What happens when you pay a fortune for tax advice from someone, and the advice turns out to be incompetent? And HMRC demands the tax back plus penalties?

If you guessed "you get all your money back" then I'm afraid you're going to be disappointed.

If you guessed "you get all your money back" then I'm afraid you're going to be disappointed.

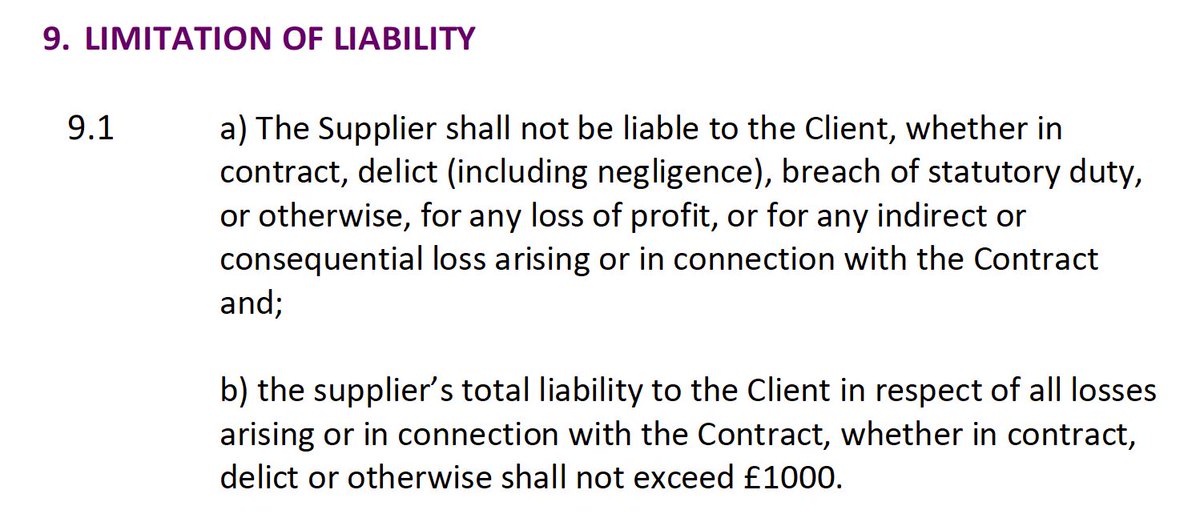

Dodgy R&D tax firm ZLX made large research and development tax credit claims for its clients, charging a 30% fee. Often these claims had no legitimate basis

I'm aware of one case where ZLX advised a small firm to make £200k in claims, for which they paid ZLX £60k fees.

They're now being pursued by HMRC for the £200k plus £100k penalties. And they're £60k out of pocket. They believe ZLX was extraordinarily negligent...

They're now being pursued by HMRC for the £200k plus £100k penalties. And they're £60k out of pocket. They believe ZLX was extraordinarily negligent...

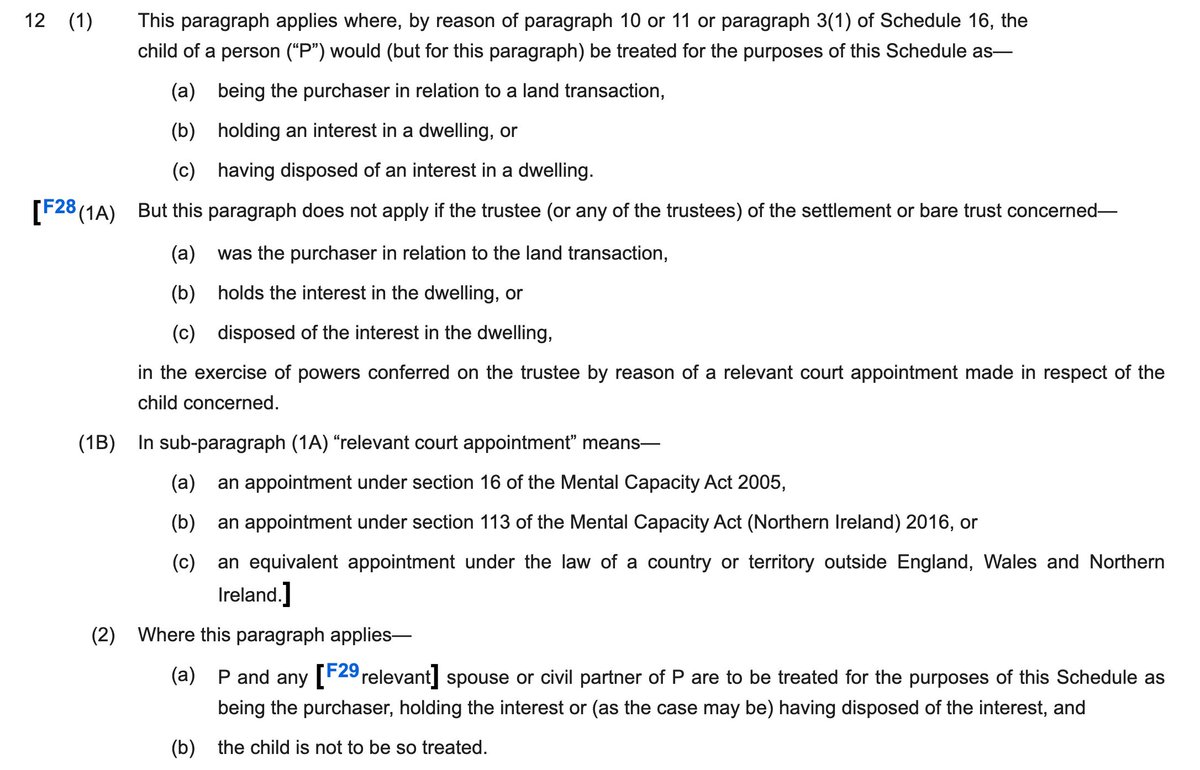

But if they want to recover their £160k loss they have to deal with this astonishing exclusion clause in ZLX's standard terms. It purports to limit liability to £1,000

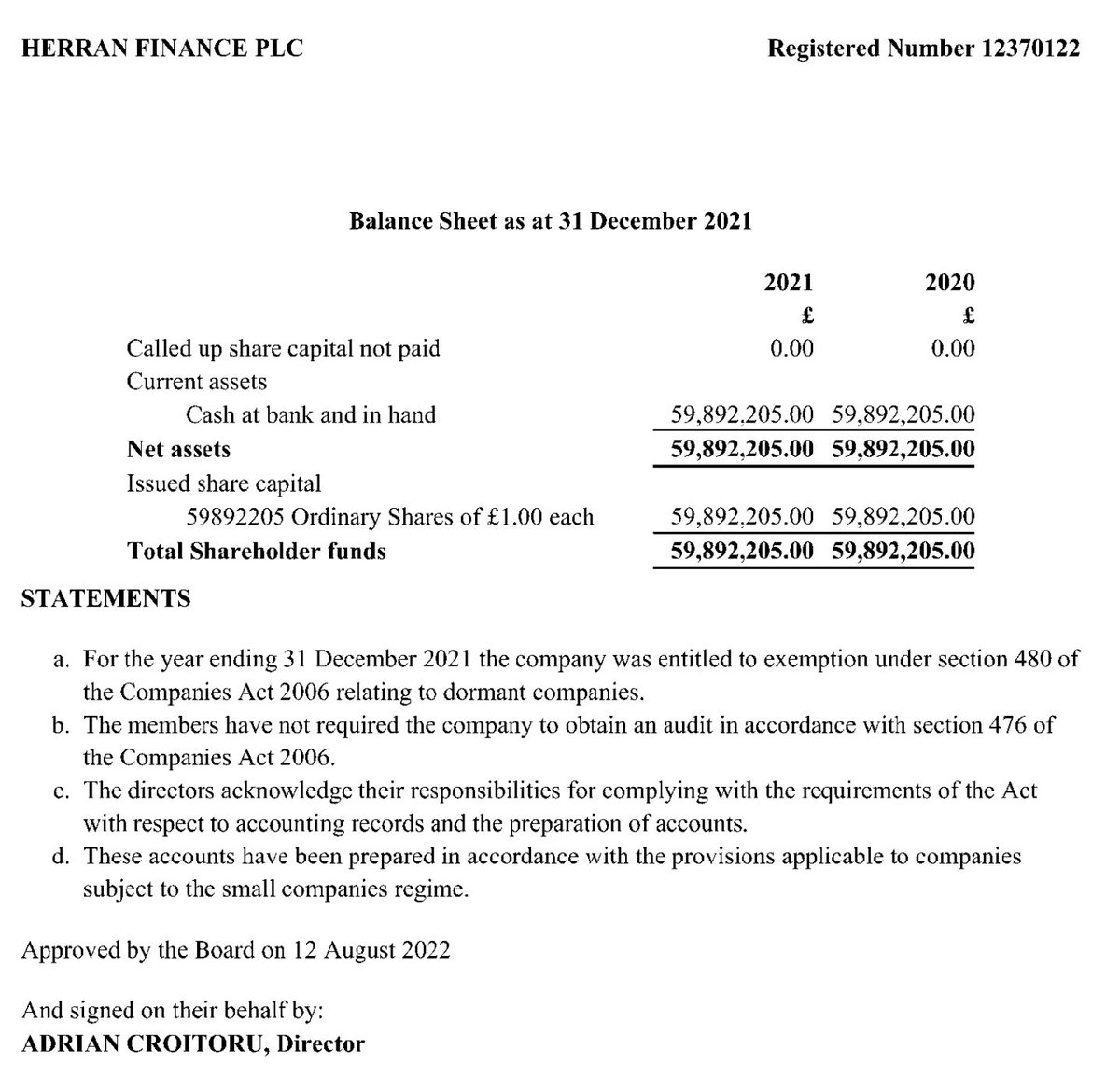

And ZLX had no insurance. The clients get nothing.

And ZLX had no insurance. The clients get nothing.

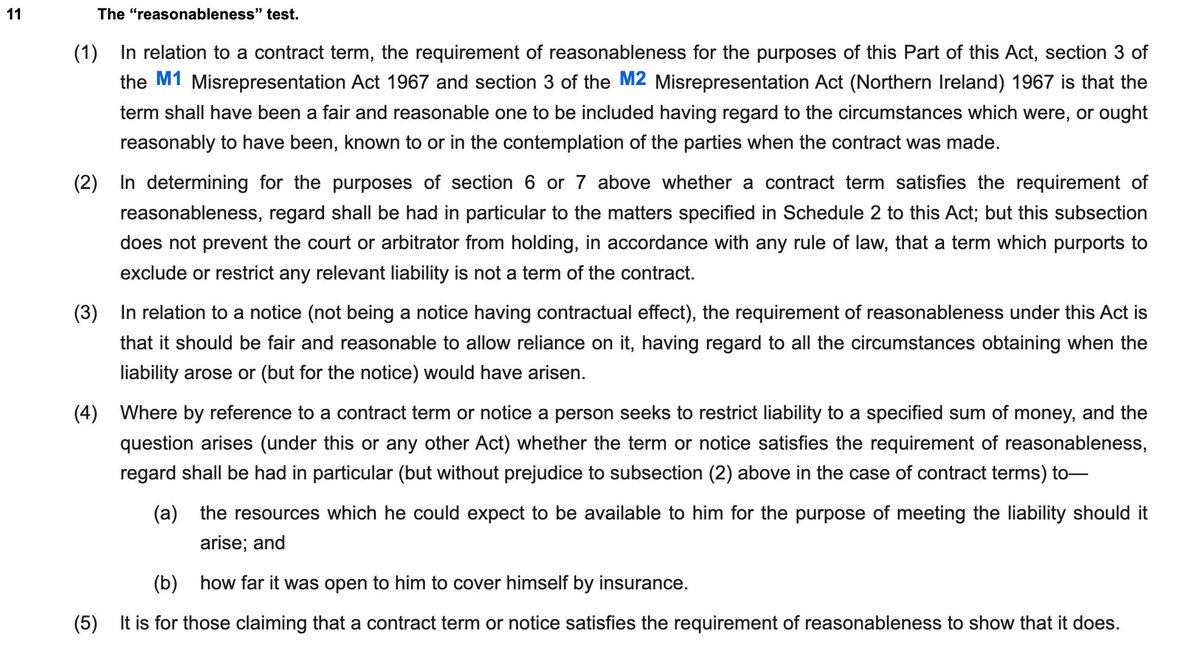

Got to wonder if that's enforceable, e.g. under UCTA (although note the contract was governed by Scottish law, where I have zero expertise).

If the clients could prove fraud then the exclusion would fall away and they could pursue ZLX's directors personally.

But that's really hard, and in the end they will have the plausible defence of just being incompetent and unqualified (which is what they were).

But that's really hard, and in the end they will have the plausible defence of just being incompetent and unqualified (which is what they were).

The hard lesson: never instruct any tax or legal professional who isn't properly insured. And certainly never accept a limitation of liability that leaves you totally unprotected.

More about ZLX in this episode of Radio 4's Untaxing:

Available now on BBC Sounds (unless you're outside the UK, in which case it isn't)bbc.co.uk/programmes/m00…

Available now on BBC Sounds (unless you're outside the UK, in which case it isn't)bbc.co.uk/programmes/m00…

And much, much more detail about ZLX here: taxpolicy.org.uk/2025/04/06/unt…

And ZLX's extremely weird R&D claim for Dundee United FC here: taxpolicy.org.uk/2025/07/31/dun…

And the brilliant reporting by the Times: thetimes.com/sport/football…

• • •

Missing some Tweet in this thread? You can try to

force a refresh