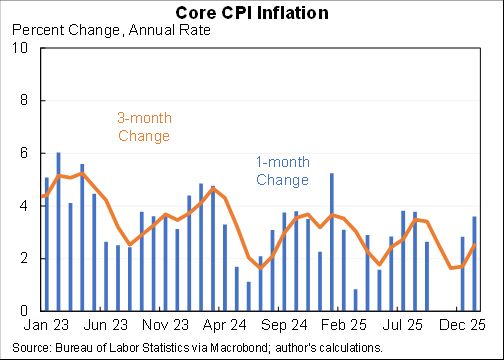

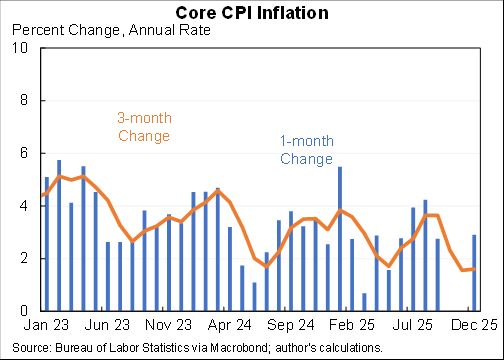

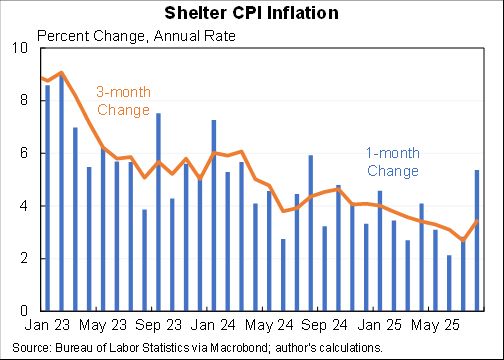

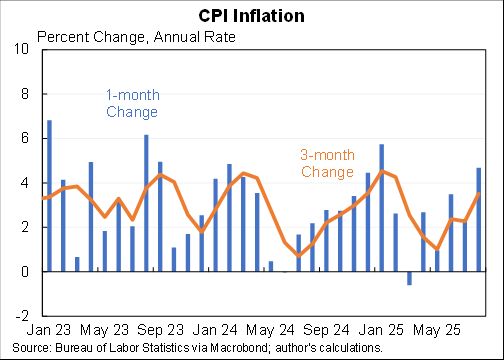

The core inflation rate increased for the fourth straight month. Annual rates:

1 month: 4.2%

3 months: 3.6%

6 months: 2.7%

12 months: 3.1%

1 month: 4.2%

3 months: 3.6%

6 months: 2.7%

12 months: 3.1%

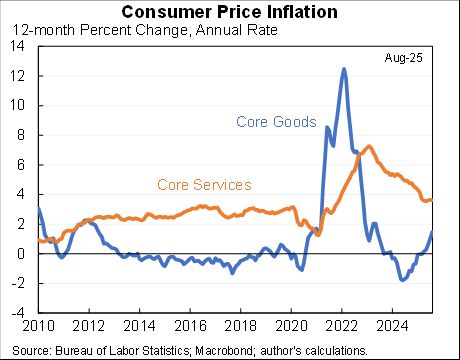

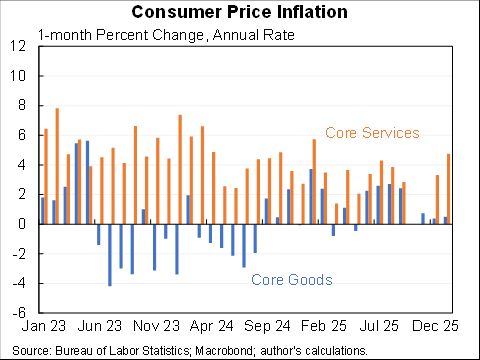

The problem recently has been in both goods and services. Core goods inflation has typically been about zero but in the run-up to this year had deflation. Now tariff-driven inflation.

And at the same time core services inflation has picked up.

And at the same time core services inflation has picked up.

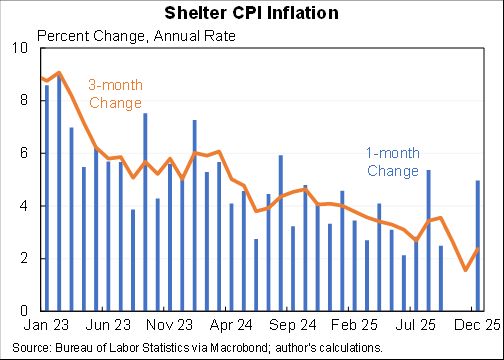

Part of the pickup in August was a pop in shelter. Wouldn't worry too much about that. But even with more normal shelter would still have very elevated core.

BTW, the actual inflation people are experiencing hasn't been as bad this year because of falling energy prices. Well they're not falling any more and overall inflation was worse than core in August.

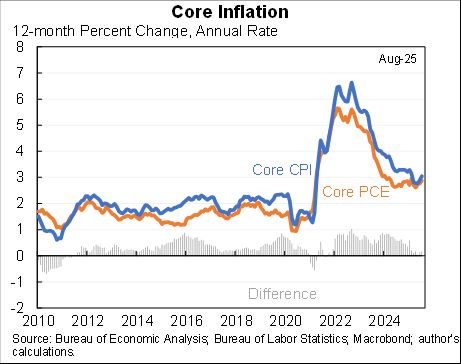

Finally, normally PCE (which the Fed targets) runs below the CPI (which is today's report). But lately they've been similar. Getting to a 3% core PCE inflation is very likely.

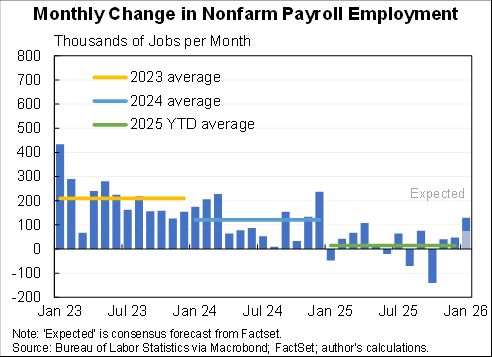

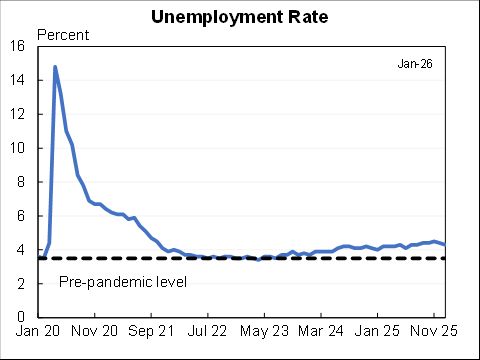

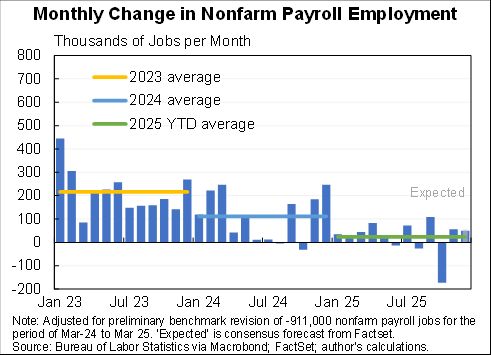

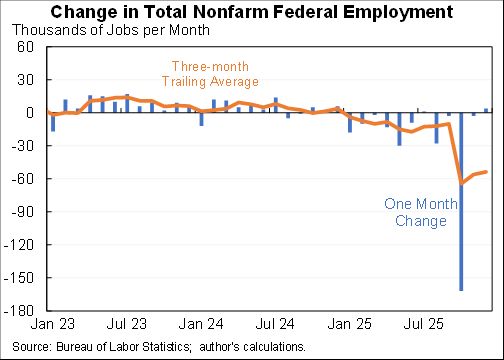

The whiff of stagflation is getting stronger as the unemployment rate continues to rise, job growth slows, and now inflation continues to pick up. There are no good options for the Fed given the set of circumstances we're facing.

• • •

Missing some Tweet in this thread? You can try to

force a refresh