The time has come:

On Wednesday, the Fed will cut rates for the first time in 2025 and "blame" a weak labor market.

This will be just the 3rd year since 1996 with Fed rate cuts while the S&P 500 is at record highs.

What happens next? Let us explain.

(a thread)

On Wednesday, the Fed will cut rates for the first time in 2025 and "blame" a weak labor market.

This will be just the 3rd year since 1996 with Fed rate cuts while the S&P 500 is at record highs.

What happens next? Let us explain.

(a thread)

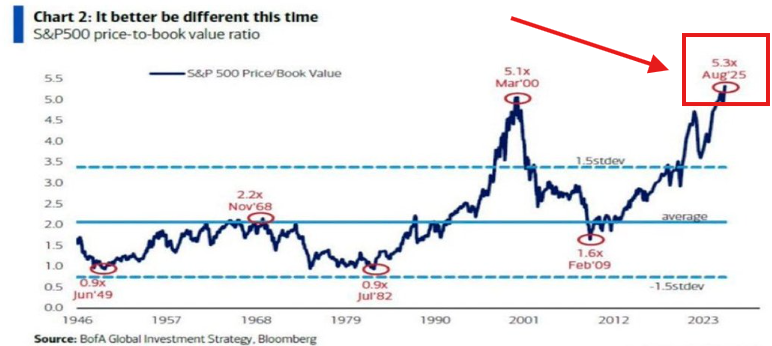

In fact, US stock valuations have reached their highest level on record, according to Bloomberg.

This surpasses the Dot-Com bubble and 1929 peak before the Great Depression.

But, it may be justified as the world experiences its biggest technological revolution in 20+ years.

This surpasses the Dot-Com bubble and 1929 peak before the Great Depression.

But, it may be justified as the world experiences its biggest technological revolution in 20+ years.

It's a rather unique situation for the Fed this time around.

Typically, the Fed cuts interest rates in a weak economy with stocks well below record highs.

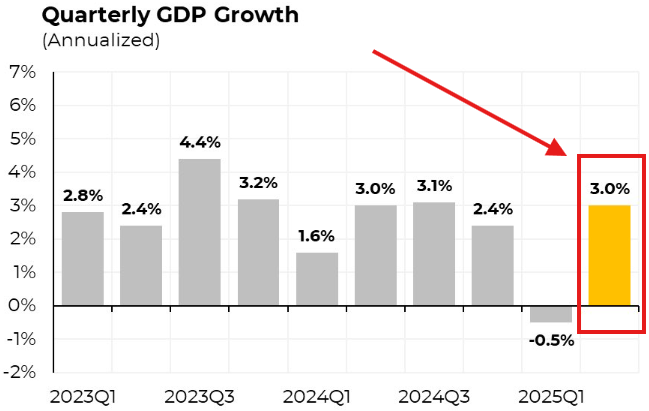

While the strength of the economy is up for debate, GDP growth remains robust.

GDP is growing at 3%+ per year.

Typically, the Fed cuts interest rates in a weak economy with stocks well below record highs.

While the strength of the economy is up for debate, GDP growth remains robust.

GDP is growing at 3%+ per year.

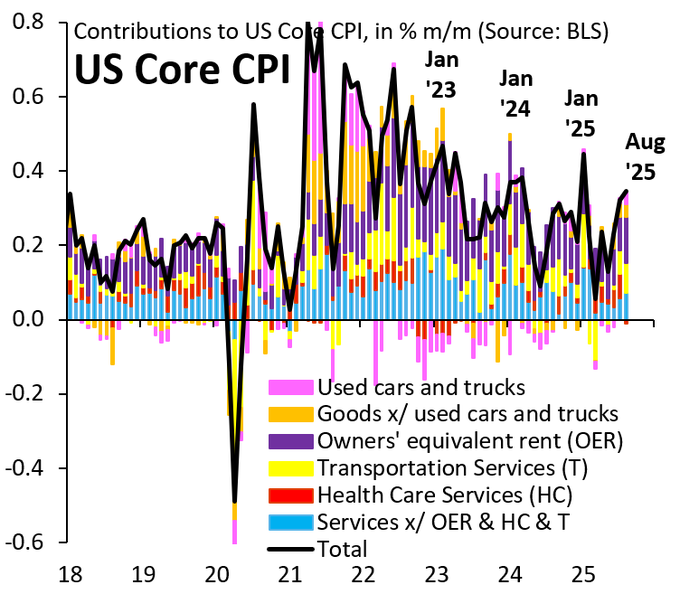

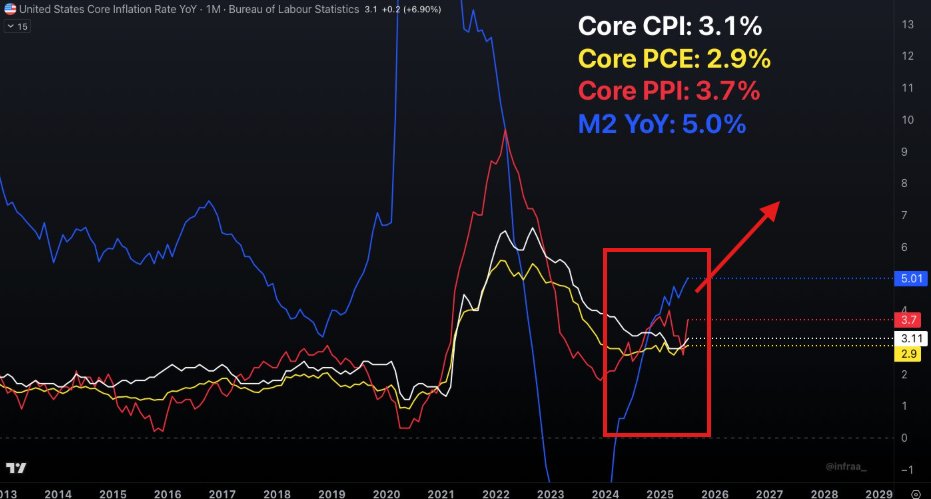

And, inflation data is running hot yet again.

This week's data showed Core CPI inflation at 3.1% in a broad-based rise across the board.

Core inflation is now 110 bps above the Fed's long-term target.

Meanwhile, the debate is whether to cut rates by 25 or 50 bps at a time.

This week's data showed Core CPI inflation at 3.1% in a broad-based rise across the board.

Core inflation is now 110 bps above the Fed's long-term target.

Meanwhile, the debate is whether to cut rates by 25 or 50 bps at a time.

Here is why:

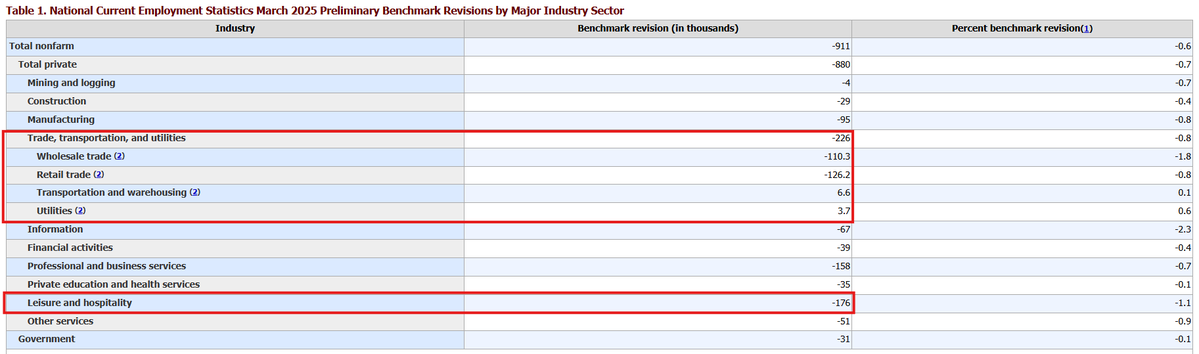

The labor market is cracking, "forcing" the Fed to cut rates.

The index of US consumers saying jobs are plentiful declined to 34.1 in July, the lowest level since 2021.

This is down ~22 points over the last 2 years as the labor market has materially slowed down.

The labor market is cracking, "forcing" the Fed to cut rates.

The index of US consumers saying jobs are plentiful declined to 34.1 in July, the lowest level since 2021.

This is down ~22 points over the last 2 years as the labor market has materially slowed down.

Amid GDP growth, hot inflation, and the AI Revolution, stocks are partying.

The S&P 500 just closed at its 24th record high of 2024 and is now up over +35% since April's low.

This marks one of the best 5-month rallies in S&P 500 history, in-line with the 2008 recovery.

The S&P 500 just closed at its 24th record high of 2024 and is now up over +35% since April's low.

This marks one of the best 5-month rallies in S&P 500 history, in-line with the 2008 recovery.

Now, rate cuts will add fuel to the fire:

We expect the Fed to cut interest rates by 25 basis points on Wednesday with the S&P 500 at a record.

There have been 2 years since 1996 where rate cuts have happened with stocks at record highs: 2019 and 2024.

So, what came next?

We expect the Fed to cut interest rates by 25 basis points on Wednesday with the S&P 500 at a record.

There have been 2 years since 1996 where rate cuts have happened with stocks at record highs: 2019 and 2024.

So, what came next?

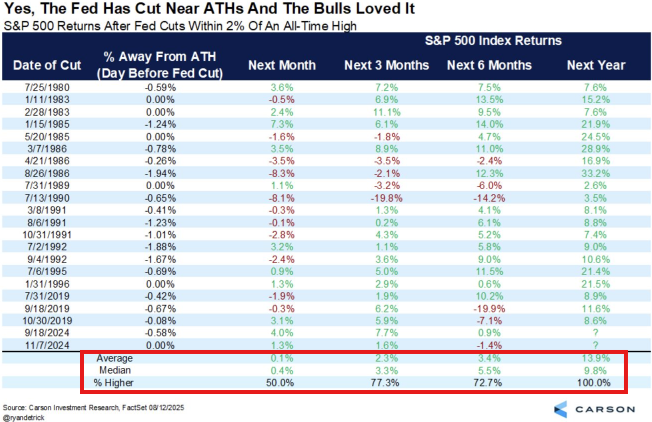

When the Fed cuts rates within 2% of all time highs, the S&P 500 typically loves it.

In 20 of the last 20 times this has happened, the S&P 500 has ended higher 1 year later.

The S&P 500 has risen an average of +13.9% over the following 12 months, per Carson Research.

In 20 of the last 20 times this has happened, the S&P 500 has ended higher 1 year later.

The S&P 500 has risen an average of +13.9% over the following 12 months, per Carson Research.

However, over the immediate term, such as the next 30 days, results are more mixed.

Since 1980, the S&P 500 has fallen in the following month 11 out of 22 times that this has happened.

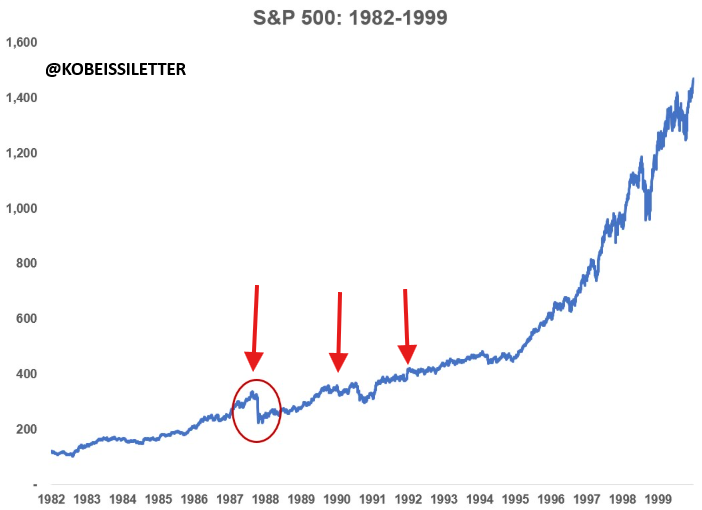

Particularly in the late 1980s and early 1990s, stocks saw weakness over the short-term.

Since 1980, the S&P 500 has fallen in the following month 11 out of 22 times that this has happened.

Particularly in the late 1980s and early 1990s, stocks saw weakness over the short-term.

This time around, we expect a similar outcome.

There will be more immediate-term volatility, but long-term asset owners will party.

Why do we think that?

Because interest rate cuts are coming into rising inflation and the AI Revolution, only adding fuel to the fire.

There will be more immediate-term volatility, but long-term asset owners will party.

Why do we think that?

Because interest rate cuts are coming into rising inflation and the AI Revolution, only adding fuel to the fire.

Gold and Bitcoin have known this.

The straight-line higher price action we have seen in these asset classes is pricing-in what's coming.

Gold and Bitcoin know lower rates into an already HOT backdrop will only push assets higher.

It's a great time to own long-term assets.

The straight-line higher price action we have seen in these asset classes is pricing-in what's coming.

Gold and Bitcoin know lower rates into an already HOT backdrop will only push assets higher.

It's a great time to own long-term assets.

The long-anticipated Fed week has arrived.

As a result, the macroeconomy is shifting and its implications on stocks, commodities, bonds, and crypto are investable.

Want to receive our premium analysis?

Subscribe to access our premium analysis below:

thekobeissiletter.com/subscribe

As a result, the macroeconomy is shifting and its implications on stocks, commodities, bonds, and crypto are investable.

Want to receive our premium analysis?

Subscribe to access our premium analysis below:

thekobeissiletter.com/subscribe

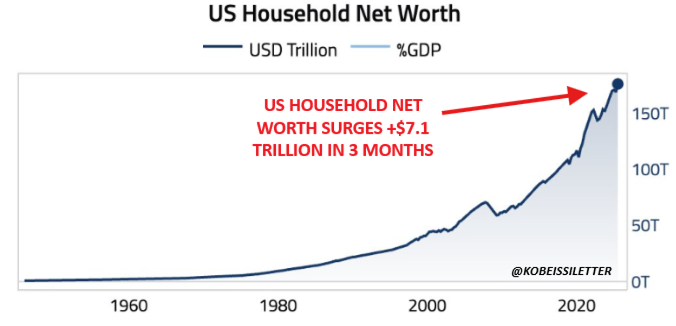

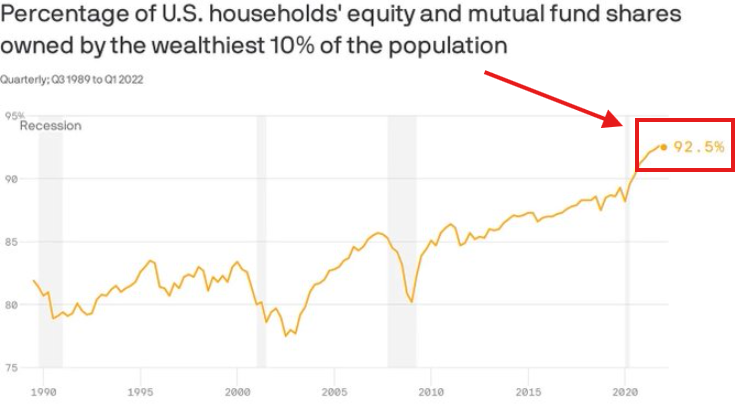

History says long-term asset owners will be rewarded as rate cuts begin.

This also means the rapidly growing wealth gap will only become larger.

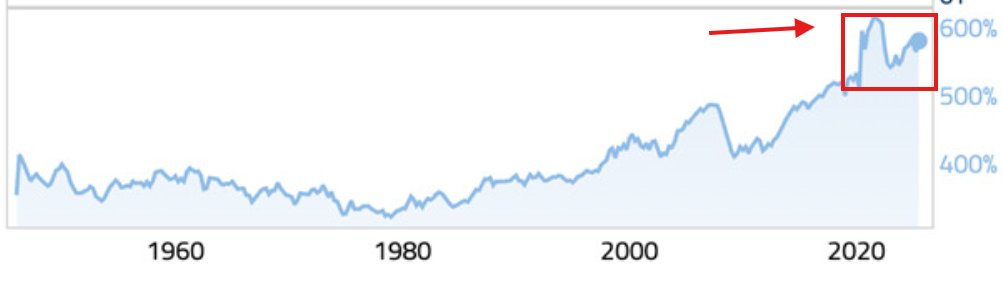

The top 10% of Americans now own 93% of the wealth.

Follow us @KobeissiLetter for real time analysis as this develops.

This also means the rapidly growing wealth gap will only become larger.

The top 10% of Americans now own 93% of the wealth.

Follow us @KobeissiLetter for real time analysis as this develops.

• • •

Missing some Tweet in this thread? You can try to

force a refresh