We are short $FFAI because we think YT Jia (founder and CEO) has based its latest pump on fake orders, a rebadged Chinese minivan, and a tsunami of lies meant to induce retail to buy right before a massive flood of new shares are authorized. Between dilution, YT’s legal problems (SEC, DOJ, Bankruptcy Court, etc..) and its track record of abysmal failure ($4.4b spent with 17 cars delivered) we think $FFAI will go back to being a penny-stock on its way to delisting.

2/

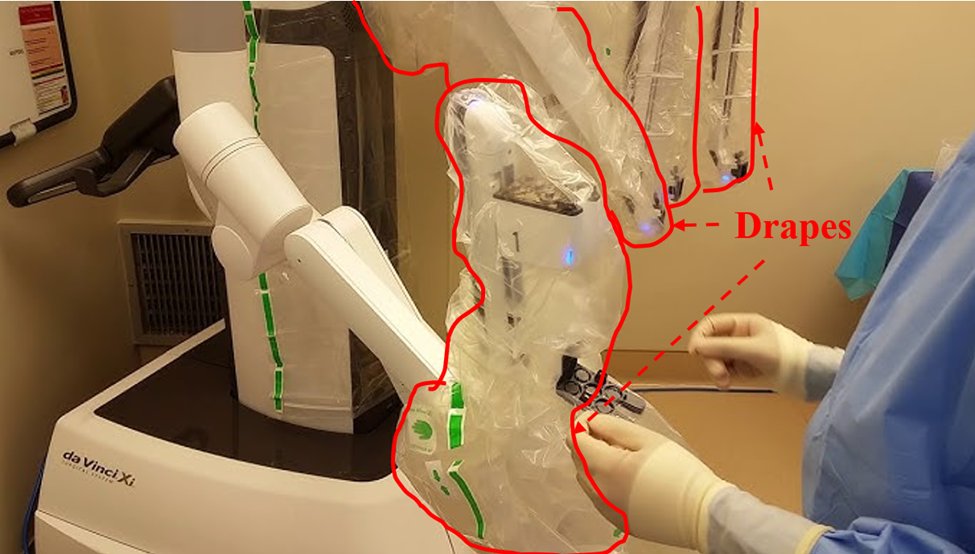

$FFAI's stock shot up after Nature’s Miracle ($NMHI) announced 1,000 preorders in a deal worth up to $100 million. We think this is fake because $NMHI has almost no money; less than $10,000 in cash and its market cap is ~$2 million. Turns out YT is former classmates with $NMHI CEO Tie (James) Li.

$FFAI's stock shot up after Nature’s Miracle ($NMHI) announced 1,000 preorders in a deal worth up to $100 million. We think this is fake because $NMHI has almost no money; less than $10,000 in cash and its market cap is ~$2 million. Turns out YT is former classmates with $NMHI CEO Tie (James) Li.

3/

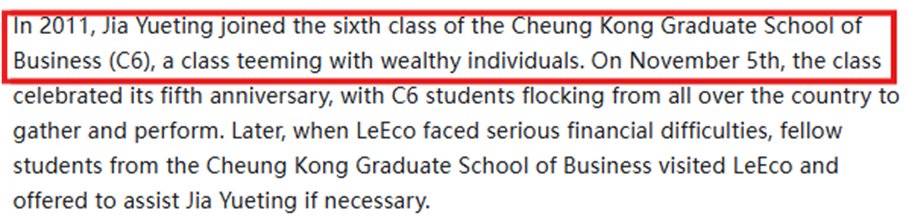

Some of the other B2B preorders for the EV minivan are with “paid co-creation partners.” Former employees revealed to us that each of $FFAI's co-creator deals for its previous vehicle cost them something like a million dollars because they were paying the co-creator to buy the car.

Some of the other B2B preorders for the EV minivan are with “paid co-creation partners.” Former employees revealed to us that each of $FFAI's co-creator deals for its previous vehicle cost them something like a million dollars because they were paying the co-creator to buy the car.

4/

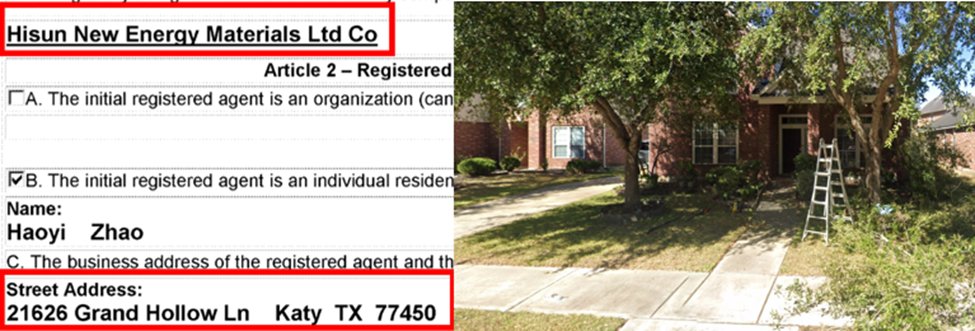

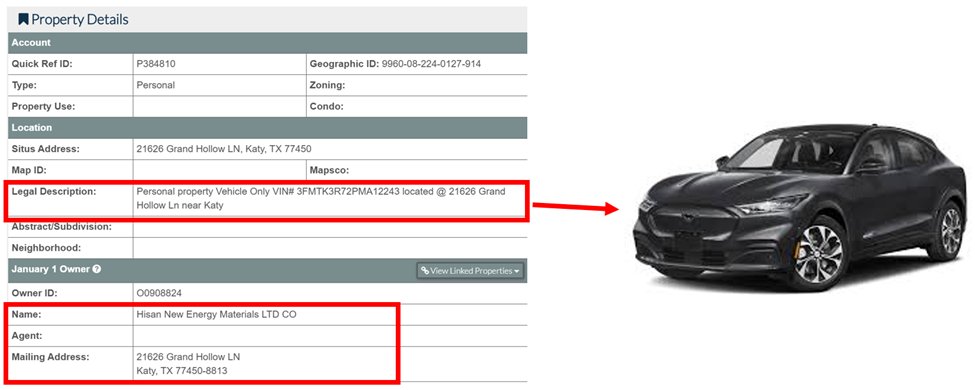

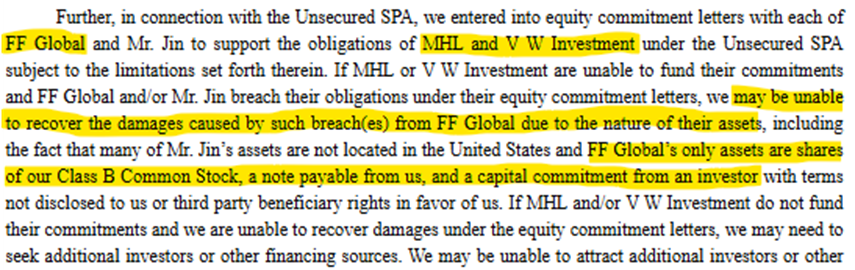

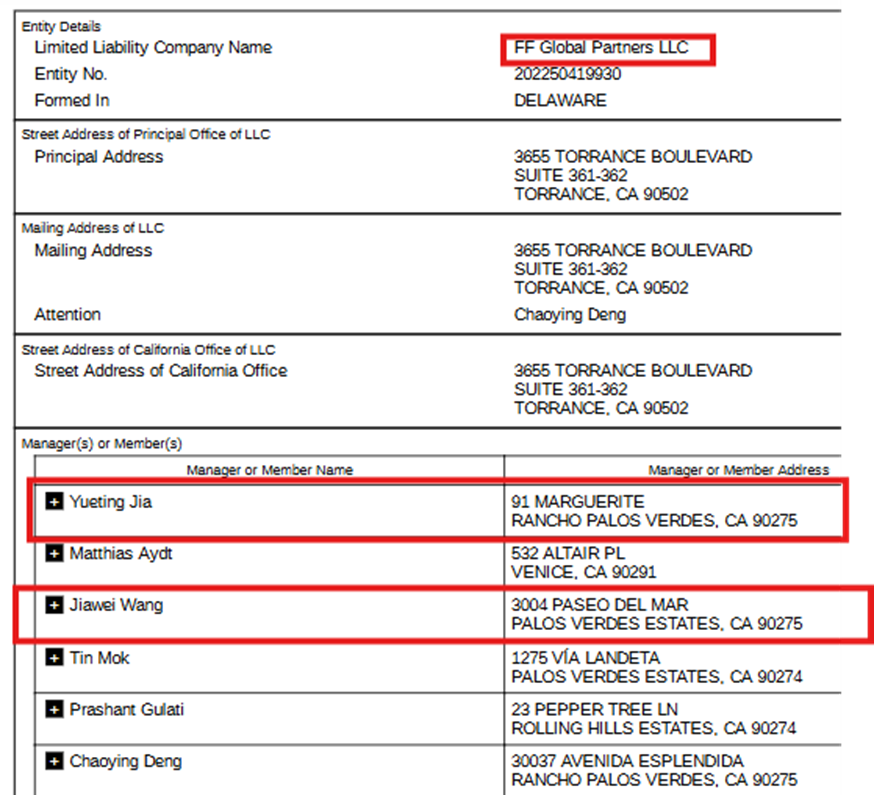

We believe a significant portion of $FFAI's financing has been fake or misleading. In May 2023 it claimed $100 million in financing from V W Investments and Metaverse Horizon, which have nothing to do with Volkswagen or $META. Instead V W Investments was founded by YT’s neighbor, and Metaverse Horizon’s location is an office in Beijing that has never been leased, and is apparently led by a 76-year-old farmer in China from YT's villiage. Its main investor is FF Global (YT and other insiders). We think YT has ultimately been the source of much of $FFAI’s financing.

We believe a significant portion of $FFAI's financing has been fake or misleading. In May 2023 it claimed $100 million in financing from V W Investments and Metaverse Horizon, which have nothing to do with Volkswagen or $META. Instead V W Investments was founded by YT’s neighbor, and Metaverse Horizon’s location is an office in Beijing that has never been leased, and is apparently led by a 76-year-old farmer in China from YT's villiage. Its main investor is FF Global (YT and other insiders). We think YT has ultimately been the source of much of $FFAI’s financing.

5/

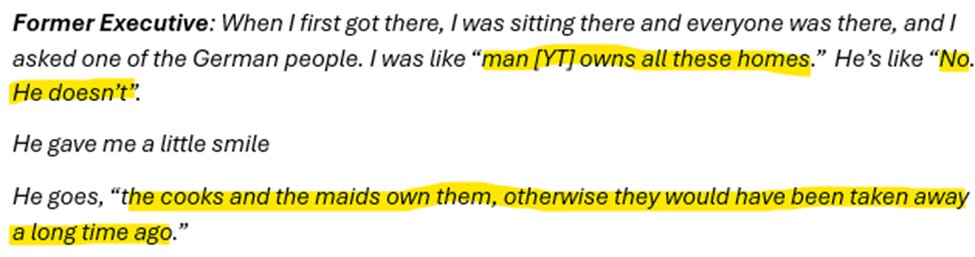

How does YT have money to fund $FFAI after emerging from bankruptcy? We think he hid assets from the bankruptcy court. For example, a former executive told us that YT and his “mafia” use several homes on the CA coast, but he was told that YT does not “own” them, instead the butlers and maids own them *wink wink*

How does YT have money to fund $FFAI after emerging from bankruptcy? We think he hid assets from the bankruptcy court. For example, a former executive told us that YT and his “mafia” use several homes on the CA coast, but he was told that YT does not “own” them, instead the butlers and maids own them *wink wink*

6/

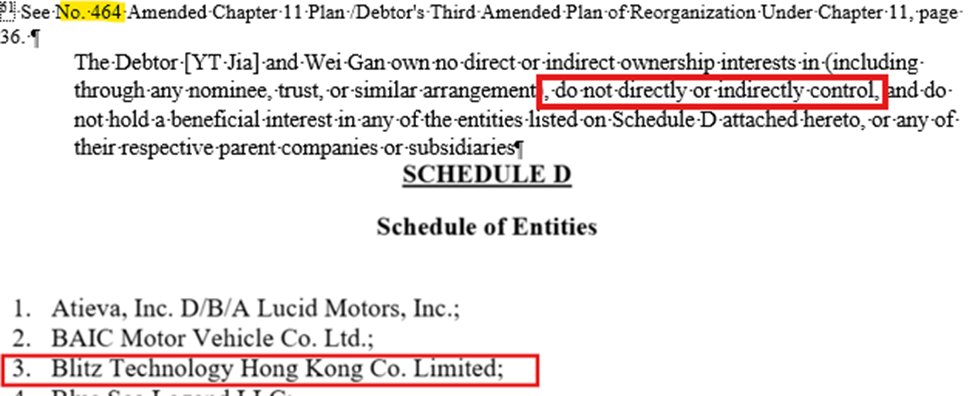

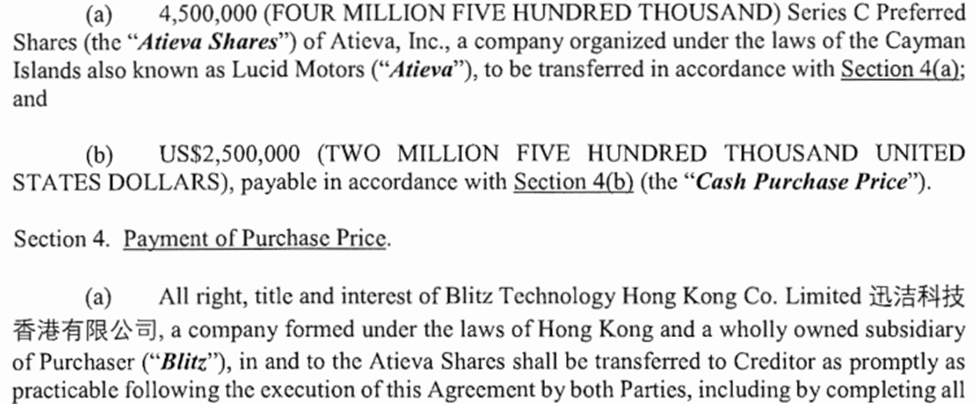

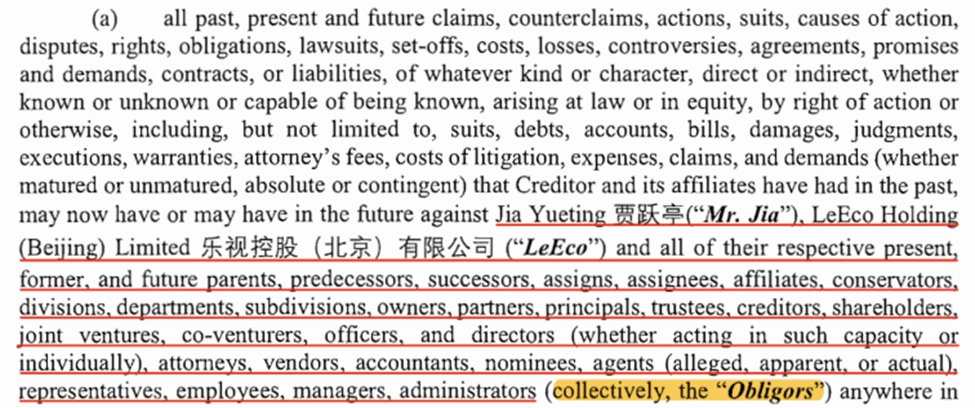

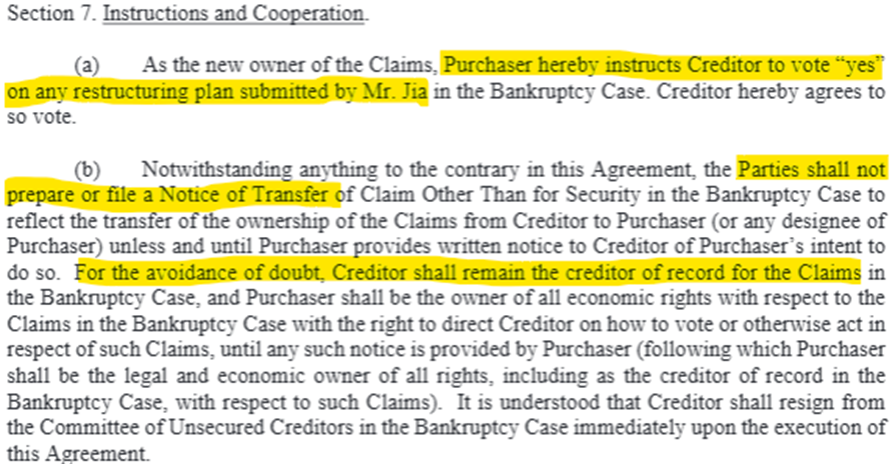

The multi-million-dollar CA homes are peanuts compared to the shares of Lucid stock we believe YT hid from the bankruptcy court. We believe he committed bankruptcy fraud when he told the court in a 2020 filing that he had no interest in Blitz Technology Hong Kong Co. Ltd (“Blitz”). One month later, Blitz, controlled by a close associate of YT’s, transferred 4.5 million shares on his behalf to one of his creditors, and the creditor agreed to remain the creditor of record and discreetly work on YT’s behalf in resolving the bankruptcy. We calculate YT may have hidden Lucid stock from the court that ultimately became worth over $1 billion.

The multi-million-dollar CA homes are peanuts compared to the shares of Lucid stock we believe YT hid from the bankruptcy court. We believe he committed bankruptcy fraud when he told the court in a 2020 filing that he had no interest in Blitz Technology Hong Kong Co. Ltd (“Blitz”). One month later, Blitz, controlled by a close associate of YT’s, transferred 4.5 million shares on his behalf to one of his creditors, and the creditor agreed to remain the creditor of record and discreetly work on YT’s behalf in resolving the bankruptcy. We calculate YT may have hidden Lucid stock from the court that ultimately became worth over $1 billion.

7/

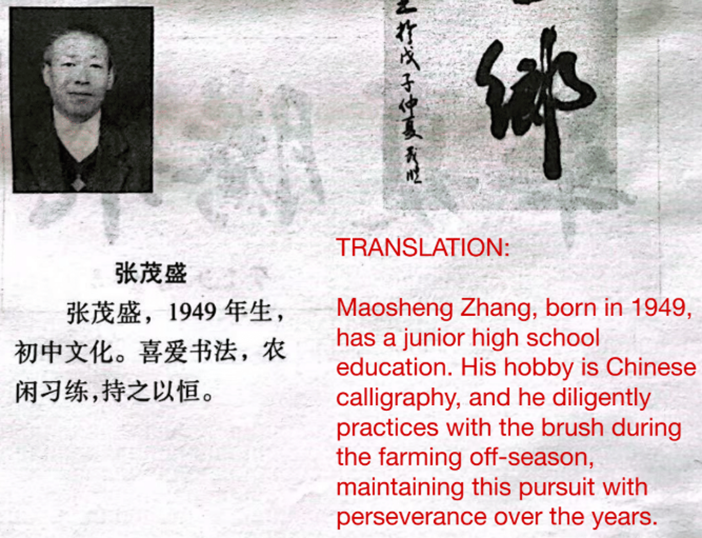

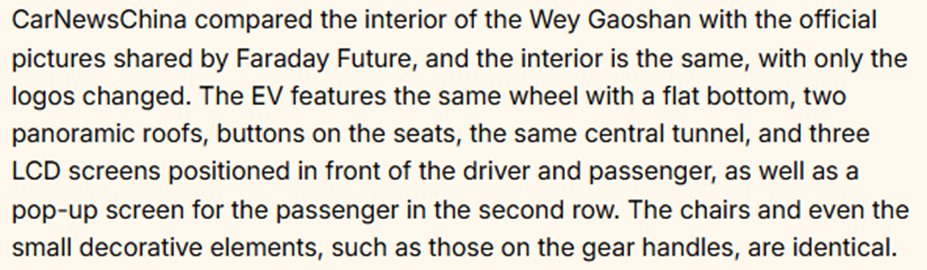

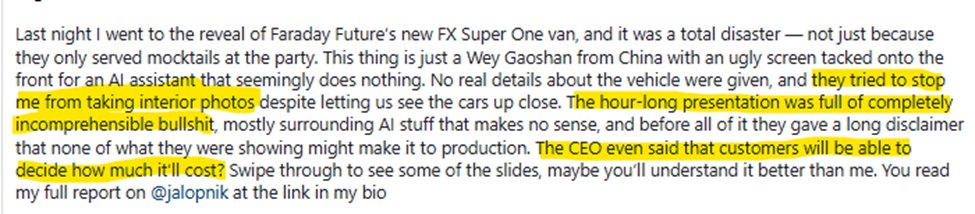

One day after disclosing its Wells Notice, $FFAI unveiled its FX Super One—which appears to just be a Chinese-made EV minivan from Great Wall Motors with the $FFAI logo swapped out. Reportedly, even the small decorative elements are the same. One reporter at the unveiling called the presentation “incomprehensible bullshit.”

One day after disclosing its Wells Notice, $FFAI unveiled its FX Super One—which appears to just be a Chinese-made EV minivan from Great Wall Motors with the $FFAI logo swapped out. Reportedly, even the small decorative elements are the same. One reporter at the unveiling called the presentation “incomprehensible bullshit.”

8/

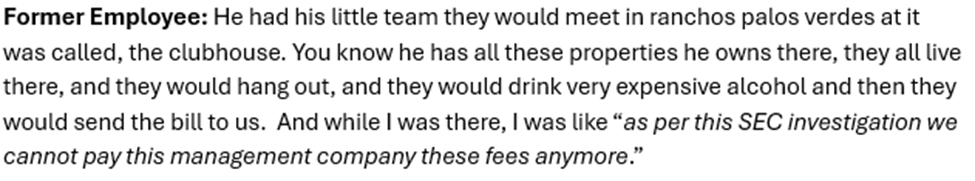

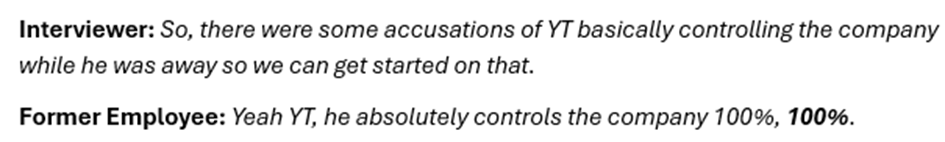

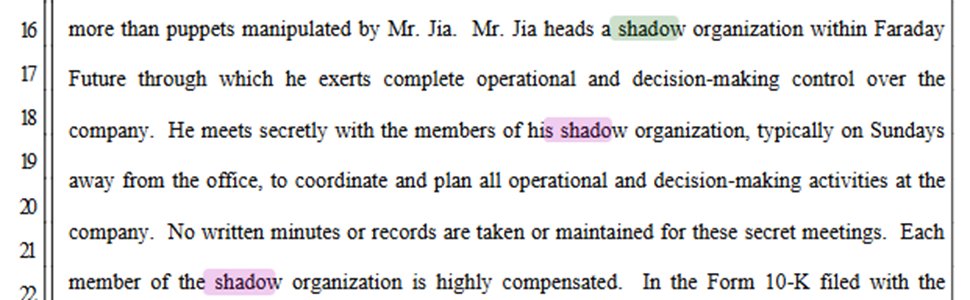

Perhaps the biggest lie YT has told the market is that he has only just returned to the CEO position, after ostensibly stepping down in 2019. We had conversations with multiple former employees who told us YT controlled the company though a Chinese “mafia.” He would talk the most and sit in the biggest chair at meetings. YT and his “mafia” would apparently meet on Sundays so YT could set the agenda for $FFAI

Perhaps the biggest lie YT has told the market is that he has only just returned to the CEO position, after ostensibly stepping down in 2019. We had conversations with multiple former employees who told us YT controlled the company though a Chinese “mafia.” He would talk the most and sit in the biggest chair at meetings. YT and his “mafia” would apparently meet on Sundays so YT could set the agenda for $FFAI

9/

According to a former employee YT and his mafia often did things that were way out of bounds: “they did things that were not even gray area, I mean it was black area stuff that they were told they can't do, and they would continue to do it.” A former finance employee at $FFAI told us that YT tried to pressure him to change projected financial results, without any justification apart from “these numbers would be better.”

According to a former employee YT and his mafia often did things that were way out of bounds: “they did things that were not even gray area, I mean it was black area stuff that they were told they can't do, and they would continue to do it.” A former finance employee at $FFAI told us that YT tried to pressure him to change projected financial results, without any justification apart from “these numbers would be better.”

10/

A lawsuit filed by $FFAI's former General Counsel (GC) alleged YT induced him to work there by falsely claiming they closed $2 billion in investments from Evergrande. The GC investigated numerous claims that YT was using the company as “an immigration farm” fostering a hostile work environment where “employees were pressured to hire attractive women for Mr. Jia.” When the GC recommended YT step back as the decision maker in 2018, “Mr. Jia became enraged, openly cursed [the GC] and threatened him.” YT’s associates then tried to access the GC’s house dressed as “plumbers” on numerous occasions.

A lawsuit filed by $FFAI's former General Counsel (GC) alleged YT induced him to work there by falsely claiming they closed $2 billion in investments from Evergrande. The GC investigated numerous claims that YT was using the company as “an immigration farm” fostering a hostile work environment where “employees were pressured to hire attractive women for Mr. Jia.” When the GC recommended YT step back as the decision maker in 2018, “Mr. Jia became enraged, openly cursed [the GC] and threatened him.” YT’s associates then tried to access the GC’s house dressed as “plumbers” on numerous occasions.

12/

@JCap_Research

@RealJimChanos

@FriendlyBearSA

@BreakoutPoint

@hibearnating

@ParrotCapital

@Seawolfcap

@QTRResearch

@muddywatersre

@ursustrades

@StockJabber

@BlackRock

@Vanguard_Group

@JCap_Research

@RealJimChanos

@FriendlyBearSA

@BreakoutPoint

@hibearnating

@ParrotCapital

@Seawolfcap

@QTRResearch

@muddywatersre

@ursustrades

@StockJabber

@BlackRock

@Vanguard_Group

• • •

Missing some Tweet in this thread? You can try to

force a refresh