🚨 Index Funds vs ETFs: Most Investors Get This Wrong!

You think they’re the same. But one small mistake here can cost you thousands.

Let’s break it down.

You’ll want to read this till the end. ("REPOST" 🔁)

A thread 🧵

You think they’re the same. But one small mistake here can cost you thousands.

Let’s break it down.

You’ll want to read this till the end. ("REPOST" 🔁)

A thread 🧵

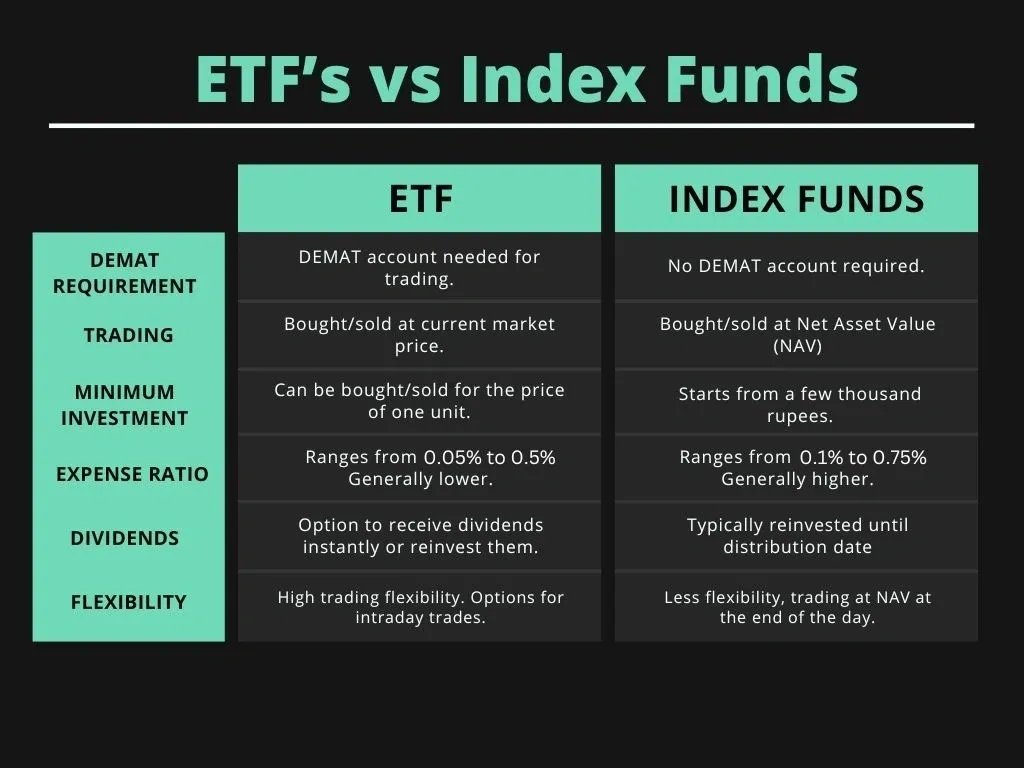

1/ On the surface, Index Funds & ETFs track the same indices.

So what’s the big deal?

Well… the way they work, how you buy them, and the hidden costs are wildly different.

Here’s what most people overlook 👇

So what’s the big deal?

Well… the way they work, how you buy them, and the hidden costs are wildly different.

Here’s what most people overlook 👇

2/ NAV Matters 📌

Index Funds: Buy/sell at end-of-day NAV.

No surprises.

ETFs: Trade like stocks.

You buy/sell at market prices during the day, not always at fair NAV.

👉 Your ETF price can drift from real value.

Index Funds: Buy/sell at end-of-day NAV.

No surprises.

ETFs: Trade like stocks.

You buy/sell at market prices during the day, not always at fair NAV.

👉 Your ETF price can drift from real value.

3/ Expense Ratio is the Hidden Trap

ETFs usually have a lower expense ratio.

But don’t get fooled, you pay brokerage + spread every time you buy/sell.

⚠️ Comparing only the expense ratio is a rookie mistake though.

ETFs usually have a lower expense ratio.

But don’t get fooled, you pay brokerage + spread every time you buy/sell.

⚠️ Comparing only the expense ratio is a rookie mistake though.

4/ SIP/SWP/STP Options

Index Funds: Fully compatible

ETFs: Nope.

No SIPs or withdrawals like mutual funds.

You’ll need to DIY with ETFs.

Not for everyone.

Index Funds: Fully compatible

ETFs: Nope.

No SIPs or withdrawals like mutual funds.

You’ll need to DIY with ETFs.

Not for everyone.

5/ Demat Account: Yes or No?

ETFs: Demat is mandatory

Index Funds: No demat needed.

You can invest directly via AMC or platforms like Zerodha, Upstox, Groww, etc.

Barrier to entry? ✅

ETFs: Demat is mandatory

Index Funds: No demat needed.

You can invest directly via AMC or platforms like Zerodha, Upstox, Groww, etc.

Barrier to entry? ✅

6/ Bid-Ask Spread

Low volume ETFs can have a huge difference between the buyer/seller price.

You might end up buying above NAV or selling below NAV.

Always check volumes & spread before buying ETFs.

Low volume ETFs can have a huge difference between the buyer/seller price.

You might end up buying above NAV or selling below NAV.

Always check volumes & spread before buying ETFs.

7/ But wait… how does the ETF price stay close to iNAV?

Because if ETFs trade like stocks, what’s stopping prices from going all over the place?

Let’s break it down 👇

(a) Awareness = Liquidity

When more people know about an ETF, more people trade it.

More trades = more volume = tighter spread = price stays close to NAV.

That’s why some ETFs are liquid, others feel like ghost towns 👻

(b) AMC appoints "market makers": their job is to buy/sell ETF units on the exchange.

They actively quote prices to ensure that the traded price stays close to the actual iNAV.

Think of them as the “stabilizers” of the ETF world.

(c) Direct Large Transactions

If a big investor wants to invest/sell, say ₹50 lakhs+, they don’t need to go through the exchange.

They can go directly to the AMC, and transact at the *real* iNAV.

This keeps large trades from distorting market prices.

Because if ETFs trade like stocks, what’s stopping prices from going all over the place?

Let’s break it down 👇

(a) Awareness = Liquidity

When more people know about an ETF, more people trade it.

More trades = more volume = tighter spread = price stays close to NAV.

That’s why some ETFs are liquid, others feel like ghost towns 👻

(b) AMC appoints "market makers": their job is to buy/sell ETF units on the exchange.

They actively quote prices to ensure that the traded price stays close to the actual iNAV.

Think of them as the “stabilizers” of the ETF world.

(c) Direct Large Transactions

If a big investor wants to invest/sell, say ₹50 lakhs+, they don’t need to go through the exchange.

They can go directly to the AMC, and transact at the *real* iNAV.

This keeps large trades from distorting market prices.

8/ So… ETF or Index Fund? 🤷♂️

Here’s the final verdict for "retail investors":

Stick to "Index Funds" if:

* You want SIPs

* You prefer automation

* You don’t want to worry about bid-ask spreads or liquidity

Here’s the final verdict for "retail investors":

Stick to "Index Funds" if:

* You want SIPs

* You prefer automation

* You don’t want to worry about bid-ask spreads or liquidity

9/ Choose "ETFs" if:

* You want intra-day trading

* You understand how spreads work

* You already have a Demat account

* You’re okay managing it all manually

There’s no “one size fits all.”

But for most beginners → Index Funds win.

* You want intra-day trading

* You understand how spreads work

* You already have a Demat account

* You’re okay managing it all manually

There’s no “one size fits all.”

But for most beginners → Index Funds win.

10/ Before You Invest in ANY Index Fund… Check These 3 Things:

Here’s your mini-checklist ✅

(a) Choose the Right Index as not all indices are created equal.

* Want stability? → Sensex / Nifty 50

* Want growth? → Nifty Next 50 / S&P 500

* Want diversification? → International or Multi-factor indices

Pick based on your risk appetite & portfolio goals.

(b) Expense Ratio

Simple rule: Lower is better*.

Index funds already aim to "match" returns, so high fees eat into your profits.

Don't overpay for passive investing.

(c) Tracking Error & Tracking Difference

This one’s a pro tip.

These measure how closely the fund mirrors the actual index.

* Tracking Error = Consistency

* Tracking Difference = Actual performance gap

Lower = Better.

Always check before investing.

Here’s your mini-checklist ✅

(a) Choose the Right Index as not all indices are created equal.

* Want stability? → Sensex / Nifty 50

* Want growth? → Nifty Next 50 / S&P 500

* Want diversification? → International or Multi-factor indices

Pick based on your risk appetite & portfolio goals.

(b) Expense Ratio

Simple rule: Lower is better*.

Index funds already aim to "match" returns, so high fees eat into your profits.

Don't overpay for passive investing.

(c) Tracking Error & Tracking Difference

This one’s a pro tip.

These measure how closely the fund mirrors the actual index.

* Tracking Error = Consistency

* Tracking Difference = Actual performance gap

Lower = Better.

Always check before investing.

That’s a wrap!

By now, you should know:

* ETF vs Index Fund: What’s right for you

* How ETFs maintain price stability

* And what to check before investing in an Index Fund

You just leveled up! 💪

By now, you should know:

* ETF vs Index Fund: What’s right for you

* How ETFs maintain price stability

* And what to check before investing in an Index Fund

You just leveled up! 💪

TL;DR: 🧵

If you want automation, simplicity & SIP, go Index Funds.

If you want real-time trading, lower fees but are okay with complexities, go ETFs.

Both have pros & cons.

But blindly choosing one can be costly.

Know the difference. Invest smarter. 💥

If you want automation, simplicity & SIP, go Index Funds.

If you want real-time trading, lower fees but are okay with complexities, go ETFs.

Both have pros & cons.

But blindly choosing one can be costly.

Know the difference. Invest smarter. 💥

If you learned something new, retweet to help others avoid rookie investing mistakes.

Let’s build a smarter investor community. 🚀

If you want to join my Stock Market WhatsApp group, comment "Join" and I'll DM you the link.

Let’s make personal finance simple & accessible. 🔥

Let’s build a smarter investor community. 🚀

If you want to join my Stock Market WhatsApp group, comment "Join" and I'll DM you the link.

Let’s make personal finance simple & accessible. 🔥

• • •

Missing some Tweet in this thread? You can try to

force a refresh