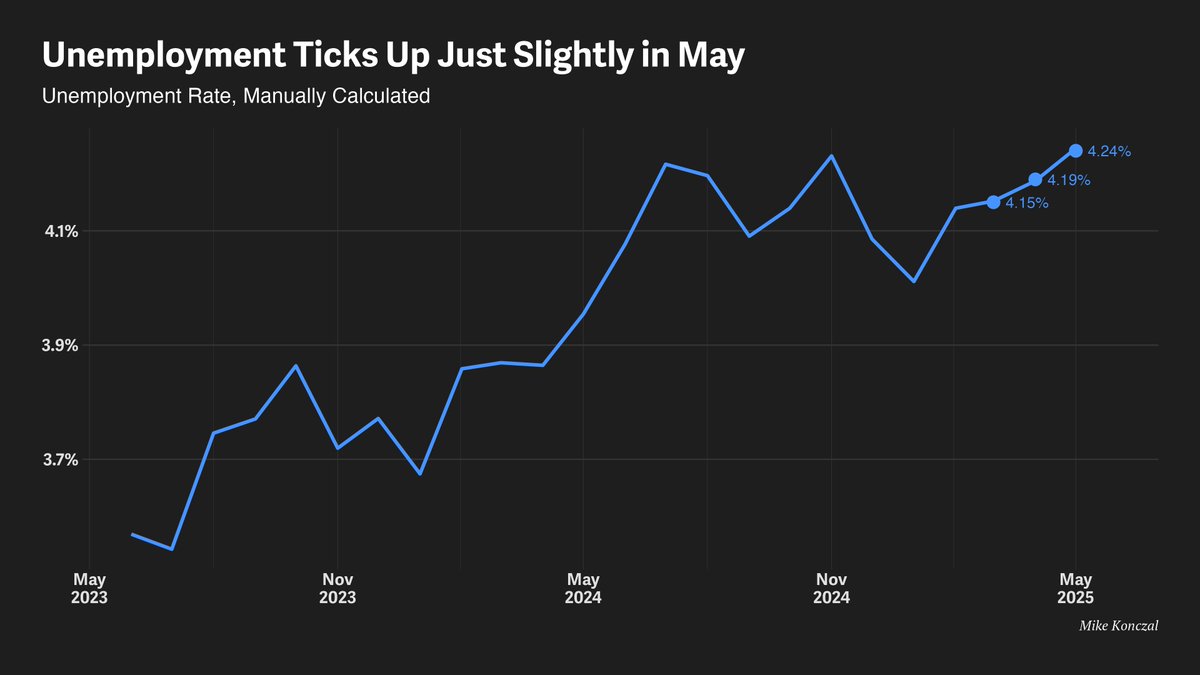

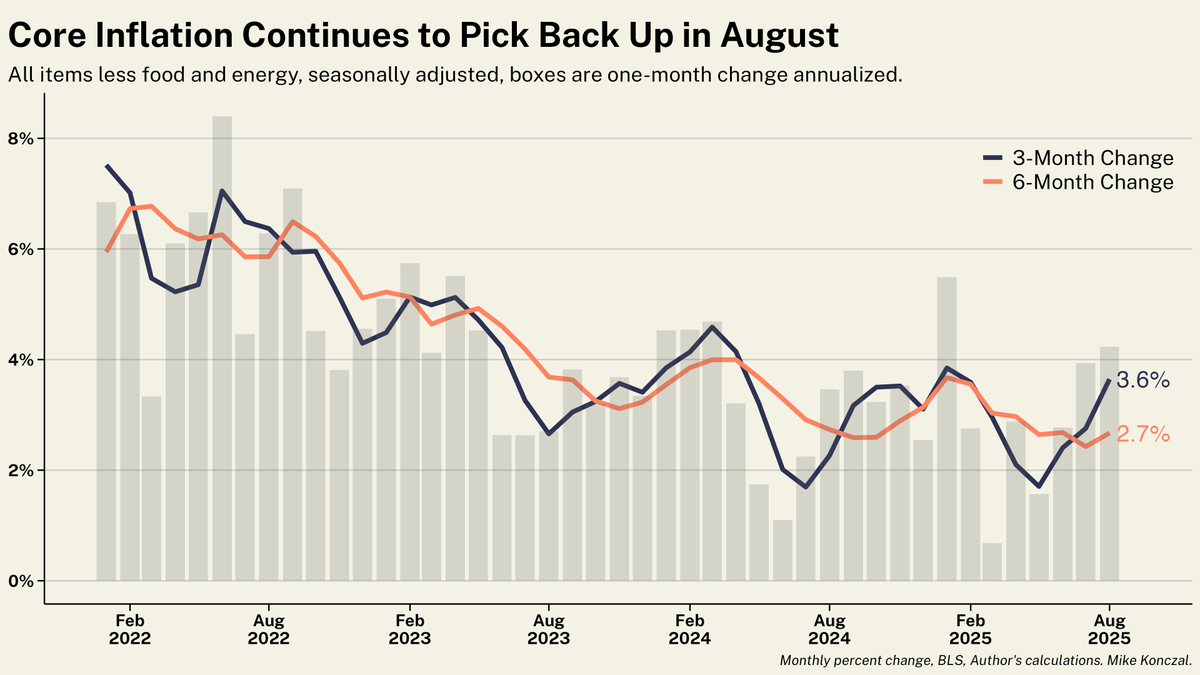

Three-month core inflation pops to 3.6%, among the highest its been in a while (and in years if you exclude January bumps). Not the direction the Federal Reserve wants to see as the labor market is quickly slowing since Liberation Day. /2

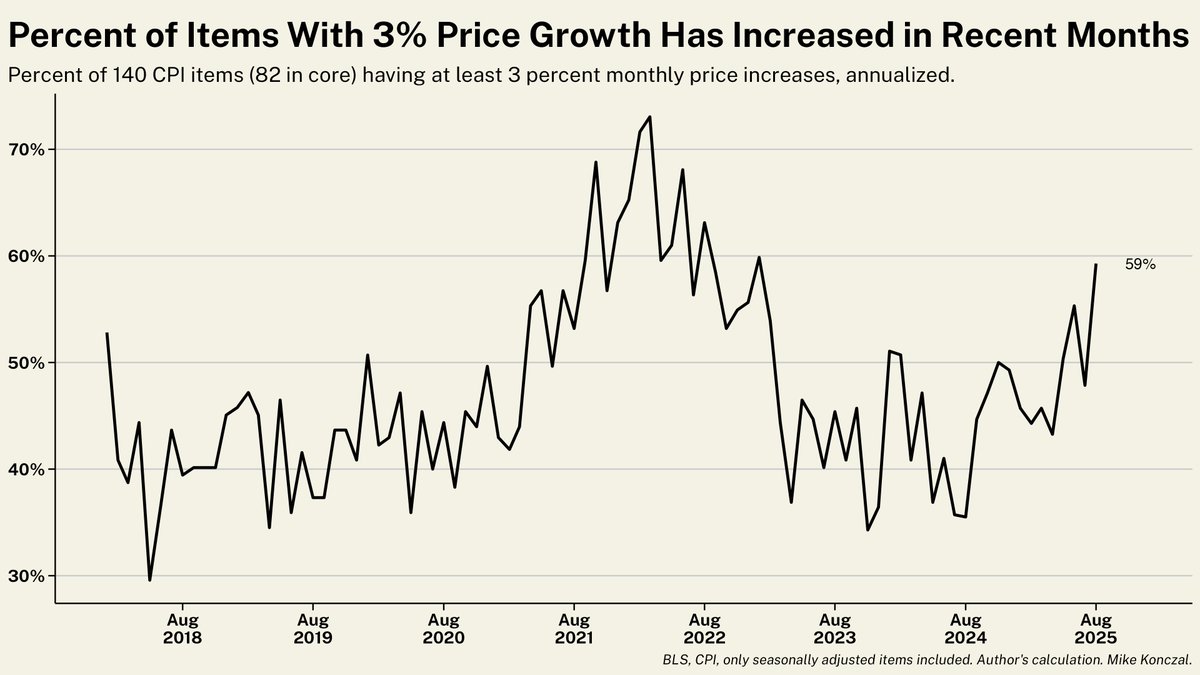

Meanwhile inflation is broadening. Here's percent of items that had at least a 3 percent (annualized) price increase over the last month, something Waller used to flag the 2023 disinflation.

I brushed this off and am surprised at its increase. ~60% for both core and overall. /3

I brushed this off and am surprised at its increase. ~60% for both core and overall. /3

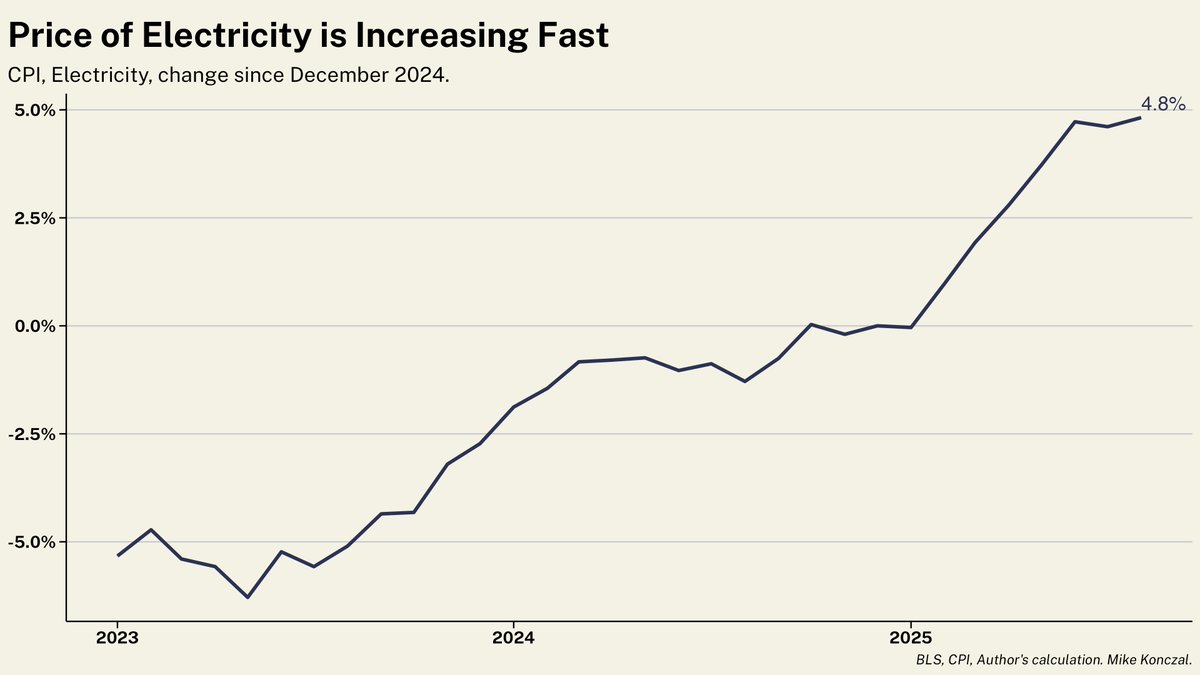

And you aren't imagining it, electricity prices are up ~5% within just this year, a dramatic rise.

/4

/4

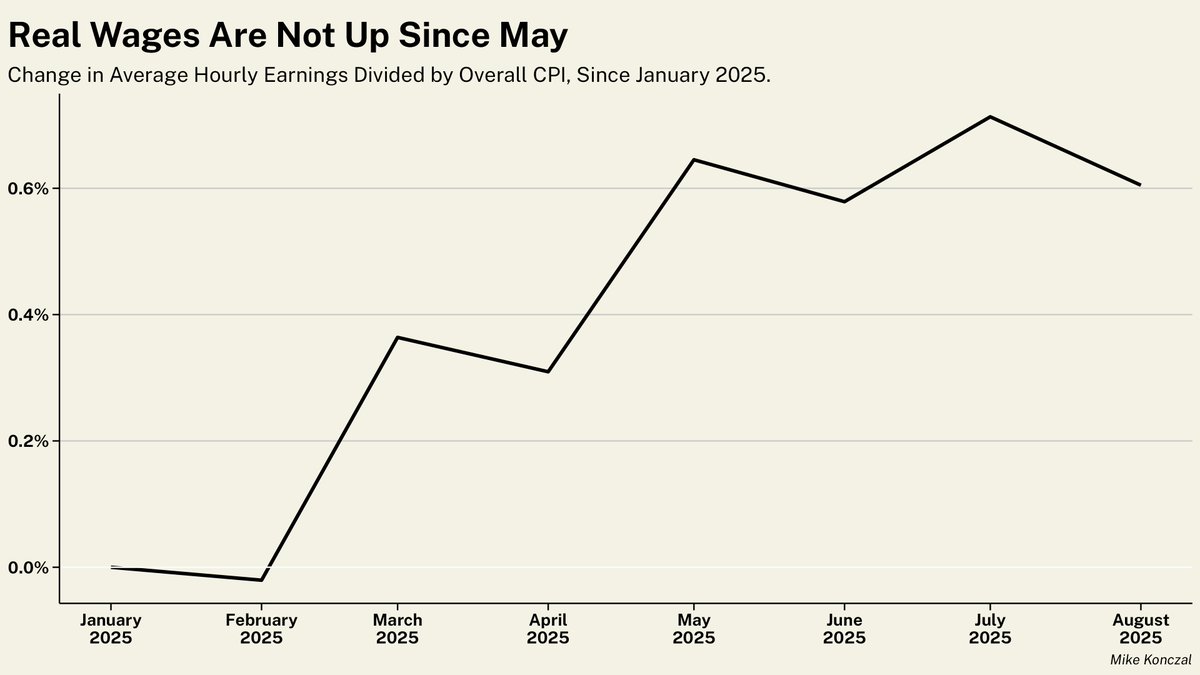

And let the hot takes begin! Real wages are flat since May, once Liberation Day really got started.

Average hourly earnings divided by overall CPI have not grown since May. People aren't making it up, and it's not surprising that consumer sentiment is at very bleak levels. 5/5

Average hourly earnings divided by overall CPI have not grown since May. People aren't making it up, and it's not surprising that consumer sentiment is at very bleak levels. 5/5

• • •

Missing some Tweet in this thread? You can try to

force a refresh