The Fed’s critics have always had a point: “independence” is not a hall pass for “incompetence.”

It’s time: competence or bust. If the Fed can’t self-correct, the public eventually will.

It’s time: competence or bust. If the Fed can’t self-correct, the public eventually will.

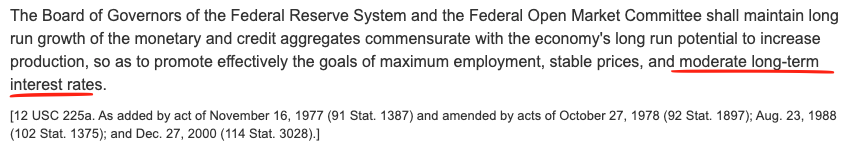

It starts with first, understanding what the Fed's mission is.

Many people incorrectly think the Fed mandate is to promote 1) maximum employment, and 2) stable inflation. This is wrong.

The Fed has a different mandate, and it's measured via THREE affected outcomes, not two.

Many people incorrectly think the Fed mandate is to promote 1) maximum employment, and 2) stable inflation. This is wrong.

The Fed has a different mandate, and it's measured via THREE affected outcomes, not two.

Here is the official definition of the Fed's monetary policy objectives as per the Federal Reserve Act.

Notice that the goal is to "Maintain long run growth of the monetary and credit aggregates ... to increase production" and the goals include MODERATE LONG TERM INTEREST RATES

Notice that the goal is to "Maintain long run growth of the monetary and credit aggregates ... to increase production" and the goals include MODERATE LONG TERM INTEREST RATES

So why does the Fed call it a 'dual mandate' rather than the three policy objectives as stated above?

Because the third mandate, by definition is highly political. It's easier to impress affecting #3 by #1, #2.

This is the big lie and why Fed credibility is nearing zero.

Because the third mandate, by definition is highly political. It's easier to impress affecting #3 by #1, #2.

This is the big lie and why Fed credibility is nearing zero.

But this is precisely where Bitcoin comes in.

Money won’t be truly fixed until we restore a price-specie anchor where “inside money” once again rests on “outside money” that is credibly neutral.

TLDR: institutional trust will only be rebuilt when money itself is apolitical.

Money won’t be truly fixed until we restore a price-specie anchor where “inside money” once again rests on “outside money” that is credibly neutral.

TLDR: institutional trust will only be rebuilt when money itself is apolitical.

• • •

Missing some Tweet in this thread? You can try to

force a refresh